Analyst Upcoming FMA How to Become a Chartered Financial Events

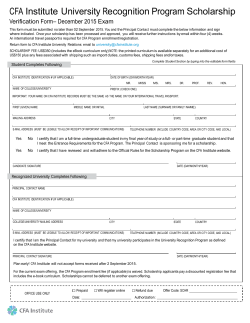

Meetings: Mondays, 12:00-12:50, Speakman 115 Volume 16 Issue 4 Upcoming FMA Events rd October 23 – Special Olympics at University of Delaware th October 29 —American Red Cross Blood Drive st November 1 – Visit from Target th November 6 – College Council Retreat th November 8 — DJ Dawson from Abbotsford Financial Consulting How to Become a Chartered Financial Monday, October 25, 2010 Analyst th On Monday, October 11 , FMA hosted a visit from the professionals at Stalla CFA Review and discussed the Chartered Financial Analyst Exam. This exam is in 3 parts, six hours each, and consists of concept questions about ethics, asset valuation, and portfolio management. Stalla is a team of professionals who specialize in helping individuals train and pass the exams to become a charterholder. The other requirements of becoming CFA certified are to have a Bachelor’s degree and have 48 months of professional experience. For additional information on Stalla CFA Review, visit http://www.stalla.com. th November 16 – Career Expo. Visit from Prudential th On October 18 , FMA received a visit from Prudential’s Kingsley Sosoo, VP of Finance, and Peter Sayre, Senior VP/Controller, who gave a special presentation on the market meltdown and how the company was able to survive the economic downward spiral. They helped members get a better idea of their company values and how they are able to remain successful with the current economy. Sosoo also discussed job opportunities for graduating seniors and internships for freshman, sophomores, and juniors. Their summer internship program gives students the opportunity to gain relevant work experience within the financial management industry as well as the ability to establish relationships with professionals. For more information on Prudential go to www.prudential.com. PAGE 2 VOLUME 16 ISSUE 4 Easy Money - Working Capital Management Effective Working Capital management can release significant amounts of cash that can be used elsewhere in a company. And it’s easy. Fixed depreciable assets are significantly larger than Net Working Capital at most companies, are more ―exciting‖, and usually represent the largest single group of investments funded by lenders and equity investors. Fixed assets often define what a company does for a living. Consequently their management gets a lot of attention. In contrast, working capital is often overlooked by corporate executives, including financial managers. Accounts Receivable, Inventory, Accounts Payable are often viewed as ―necessary evils‖ that must be tolerated in order to facilitate the ―real‖ business of managing the fixed assets. Unfortunately, this view – based either on lack of attention or lack of understanding – can negatively impact a company’s return on total assets and return on invested capital. Working Capital assets, including Cash, Receivables and Inventory often represent a substantial investment that has a zero ROI (Return On Investment). Actually, these assets have a negative ROI because they produce no revenue but require expenditures to manage them. On the other side of the balance sheet lie current liabilities including Accounts Payable. These funds owed to vendors and suppliers who have advanced credit to the business can be viewed as ―free‖ money – that is, a loan with no interest unless penalties are imposed for late payment. Effective Working Capital Management consists of minimizing investment in Current Assets and maximizing the use of vendor credit. Competitive pressures usually require granting credit to buyers, so Accounts Receivable are unavoidable. Nevertheless, receivables can be minimized through several simple techniques. Similarly, Inventory and Accounts Payable can be managed so as to minimize Inventory and maximize Payables. Improvements in Working Capital Management can be implemented immediately and quickly produce excellent results. Want for information? Contact Prof. Steve Kamp at kamp@temple.edu Financial Management Association - Executive Officers 2010 Executive Officers President, Judy Martin, judith.martin@temple.edu Vice President, Pete Grant, pete.grant@temple.edu Treasurer, Hyman Lee, hyman.lee@temple.edu Secretary, Wenhao Zuo, wenhao.zuo@temple.edu

© Copyright 2025