Journal Entries - College of Business

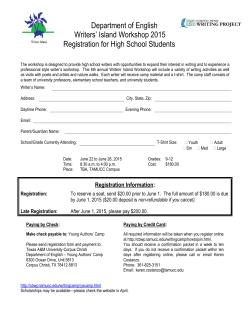

VO LUME 6 College of Business Accounting,, Finance and Business Law ISSUE 2 SPRING 2015 Table of Content Focus on Adjuncts ........................................... 2 Student Accounting Society News ................... 4 Student Finance Association News .................. 6 Texas State Society CPAs Opportunities ......... 8 Important Dates and Career Services ............... 9 TSBPA Requirement for CPA Exam ............. 10 Volunteer Income Tax Assistance ................. 11 Journal Entries MESSAGE FROM THE AFBL DEPARTMENT CHAIR Dr. Don Deis Greetings fellow Islanders! In preparing for this issue of “Journal Entries” I looked over several past issues and noticed a reoccurring theme about our enrollment growth. We have really come a long way since I and about 900 others enrolled in 1973 as the first class of Texas A&I University – Corpus Christi, which would later become Corpus Christi State University and then Texas A&M University – Corpus Christi. The faculty and classrooms were all contained in four buildings of which two remain: ROTC and Classroom East. The library was housed in the ―round‖ building. The College of Business was so tiny that there were no departments – just a College. Highly qualified faculty who are committed to their students is one feature that has been consistent throughout all the years of our history. This issue of “Journal Entries” focuses on a very important group of faculty - area professionals who serve as adjunct professors. These dedicated individuals bring a wealth of experience into the classroom. As you read about the adjuncts you will note that some are fellow TAMUCC alums and the others are ―islanders by choice.‖ Their many contributions are critical to our success! In November, Dean Gamble and I traveled to Houston to meet with the Houston Chapter of the Texas A&M University – Corpus Christ Alumni Association. The Houston chapter is the largest of the out-oftown chapters. There was a big turnout and we had a wonderful time meeting alums from the ‗50s, ‗60s, ‗70s, ‗80s, ‗90s, and from 2000 to last 2014. During homecoming the University of Corpus Christi alums restored the anchor and dedication plaque to the Island University near the University Center. It had been missing for 40 years! In many ways, returning the anchor closes the loop and ties us altogether: UCC, A&I-CC, CCSU, and TAMUCC. I hope that all of you will remain engaged with your Island University after you graduate. Please remember to ―Like‖ the A&M-CC Accounting Program page in Facebook and please send me a message in my Facebook, email, or call if you want to discuss anything having to do with your accounting program. Go islanders! Don Don Deis A&M-CC alum, Class of 1975 & 1977 Department Chair Journal Entries is distributed to your Islander e-mail account. To access your Islander e-mail, visit: http://sail.tamucc.edu/ 1 Mr. John Brashear Mr. John Brashear is an adjunct professor at Texas A&M University-Corpus Christi. He is an accounting instructor for Fraud Examination, Financial Accounting, Federal Income Tax 1 and Multinational Entities: Accounting and Consolidations. He also teaches the Philosophy recitation of Foundations of Professional Ethics. He was formerly an undergraduate professor at the University of Houston Clear Lake where he taught Federal Taxation of Individuals and Managerial Accounting. Mr. Brashear received a Bachelor of Science in Marine Engineering Systems with Honors from the United States Merchant Marine Academy in Kings Point, N.Y. He received a Master in Business Administration from Baylor University in Waco, TX. He also received a Masters Degree in Accounting from Rice University in Houston, TX. While receiving his masters at Baylor he worked as a graduate research assistant for Dr. Conway and Dr. Comer on public utility pricing. Although he enjoys flying an airplane and glider, his love and educational interests are accounting and taxation. Dr. Ahmed Elkassabgi Dr. Ahmed Elkassabgi has lived in Corpus Christi most of his life. His family moved to Corpus Christi from Houston when he was 4 years old. He attended Woodlawn Elementary School, Haas Middle School, and King High school where he graduated in 1999. He earned his Bachelors degree in Electrical Engineering at Texas A&M University – Kingsville in 2004. While getting his Bachelors degree he interned at Oak Ridge National Laboratory in Oak Ridge, TN., where he worked with a team of engineers that were funded by the International Atomic Energy Agency and the U.S. Department of Energy. His job was to write a computer program that would act as a bridge to