Renew, restore and renovate

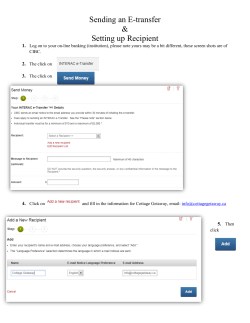

A20 - THE MUSKOKA SUN: Spring 2009 START PLANNING FOR YOUR COTTAGE UPGRADE NOW! The 3 R’s of spring: Renew, restore and renovate Home Renovation Tax Credit also applies to cottages By Kim Good W hile the economy flounders worldwide, governments are trying their best to restore consumer confidence and keep the dollars flowing. Part of the Canadian government’s plan to encourage spending and help keep the recession at bay is to introduce a temporary Home Renovation Tax Credit for 2009. But don’t let the word “home” throw you off, cottage renovations are also eligible for the 15-per-cent credit claimable on your 2009 income tax return. Meant to stimulate economic activity by creating a demand for labour and construction materials while encouraging homeowners to invest in their greatest assets, the Any improvements to an eligible dwelling qualify tax credit can be claimed on the portion of eligible expenditures exceeding $1,000, but not more than $10,000. This means that the maximum tax credit that can be received is $1,350, or 15 per cent of the $9,000 difference. Examples of eligible expenses include renovations to a kitchen, bathroom, or basement; new carpet or hardwood floors; building an addition, deck, fence, retaining wall or dock; a new furnace or water heater; painting the interior or exterior; laying new sod or landscaping; and the list goes on. Basically, any improvements to an eligible dwelling or dwellings, or the land on which they sit, excluding routine maintenance, qualify. If in doubt, go to the Canada Revenue Agency website at www.cra-arc.gc.ca, scroll to the bottom and click Budget 2009 for more information. For cottages that are jointly owned, by family members for example, the expenses can be divided and claimed separately, with each family eligible for up to $1,350 on their share of the improvements. For example, Bob and Jerry are brothers who, with their families, own equal stakes in the family cottage. Together they incur $12,000 in kitchen renovations for the cottage, which cannot include the cost of new appliances, and $3,500 for a new dock. As well, Jerry installs a new furnace in his home at a cost of $5,000. Bob makes a claim for $6,750 ($7,750 – 1,000) for his share of the cottage expenses and receives a credit of 15 per cent of this amount or $1,012.50 on his 2009 tax return. Jerry’s total costs for home and cottage come to $12,750 ($7,750 + $5,000), so he claims a $1,350 credit on the maximum allowable amount of $9,000 ($10,000 – 1,000). If you have any intention of renovating in the near future, 2009 is the year to do it. To be eligible, goods and services must be purchased after Jan. 27, 2009 and before Feb. 1, 2010. It should be noted that expenditures for projects where an agreement was entered into before Jan. 28, 2009 will not be eligible for the credit. A little VANITY is a good thing... call us and see the best selection in Muskoka! SPRING IS THE SEASON: Once the snow is finally gone, hammering and sawing will be heard across Muskoka as people take advantage of the Home Renovation Tax Credit to get the job done. Just don’t forget your bug gear, or hire out and let the professionals deal with it. (Photo by Brett Thompson) P R E S T IG E R E NO VAT ION S Carpentry n Contractor n Millworking Residential n Commercial Build New n Additions n Renovations Restorations n Decks n Boathouses n Docks Architectural Trim & Details CADD Custom Trim Milling Available 279 Manitoba Street, Bracebridge and the ‘NEW’ Bathroom Design Centre at North Muskoka House, 365 Hwy 60, Huntsville 645-2671 788-3800 a R. James Cook Muskoka and surrounding area Ph: 705-801-5656 • Fax: 705-687-6178 Email: prestigerenovations@hotmail.com a

© Copyright 2025