e e erat d d - Federated Investors (UK)

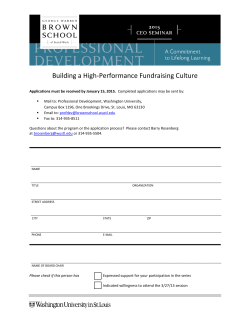

Federated Short-Term Sterling Prime Fund Class 8 Shares - accumulation 31 May 2015 Standard & Poor’s AAAm rated Fitch AAAmmf rated Moody’s Aaa-mf rated CREDIT RATING (%) INVESTMENT OBJECTIVE AND STRATEGY The Fund aims to provide capital stability and income through investment in short-term fixed income and variable rate securities. The Fund will invest in high quality, liquid securities from both within and outside the UK, aiming to achieve capital preservation with money market returns. The Fund is a European Securities and Market Authority (“ESMA”) Short-Term Money Market Fund. INVESTMENT MANAGER’S REPORT The Bank of England (BOE) cut its forecast for UK economic growth for both this and next year. Growth prospects for 2015 were lowered to 2.50% from 2.90%, and the expectations for 2016 fell from 2.90% to 2.40%, Governor Carney said the downgrade was due to the stronger pound, higher projected bank rates, a poor outlook for housing investment and a forecast for weaker productivity. Meanwhile, the UK economy entered deflationary territory for the first time in more than 50 years. This has been widely expected, with lower energy prices, the strength of sterling and the ongoing supermarket price wars, but it was air and ferry fares that eventually pushed the annual CPI rate to fall by 0.10%. No one expects a period of outright deflation similar to the one that lasted for 12 years beginning in 1921 to reoccur as the impact of lower oil prices fade from the year-on-year measure. Indeed expectations are for a short-lived negative period. Mr. Carney fully expects inflation to return to the BOE’s 2.00% target next year. The unemployment rate remained at 5.50%, with 202,000 new jobs created, and real-time earnings were the best since 2007. However, the BOE cut its wage growth forecast in 2015 from 3.50% to 2.50%. A-1+ 52.8 A-1, 7 days or less 16.0 A-1, 8 days or more 31.2 PORTFOLIO COMPOSITION (%) Govt 0.4 DEPO 18.3 CP 23.2 CD 41.0 FRN 12.6 BOND 2.8 Short-Term MMF 1.7 EFFECTIVE MATURITY SCHEDULE (%) O/N 20.3 PERFORMANCE Net Average Annual Total Returns (%) (See Important Legal Information) 1 Week 1.1 1 Month 12.2 Cumulative 3 Month Year to Date 1 Year 3 Year 0.45 0.45 0.44 0.47 5 Year Since Inception 2 Months 13.1 0.62 0.76 6 Months 28.4 3 Months 16.7 1 Year 8.2 Past performance is no guarantee of future performance and the value of investments and income (yield) from them may fall as well as rise and investors may not get back the amount originally invested. All returns are shown annualised on an actual/365 day count basis. Fund returns are net of fees and charges for share class 8. WEIGHTED AVERAGE MATURITY TOP PORTFOLIO ISSUERS (excluding overnight deposits) 58.05 days LIQUIDITY** Mizuho Bank Ltd. Toronto Dominion Bank Metropolitan Life Global Funding I Daily Weekly **Calculated according to the Institutional Money Market Funds Association (IMMFA) guidelines. Citibank NA, New York DZ Bank AG Deutsche Zentral-Genossenschaftbank Pohjola Bank plc Citibank NA, New York Sumitomo Mitsui Banking Corp. Nordea Bank AB Sumitomo Mitsui Banking Corp. These holdings may not be indicative of future portfolio composition. Because this is a managed portfolio, the investment mix will change. For Professional Investors Only 20.36% 21.42% ederated Federated Short-Term Sterling Prime Fund 31 May 2015 Class 8 Shares - accumulation SHARE CLASS DETAILS FUND INFORMATION Class ISIN SEDOL Dividend Ongoing Charges* 8 GB00B2R5TL51 B2R5TL5 Accumulating 11bps Min Initial Investment £30,000,000 *The ongoing charges figure is based on the annual management charge and the running costs of the fund for the 12 month period ending 31 December 2014. It excludes portfolio transaction costs. The ongoing charge figure may vary from year to year. Domicile UK Structure OEIC UCITS Launch Date 09 January 2009 Dealing Cut Off 1.30pm London Time Liquidity Same Day Currency GBP Benchmark FEDERATED INVESTORS (UK) LLP Federated Investors (UK) LLP offers liquidity fund products on a wholesale, competitive basis for a variety of corporate and institutional investors to distribute to their client base or use in the management of their own liquidity. Originally established in 2007 under the name Prime Rate Capital Management LLP, as an independent, UK-domiciled specialist provider of AAA-rated liquidity