Office Market Germany 2015 Rental and Investor

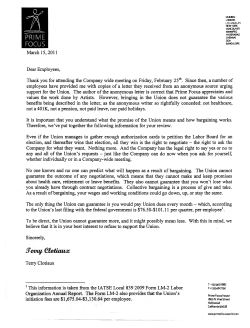

Office Market Germany 2015 Rental and Investor Markets A positive economic environment is ensuring continuing stable demand for office space in the new building/firsttime lease segment, an investor focus on value-added properties, and a strong wave of expansion e ncompassing B locations and, in some cases, B cities. A high level of redevelopment pressure and added value should be e xpected in this segment, along with changes of use from commercial to residential: Mixed-used property structures are increasingly frequent. In a context of strong international demand, a further decline in yields should be expected in 2015. Kiel 14,00 14.00 6.7 6,7 Rostock 11,00 11.00 7.1 7,1 Lübeck 12,50 12.50 7.5 7,5 Schwerin Wilhelmshaven 11,00 11.00 8.1 8,1 8,50 8.50 6.7 6,7 Hamburg 24,00 24.00 4.5 4,5 Oldenburg 12,00 12.00 6.5 6,5 Bremen 12,85 12.85 5.4 5,4 22,50 22.50 4.7 4,7 Berlin 12,00 12.00 7.2 7,2 13,70 13.70 6.0 6,0 11,50 11.50 7.5 7,5 Dusseldorf Düsseldorf 26,00 26.00 4.7 4,7 Ratingen 14,00 14.00 6.3 6,3 Neuss 8,00 8.00 6.3 6,3 10,80 10.80 7.5 7,5 10,50 10.50 6.8 6,8 8,30 8.30 7.5 7,5 7.5 7,5 Halle/Saale 9,50 9.50 7.0 7,0 6.1 6,1 Bonn 12,00 12.00 6.2 6,2 Magdeburg 10,80 10.80 6.5 6,5 Cottbus Essen 9.50 9,50 Hagen Krefeld 7.0 7,0 Ratingen MönchenWuppertal gladbach Solingen 12.00 12,00 13.00 13,00 8.50 8,50 Dusseldorf Düsseldorf 6.3 6,3 6.8 6,8 9.1 9,1 Neuss Leverkusen Cologne Köln Siegen 12.00 12,00 Marburg 7.5 7,5 21.50 21,50 Aachen 11.00 11,00 4.9 4,9 14,00 14.00 6.3 6,3 Braunschweig Paderborn 8,50 8.50 7.1 7,1 Hamm 13.20 Dortmund 13,20 Bochum Duisburg Salzgitter 6,50 6.50 6.8 6,8 Bielefeld Münster Gütersloh 11,50 11.50 6.4 13,50 13.50 6.3 6,3 14,00 14.00 5.8 5,8 11,00 11.00 6.8 6,8 14,00 14.00 5.9 5,9 Potsdam Hanover Hannover Osnabrück 8,20 8.20 7.8 7,8 Kassel Leipzig 12,00 12.00 5.5 5,5 Dresden Weimar Erfurt Jena 10,50 10.50 7.0 7,0 7,00 7.00 7.9 7,9 11,00 11.00 7.3 7,3 10,00 10.00 7.2 7,2 12,00 12.00 6.3 6,3 Gera Chemnitz 7,20 7.20 7.9 7,9 9,00 9.00 8.0 8,0 17,50 17.50 5.3 5,3 10,00 10.00 6.6 6,6 Koblenz 11,00 11.00 7.1 7,1 14,00 14.00 5.8 5,8 38,00 38.00 4.4 4,4 Frankfurt/M. Offenbach/M. Aschaffenburg Darmstadt Wiesbaden Mainz 12,50 12.50 6.2 6,2 Trier 12,00 12.00 7.2 7,2 Saarbrücken 13,00 13.00 6.4 6,4 9,50 9.50 6.8 6,8 14,00 14.00 6.1 6,1 10,00 10.00 7.5 7,5 Kaiserslautern 13,00 13.00 6.9 6,9 9,50 9.50 6.8 6,8 Würzburg 9,70 9.70 6.5 6,5 14,00 14.00 6.0 6,0 Karlsruhe 13,00 13.00 6.2 6,2 Erlangen Nuremberg Nürnberg 8,80 8.80 7.1 7,1 Heidelberg 12.50 Prime rent in €/m2 7.5 Prime yield in % 6-month trend: rising stable falling 13,00 13.00 6.5 6,5 Fürth Mannheim 9,60 9.60 6.7 6,7 Bamberg 11,50 11.50 7.1 7,1 Ludwigshafen Prime rents and prime yields 9,00 9.00 6.6 6,6 Schweinfurt 13,5 13.5 5.4 5,4 Heilbronn Regensburg 11,50 11.50 6.2 6,2 11,00 11.00 6.4 6,4 Stuttgart 13,00 13.00 7.0 7,0 Ingolstadt 20,00 20.00 5.0 5,0 11,00 11.00 6.0 6,0 Ulm Augsburg 15,00 15.00 5.9 5,9 Munich München 35,00 35.00 4.4 4,4 Freiburg 13,50 13.50 6.6 6,6 14,80 14.80 6.5 6,5 Konstanz 2015 AverageAverage prime rent prime yield A cities B cities C cities D cities 26.71 13.10 12.08 9.73 €/m2 €/m2 €/m2 €/m2 4.65% 6.03% 6.67% 7,16% As of 1st quarter 2015 Contact: research@catella.de Source: Catella Research 2015 Yield/Risk Profile for Office Markets in 2015 Prime yield as % Prime yield as % 8.0% 9.0% Solingen Section Overview: B, C, D Cities Wilhemshaven Chemnitz Weimar Gera 8.0% Halle 7.0% Kaiserslautern Paderborn Siegen Lübeck Krefeld Marburg 6.0% Osnabrück Stuttgart 5.0% Berlin Frankfurt Hamburg Munich 10 20 30 Bielefeld 40 50 60 70 80 Kiel Erlangen Ludwigshafen Bochum Freiburg Darmstadt Duisburg > 5 million m² 2 million to 5 million m² < 2 million m² (further differentiation for C & D in terms of regional significance) } Aachen Dortmund 6.0% Heilbronn Mannheim Essen Aschaffenburg Cottbus Schwerin Bamberg Konstanz Braunschweig Neuss Ingolstadt Ratingen Hamm Mainz Potsdam Mönchengladbach Heidelberg Augsburg Münster Erfurt Schweinfurt Dresden Karlsruhe Office markets have been classified on the basis of their size (existing stock). Offenbach Salzgitter Saarbrücken Risk factor Category A = B = C = D = Wuppertal Fürth Koblenz Regensburg Hagen Kassel Dusseldorf Jena Rostock Gütersloh 7.0% Magdeburg Trier Würzburg Cologne 4.0% Leverkusen Ulm Hanover Wiesbaden Leipzig Bremen Nuremberg Bonn 5.0% Risk factor Methodology: Risk model Catella Research 2015, schematic presentation on the basis of a fully leased property in the new building/first-time lease, A location category 45 50 55 60 65 As of 1st quarter 2015 Source: Catella Research 2015

© Copyright 2025