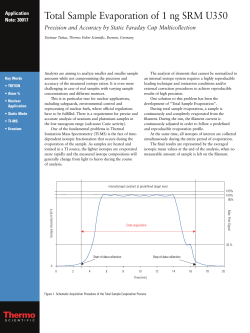

Latest Annual Report - Thermo Fisher Scientific