Suits you … suits your customers! customer service

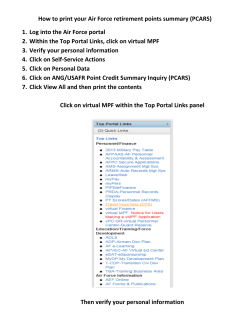

Suits you … suits your customers! How to deliver a truly tailored customer service Developed for the Deloitte Customer Service Leaders Forum Contents Introduction 1 Customer service – made to measure • Strategies for tailoring your customer service interactions 3 Delivering the perfect fit for you and your customers • Approaches to delivering a bespoke customer service 12 Conclusion 16 Contact us 16 Suits you … suits your customers! How to deliver a truly tailored customer service 1 Introduction Are you designing the perfect fit for your organisation and your customer base? As a customer service leader, you are constantly challenged to achieve the seemingly impossible: delivering customer service which supports your brand promise, meeting or exceeding your customers’ ever-increasing expectations, managing risk (operational, financial and reputational) and achieving ever more operational efficiencies. This requires an unrelenting focus on continuous improvement – but managing change can be an unwelcome distraction from achieving demanding customer service levels. You are bombarded with new ideas, hot topics and trends, from the media, colleagues and consultants. How do you know which to focus on, and which to ignore? In writing this paper, our motivation is to help you address these challenges. We have reviewed and consolidated the best of the thinking in the market, overlaid our own views and experience of what works and what does not, and given you a single point of reference for where to seek out new solutions for improving your customer service. A common theme involves the need to define strategies for proactively managing customers at every step, and through every stage, of their lifecycles of interaction with your organisation. This enables you to align cost-to-serve with the potential value of the contact and the customer, differentiating service levels where appropriate. This in turn allows you to maximise the value of the customer to you – and your value to the customer – across their lifetime with you. “Defining strategies for proactively managing customers through every stage of their interaction with your organisation will allow you to maximise the value of the customer to you – and your value to the customer – across their lifetime with you.” As the strategies that can be deployed are becoming increasingly sophisticated, so the deployment challenges are becoming increasingly complex. This paper presents a selection of these strategies, together with an approach for how they can be deployed, and some lessons we have learned from doing so. The strategies we focus on are: 1.Self-service – often used as an effective driver of cost reduction, but also with a strong role to play in driving improvements to the customer experience 2.Authentication – related to self-service, new technologies also help to manage the risks associated with customer interactions, while improving the experience 3.Profile matching – on the cutting edge of new developments, evidence suggests that matching customers to service advisors whom they are more likely to relate to, will help drive a better service experience 4.Sales-through-service – another hot topic, as the customer service function continues its strategic shift from a cost centre to a profit centre 5.Social media – the buzz-word of the moment, viewed as hype by some media commentators, but with an increasing role to play in delivering an improved customer experience 2 As figure 1 below illustrates, all of these strategies can have a role to play in maximising the customer’s value – and the value given to the customer – across their lifecycle: Figure 1. Strategies for increasing customer value across the lifecycle • Determine the ‘next-best action’ to drive sales through service Customer value • Use profile-matching to deliver a better customer experience • Monitor social media to understand the drivers of dissatisfaction and churn • Use self-service channels to reduce acquisition costs • Factor this into the proposition design, right from the start Acquisition Costs Customer Profitability (Revenue, cost and churn) Customer Life-time • Identify customers as part of the take-on process • Authenticate their identities at subsequent interactions I hope that you find this paper interesting, insightful and helpful in your ongoing quest to improve the service you provide to your customers. Yours sincerely, Scott Wheatley Lead Partner, Customer Service Effectiveness Suits you … suits your customers! How to deliver a truly tailored customer service 3 Customer service – made to measure Strategies for tailoring your customer service interactions Strategy 1: Self-service Self-service is about helping customers to help themselves Self-service is the ability of a customer to either partly or fully complete their service or sales need without speaking to a human. Typically this is enabled through online services (i.e. website-based) or via telephony channels such as push-buttons or speech recognition. Increasingly customers are using mobile devices to access these services. Self-service also encompasses a range of other processes such as check-in kiosks at airports, automated teller machines at banks and self-service check-outs at supermarkets. These are now familiar territory for customers and represent excellent examples of where a simple customer