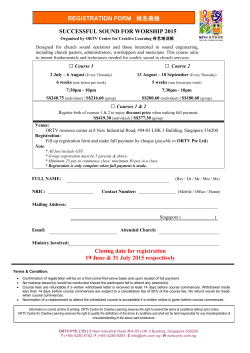

RISING THE NEXT LEVEL