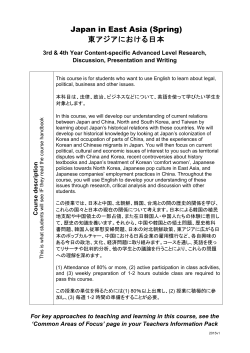

multiethnic metrics market access