process has been developed into a simple, intuitive, no-frills self-service process that works. These solutions work because the processes are simple, easy to use and provide tangible benefits over alternatives – for instance, no queues and 24 hour access. Importantly, face-to-face alternatives are typically provided for those that cannot or choose not to use the self-service option. “Many UK organisations are now using ‘say anything’ natural language speech recognition software which allows callers to tell them who they are and why they are calling in their own words.” So what’s new? Self-service technology has maturated significantly over the past five years and in particular, speech recognition has evolved into a robust technology that is being used for call routing and identification and verification of callers, as well as automating low value transaction customer enquiries. Many UK organisations are now using ‘say anything’ natural language speech recognition software which allows callers to tell them who they are and why they are calling in their own words. Then, using this information in combination with an automated identification and verification process, they are able to route calls appropriately. This approach allows organisations to build their response capability around the customer and allows the customer to interact in a more natural way, whilst reducing cost for the organisation and making customer and call centre interactions richer in both content and conversation. In the online world, organisations continue to experiment with how to offer additional products and services. Organisations leading the way are using analytics to establish offers that reflect both the customer’s unique profile and also use the context of the enquiry being made. This approach aligns with a trend to provide only additional information and offers that are going to be of genuine interest to the individual customer. There is also a distinct trend to integrate self-service channels more tightly with other channels to provide a seamless customer experience. Integrating web self-service processes with live-chat (both text and video) and contact centre processes can provide customers with both proactive help to resolve their needs and also provides additional education to allow them to successfully navigate self-service in the future. This is turn can help create long-term changes in customer behaviours. A recent update to the suite of self-service options – virtual assistants – builds on this integration trend. Virtual assistants are not a new concept, but for some organisations, improvements to functionality are allowing them to become a key part of the web self-service experience. However, ongoing maintenance and updating of the knowledge-base that they (and, ideally the rest of the customer service workforce) rely upon is essential to ensure continued relevance. Finally, the explosion of other mobile devices such as iPhones and iPads is changing the way customers want to interact with you. Whilst still in its infancy, mobile device self-service is exploding. With more than six billion applications downloaded globally at the time of writing, the marketplace continues to grow exponentially. 4 Organisations that are successful in this space are keeping things simple, with applications that are easy to use and cleverly marketed. A customer must know about your application and then actively choose to download it, thus poorly-marketed applications may never even make it to the customer’s screen. Applications are ranked by users and rankings are published for the world to see; those with positive user feedback benefit from free marketing through online forums and communities – although the reverse is also true! However, getting customers to download your application is one thing; continued usage is another. Beyond download volumes alone, you need to consider the ‘stickiness’ of the application. Before launching, ensure your mobile device self-service application has been well designed, has a well thought-out marketing strategy, and has a clear purpose in your wider channel and customer strategy. Anything less risks damage to brand, increased contacts on other channels from customers due to ‘failure demand’, and a disjointed customer experience between channels. Strategy 2: Authentication Authentication is about managing your risk by knowing who you are doing business with In today’s marketplace, customers can be interacting with your organisation from anywhere in the world, at any time. Responding to the risk this poses to data security, over recent years we have seen a surging interest from organisations hoping to find new ways to protect both themselves and their customers’ details; this trend follows a range of high-profile examples of fraud and lost customer data, occurring both in the private and public sectors. Organisations leading in this area have realised that it is no longer good enough to have siloed contact Identification and Verification (ID&V) processes that are inconsistent across products and channels. These organisations are redesigning their customer ID&V processes, both from the ground up and enterprise-wide. By developing risk-based processes that use customer segmentation (who the customer is), and looking at customer demand types (why the customer is calling), organisations are able to create more robust, customer-friendly experiences. Common authentication solutions