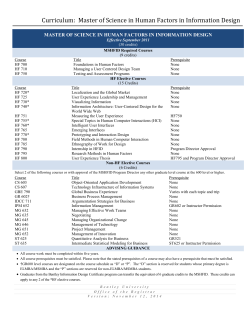

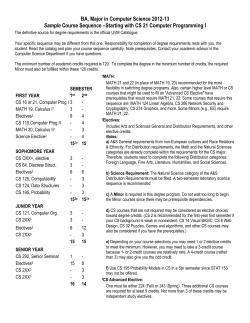

MAcc Brochure - University of Utah

Masters of Accounting MAcc / macc.business.utah.edu / (801) 581-7275 / macc@utah.edu / 22 nd MAcc Class Profile - 2014 Ranked Undergraduate & Masters Degree Programs 2013 Average Ugrad GPA 32 credits 30 credits - 14 core / 18 elective - 13.5 core / 16.5 elective Fall: 17 credits 6 - 9 credits per semester Spring: 15 credits Core classes on Tues/Thurs Evenings Start: Fall or Spring Average Acctg GPA 35% Non-University of Utah Part-time: 4 - 5 semesters part-time Full-time Program 2 semesters 20 Students 3.71 94 Students 3.54 13% Out-of-state 53 33% Female The School of Accounting is separately accredited by the AACSB Full-time: Fall 2016/Spring 2016 Scholarships awarded 22% Non-accounting majors Age 27/28 Average (FT/PT) 12% International Permanent Resident 44% Multilingual Careers Management 95% 73% 34% MAcc graduates employed within 3 months of graduation over the past 10 years Percent of graduates employed in public accounting Graduates accepting positions out-of-state Sample of Employers: $50,900 Utah • California • Texas • Nevada • Colorado • Washington D.C. • Arizona • Oregon • Virginia • Washington Average starting salary EY • PwC • Deloitte • KPMG • Eide Bailly • Office of the Utah State Auditor • Mantyla McReynolds • Tanner LLC • Squire and Company • Grant Thornton • Adobe • Backcountry.com • Barrick Gold North America • CBIZ MHM • Comcast Cable • Freddie Mac • Goldman, Sachs & Co. • Goverment Accountability Office • JC Penney • Larson CPA • McGladery • Overstock.com • Questar • Utah Department of Education • Zions Bancorporation • Zions Bank / macc.business.utah.edu / (801) 581-7275 / macc@utah.edu / 1 MAcc Emphasis Course - 14 credits Tax (full-time only) Full-time: 14 core credits 18 elective credits - 9 credits in acctg - 9 credits in acctg or business ACCTG 6740 Professionalism/Teams (2) ACCTG 6320 Advanced Corp. Tax (3) ACCTG 6360 International Taxation (1.5) ACCTG 6300 Tax Research (1.5) ACCTG 6350 Partnership Taxation (3) ACCTG 6370 State & Local Taxation (1.5) ACCTG 6380 Advanced Federal Tax Issues (1.5) Audit/Financial ACCTG 6740/6741 Professionalism/Teams (2/1.5) ACCTG 6610 Reading & Interpreting Financial Stmts (3) ACCTG 6510 Cases in Auditing & Systems (3) ACCTG 6620 Business Valuation & Analysis (3) ACCTG 6730 Business & Tax Strategy (3) or ACCTG 6732 Corporate & LLC Taxation (3) Accounting Info Systems ACCTG 6740/6741 Professionalism/Teams (2/1.5) ACCTG 6520 IT Risks & Controls (3) ACCTG 6510 Cases in Auditing & Systems (3) IS 6420 Database Theory & Design (3) ACCTG 6730 Business & Tax Strategy (3) or ACCTG 6732 Corporate & LLC Taxation (3) Prepares students learn to read, interpret, and apply IRS tax codes. If you enjoy constantly learning, solving puzzles and making a difference in the financial well-being of a company or individual, tax is for you. Full-time: 14 core credits 18 elective credits - 9 credits in acctg - 9 credits in acctg or business Part-time: 13.5 core credits 16.5 elective credits - 9 credits in acctg - 7.5 credits in acctg or business Review the financial statements of a company to ensure a company’s financials are fairly stated. Strong interpersonal and critical thinking skills, get to know the ins and outs of the business, and spend time at different client locations. Full-time: 14 core credits 18 elective credits - 6 credits in IS - 6 credits in acctg - 6 credits in acctg or business Part-time: 13.5 core credits 16.5 elective credits - 6 credits in IS - 6 credits in acctg - 4.5 credits in acctg or business Combines an understanding of auditing with an expertise in information systems. Students will learn how to ensure the data is reliable, secure, accessible and relevant. Sample of Electives: ACCTG 6270 Strategic Cost Mgmt (3) ACCTG 6910 Accounting Communications (3) ACCTG 6680/6681 Corp Governance & Comm. (1.5) ACCTG 6310 Taxation of Deferred Comp. (1.5) ACCTG 6540 Fraud Exam. & Forensic Acctg (3) ACCTG 6850 Acctg Ethics (1.5) ACCTG 6340 Estate & Gift Tax (1.5) ACCTG 6660/6661 Financial Acctg Reporting (3) STRAT 6760 Profiles in Leadership (3) ACCTG 6400 Adv. Excel & Access (3) ACCTG 6670/6671 Advanced Auditing (1.5) OIS 6500 VBA for Business (1.5) * can take any of the other emphasis’ core courses as electives Prerequisites Six of seven required courses listed below must be completed before starting the MAcc program. The seventh course must be completed prior to completion of the MAcc program. • • • • • • • ACCTG 5110 Financial Accounting I ACCTG 5120 Financial Accounting II ACCTG 5130 Financial Accounting III ACCTG 5210 Managerial Accounting ACCTG 5310 U.S. Tax ACCTG 5410 Accounting Information Systems ACCTG 5510 Auditing For a listing of MAcc equivalents go to: http://macc.business.utah.edu/form/course-equivalencies 2 / macc.business.utah.edu / (801) 581-7275 / macc@utah.edu / * can take business electives in finance, information systems, management, marketing and operations Application Deadlines Spring 2016 Fall 2016 Application Open: July 15 Priority Deadline: October 15 Regular Deadline: November 15 Rolling Admissions are available until December 15 Application Open: July 15 Priority Deadline: March 1 Regular Deadline: April 15 Rolling Admissions are available until July 15 International Deadlines Spring 2016 Fall 2016 Application Open: July 15 Deadline: August 15 Application Open: July 15 Deadline: March 1 Notes: For Spring 2016, an additional $30 fee will be charged for applications submitted after November 1, 2015. For Fall 2016, an additional $30 fee will be charged for applications submitted after April 1, 2016. International applicants who currently live in Utah and do not require an I-20 or F-1 visa may be eligible for an extended international deadline. Please contact macc@utah.edu for details. * Scholarship priority is given to full-time applicants who apply by this deadline Tuition Full-Time Resident MAcc.......................................................................................................................................