- Important Links

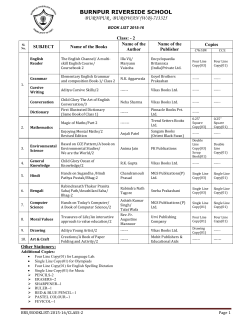

Corporate India Advisors LLP Indirect Tax Newsletter 31st March 2015 INSIDE THIS ISSUE 1 Service Tax 2 CENVAT Credit 3 Central Excise 4 Customs and FTP 5 VAT/CST Contents Notifications/Circulars Customs …………………………………………………………………………………………………1 Foreign Trade Policy………………………………………………………………………………2 Judgments Service Tax…………………………………………………………………………………………….3 CENVAT Credit……………………………………………………………………………………….5 Central Excise…………………………………………………………………………………………5 Customs & FTP……………………………………………………………………………………….7 VAT/CST…………………………………………………………………………………………………8 News & Comments……………………………………………………………………………..9 Notifications / Circulars Customs Notification Safeguard Duty levied on import of saturated fatty alcohols The Central Government imposed Safeguarding Duty on Saturated Fatty Alcohols excluding the Saturated Fatty Alcohols with carbon chain length of pure C8 falling under Tariff item 2905 17 00 or subheading 3823 70 of the Customs Tariff Act. The Safeguarding Duty shall be imposed at the following rate: a) 20% ad valorem , when imported between the period 28th August 2014 to 27th August 2015 b) 18% ad valorem, when imported between the period 28th August 2015 to 27th August 2017;and c) 12% ad valorem, when imported between the period 28th August 2017 to 27th February 2018 This imposition shall come in effect from date of imposition of provisional Safeguard duty, i.e. from 28th August 2014 Notification No. 1/2015‐Customs (SG) Dated 13‐03‐2015 Indirect Tax Newsletter Page 2 Notification Definitive Anti Dumping Duty imposed on Sheet Glass The Central Government imposed Definitive Anti Dumping Duty on the “Sheet Glass” falling under Tariff item 7004 20 11 or 7004 20 19 of the first Schedule to the Custom tariff Act. The rate of anti dumping duty is USD 63/MT based on the country of origin and country of export per MT. The duty shall be effective for the period of 5 years from the date this notification is published. Notification No. 07/2015‐Customs (ADD) Dated 13‐03‐2015 Circular Compliance to the orders mandatory for import of steel products On the representations received by the CBEC that the import of steel products are being allowed without compliance of mandatory Indian Standards, the board has advised that the import of such products should not be allowed without complying the Steel and Steel Products (quality Control) Order, 2012 and Steel Products (Quality Control) Second Order, 2012 as amended. Circular No. 08/2015‐Customs Dated: March 24, 2015 Foreign Trade Policy Notification Mandatory documents prescribed for Export and Imports of goods The Central Government has inserted Para 2.53 of FTP, 2009‐14, prescribing the mandatory documents required for exports and import of goods from/into India. The documents for export of goods from India are Bill of lading/ Airway Bill, Commercial Invoice cum packing List and Shipping Bill/ Bill of Export, For imports, the prescribed documents are Bill of lading/ Airway Bill, Commercial Invoice cum packing List and Bill of entry. Further, for export / import of specific goods or the goods which are subject to restrictions or for which No Objection Certificate is required, the regulatory authority may electronically or in writing can seek for additional documents. The Notification shall come into effect from 1st April 2015. Notification No. 114/(RE‐2013)/2009‐2014 dated 12‐03‐2015 Notification Amendment in Classification of Export of Military Stores The Central Government had amended Table A of Schedule 2 of ITC (HS) Classification of Export and Import of Military Stores. Now, for exports of military stores as specified in Export Licensing Note of Table A, No Objection Certificate (NOC) shall be obtained from the Department of Defence Production, the description of item in the Shipping Bill shall be prefixed the Serial No. of the item indicated in Table A as MS 001 or as the case may be and the Shipping Bill shall indicate the number and date of NOC of department of Defence production. Notification No. 115(RE‐2013)/2009‐2014 dated 13‐03‐2015 Notification Addition of two new ports for import of new vehicles The Central Government has amended condition 2 to Chapter 87 of ITC(HS) 2012, Schedule 1 of the Import Policy to add two new Customs Port i.e. Kattupalli port and APM Terminals , Pipavav Port to the existing list of 12 ports/ICDs through which import of new vehicles is permitted. Page 3 Indirect Tax Newsletter With this amendment, new vehicle can now be imported through following Customs ports: Seaports‐ (i) Nhava Sheva, (ii) Mumbai, (iii) Kolkata, (iv) Chennai, (v) Ennore, (vi) Cochin, (vii) Kattupalli, (viii) APM Terminals Pipavav; Airports‐ (ix) Mumbai Air Cargo Complex, (x) Delhi Air Cargo, (xi) Chennai Airport; and ICDs ‐ (xii) Telegaon