include something the customer knows (e.g. password, date of birth), or something that customer has access to (e.g. smart card reader, SMS text), or a mixture of these measures. However, increasingly more robust processes that strengthen security but also maintain customer experience are being considered. Typically this type of authentication involves utilising something intrinsic to a customer that cannot be stolen (e.g. fingerprint, iris scan or ‘voice-print’). Voice biometrics, as part of a risk based authentication process, eliminates the reliance on procedures such as pins, passwords, smart code readers and secret questions. It replaces them with something almost everybody has – their voice. Voice biometrics uses an enrolled customer’s ‘voice-print’, which comprises over 100 distinct and unique aspects of the individual’s voice, in order to authenticate a customer. “Voice biometrics can make it almost impossible for a fraudster to successfully complete an online transaction.” Although the contact centre applications are obvious, voice biometrics can also be used to increase authentication online by providing an additional layer of protection for high risk transactions. For example, when a customer attempts to withdraw or transfer large amounts of money out of an account, an outbound phone call can be made to the customer’s pre-registered device, asking them to identify themselves using their ‘voiceprint’. Once the customer has attempted to authenticate themselves, the transaction can either by approved immediately and shown to the customer on the screen or escalated via the phone call to a specialised team for more details. Using voice biometrics in this way reduces the risk of fraud as a customer has to physically respond in real-time to approve the transaction. Voice biometrics can make it almost impossible for a fraudster to successfully complete an online transaction. Organisations that have implemented voice biometrics have found that in addition to experiencing significantly reduced levels of call centre and online fraud, customer convenience and experience improvement are proving to be major benefits. This is particularly true where previous processes required customers to input long and laborious identification and personal questions. Suits you … suits your customers! How to deliver a truly tailored customer service 5 Strategy 3: Profile matching Profile matching is about making smart decisions about who your customer speaks to in your organisation Customer and contact centre advisor profile matching is an emerging tool that helps organisations match customers with contact centre advisors with whom they are more likely to have a positive experience and outcome. It operates, in concept, similarly to an online dating service, matching customers and advisors based on a defined set of variables. The match criteria can be based either on demographic data (such as age, sex or location), or a product or service match, where the contact centre advisor is a known advocate of a product/service. When this type of context is combined with such elements as the customer contact history, it is also possible to further enhance relationships by trying to connect the customer to someone with whom they have previously had a positive experience. Typically this process has involved matching customers who have enquires about a specific product or service with a customer advisor who actually owned that product or used that service, and who could therefore speak from their own genuine experience. For example: 1. Bill lives in Newcastle and is interested in buying an iPhone. He is connected to Lucy who also lives in Newcastle and owns an iPhone. 2. Mary, a pensioner, calls her bank because she is having problems using internet banking; she is connected with Jane in the call centre, who is also a pensioner and regularly uses online banking. The profile matching is enabled by real-time decision logic and business rules which connect something about the caller’s demographic and/or reason for contact with a similar attribute associated with the advisor. This common ground builds empathy and trust with the customer, and in turn deepens loyalty and willingness to associate with the brand. A word of caution: This strategy is at the early stages of use, and it will be some time before it achieves greater acceptance. Much like the challenges faced with complex skills-based routing, it has the potential to cause problems in workforce utilisation efficiency if applied too rigorously, so use of pilots and phased roll-out are advisable. Creating simple matching strategies based on customer and advisor segmentation is the key to understanding and unlocking the potential benefits profiling matching can provide. Organisations that have embraced profile matching find their advisors are more empowered to provide genuine help and knowledge – which in turn fosters increased customer spend, greater customer loyalty and brand advocacy from customers. Strategy 4: Sales-through-service Sales through service is about making the most of every precious customer interaction In a world of ever-diminishing returns from outbound marketing campaigns, poor responses to direct mail and email and customers rejecting unsolicited and irrelevant contact by signing up to the Telephone Preference Service (TPS) and other ‘don’t call me’ lists, every contact you have with your customer becomes more precious. Increasingly, inbound service interactions are the most valuable form of customer contact, and some organisations have found that customer service contact centres have become their largest sales channel. Making the most of these contacts means being able to determine the ‘next best action’ to take – often in real time. This requires a consistent view of transactional data such as customer history and value, predictive models for churn and purchase propensity and customer lifetime value, business rules that apply policies or commercial priorities, and a decision engine that can combine these factors to calculate the best course of action. 