HOW TO EVALUATE THE YIELD CURVE IN A TRANSITION ECONOMY

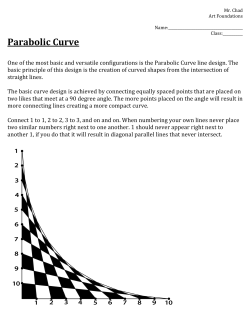

Session 1.4 Macroeconomic Policy and Investment HOW TO EVALUATE THE YIELD CURVE IN A TRANSITION ECONOMY Zdravka Aljinović Faculty of Economics, University of Split, Matice hrvatske 31, 21 000 Split, CROATIA Phone: ++385 21 430 644; Fax: ++385 21 430 701 E-mail: zdravka.aljinovic@efst.hr Boško Šego Faculty of Economics, University of Zagreb, Kennedyjev trg 6, 10 000 Zagreb, CROATIA Phone: ++385 01 23 83 333; Fax: ++385 1 23 35 633 E-mail: bsego@efzg.hr Abstract: Evaluation of the yield curve is standard on financial markets in developed countries. A well-evaluated yield curve reflects and forecasts the condition of an economy and is an important factor in decision making of all participants on the financial market and beyond it. With development of financial market in transition countries an increasing need arises for a well-evaluated yield curve. This paper firstly presents the elements of the new theory of the term structure of interest rates, i.e. the most renowned single factor diffusion models of interest rates (CIR and Vasicek model), and then applies it on the Croatian government securities market. Although in Croatia, considering the development level of financial market, there are many limiting factors in application of these models, the authors have evaluated and explained the yield curve for 30 dates in the course of 2001. 1. DEFINITION AND THE THEORIES OF THE TERM STRUCTURE OF INTEREST RATES The term structure of interest rate, by which we mean the fluctuation of interest rate depending on time to maturity, has been subject to research for more than a century in countries with developed financial market. The relationship between yield to maturity and time to maturity can be graphically presented by the yield curve. We distinguish between four possible forms of yield curve: regular (rising), inverse (falling), straight and winding, as shown in the Figure 1. 1152 Fifth International Conference on “Enterprise in Transition” yield to maturity rising straight falling winding time to maturity Figure 1. Basic forms of yield curve Although the rising form of the yield curve is the most frequent, and that is why it is called regular or normal, the other forms described above can also be found in different countries. It has been said that the knowledge of interest rates fluctuations, or the knowledge of the current yield curve, on developed financial markets is almost a question of general culture. A well-evaluated yield curve not only perfectly reflects the current condition of some economy but also provides foresight. It is an unavoidable tool for every financial intermediary or any participant in financial market activities. Consequently, for more than a century, theories have been developed and applied to approximate and forecast the yield curve. The oldest, expectations theory1 is based on the assumption that investment is carried out exclusively in accordance with investor's expectations on the future yield curve fluctuation without taking into account time to maturity. According to this theory the expected growth of short-term interest rates will result in the rising yield curve, while the expected fall in the short-term interest rates will result in the falling yield curve. Undoubtedly, the expectation elements have to be considered in the analysis of term structure of interest rates. However, it cannot be the only element affecting the yield curve form. Another theory not only considers interest rate expectations but also assumes that investors and issuers take into account time to maturity, i.e. that in order to avoid risk they prefer one term structure to another. According to this theory of preferred habitat2 the formation of yield curve is significantly affected by the time premium, which reflects the preferences of investors 1 The first contributions to this topic can be found in publications at the end of 19th and the beginning of 20th century. The most important among them are: Fisher, I., “Appreciation and Interest”, Publications of the American Economic Association, 1896, then Hicks, J., Value and capital, Oxford University Press, London, 1939, and Lutz, F., “The Structure of Interest Rates”, Quarterly Journal of Economics, 1940. 2 The founders of this theory are F. Modigliani and R. Sutch in “Innovations in Interest Rate Policy”, American Economic Review, 1966. 1153 Session 1.4 Macroeconomic Policy and Investment and issuers in terms of time to maturity. As for expectations, they play the same role as in the expectations theory: the expected increase of short-term interest rates will contribute to the rise of yield curve, while their expected fall will contribute to its levelling or fall. According to liquidity preference theory3 taking into account risks implied by different term structures means that long-term bonds are for all investors riskier and less attractive than the short-term ones. In order to encourage investors to buy longer-term bonds issuers add a risk premium or liquidity premium to them. Introduction of liquidity premium almost always results in a rising yield curve. Even in the case when investors expect the yield to maturity to decrease and when according to previous explanations yield curve should be a falling one, by addition of the liquidity premium it becomes a rising one. Unlike the previous theories, the