$26,500 Full-Time Non-Resident MAcc............................................................................................................................$49,300 Part-Time Resident MAcc......................................................................................................................................$32,400 * These estimates reflect the tuition and fees for all required credit hours taken over the course of either 2 semesters (full-time) or 4 semesters (part-time) at the current tuition rate. Please note that these are estimates and tuition rates may increase without notice. http://fbs.admin.utah.edu/income/tuition/ Scholarships Scholarship priority is given to all full-time applicants who apply by the priority deadline. No separate application is required. Scholarship notification is sent separately from admission decision. Scholarships are awarded for fall and spring semesters and disbursed in two equal payments. To be given priority consideration for a scholarship the following criteria must be met: • A complete application is submitted • At least 4 accounting prerequisites completed • Recommendations can be submitted after the deadline, but must be received before the Admissions Committee meets (approx. 2 weeks after deadline) • Full-time applicant Note: Awards given to those with less than 6 prerequisites complete will be contingent upon maintaining grades. Amounts and availability are all subject to change. Merit-based Scholarships Scholarship Estimated Amount Non-Merit Based Scholarships Scholarship Estimated Amount Graduate Fellowship $10,000 Community Service $4,500 Outstanding Academic Achievement $5,000 Diversity $4,500 Academic Leadership $3,000 Academic Excellence $1,000 To qualify, you must submit an essay within the online application by the priority deadline Non-Resident Scholarships Assists non-residents with non-resident tuition through a cash scholarship. Non-residents are eligible to be awarded between $9,500 and $19,000 to reduce their non-resident tuition bill. These scholarships are for fall and spring semesters and are disbursed in two equal payments. To be considered, applicant must meet the following criteria: • Meets or exceeds admissions requirements • Is a non-resident / macc.business.utah.edu / (801) 581-7275 / macc@utah.edu / 3 Application Requirements Masters of Accounting Online Application prerequisites or equivalents completed. (See acctg prerequisites section) Bachelor’s Degree from an Approved institution Accounting Prerequisites Undergraduate GPA A minimum cumulative 3.00 undergraduate GPA is required for admission. If you don’t have a 3.00 cumulative GPA, we will accept a 3.00 GPA from the last 60 credit hours taken. http://app.applyyourself.com/?id=utahgrad (See acctg prerequisite section) Transcripts GMAT Test Score An official GMAT test score is required for all graduate applicants except Fast Track, Preferential and those who already have a CPA. No minimum score requirement. On average, it takes 2-4 weeks for us to receive official GMAT scores. You are welcome to submit unofficial scores via e-mail for conditional consideration. Meet Accounting and Undergraduate GPA Minimums (Submitted within online application) The online application will require you to: 1. List all colleges and universities you have attended including the University of Utah, regardless of length of attendance. 2. Upload a copy of your unofficial transcripts from each institution, including the University of Utah. If admitted, you will be asked to submit official transcripts to the University of Utah Graduate School for verification. Official transcripts from the University of Utah do not need to be sent in. Accounting GPA Calculated based on 6 of the 7 accounting Two Professional or Academic Letters of Recommendation (Requested within online application) Personal Statement (Submitted within online application) Professional Resume (Submitted within online application) English Language Proficiency International applicants must submit an English proficiency score that is less than 2 years old from the TOEFL (100+ ibt or 600+ pbt) or IELTS (7.0+), unless you qualify for an English Proficiency Waiver. Check to see if you are eligible: http://admissions.utah. edu/apply/international/english-proficiencywaivers.php * An interview may be requested and all admission decisions are subject to approval by the MAcc Committee. Application Options Fast Track Application Applicants who qualify for our Fast Track program earn the right to waive the GMAT, recommendations and essays. The online application and application fee is still required. Qualifications: 3.50+ Accounting GPA * 3.30+ Overall Undergraduate GPA All accounting prerequisites completed at the University of Utah Preferential Application Applicants who qualify for our preferential program earn the right to waive the GMAT. The online application and application fee is still required. Qualifications: 3.70+ Accounting GPA * 3.70+ Overall Undergraduate GPA All accounting prerequisites completed at another approved U.S. Institution Regular Application Qualifications: 3.20+ Accounting GPA * 3.00+ Overall Undergraduate GPA * Calculated using 6 out of 7 accounting prerequisites. Lowest grade will be dropped. If less than 7 are completed, all grades used to calculate your accounting GPA. Revised 5.15 / macc.business.utah.edu / (801) 581-7275 / macc@utah.edu / 4

© Copyright 2025