6 Figure 2. Components of a ‘next best action’ solution for sales through service Transactional data (e.g. CRM) Outcomes – to drive self-learning Social Network Analysis Predictive models – e.g. churn and purchase propensity, lifetime value Marketing Decision Next Best Action Business rules – e.g. commercial priorities Sales Customer Service Contextual data – captured during the interaction Although many businesses have embraced sales through service, many service organisations still have a natural reluctance to ask their people to sell. However, experience has shown that by developing the ability to engage in a manner that is relevant, dynamic and personal to each individual customer, customer loyalty can be increased at the same time as increasing revenue. This ‘holy grail’ can be achieved through: • Decisions informed by customer lifetime value, as opposed to short-term or single purchase views. This means that a long-term view can be taken e.g. on how much discount can be afforded, or what rates will be profitable. • Improving the information and inputs into models and decisions. By integrating marketing response data with CRM systems – from outbound voice, direct mail and email campaigns – it is now possible to provide an holistic view of customer interaction and response, which in turn drives better decisions. • Increasing use of real-time contextual information as part of the ‘next best action’ decision. Decisions taken will be more accurate, which will enable a more precise target offering and better take-up. • Using decision engines to drive and co-ordinate both inbound recommendations and outbound 1:1 communications. This will refocus campaign planning from a product focus to a more ‘customer-holistic’ alignment around lifecycle stages. • Recognising that the ‘next best action’ need not be an offer. Instead, it might be a request for missing profile information (such as email address), or a proactive service message. “Experience has shown that by developing the ability to engage in a manner that is relevant, dynamic and personal to each individual customer, customer loyalty can be increased at the same time as increasing revenue.” Suits you … suits your customers! How to deliver a truly tailored customer service 7 Applying these techniques will allow you to move from a situation where each customer is treated as simply part of a homogenous mass market, where everyone receives the same, untailored communications and offers, to one where you are able to treat each customer as an individual, with highly tailored messages and actions, aligned to their individual needs: Figure 3. progression from mass-market to individual tailoring From … mass-market offers Offer 1 Offer 2 Offer 3 To ... highly tailored ‘next best actions’ Action 1 Action 4 Action 5 Action 2 Action 6 Action 7 Action 3 ? Decision Action 8 These techniques will help to proactively manage a customer through their lifecycle, and so maximise their lifetime value to your organisation – and your value to them. “Social media represents a transition from monologue to dialogue between an organisation and its customers. To be effective, it should not be seen as an intrusive campaign, boasting about a product, but rather a conversation between equals.” Strategy 5: Social media Social media is about understanding and communicating with your customers Social media is an umbrella term used to describe a host of sites and technology that facilitate social interaction, sharing of user-generated content and aggregation of users’ opinions and recommendations. Also falling under the wing of social media are technologies like microblogging via Twitter (where a person ‘tweets’ brief thoughts and opinions); sites such as YouTube and Flickr, which allow users to share photos and videos; and RSS (Really Simple Syndication), which acts as an aggregator of personal news and other media. Social media continues to expand at lightning speed: Facebook, Twitter, YouTube and other Web 2.0 applications have not only infiltrated the consumer world, but are swiftly becoming accepted channels for doing business. As consumers become more empowered by mobile devices and easy access to the internet, the line between customer and organisation will continue to become more blurred. Social media represents a transition from monologue to dialogue between an organisation and its customers. To be effective, it should not be seen as an intrusive campaign, boasting about a product, but rather a conversation between equals. The benefits to the organisation of embracing social media grow along a spectrum, from at one end providing the ability for customers to ask direct questions, through enabling them to propose to react to ideas (providing a valuable source of direct feedback), to enabling them to describe a (hopefully positive) experience