segmented market theory4 completely rejects the influence of the expected yield to maturity on the investment choice. According to this theory the investment choice is affected only by the preferences to time to maturity. Different investors simply have different interests and therefore different preferences when time to maturity is in question and therefore the bond market is divided into the short-term and long-term segment. Each segment is dominated by large institutional investors. With such interdependence of supply and demand, in which relative demand pressure in the short-term market is lower than in the long-term one, yield curve will be a rising one. The market segmentation theory explains the inverse form of yield curve by the greater pressure of demand in the short-term than in the long-term market. The expected fluctuation of the future interest rates, preference for some time to maturity or subdivision of the bond market in terms of time to maturity are surely important factors in formation of the yield curve. However, they should not be considered separately, isolated from the effect of other factors. A wider analytical interpretation of the term structure should synthesise their effects5. The seventies provided an entirely different approach to the analysis of the term structure of interest rates and many other financial issues. Those were the years of a great wave of financial innovations on the capital markets of developed countries, which was the main motive for introduction of stochastic methods into financial modelling. New securities were intensively introduced characterised by pronounced uncertainty in terms of the inflow of money generated by them. Consequently, it was necessary to "model uncertainty", and the right tool for that are stochastic processes and stochastic differential equations. This marked the beginning of the age of mathematical finance and within it "the new term structure theory". Today on one side there are traditional theories such as expectations theory, theory of preferred habitat, liquidity preference theory, and segmented market theory, while on the other side there are models belonging to the new theory. Naturally, traditional theories are founded on understandable and logical hypotheses, and therefore they have survived for decades and 3 The origins of this theory can be found as early as 1946 when J. Hicks in the second edition of Value and Capital, points out that pure expectations theory has to be modified by appreciating the principle of liquidity premium. 4 The bases of this theory are found in “The Term Structure of Interest Rates”, Quarterly Journal of Economics, 1957 by J. M. Culbertson. 5 See more about traditional theories in Aljinović (1999), pp. 9-32. 1154 Fifth International Conference on “Enterprise in Transition” even a century, so nobody wants to scrap them. Nevertheless, since the emergence of the new term structure theory, the use of traditional theories for evaluation of yield curve has been declining, and the new theory models have been increasingly developed, improved and applied. 2. THE NEW TERM STRUCTURE MODELS The main part of the new term structure theory are single factor diffusion models built on the assumption that the main variable (single factor) describing the condition of an economy is a very short term interest rate, spot interest rate, which according to most authors is approximated by diffusion stochastic process. Consequently, the main mathematical concept of the new term structure theory is diffusion stochastic process, which could be simply described as continuous Markov process. It is believed that it best approximates the fluctuation of the spot interest rate. Namely, it is assumed that the future development of the spot rate is defined only by its present value and is independent of the values preceding the present conditions. In the process, the feature of continuance ought to provide a low probability of sudden and leaping changes in value of the spot rate. Models are distinguished according to the specific diffusion process by which the spot interest rate is presented. The most frequently used models are Cox, Ingersoll, Ross (CIR) designed in 1985, and Vasicek designed in 1977. Starting from the specific diffusion processes, or stochastic differential equations presenting the fluctuation of the short-term interest rate and using also Itoo's lemma and stochastic integration the authors firstly derive formulas for evaluation of interest rate sensitive (IRS) securities and then obtain the values of interest rates for different times to maturity. There are olso other numerous applications of these models, but they are not the issue in this work. 2.1 Cox, Ingersoll, Ross (CIR) model The spot interest rate is given as a diffusion process of particular form: dr ( t ) = k ( q - r )dt + s rdz( t ) . (1) This process has an important feature: the spot interest rate r(t) does not deviate significantly and long from its central position or long-term valueq. The interest rate pursues the value q at adaptation speed k. For s , k ,q > 0 the solution r(t) of equation (1) is unique and non-negative. It is assumed that the market price of risk is given by r( t ) q( t , r ( t )) = l , l = const. (2) s With the given assumptions on the form of the spot rate and the market price of risk, the authors of the model reach the following expression for the value P of the zero-coupon bond