Pune, (xiii) Tughlakabad & (xiv) Faridabad.” Notification No. 117(RE‐2013)/2009‐2014 Dated 13‐03‐2015 Judgments Service Tax Service tax not payable by the air travel agent on fuel surcharge In this case the appellant, an air travel agent, discharged service tax under the Service Tax Rules on basic fare without including the fuel surcharge. The authorities demanded service tax by alleging that the value is deflated to the extent of fuel surcharge. The Tribunal negated the departmental contentions by holding that the value relevant for service tax purpose is the basic fare, which presently excludes the fuel surcharge. Kafila Hospitality & Travels Ltd. Vs. CST, Delhi [2015‐TIOL‐406‐CESTAT‐DEL] Appeal in relation to service consumed in SEZ whether exempt or taxable, will lie before Supreme Court In this case the question before the Hon’ble High Court was whether the underlying input services will be treated as exempt. The High Court of Bombay held that the relevant issue definitely relates to determination of rate of duty and hence the issue will lie before the Supreme Court in terms of Section 35‐ G( 1) of the Central Excise Act, 1944. CCE & ST, Pune Vs. Credit Suisse Services (I) Pvt. Ltd. [2015‐TIOL‐552‐HC‐ MUM‐ST] Exemption to performing artists in folk or classical art forms of music etc. under Notification No.25/2012 is valid The petitioner sought quashing of the exemption in respect of services provided by a performing artists in folk or classical art forms of music etc. from service tax as discriminatory and violative of Articles 14 and 19(1)(g) of the Constitution of India in the absence of the same benefit being extended to other performing artist namely film actors. The Hon’ble High Court denied holding the entry as invalid since two categories are clearly different and distinguishable and cannot be treated at parity. The mere fact that there was an element of drama or acting both in case of theatre and in case of films did not mean that the two activities are identical, taking into consideration the circumstances in which films are made and theatre is performed. Siddharth Suryanarayan Vs. UOI [2015‐TIOL‐561‐HC‐MAD‐ST] Page 4 Fencing of Indian borders is not subject to service tax under Erection, Commissioning services Indirect Tax Newsletter In this case the appellant was engaged in fencing the India Bangladesh border. The dispute arose whether the activity is subject to service tax under the taxable category of Erection, Commissioning or Installation agency services. The Tribunal held that the activity will not be subject to service tax since fencing could loosely be called as a structure, but the services rendered by them are not in the nature of Erection, Commissioning or Installation, but in the nature of civil construction. Mackintosh Burn Ltd Vs. CC, CE & ST, Shillong [2015‐TIOL‐457‐CESTAT‐KOL] Prior service tax registration not mandatory for refunds In this case the appellant were denied the refund of input services under Rule 5 of CENVAT Credit Rules, 2004 on the basis that the appellant did not hold the service tax registration. The Tribunal held that holding registration is not a prior consideration for availment of CENVAT credit and hence refund will be allowed. KPIT Cummins Global Business Solutions Ltd. Vs. CCE, Pune‐I [2015‐TIOL‐400‐ CESTAT‐MUM] Refund under 41/2007 not allowed if assesse is not registered In this case the appellant filed a refund claim under Notification 41/2007 ST dated 6.10.2007 without getting itself registered. The authorities rejected the refund claim for non registration of the assesse. The Tribunal upheld such rejection by holding that obtaining registration is not mere procedural part but is substantial portion of the notification. Sirius Overseas Pvt. Ltd Vs. CCE, ST & C, Visakhapatnam‐II [2015‐TIOL‐434‐ CESTAT‐BANG] Filing of refund online will be date of refund filing In this case the appellant filed the online refund claim within time but the hard copy was filed later on. The authorities denied the refund claim alleging it time barred. The Tribunal regularised the refund claim by holding that since the online refund was filed in time, claim is not time barred. Transcend Mt Services Pvt. Ltd Vs. CST, Delhi [2015‐TIOL‐448‐CESTAT‐DEL] Provisions as applicable on date of institution of proceeding will prevail till it attains finality In this case the High Court of Kerala dealt with the requirement of payment of mandatory pre‐deposit of 7.5% for filing the appeals. The High Court held that in the present case since the proceedings started before the enactment of Finance Act, 2014, the petitioner cannot be compelled to deposit the said amount for the purpose of appeal. Muthoot Finance Ltd. Vs. UOI [2015‐TIOL‐632‐HC‐KERALA‐ST] Extended period not invokable if short payment depicted in return In this