to fellow customers, to ultimately facilitating customers to be positively influenced by fellow members of their community, with respect to your products or services. In this sense, Social Media provides an entirely new contact channel between organisations and their customers, facilitating through electronic means the type of interaction seldom seen since the famous ‘Tupperware parties’ of the 1970s. 8 Organisations leading the way are including social media in their end-to-end customer service strategy, operational processes and integrating it within their multi channel proposition. We have found that four behaviours are key to a successful social media channel strategy: 1. Constantly listen for feedback Integrated reporting and monitoring processes are an essential element as they enable you to find out what your customers are saying about your company’s brand, products and services. This reporting can also be used to identify what consumers are saying about competitors’ services and products, providing compelling customer insight for all areas of the organisation. Most importantly, listening provides you the opportunity to respond and engage with customers as they provide feedback and interact within their online communities. 2. Respond quickly Responding within hours rather than days will prove to customers that you are listening, and allow you to resolve an issue before it becomes a wider problem in your customer community. A timely response can also reduce demand in other channels as customers resolve issues through the use of published information and forums, rather contacting call centres and other channels. 3. Communicate open and honestly Transparency is essential in all communication with customers. In the online world, false or misleading information can ‘go viral’ within hours and spread across a large part of your customer community before you are given a chance to respond. On the other hand, an emerging benefit of open and honest communication is the acquisition of new customers who become attracted to the persona of the online brand or who have gained interest and initial trust through recommendations by online friends and communities. 4. Prepare to respond in public Social media by design is in most cases a public forum, and while organisations need to adhere and respect privacy laws you must be prepared to respond appropriately to ensure customers are provided with relevant and tailored information. Responding publicly also ensures your brand is reinforced; customers and potential customers watching can see a visible footprint and effort being made to engage and connect with your online customers. Social media is and will continue to become an integral part of how customers choose to interact with you. Having a clear strategy and the right operational processes and behaviours are critical to ensuring social media is a positive experience for both you and your customers. Suits you … suits your customers! How to deliver a truly tailored customer service 9 Social Network Analysis A further development in the use of social media as a customer service channel is Social Network Analysis (SNA). This involves analysing the relationships between individuals in a community, such as that provided by social media. These can be represented in a social network diagram, which highlights influences within a network. In the diagram below, the yellow ‘node’ indicates the person with the strongest network and the highest potential influence. Figure 4. Social Network diagram highlighting influencers within a network Source: Wikipedia SNA involves classifying individual customers by the influence they wield over other users in your network; for example they may be: • Trendsetters: Customers with a large social graph (compared to other customers in the network) and high number of reciprocal connections with customers within your network • Followers: Customers with an average-sized social graph and average reciprocal connections with other customers in your network • Outliers: Customers with a large social graph but fewer reciprocal connections with other users i.e. majority of interactions are unidirectional • Marginals: Customers with a small social graph and a low number of reciprocal ties i.e. a majority of interactions are unidirectional 10 SNA enables you to discover the Trendsetters in your network, without whom your network is at risk of higher churn, diminished potential for value creation, and lower revenue. These influencers are those with certain social network characteristics – e.g. a high number of contacts, high frequency of interaction – that imply that their influence on their peers is likely to be greater than average. This in turn means that their value to your organisation might be greater, and so that it is worth spending more on, for example, retaining them. SNA can also be performed on other interaction data such as call data records held by telecoms companies. Once you understand this aspect of your customers, you can put the information to use as with Sales through Service (see previous section) – by using it to drive the decision about the ‘next best action’ to take the next time you interact with that customer. Case study: Transforming the fortunes of a European Telco Our client is a major European provider of telecommunications, broadband internet and pay television. The local media and telecoms market had become increasingly competitive, with