Wynne and the Dormant Commerce Clause (and

Wynne and the Dormant Commerce Clause (and more) COST 2015 Spring Audit Session/ Income Tax Conference Memphis, Tennessee April 23, 2015 Karl Frieden, COST, Moderator Jane May, McDermott Will & Emery Steven Wlodychak, EY 1 Agenda The Facts of the Case and the State Court Decisions The Key Constitutional Arguments The Potential Impact of a Decision for Maryland Oral Arguments April 23, 2015 Wynne and the Dormant Commerce Clause (and more) 2 1 The Facts of the Case and the State Court Decisions 3 Maryland Comptroller of the Treasury v. Wynne – ISSUE: Does the dormant Commerce Clause require a state to provide its residents an “other state tax credit” against ALL income taxes levied by the state? Maryland imposes two income taxes State income tax (5%), and County income tax (up to 3%) Maryland resident S corporation shareholder paid taxes on multistate tax business to all states April 23, 2015 Reported and collected on the SAME FORM! Not only claimed credit against the Maryland state income tax (allowed specifically by statute) but also against county tax (for which no statutory credit was available) Wynne and the Dormant Commerce Clause (and more) 4 2 What Is Not in Dispute in the Wynne Case – The undisputed facts in the case include: The amount in dispute consists entirely of “business” income: The flow through income from the Wynne’s 2.4 percent ownership of the S Corporation, Maxim Health Services Inc. The Wynnes’ salary income was sourced to and taxed fully by Maryland. Double taxation occurred here: The Wynnes were taxed on their flow through income from the S Corporation (Maxim) in 38 states other than Maryland. Maryland only provided them with a credit for 60 percent of these taxes paid to other states. The S corporation income was properly sourced to the other 38 states. April 23, 2015 Wynne and the Dormant Commerce Clause (and more) 5 What Is Not in Dispute in the Wynne Case – Maryland wants it both ways. It seeks to tax residents such as the Wynnes on all of their distributive share of the S corporation income – less the 60 percent credit allowed for taxes paid to other jurisdictions. And it seeks to tax non-residents on all of their income sourced to Maryland. April 23, 2015 Wynne and the Dormant Commerce Clause (and more) 6 3 Maryland Comptroller of the Treasury v. Wynne – Procedural background: Comptroller denied the refund claim for the county portion of tax Tax Court upheld Howard County Circuit Court (Judge Lewis Becker) overruled Tax Court (80 page opinion!) (June 29, 2011): County income tax authorized by state law. Dormant Commerce Clause requires state to provide “other state tax credit” not only against the state portion of the tax but also the county portion of tax. Failure to do so would, in effect, unconstitutionally favor in-state investment over multistate business. Comptroller appeals to Md. Special Court of Appeals; Taxpayer petitions to appeal directly to Md. Ct. of Appeals (Md.’s highest court) Wynne and the Dormant Commerce Clause (and more) April 23, 2015 7 Maryland Comptroller of the Treasury v. Wynne – Procedural background: Md. Court of Appeals affirms Howard County Circuit court (Jan. 28, 2013): Failure to provide an “other state tax credit” against the county income tax would violate dormant Commerce Clause because it favors instate investment over out-ofstate investment. Comptroller files petition for certiorari to US Supreme Court US Supreme Court asks US Solicitor General for its position May 24, 2014 – US Supreme Court grants certiorari April 23, 2015 Wynne and the Dormant Commerce Clause (and more) 8 4 The Key Constitutional Arguments 9 Maryland Comptroller of the Treasury v. Wynne Question Presented: “Does the United States Constitution prohibit a state from taxing all the income of its residents – wherever earned – by mandating a credit for taxes paid on income earned in other states?” April 23, 2015 Wynne and the Dormant Commerce Clause (and more) 10 5 Maryland Comptroller of the Treasury v. Wynne – Issues: Due Process Clause? Commerce Clause? Both? Commerce Clause Does Commerce Clause apply to individuals? Does Commerce Clause protect residents from their own states? How do Complete Auto tests apply in this context? Can states tax on both the basis of residence and source? Wynne and the Dormant Commerce Clause (and more) April 23, 2015 11 Maryland Comptroller of the Treasury v. Wynne – State of Maryland’s Argument: Maryland can tax all income of its residents no matter where earned. Oklahoma Tax Comm’r v. Chickasaw Nation, 515 U.S. 450 (1995). Justified by benefits state confers on residents Justified by residents’ political power Commerce