case the appellant depicted the short payment of service tax in the relevant return. The authorities demanded service tax by invoking the larger period. The Tribunal disallowed invocation of larger period by holding that since the correct calculation were already depicted in the return, the larger period cannot be invoked. Central Warehousing Corporation Vs. CST, Ahmedabad [2015‐TIOL‐405‐ CESTAT‐AHM] Page 5 Indirect Tax Newsletter CENVAT Credit Reversal under Rule 6 not required for sale to SEZ Security services are inextricably linked to manufacture In this case the appellant cleared the goods to DTA on payment of duty and to SEZ unit without payment of duty after following the ARE‐1 procedure. The revenue demanded an amount equivalent to 10%. The Tribunal negated this demand and held that clearances to SEZ is akin to exports and hence the demand under Rule 6 of CENVAT Credit Rules, 2004 will not sustain. S P Fabricators Pvt. Ltd. Vs. CC, Chennai II [2015‐TIOL‐474‐CESTAT‐MAD] In this case the Tribunal held that the input security services have inextricable link with the manufacturing process and hence the CENVAT credit cannot be denied. Sar Ispat Pvt. Ltd. Vs. CCE, , Puducherry [2015‐TIOL‐488‐CESTAT‐MAD] Credit on inputs used for constructing passive infrastructure is available In this case the appellant procured the inputs etc. for constructing the passive infrastructure to provide the business support services. The authorities denied the credit citing the creation of immovable property. The Tribunal allowed the credit by holding that goods when brought were not immovable property and since there is inextricable link between provisions of services, the credit will be allowed even if the result is immovable property. The Tribunal also held that facts are closer to the Sai Sahmita Storages Pvt. Ltd. Vs. CCE ‐ 2011‐TIOL‐863‐HC‐AP‐CX and distinguish from Bharti Airtel Ltd. Vs. CCE, Pune‐III ‐ 2014‐TIOL‐1452‐HC‐MUM‐ST. Reliance Infratel Ltd. Vs. CST, MumbaI‐II [2015‐TIOL‐516‐CESTAT‐MUM] CENVAT Credit allowed on MS Rod Sheets, M.S.Chennel, Flats etc. used in the fabrication of fly ash hooper, fly ash bin In this case the High Court of Madras allowed the CENVAT credit on these items by holding that these items will qualify as accessory etc. of the capital goods and hence credit is allowed. India Cements Ltd. Vs. CCE NO 1, Foulks Compound Annai Medu, Salem‐ 636001 [2015‐TIOL‐650‐HC‐MAD‐CX] Central Excise Job work charges to include the value of scrap sold In this case a manufacturer appointed a job worker for manufacturing the goods. The job worker retained the scrap and sold the scrap in the market. The authorities demanded excise duty on the value of scrap so sold. The Tribunal upheld such demand by holding that the consideration for job worker will be job work charges plus the consideration obtained by selling the scrap in the market. CCE, Pune‐III Vs. Ankur Packaging Pvt. Ltd. [2015‐TIOL‐472‐CESTAT‐MUM] Page 6 Suo‐motto re‐credit is allowed in case of favourable order by appellate authority Indirect Tax Newsletter In this case the respondent paid duty under protest by reversing the credit. The Commissioner (Appeals) held non‐payment of duty and pursuant to this order, the respondents suo‐motto recredited its accounts with the same amount. The authorities objected to it and issued another notice proposing recovery of the credit availed again. The Tribunal negated these contentions and held that once the appellate authority have held in favour of respondent, there is no bar for suo‐motto recredit. CCE, Ahmedabad Vs. Chiripal Industries Ltd. [2015‐TIOL‐471‐CESTAT‐AHM] Specific disclosure to authorities is not requirement for non invocation of larger period In this case the authorities invoked the larger period for the goods cleared without payment of duty by a manufacturer on the basis that manufacturer has not disclosed this aspect to the authorities. The Supreme Court held that filing of Form CT‐3 indicates that matter is in knowledge of the authorities and hence the larger period cannot be invoked. CCE, Mumbai Vs. Blue Star Ltd. [2015‐TIOL‐19‐SC‐CX] Value of Packing required to make the goods marketable is addible in transaction value In this case the finished products were packed in plastic containers and then put in cartons for selling to the wholesale dealers for the purpose of transportation. The Supreme Court held that the test is whether packing is done in order to put the goods in marketable condition and whether the goods are capable of reaching the market without the type of packaging concerned. If yes, then the cost of packing is includible in the transaction value. CCE, Chennai Vs. Addisons Paints & Chemicals Ltd. [2015‐TIOL‐18‐SC‐CX] Bonafides of assesse cannot be doubted if the authorities themselves have the doubts about