a real focus on price as a major competitive edge. Our client asked Deloitte to support them in making a step-change in their profitability through improving the way they manage their customer relationships. Our approach We focused on several areas, including: • The re-definition of their customer contact strategy, using this and the results of an analysis of their service operations across internal and outsourced providers (onshore and offshore) to restructure their operating model • The development a three-year online strategy, and definition of the customer-facing capabilities required to deliver it • The mapping and analysis of the journey of ‘early life’ customers, their key interactions, and the operational performance at each, to identify root causes of churn • Driving up sales-through-service, providing ‘next best offers’ to up-sell/cross-sell to customers during service interactions on the phone. We launched and measured training and sales pilots throughout our client’s offshore contact centres Results These initiatives delivered: 1. An enhanced service delivery model, bringing a renewed focus to 1st and 2nd tier customer care 2. A new e-commerce and e-care platform that has seen sales rise 300% over the last 12 months, and cost to serve reduced by 25% 3. Targeted change initiatives to improve performance during early life, and a 3% reduction in churn 4. The conversion of 10% of incoming fault calls to cross-sells and up-sells within the first three months of the sales-through-service programme In addition, our client experienced minimal impact on average handling time as a result of sales conversations within the care function, and also witnessed an increase in agent satisfaction in the outsourced contact centres and subsequent reduction in agent attrition, together with improvements in customer satisfaction and call quality delivery. Suits you … suits your customers! How to deliver a truly tailored customer service 11 Delivering the perfect fit for you and your customers Approaches to delivering a bespoke customer service So how can you take the strategies we have discussed and make them work for you? From our experience of delivering these strategies for our clients, we believe the following steps should be followed to improve the value of your service interactions – for both your organisation and your customers. 1. Define your customer contact strategy An effective contact strategy should consider four key dimensions: 1. The customer segment being served 2. The service being delivered 3. The channel the service is delivered through 4. The desired customer experience Figure 5. The elements of a customer contact strategy g etin ark M r contacts tome Cus Customer Customer experience Revenue Se rv Cu st ic e Cost o m er c o n t a c ts Sales Customer strategy Channel Service Experience Our recommended approach is to consider each contact at every stage of the customer lifecycle in order to determine the most appropriate treatment: the channels the service should be delivered through, and the desired (and affordable) experience. These contacts could be triggered by specific events, targeted at maximising the service experience and the customer’s lifetime value, for example moving customers to a better value package, or notifying them of a service outage before they need to call. 12 Figure 6. Planning customer contacts across the lifecycle Active At Risk New Customer Value of customer Attempt re-sign contract Receive Start contract renewal process retention offers Call into to cancel product Upgrade existing package Churned Receive win-back offers Receive up-sell communications and offers Manage profile updates Receive cross-sell communications and offers Submit and track service issue or complaint Receive bill View transaction history, service usage and invoices Prospect Track order status Send welcome pack/call Buy product(s) and/or services Receive inbound marketing response Make out bound prospect contact Browse products and services Customer led interaction Business led interaction For each interaction, you should consider the potential value of that contact, both to your organisation and to the customer, and use this perspective to drive the contact strategy. Based on treatment identified, organisations should model the associated economics (cost-to-serve, revenues, investment) and ensure alignment with available operations budget. This should form a ‘customer lifecycle management plan’, which includes proactive sales and service contacts at various stages of the lifecycle, and which may be different for distinct customer segments. For this exercise, all customer-facing business functions should play an active role. “For each interaction, you should consider the potential value of that contact, both to your organisation and to the customer, and use this perspective to drive the contact strategy.” 