transition from an old 3D Nuclear Reactor simulation program to a new more sophisticated one. Upon graduation, he landed a job as a Patent Examiner at the United States Patent and Trademark Office. He examined patent applications in 3D simulation hardware; he specifically examined algorithms that reduced the computing power needed to simulate 3D images on computers. He left the patent office in 2005 to get his MBA at Texas A&M University – Corpus Christi where he graduated in Spring of 2008. In the Fall of 2008 He worked as an Adjunct Professor at TAMUCC at the College of Science and Technology. In the Spring of 2009 he was accepted into the PhD program in Finance at Texas A&M International University where he graduated in the Spring of 2014. Now, he is an Adjunct Professor at TAMUCC teaching Finance. Ms. Sharon Polansky Ms. Sharon Polansky is the Director of Master‘s Programs for the College of Business. She also teaches undergraduate accounting courses as an adjunct instructor. This Spring 2015 semester, Ms. Polansky is teaching Managerial Accounting and Auditing Principles and Procedures. Ms. Polansky holds an undergraduate degree in mathematics from the University of Texas at Austin and an MBA from Corpus Christi State University (now Texas A&M University-Corpus Christi). She received her CPA license in 1982. In addition to working at the University, she has public accounting experience with Peat Marwick Mitchell (now KPMG) and Fite & Wheeler. Ms. Polansky also worked as a statistician for Central Power & Light Company and the City of Austin Electric Utility. 2 Mr. Thomas Matthews Mr. Matthews has served as Chief Investment Officer and Chief Credit Officer at American Bank since 1995. Prior to 1995 he served as Chairman and CEO of The Bank of Corpus Christi (sold to IBC in late 1994). He has over 40 years of experience in commercial banking and has been an Adjunct Instructor in Finance since the fall semester 2004. His educational background includes: BBA - The University of Texas at Austin; MBA - The University of Houston; Graduate of the Stonier School of Banking at Rutgers University. He is married to Susan and they have one adult daughter and two grand children. Mr. Scott Kruse Mr. Scott Kruse holds a Masters of Accountancy degree from Texas A&M UniversityCorpus Christi and a Bachelor of Science in Sociology from Drury University. His adjunct teaching includes Financial & Managerial Accounting and he also assists with the online MBA Managerial Finance course. His professional experience includes both public and private industry accounting. Before coming to TAMU - Corpus Christi he was the Chief Financial Officer at the Waterstreet Restaurant Group in Corpus Christi. He also participates in the Young Business Professionals of the Coastal Bend, Accounting Advisory Board at TAMU – Corpus Christi, and volunteers his time at numerous groups in Corpus Christi. He grew up in a military family and has lived in many areas, including Texas, Hawaii, Washington D.C., Rhode Island, & Missouri. Ms. Ginger DeLatte Ms. Ginger DeLatte grew up in New Orleans with two parents in science education. Her sister also went into a science education field. As she pursued her Bachelor in Business Administration and Master of Accountancy at Baylor University she used to joke she was the "black sheep" of the family for going into business instead of the "family business" of Science. After graduating from Baylor she moved to Dallas and spent over 10 years working at TXU and Dal-Tile Corp progressing at each company. She spent much of her time focusing on inventory, but also had numerous opportunities to create and analyze full financial statements and communicate those results to both Executives and the sales force. The analysis she performed help shape business decisions and those discussions were some of the most rewarding moments of her Industry career. In the summer of 2011 she moved to Portland, TX with her husband (Brian) and two children (Taylor who is now 5 and Josh who is 3). She continued to tele-commute with her former company in Dallas and did some contracting work. However, before she knew it, the real family business found her - teaching. While at Baylor she tutored student-athletes and had some amazing faculty members. She knew then she wanted to teach one day and provide that same support she was able to receive, but didn't know when that would happen. Moving here finally gave her that opportunity. She is starting her third year as an adjunct professor at Texas A&M - Corpus Christi and currently teach two sections of Principles of Financial Accounting and one section of Managerial Accounting. She also assist with the online MBA Managerial Finance course. She completely loves teaching the students at this university, but the bigger joy is getting to know the students and encouraging them while they pursue their passions. 