Clause April 23, 2015 Does not apply Was never intended to protect residents from taxation by their own states. Goldberg v. Sweet, 488 U.S. 252 (1989) or If applied, does not invalidate Maryland’s tax Wynne and the Dormant Commerce Clause (and more) 12 6 Maryland Comptroller of the Treasury v. Wynne – State of Maryland’s Argument: (cont’d) Fairly apportioned because Maryland can tax 100% of its residents’ income The “fair share” of a resident’s income is ALL OF IT Does not discriminate Treats residents’ income the same regardless of where earned Does not impose disproportionate burdens on nonresidents Even if problematic, results from multiple states taxing on different bases Wynne and the Dormant Commerce Clause (and more) April 23, 2015 13 Maryland Comptroller of the Treasury v. Wynne – Wynnes’ Argument: Due Process Clause does not invalidate Maryland’s tax. Commerce Clause does. “Maryland’s tax therefore is obviously invalid if the usual Commerce Clause rules apply. The only question for this court, then, is whether they do. The answer is yes.” Commerce Clause prohibits burdens on interstate commerce that subject it to double taxation (or the risk thereof) that intrastate commerce does not bear. Maryland’s tax “punishes residents for doing business across state lines.” April 23, 2015 MeadWestvaco Corp. v. Illinois Dep’t of Rev., 553 U.S. 16 (2008) Violates Complete Auto test. Wynne and the Dormant Commerce Clause (and more) 14 7 The Potential Impact of a Decision for Maryland 15 The Consequences of a Maryland Win in Wynne – In 1980, 11 percent of all state and – local taxes paid on business income were collected under the individual income tax (e.g. from S Corporations, partnerships and sole proprietors) compared to 89 percent collected under the corporate income tax. By 2013, 41 percent of all taxes paid on business income were collected under the individual income tax compared to 59 percent under the corporate income tax. – – In 1980, the percent of all businesses (S Corporations, partnerships and sole proprietors) that paid tax under the individual income tax was 83 percent compared to 17 percent that paid tax under the corporate income tax. By 2007, the percent of all businesses that paid tax under the individual income tax was 94 percent compared to only 6 percent that paid tax under the corporate income tax. April 23, 2015 Wynne and the Dormant Commerce Clause (and more) 16 8 A Discriminatory Two-Tier System Under the Commerce Clause – A decision for Maryland in the Wynne case would create a discriminatory two-tier system for taxing interstate commerce. Commerce Clause protection against the double taxation of income earned in a multistate business would not apply to the 94 percent of business entities (e.g., S corporations, partnerships, sole proprietors) that pay 41 percent of all income taxes paid on business income under the individual income tax. Based on current trends, this amount will be about 50 percent of all income tax within the next two decades. – How far does this apply – sales/use taxes, piggyback and non-piggyback local income taxes, etc.? April 23, 2015 Wynne and the Dormant Commerce Clause (and more) 17 Oral Arguments 18 9 Maryland Comptroller of the Treasury v. Wynne – US Solicitor General Donald Virrilli, Jr. Dormant Commerce Clause was not designed to, nor has it ever been used to, protect citizens from their own state(!) Citizens of a state have recourse: Vote for legislators who will change the law! Enact the “other state tax credit” against the county income tax by legislation. Wynne and the Dormant Commerce Clause (and more) April 23, 2015 19 Comptroller v. Wynne – US Supreme Court Hearing – “Fair share” Justice Scalia questioned Taxpayer on impact of tax credit mechanism on “fair allocation” of taxes among similarly situated residents Sets up example – Neighbors with five kids (just like the Wynnes had) Both send kids to school, rely on local fire and police protection. One neighbor earns ALL of her income in Maryland and pays all of her income taxes to Maryland. Other neighbor earns ALL of her income OUTSIDE of Maryland, pays income taxes to other states and then takes a full “other state tax credit” against Maryland income taxes – paying NOTHING to Maryland. Is that fair? Resident working out of state not paying taxes for in-state services? April 23, 2015 Wynne and the Dormant Commerce Clause (and more) 20 10 Comptroller v. Wynne – US Supreme Court Hearing – Resident v. Non-resident taxes April 23, 2015 US Solicitor General’s argument focuses on nondiscriminatory nature of county resident tax All residents, regardless of where income was earned, were subject to the county tax at the