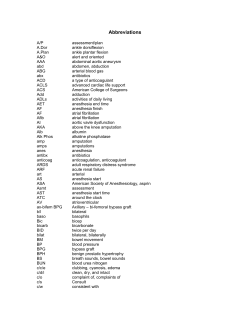

H I P