3 The Student Accounting Society (SAS) at Texas A&M University- Corpus Christi is excited about the Spring semester! We have four great speakers coming to campus this semester to share their expertise and experiences. Our speakers all have different backgrounds to provide students the opportunity to hear about the different avenues that are available for their futures. SAS welcomes both graduate and undergraduate students to attend our speaker meetings. Flyers and emails are typically circulated a week prior to a meeting and a full schedule is available in this newsletter. Students can enjoy free pizza at every SAS meeting while being exposed to the numerous job options that are available in the accounting field. SAS also promotes student membership of the Corpus Christi Chapter of the Texas Society of CPA‘s (TSCPA); a professional organization for Certified Public Accountants (CPA‘s) in Texas. Students can join TSCPA for a discounted annual price and reap all of the benefits of professional member membership. These benefits include access to job postings across the state and networking opportunities with local CPA‘s through the mentor program. A Student Luncheon is hosted by the Corpus Christi Chapter of TSCPA at the end of each semester where top CPA‘s from the community volunteer to sit on a Q&A Panel. These panelists provide students with additional understanding of topics such as sitting for the CPA exam and how to build a successful accounting career. Students are invited to attend this and all other Corpus Christi Chapter Luncheons which are held each month and are well publicized at SAS meetings. Current Officers: President - Justin Jevric Vice President - Megan Lawler UCSO Representative - Elena Anderson Treasurer - Katie Hunt Secretary—Ashley Vanecek Membership - Kelli Chancellor Marketing - Myriam Stephanie Ortiz For more information contact SAS at tamucc_sas@yahoo.com Spring 2015 SAS Meeting Dates All meetings at 3:30am in OCNR 135 February 11th (W) Patricia Chastain, Career Counselor for College of Business March 25th (W) Louis Tatum, CPA, and CFO of Workforce Solutions April 8th (W) Bay Ltd. April 22nd (W) Michael Hunter, Borden Insurance, and Alumni of TAMUCC Facebook page https://www.facebook.com/sas.tamucc 4 Student Accounting Association Photos from Fall 2014 5 Student Finance Association SFA as an organization, we connect students in the university and to the community. With the goal of learning and growing, we encourage students to participate in our meeting at which they can meet, talk, and discuss with financial advisors, managers, CEO, business owners, recruiters, and so on about career in financial field. Besides that, we hold field trips to companies in order to help student interact with company in a more realistic way. Advisor: Dr. Armand Picou Officers: Trang Nguyen—President Cameron Valverde—Vice President Cody Lang—Treasury Jerry Khim—Webmaster Ashley Animashaun—Social Media officer Christine Choe—Public relation officer Christina Martinez—Marketing officer Josh Carrillo—Historian officer Blake Provost—UCSO representative SFA activities Spring 2015 02/19/2015 Welcome Merrill Lynch Senior financial advisor 03/13/2015 Field trip to Mirabal Montalvo Real Estate Company 03/31/2015 Welcome alumni Travis Cruger 04/16/2015 Welcome Mark Oser Primerica Regional Vice President and Nicholas Indridson Division Director 05/02/2015 Pot luck/Cook out for SFA officers and members FMI: sfa@tamucc.edu and sfa@islander.tamucc.edu 6 Student Finance Association Meetings 7 Texas State Society of CPAs Student Opportunities Texas Society of CPAs Student Memberships Available TSCPA student members enjoy unlimited access to tscpa.org; a subscription to Today’s CPA magazine and TSCPA electronic newsletters, including a monthly e-newsletter written exclusively for students and exam candidates; CPA exam review discounts; admittance to the Society’s Mentor Network; access to online job and internship postings; and membership in the local TSCPA chapter. Students can sign up for membership online at www.tscpa.org by clicking on Join TSCPA. Free Local Online Job Bank for Students – Get That Job! The Corpus Christi Chapter of TSCPA has added an online job bank where student job seekers can post their resumes in .pdf or .doc(x) format at no charge. The job bank has 4 objectives: 1) increase awareness of local employment opportunities for accounting graduates and CPAs; 2) promote the chapter to local students; 3) provide members with