same rate – there was no discrimination Court questions focused on the ENTIRE personal income tax scheme as a whole, questioning interaction of county income tax with the special compensatory non-resident income tax intended to collect same tax on non-residents Justices questions seemed to suggest Maryland’s personal income tax regime should be looked at in its entirety Wynne and the Dormant Commerce Clause (and more) 21 US Supreme Court Hearing – Nov. 12, 2014 “Word of the Day” April 23, 2015 Wynne and the Dormant Commerce Clause (and more) 22 11 Comptroller v. Wynne – US Supreme Court Hearing – Hawaiian Hot Dog Stand JUSTICE BREYER: To be specific, you live in California. You have a hot dog stand in Hawaii. All right? It has a $1,000 income. It comes back to California. You pay 13½ California tax. Hawaii wants to charge another 12. So you're paying 25 percent. Can California say: That's fine; we give them no credit for the 11 percent they're paying in Hawaii? So the bottom check that you get is $750, not a 1,000. But if your hot dog stand were in California, the check would not be 750, it would be approximately 900. Okay? Now, is that constitutional or not? MR. BROCKMAN: It is, Your Honor. JUSTICE BREYER: Okay. That's what I thought. Then your answer -JUSTICE SCALIA: Move to Hawaii is what you're saying. (Laughter.) Wynne and the Dormant Commerce Clause (and more) April 23, 2015 23 Comptroller v. Wynne – US Supreme Court Hearing – Tariff? Transcript of Hearing: – Justice Breyer (question for US S.G. (pg. 22)): April 23, 2015 “… I don't know who's at fault. Switzerland has a tax on milk from cows that are pastured at less than 5,000 feet. It's Belgium's fault. They don't have any mountains. (Laughter.) I mean, I don't know who's at fault, but that is a discriminatory tariff. Wynne and the Dormant Commerce Clause (and more) 24 12 Comptroller v. Wynne – US Supreme Court Hearing – Tariff? This is a state tax case. What the heck does a “tariff” have to do with state taxes? Justices Breyer and Alito and Chief Justice Roberts all questioned whether the Maryland personal income tax system acted as a tariff. Neither the Taxpayer nor Maryland (nor the US Solicitor General) briefed “tariffs” Only appears in the Tax Economists’ Amicus Brief (pg. 4): Wynne and the Dormant Commerce Clause (and more) April 23, 2015 25 Comptroller v. Wynne – US Supreme Court Hearing – Tariff? April 23, 2015 Why is all this important? West Lynn Creamery, Inc. v. Healy, 512 U.S. 186, 193 (1994) Justice Stevens: Because of their distorting effects on the geography of production, tariffs have long been recognized as violative of the Commerce Clause. In fact, tariffs against the products of other States are so patently unconstitutional that our cases reveal not a single attempt by any State to enact one. Instead, the cases are filled with state laws that aspire to reap some of the benefits of tariffs by other means. … Wynne and the Dormant Commerce Clause (and more) 26 13 Comptroller v. Wynne – US Supreme Court Hearing – Tariff? Import-Export Clause? State Taxes? Justice Thomas has consistently held that there is no such thing as the “dormant Commerce Clause” Justice Scalia has said the same thing (but for longer) – Even in this case, he called it the “imaginary negative Commerce Clause” (Transcript at pg. 10) American Trucking Assns., Inc. v. Smith, 496 U.S. 167, 204 (1990) But … maybe there is another way – Import-Export Clause (?) Camps Newfound/Owatonna, Inc. v. Town of Harrison, 520 U.S. 564, 610 (Thomas Dissent) April 23, 2015 Not only international commerce, but interstate commerce was the intent of this provision back in the 1780' Wynne and the Dormant Commerce Clause (and more) 27 So … How will the Court Rule? 28 14 So, how will Wynne be decided? – DISCLAIMER! These are Steve’s picks ONLY Not EY’s, MW&E’s, COST’s Need 5 votes For taxpayer: Tax violates dormant Commerce Clause; discriminatory tax For taxpayer: ImportExport Clause; Unconstitutional Tariff Alito Kennedy Breyer Roberts Sotomayor? Dormant Commerce Clause survives April 23, 2015 Thomas Scalia (“imaginary For state: dormant Commerce Clause does not protect residents from own state Ginsburg Kagen dormant commerce clause”) Wynne and the Dormant Commerce Clause (and more) 29 QUESTIONS Karl Frieden Vice President and General Counsel Council On State Taxation kfrieden@cost.org 202-484-5215 Jane May, Partner McDermott Will & Emery jmay@mwe.com 312-984-2115 April 23, 2015 Steven Wlodychak, Principal State and Local Tax Leader EY Center for Tax Policy steven.wlodychak@ey.com 202-327-6988 Wynne and the Dormant Commerce Clause (and more) 30 15

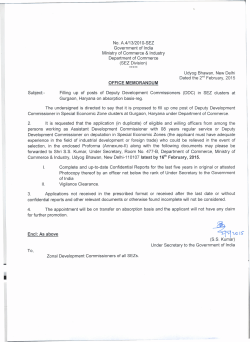

© Copyright 2025