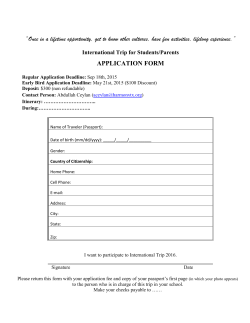

YOUR TRAVEL INSURANCE POLICY