2. Exploit your existing channel capabilities Too often, channel development projects, particularly relating to self-service, are technology-led, with an insufficient focus on how the organisation needs to change to fully exploit the potential of their existing capabilities. This often translates into low customer satisfaction, insufficient take-up of new functionalities and low internal advocacy. Our recommended approach is to define a plan for how the business will exploit existing channel capabilities across the organisation, including acknowledgement of the effort required to implement it, and confirmation of the roles and responsibilities across business functions. Suits you … suits your customers! How to deliver a truly tailored customer service 13 The starting point is often to improve the usability and usefulness of the tools available to customers when they try to resolve a problem – or they will quickly become disaffected with the idea of self-service. This is particularly relevant from a web perspective, where online help tools have often failed due to a poor ability to understand the customer input and respond with a relevant resolution/response. Providing a consistent experience across channels, and then integrating processes across channels for a ‘joined-up’ experience, is also a fundamental enabler. Once this is in place, organisations should then consider measures such as targeted marketing and promotion to customers, and engagement with front-line delivery staff, to create the mindsets and behaviours required to help customers be more comfortable interacting with new technologies, such as self-service. This can mean investing time with the customer to educate and train them to use self-service, rather than simply resolving the enquiry; doing so can transform these customers into regular self-service users. This is particularly important for low cost products and services where the customer is expected to use self-service as their primary means of interaction, but often do not have the skills or confidence to do so. Another consideration is making interactions more valuable for customers, particularly for those whose interaction points through the year are few and far between. Many organisations are starting to provide interactive customer education through video-style help, dynamic knowledge bases and virtual help assistance where a customer can ask a question online and receive a relevant, tailored response. Customer take-up of a new self-service offer may rely on the ability to offer a differentiated service (e.g. discounts are offered when transacting through self-service). Figure 7. Approaches for channel migration towards self-service 1. The first prerequisite may be the hardest to get right – providing a consistent experience across all channels, and cross-channel integration. Additional functionality that is not available on through other channels may also be required as an incentive e.g. value-adding features on an iPhone app to increase its ‘stickiness’. 2. Promotion: be introduced, such as through targeted campaigns such as messages on invoices. charging for paper bills, although some negative impact Actively ‘train’ customers in on customer satisfaction may how to use self service result. doing so. Active promotion through other channels ‘competing’ for service and sales transactions may be required. 3. Encouragement: 4. Persuasion: ‘Hard’ 5. Persuasion: 6. Forcing: provide excellent provide ease of advertising/ financial financial penalties remove access to customer access to awareness incentives (- ve ) services through experience within channels and campaigns and (+ ve ) channels signposting training certain channels, for certain customers 2. Raising awareness of the channels 4. If take-up is still not sufficient, active 6. Finally, mandatory channel shifts may available to customers is the key to encouragement may be made through be enforced, through restricting access improved take-up. Simple steps that passively refer customers from one positive financial incentives, e.g. discounted service rates for customers to certain channels only to customers within certain segments, or by removing channel to another are easy to who accept restricted channel access. implement, yet effective at accelerating channel migration e.g. IVR messages that alert customers to online options. 14 5. Financial penalties may also steps may be taken, e.g. channels, and the benefits in ‘Soft’ 1. Enablement: 3. If necessary more active economically unviable channels altogether. 3. Take an end-to-end view measuring and managing customer contacts across the lifecycle In order to properly understand and manage the impacts of the different strategies deployed at different stages of the customer lifecycle, organisations must take an end-to-end view of measurement. Therefore, agreeing a realistic approach to monitoring performance across the lifecycle is essential before you begin to make changes to your service operations. Our recommended approach is to use a balanced scorecard of measures that consider revenue, cost and customer experience factors across the customer lifecycle. The Net Promoter Score (NPS) is increasingly used as a holistic measure of customer experience, which can also be used to measure the impacts of specific interactions at specific stages of the customer lifecycle. For example, a poorly designed IVR experience can be a net detractor, whereas an excellent web experience that exceeds the customer’s expectations can have a positive impact. Customer Lifetime Value (CLV) is a prediction of the net present value of a customer at a given point in time (typically at the point of acquisition), which considers both revenue (e.g. cross-sell through service) and cost (e.g. service interaction costs) across the customer’s entire remaining lifecycle. The benefit of using CLV as a measure is that it can allow an organisation to assess trade-offs between costs invested in one lifecycle stage, and benefits realised in another. For