a forum to promote their job openings; and 4) add membership value for members seeking employment. CPA candidate and members can also post resumes for free; there is a charge for non-member CPAs. Student resumes remain online for 90 days. Employers will also post positions there (free). To submit a resume or job posting, or ask additional questions contact mbentley@tscpa.net.To view Local CPA Mentors Available!! Any student interested in having a mentor can complete the form on the Corpus Christi Chapter of TSCPAs at this link: http://corpuschristi.tscpa.org/MenteeParticipationForm.pdf For Information about these Student Opportunities Contact: Melinda Bentley Corpus Christi Chapter Liaison 972-687-8579 or 800-428-0272, ext. 279 14651 Dallas Parkway, Suite 700, Dallas, Texas 75254 FAX: 972/687-8679 | mbentley@tscpa.net | corpuschristi.tscpa.org Texas Society of CPAs: Connecting. Protecting. Advancing. 8 Deadlines for TAMUCC Graduate School Applications Summer I: April 15 Summer II: May 15 Fall: July 15 Upcoming Events The Accounting, Finance and Business Law department is offering exciting events for accounting students! Together with Career Services and other partners, there’s a lot to do! We hope these events will enhance your educational experience. Teacher Job Fair — Wednesday, April 8, 2015, 9:30 am—12 pm, Anchor Ballroom Contact Career Services for more information about these and other events to shape your career - http://career-services.tamucc.edu Meet the CPAs Luncheon—May 1, 2015. Sponsored by the Corpus Christi Chapter of the Texas Society of CPAs. The chapter normally maintains a resume book that is distributed to member firms. For more information, check out the Corpus Christi Chapter’s website— http://corpuschristi.tscpa.org/calendar.asp Patricia Chastain Career Counselor College of Business Resume Reviews Career Counseling and Exploration Internship Mock Interviews Fulltime, Part-time, On Campus, Off Campus Jobs Career Choices and Salary Expectancy Contact Ms. Chastain Phone: (361) 825-2955 9 ARE YOU READY FOR THE CPA EXAM? TEXAS STATE BOARD OF PUBLIC ACCOUNTANCY REQUIREMENTS AND CPA REVIEW MATERIALS DISCOUNTS SNAPSHOT OF TSBPA EDUCATION REQUIREMENTS FOR THE CPA EXAM Be of good moral character Hold a baccalaureate or higher degree Complete 150 semester hours of college credit Complete 30 semester hours of upper level accounting courses (some accounting courses may not qualify – check TSBPA rules) Complete 24 semester hours of upper level business courses Complete a 3 semester hour ethics course that has prior Board approval ACCT 4345 or ACCT 5345 Ethics for Accountants and Business Executives Satisfy the Board‘s 2 credit hour research and analysis requirement and 2 credit hour business communication requirement Research requirement: ACCT 5371 Tax Consulting, Planning and Research or ACCT 3321 Federal Income Tax I and ACCT 4311 Auditing Principles and Procedures Communication Requirement: MGMT 3315 Communicating in Business or ACCT 5341 Advanced Auditing and Assurance Services or ACCT 5381 Accounting Theory At least 15 semester credit hours of accounting must be physical attendance in class; that is, no more than 15 credit hours of online accounting courses can be counted Click on Texas State Board of Public Accountancy for more information or talk to Ms. Sharon Polansky. CPA EXAM REVIEW COURSE DISCOUNTS FOR TAMUCC STUDENTS AND ALUMS! CPAexcel: http://tamucc.cpaexcel.com/ Gleim: https://www.gleim.com/accounting/cpa/sitelicense/siteorder.php?slID=1391 10 HELP LOW-INCOME PEOPLE FILE FREE INCOME TAX RETURNS A GREAT OPPORTUNITY TO EXPAND YOUR SKILLS AND EXPERIENCE WHILE GIVING BACK TO THE COMMUNITY!!! How Volunteering Helps Families and Our Community Help families save money and get refunds they deserve Brings money back into the community – to be spent here What You Get From Volunteering Add tax-preparer certification to your resume Gain experience and confidence for future employment Volunteer Requirements 1. Complete IRS Tax Training and certification (training starts in Jan 2015) 2. Volunteer a minimum of 4 hours a week (Jan – April) 3. Pass the IRS “Standard of Conduct” We need tax preparers, and quality reviewers. Or consider being a greeter. The Coastal Bend CA$H Coalition is a collaborative project of United Way of the Coastal Bend, Goodwill Industries of South Texas, Del Mar College, Coastal Community and Teachers Credit Union, Texas A&M University-Corpus Christ, the Internal Revenue Service, Texas A&M University-Kingsville and Workforce Solutions of the Coastal Bend. For more information and the training schedule, go to www.uwcb.org Or contact Anita Reed at anita.reed@tamucc.edu 11

© Copyright 2025