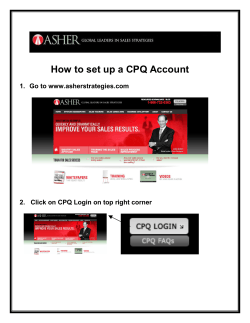

CLACKAMAS FIRE DISTRICT #1 401(a) DEFINED CONTRIBUTION