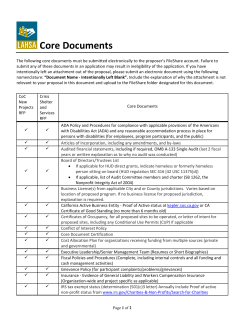

55838_Ch 07_Executive Board Summary.indd