funds (known as Qualifying Money Market Funds), it was acquired on 13 April 2012 by Federated Investors, Inc., one of the largest investment managers in the US. On 23 September 2013 it was renamed Federated Investors (UK) LLP. 7 Day £ LIBID Fund Volume £1.8 billion PORTFOLIO MANAGERS Dennis Gepp Senior Vice President Chief Investment Officer, Cash ABOUT FEDERATED A financial industry pioneer since 1955, Federated is a leading global investment manager known for its stability. Federated continues to increase its market footprint through both organic growth and strategic acquisitions to take advantage of global opportunities. As one of the largest US investment managers with assets under management of approximately US$355 billion, Federated has been managing international investments since 1984, upon the launch of one of the first international equity funds. In 1991, Federated International Management Limited (“FIML”) was established in Dublin to manage Irish-domiciled UCITS. Federated opened an office in Frankfurt in 1998 and subsequently created Federated Asset Management GmbH to further concentrate on the German market and the German-speaking countries in Europe. In 2012, Federated acquired Prime Rate Capital Management LLP, now Federated Investors (UK) LLP, as a manager of UK-domiciled UCITS. FIML, Federated Asset Management GmbH and Federated Investors (UK) LLP are part of a highly experienced investment franchise with more than 200 investment professionals managing products on a truly global basis. Gary Skedge Vice President Senior Portfolio Manager IMPORTANT LEGAL INFORMATION This document is issued by Federated Investors (UK) LLP of Nuffield House, 41-46 Piccadilly, London, W1J 0DS, a limited liability partnership registered in England OC327292 which is authorised and regulated by the Financial Conduct Authority with FCA reference number 469674. Past performance is no guarantee of future performance and the value of investments and income (yield) from them may fall as well as rise and investors may not get back the amount originally invested. Although the fund will attempt to maintain a stable net asset value per share, there is no assurance it will be able to do so. Shares of money market funds are not bank deposits and are not guaranteed by any government agency or other entity. For detailed information on the specific risks of investment, please refer to the fund’s prospectus. Tax assumptions are subject to statutory change and the value of tax reliefs will depend on individual circumstances. Portfolio holdings are as of the date indicated, are subject to change, are not indicative of future holdings, and should not be viewed as a recommendation, investment advice or suitability of any investment. Fund credit ratings are based on an evaluation of several factors, including credit quality, diversification, and maturity of assets in the portfolio, as well as management strength and operational capabilities. Ratings of funds and their portfolio holdings are subject to change and do not remove market risks. Applications to invest must only be made on the basis of the offer document relating to the investment, which is only available to Eligible Counterparties and Professional Clients. The Federated Short-Term Sterling Prime Fund is a sub fund of the umbrella fund, Federated Cash Management Funds which is an OEIC governed by UK law and authorised by the FCA. Any investment in the funds is made subject to the terms of the Funds’ Prospectus and relevant Key Investor Information Document, which are available in English free of charge from the Investment Manager, Federated Investors (UK) LLP, Nuffield House, 41-46 Piccadilly, London, W1J 0DS. For a copy of the Prospectus, Key Investor Information Document, information on portfolio holdings or other matters, please contact us on +44 (0) 20 7618 2600, or email us on info@FederatedInvestors.co.uk. Alternatively please see the information on our website at FederatedInvestors.co.uk. FURTHER INFORMATION Federated Investors (UK) LLP Nuffield House, 41-46 Piccadilly London, W1J 0DS For Professional Investors Only Federated Investors (UK) LLP Federated is a registered trademark of Federated Investors, Inc. G44548-16 (6/15) 2015 ©Federated Investors, Inc. Phone Fax Email Website +44 (0) 20 7292 8620 +44 (0) 20 7292 8655 info@FederatedInvestors.co.uk FederatedInvestors.co.uk

© Copyright 2025