example, some Telcos have noted that incurring greater cost during initial installation by using an engineer rather than relying on the customer to get it right, can lead to reduced downstream churn and so greater CLV (implying that self-service is not always the right answer!). Figure 8. Illustration of a positive impact on Customer Lifetime Value of greater cost in one lifecycle stage Illustrative CLV for operators with self-install Customer value Illustrative CLV for operators with engineer install Customer value Customer Life-time Customer Life-time Additional up-front cost invested in engineer installation Reduce churn leads to greater overall lifetime value Implementing and embedding these measures within an organisation can involve significant change. Organisation structures need to provide accountability for end-to-end processes which may cut across several functional divides. The processes themselves may need to be streamlined in order to allow effective measurement (and provide a better customer experience). And management information systems, and the insight and analytics systems that use them, may need to be integrated or upgraded to provide the end-to-end view and predictive models necessary to take accurate decisions. Ongoing ownership and maintenance of the customer contact strategy, and end-to-end measures such as NPS, are increasingly part of the remit of a central service channel management capability. This provides direction to the functions responsible for operational delivery of customer service; in some organisations, this capability can be found within a Customer Experience team. This concept is also increasingly being broadened to cover larger proportions of the end-to-end customer lifecycle, providing accountability for CLV and a remit for ensuring that decisions taken in one stage of that lifecycle maximise the overall benefit. “The benefit of using Customer Lifetime Value as a measure is that it can allow an organisation to assess trade-offs between costs invested in one lifecycle stage, and benefits realised in another.” Suits you … suits your customers! How to deliver a truly tailored customer service 15 Conclusion As we have seen there are many ways in which, as leaders in the field of customer service, you can ‘cut your service coat according to your cloth’, and yet still deliver a great customer experience and value to your organisation. Taking the time to plan how to actively manage your customers at every step of their journey with you – ‘true customer relationship management’ – can pay dividends later on. In doing so, you will begin to move away from the ‘one size fits all’ approach to mass-market customer management, to deliver a truly tailored service – like the traditional tailor, who always refers to his customers by name and knows what they are likely to want, whenever he speaks to them. This bespoke service – if fitted well – will better suit you, and better suit your customers. Contact us We hope that you have found the information in this paper helpful. If you would like to discuss the themes covered in more depth, please contact one of our Customer Service team members below: Scott Wheatley Partner, Customer Service Effectiveness Lead Financial Services 01225 739429 swheatley@deloitte.co.uk Lorraine Barnes Partner Financial Services 020 7303 7514 lobarnes@deloitte.co.uk Robert Bryant Partner, Customer Management Lead Tourism, Hotels & Leisure 020 7007 2981 rmbryant@deloitte.co.uk Chris Lamberton Partner Public Sector 020 7007 0450 clamberton@deloitte.co.uk Paul Thompson Partner Technology, Media & Telco 0113 292 1735 pmthompson@deloitte.co.uk Giles Warner Partner Technology, Media & Telco 020 7007 7305 gileswarner@deloitte.co.uk Malcolm Wilkinson Partner Consumer, Commerce & Industry 020 7007 1862 malcolmwilkinson@deloitte.co.uk Andrew McNeill Director Financial Services 020 7007 6151 amcneill@deloitte.co.uk Richard Small Director, Multichannel and Contact Centre Lead Cross Sector 020 7303 7971 rsmall@deloitte.co.uk Duncan Barnes Senior Manager Technology, Media & Telco 020 7303 8529 dbarnes@deloitte.co.uk For more information, on the Customer Service Leaders Forum, please visit us at: www.deloitte.co.uk/customerservice 16 Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see www.deloitte.co.uk/about for a detailed description of the legal structure of DTTL and its member firms. Deloitte MCS Limited is a subsidiary of Deloitte LLP, the United Kingdom member firm of DTTL. This publication has been written in general terms and therefore cannot be relied on to cover specific situations; application of the principles set out will depend upon the particular circumstances involved and we recommend that you obtain professional advice before acting or refraining from acting on any of the contents of this publication. Deloitte MCS Limited would be pleased to advise readers on how to apply the principles set out in this publication to their specific circumstances. Deloitte MCS Limited accepts no duty of care or liability for any loss occasioned to any person acting or refraining from action as a result of any material in this publication. © 2010 Deloitte MCS Limited. All rights reserved. Registered office: Hill House, 1 Little New Street, London EC4A 3TR, United Kingdom. Registered in England No 3311052. Designed and produced by The Creative Studio at Deloitte, London. 7413A Member of Deloitte Touche Tohmatsu Limited

© Copyright 2025