the dutiability In this case the petitioner was cutting the larger steel plates into smaller one and did not paid excise duty as it considered not amounting to manufacture. The Supreme Court held that since the authorities themselves were not clear about whether the process amount to manufacture or not, the bonafides of the petitioner cannot be doubted and hence larger period cannot be invoked. Sanjay Indl Corpn & Anr Vs. CCE, Mumbai [2015‐TIOL‐17‐SC‐CX] Ground not mentioned during the main hearing cannot be heard during rectification application Tribunal cannot remand the case back on multiple occasions In this matter the Supreme Court dismissed the petition by holding that since the issue raised in the rectification application was not argued at the time of hearing of the main case, the ROM application cannot survive. CCE, Jaipur Vs. Hindustan Zinc Ltd. [2015‐TIOL‐16‐SC‐CX] In this case a matter was adjudicated thrice during last 12 years and was remanded back by the Tribunal. On application of both the parties against the remand back, the High Court of Bombay quashed the remand back order and asked Tribunal to decide the matter on merits. RalliS India Ltd. Vs. CCE, [2015‐TIOL‐630‐HC‐MUM‐CX] Page 7 Amortized value of tools and dies given on FOC basis to job worker to be added in transaction value Indirect Tax Newsletter In this case the appellant did not discharged excise duty on such amortised value and declared on the invoice that the price is the sole consideration. The Tribunal held that the amortized value is includible in transaction value and larger period is also invokable since the appellant has misdeclared the facts by putting on the invoice that price is the sole consideration. ITW India Ltd. Vs. CCE, Pune‐1 [2015‐TIOL‐504‐CESTAT‐MUM] Customs SCN to be treated as served by affixing on notice board only after exhausting all the options In this case the petitioner changed the premises under an intimation to the authorities. The authorities dispatched the SCN to the old address and postal authorities marked as ‘left’. The tribunal treated the appeal as time barred. The High Court of Bombay regularised the appeal by treating that is within time by holding that since the order was not sent to new address, resort to putting the SCN on the notice board cannot be resorted. Balaji Marbles vs. UOI & ANR [2015‐TIOL‐642‐HC‐MUM‐CUS] Exemptions as available under excise will be available for CVD purposes In this case the Supreme Court held that for the purposes of levying CVD, one should assume that the goods are manufactured in India and then calculate the duty. Accordingly, it was held that all excise duty exemptions as are available for manufacturing in India, will be also available on importing a the corresponding product in India for CVD purposes. Aidek Tourism Services Pvt. Ltd. Vs. CC, New Delhi [2015‐TIOL‐23‐SC‐CUS] Reasonable cause to be shown for extension of warehousing period and subsequent re‐export In this case the goods were lying at the warehouse of the appellant for last 15 years. The petitioner sought extension of warehousing on the basis of it being declared sick company. The High Court disallowed the permission for re‐export of goods citing that there was no conscious effort on the part of petitioner to actual re‐export the goods. Mere filing of extension without reasonable cause is not enough. Binny Ltd. Vs. CC (Imports) Customs House, No.60, Rajaji Salai Chennai – 600001 [2015‐TIOL‐602‐HC‐MAD‐CUS] General baggage exemption cannot be clubbed for for family members In this case the petitioner imported a television and argued for duty free clearance under Baggage Rules by clubbing the exempt limits of all the family members. The High Court of Calcutta denied these contentions and held that the general free allowance will be considered for the importer only without clubbing the limits applicable for other persons. Dinesh Kumar Goyal & ANR Vs. ACS & ORS [2015‐TIOL‐690‐HC‐KOL‐CUS] Indirect Tax Newsletter Page 8 VAT Process of perforation of papers, printing the lines and insertion of carbon paper amounts to manufacture In this case the petitioner were engaged in purchasing the paper, perforating the paper on both side, printing the lines on paper and inserting the carbon papers between the papers. Under the Bombay Sales Tax Act, 1959 the term "manufacture" was defined to include producing, making, extracting, altering, ornamenting, finishing or otherwise processing treating, or adapting any goods, or using or applying any such process, as the State Government may, having regard to the impact thereof on any goods or to the extent of alteration in the nature, character or utility of any goods brought about by such process, by notification in the Official Gazette, specify. In these circumstances the Hon’ble High Court of