at time t, with maturity at time T: P(t ,T ,r ( t )) = A( t , T )e - r ( t ) B ( t ,T ) (3) where A(t,T) and B(t,T) are functions independent of r: f üï 3 ìï f1e f2 ( T -t ) A( t ,T ) = í ý , f ( T -t ) - 1] + f1 ïþ ïî f2 [e 1 e f1 ( T - t ) - 1 B( t , T ) = , f2 [e f1 ( T - t ) - 1] + f1 (4) (5) 1155 Session 1.4 Macroeconomic Policy and Investment k + l + f1 2 kq , f3 = 2 . (6) 2 s The term structure of interest rates R is now easily calculated by the formula: ln P( t , T , r ) R( t , T , r ) = . (7) T -t Observed for an increasingly longer time to maturity, R(t,T,r) achieves a marginal value independent of the current interest rate: lim R( t , T , r ) = R¥ = ( f1 - f2 )f3 . (8) f1 = ( k + l )2 + 2s 2 , f2 = T ®¥ 2.2 Vasicek model Vasicek (1977) spot interest rate approximates by the Ornstein-Uhlenbeck process: dr ( t ) = a ( g - r )dt + rdz , a > 0 . (9) The Ornstein-Uhlenbeck process with a > 0 is sometimes called the elastic random walk. It is a Markov process with normally distributed increments. In contrast to the random walk (the Wiener process), which is an unstable process and after a long time will diverge to infinite values, the Ornstein-Uhlenbeck process possesses a stationary distribution. The instantaneous drift a ( g - r ) represents a force that keeps pulling the process towards its long-term mean g with magnitude proportional to the deviation of the process from the mean. The stochastic element, which has a constant instantaneous variance r 2 , causes the process to fluctuate around the level g in an erratic, but continuous, fashion. It is assumed that the market price of risk is constant, q( t ,r ( t )) = q , (10) independent of the calendar time and of the level of the spot rate. With the given assumptions in this model, we reach the following expression for the value P of the zero-coupon bond at time t, with maturity at time T: é1 ù r2 -a ( T - t ) -a ( T - t ) 2 P( t , T , r ( t )) = exp ê (1 - e ) R¥ - r ( t )) - ( T - t ) R¥ ) ( ú , (11) 3 (1 - e 4a ëa û where rq 1 r 2 R¥ = g + . a 2 a2 (12) The choice of presented models among an already large number of existing single factor diffusion models is not accidental. They are the most frequently mentioned, analysed and, most importantly, applied models. Their application and analysis of their ex-ante and ex-post results has confirmed their quality. Yet, we have to say that the presented models have also been criticised. Most frequently, and this paper is no exception, they are presented isolated from the framework in which they emerged. Therefore it cannot be seen in what way precisely these diffusion processes were arrived in presenting changes of the spot rate. The given equations have their background, i.e. they are derived within a wider framework, which cannot be seen in this way of model presentation. Besides, invariability of the long-term interest rate in the course of time is also criticised. 1156 Fifth International Conference on “Enterprise in Transition” 3. AN APPLICATION OF THE NEW TERM STRUCTURE MODELS IN EVALUATING YIELD CURVES ON THE CROATIAN FINANCIAL MARKET The key data in evaluation of parameters of the given models are the data on price (or interest rate) and time to maturity of treasury notes. Namely, treasury notes are basic securities by which central banks carry out the open market policy regulating the quantity of money in circulation, and the interest rate on treasury notes is the orienting interest rate in negotiation of other forms of credit or in securities issue. At this moment it would be hard to say that treasury notes have such role in Croatia, it can however be stated that the interest rates on treasury notes of the Croatian National Bank, or treasury notes of the Ministry of Finance adequately reflect the value of the market interest rates. In addition to the treasury notes, the same data on other government securities would be useful in evaluation of parameters, as usually happens when these models are applied on developed financial markets. However, among the sparse issues of other government securities that are currently traded on the secondary market, there are no Kuna bonds. Except treasury notes, all other government securities are denominated in euro. Naturally, "pure" data are required, i.e. data on the price and time to maturity of bonds denominated in a single currency, ant in this case it is the national currency. Only the data on government securities are taken into account, because the analysis of the term structure of interest rates is carried out assuming the certain payback of money invested in the security increased by the interest. In this sense, government bonds provide the best security. Evaluation of parameters of diffusion models is the problem that has been being solved for years. This analysis follows the modern attitude that in the estimation of the future fluctuation of interest rate data from the past should not take part. Only the situation on the market at a given moment, i.e. the existing market data on interest rates for different times to maturity can be used in evaluation of the model parameters, i.e. in the forecast of interest rate fluctuation on a given date. Using the survey of the achieved conditions in the auctions of treasury notes input data are obtained for evaluation of parameters of CIR and Vasicek model. The input data are P( t , T , r ( t )) and T - t . The obtained equation for evaluation of the CIR