Bombay held that since in the normal trade practice the resultant paper is identified as specific item, the processes undertaken and of the above nature results in a product emerging and for specified purpose and utility, that is sought and known in the commercial world as a distinct product having a different identity. Sakhi Industries Ltd. Vs. The State of Maharashtra [2015‐TIOL‐520‐HC‐MUM‐ CT] Assessee need not file an indemnity bond if C forms misplaced by the authorities In this case the petitioner submitted the original C forms to the authorities and obtained the acknowledgment. The forms were misplaced by the authorities. The authorities demanded the indemnity bond from the petitioner. The Hon’ble High Court of Madras denied submission of indemnity bond and held that since the forms are misplaced by the authorities, the petitioner will be allowed to submit the duplicate copies of the C form with the authorities. Sree Kumar Engineering Works Vs. Assistant Commissioner (CT) [2015‐TIOL‐ 579‐HC‐MAD‐VAT] Transfer of goods by branch office to head office purchased pursuant to auction is stock transfer In this case an assesse had a branch office in the State of Andhra Pradesh and head office in the State of Maharashtra. The branch office purchased the beeri leaves from State Government pursuant to auction and transferred the goods to HO. The authorities treated the sale as sales within the State and imposed sales tax. The Supreme Court held that there was no nexus between the auctioner and the HO and sales concluded when the branch office paid the auctioner for the beeri leaves. The transfer of goods by branch office to HO will be treated as stock transfer not subject to sales tax. CCT Hyderabad Vs. Desai Beedi Company Andhra Pradesh [2015‐TIOL‐21‐SC CTLB] Page 9 Contract for printed material for a particular customer is a works contract Indirect Tax Newsletter In this case the petitioner printed the material for its client. The printed material could not have been sold to another person. In this fact pattern, the Hon’ble High Court of Madras held that sine the work executed by the assessee related to printing of materials and such printed materials were meant for particular customers, who placed orders and it cannot be sold in the open market like any other goods, the contract is works contract even if some material is incidentally transferred to the contractee. Heritage Printers Vs. The Joint Commisioner (SMR) Of Commissioner Taxes Office Of The Special Commissioner & Commissioner Of Commercial Taxes Chepauk, Chennai ‐ 600 005 [2015‐TIOL‐608‐HC‐MAD‐CT] News and Comments FTP to be released by 01‐04‐2015 The rate of service tax to be changed from 12.36% to 14% from notified date after passing of the Finance Act The Government of India will be releasing new Foreign Trade policy on 1st April, 2015. The proposed 14% Service Tax rate will be implemented from a date to be notified after enactment of the Finance Bill, 2015. The exact date of which will be known after the Finance Bill gets assent of the Hon’ble President of India and the ministry notifies the date for the change. Moreover, the “Education Cess” and “Secondary and Higher Secondary Education Cess” shall be subsumed in the revised rate of Service Tax i.e. 14% (No Cess on Service Tax). Hence, one should not charge or pay 14% until a date has been notified after the President’s assent (Expected after end of April in early May). Page 10 Indirect Tax Newsletter Corporate India Advisors LLP MUMBAI DELHI Suresh Rohira RohiniAggarawal suresh@cia-llp.com rohini@cia-llp.com Phone: 022- 26830349 Pankaj Goel pankaj@cia-llp.com PUNE Phone: 011-45002880 Kumar Iyer kumar@cia-llp.com Phone: 020-26438202 About CIA CIA is an indirect tax specialist firm. CIA is run by eminent professionals having a niche experience in all realms of indirect taxes in leading multinational consulting firms. The services comprises of Service tax, Central Excise, Foreign Trade Policy, Customs, Value Added Tax, Central Sales Tax, Anti‐dumping / Subsidy Measures and Goods and Services Tax. CIA has Wide spectrum of network on PAN India basis and provides best value for money proposition. CIA leverages upon its strong knowledge base, research and professionals with distinguished background For Private Circulation Only CIA does not assume any responsibility for the information given under the document. While every effort has made to avoid errors or omissions in this publication, it is suggested that to avoid any doubt the reader should cross‐check all the facts, law and contents of the publication with original Government publication or notification or judgment. CIA neither accepts nor assumes any responsibility or liability for any act undertaken by any reader of this publication in whatsoever manner.

© Copyright 2025