model zerocoupon bond is very complex and it would be difficult to obtain the estimation for the original parameters k ,q and s . Therefore we shall estimate the derived parameters f1 ,f2 ,f3 and the short-term interest rate r(t). The Vasicek model solution for the price of the zero-coupon bond is simpler than the CIR model solution, and therefore here we can estimate the original parameters. However, here also the only input data are P( t , T , r ( t )) and T - t . As for the value of R¥ , among the available data, at no moment do we have the data on the interest rate for such a long time to maturity that could represent the approximate value of the interest rate when T - t ® ¥ , i.e. the approximate value of R¥ . Consequently, with the parameters a and r we also ought to estimate the short-term interest rate r as well as the long-term interest rate R¥ . Subsequently, if necessary, from the expression for the long-term interest rate we can obtain the evaluation of the parameter g as well as the evaluation of the market price of risk q. For the selected date, when we want to evaluate the yield curve, we need the data on the current market interest rates for different times to maturity. Then we have to determine the yield curve, which will, as well as possible, approximate the existing values. Naturally, the 1157 Session 1.4 Macroeconomic Policy and Investment evaluation quality will depend on the number of data on interest rates for different times to maturity. As expected, in the Croatian market we still cannot talk about sufficient data. The problem with the Croatian financial system is the underdeveloped security market and poor supply of financial instruments. And while financial operators are to some extent active on the primary market of short-term securities, secondary trading is still negligible. Consequently, most of the data to be used here are the data from the primary market, and they are the data on the treasury notes interest rates. As their prices are determined at auctions, on the basis of supply and demand, we can consider them market prices. Using the survey of terms achieved at auctions of treasury notes we have obtained the input data for evaluation of CIR and Vasicek model parameters. Our intention is to evaluate the parameters of these models and then the yield curve for every week in 2001. For parameter evaluation we use the statistical package STATISTICA which offers these methods for nonlinear parameter estimation: Quasi-Newton, Simplex, Simplex and quasiNewton, Hooke-Jeeves pattern moves, Hooke-Jeeves and quasi-Newton, Rosenbrock pattern search. According to the instruction given at program activation, the choice of methods should follow the order in which they are proposed. Therefore we choose the Quasi-Newton method. The loss function is defined as the sum of the squared deviation about the predicted values, n i.e. as å( y i =1 i - y$i )2 , where yi are predicted values, y$i are our input data or empirical values, n is a number of observations. Naturally, the aim is to minimise the loss function. Thus an important role in the evaluation of parameters is played by the least squares method. For most researchers the proposed Quasi-Newton method provides the "best" results. In this method the second order (partial) derivatives of the loss function are asymptotically estimated, and used to determine the movement of parameters from iteration to iteration, so that the path to the loss function minimum is followed. Other procedures do not estimate the second order derivatives of the loss function and most often use various geometrical methods to minimise that function. Consequently, we used the Quasi-Newton method in order to evaluate the parameters of the CIR and Vasicek model for 47 dates in 2001 for which data were available from auctions of treasury notes. What seemed to be the greatest problem was the small number of observations for most dates. Nevertheless, the result was reached in 30 cases, most frequently with the loss equal to 0. For those cases in which the process of parameter estimation did not converge we did not apply any other method for nonlinear parameter estimation. For the CIR model the evaluated parameters are f1 ,f2 ,f3 and the short-term interest rate r(t). Then by using the formula (8) we obtain the result for the long-term interest rate R¥ . For the Vasicek model the evaluated values are a , R¥ - r , R¥ and r , after which it is easy to calculate the value of the short-term interest rate r(t). Among the obtained results we separate those that have the same significance with both models. They are the spot interest rate and the long-term interest rate, r and R¥ . We have to 1158 Fifth International Conference on “Enterprise in Transition” point out that the obtained values for both models are very close, and for the spot interest rate they are almost identical. Here is the graphical presentation of the spot interest rate and long-term interest rate movement within the observed time for CIR and Vasicek model. spot interest rate r(t) long-term interest rate 0,18 0,16 0,14 0,12 0,1 0,08 0,06 0,04 0,02 18.12. 20.11. 27.09. 04.09. 14.08. 01.08. 24.07. 10.07. 26.06. 12.06. 17.04. 20.03. 06.02. 16.01. 02.01. 0 Figure 2. Resulting values of the spot rate and long-term interest rate for CIR model spot interest rate r(t) long-term interest rate 0,18 0,16 0,14 0,12 0,1 0,08 0,06 0,04 0,02 18.12. 20.11. 27.09. 04.09. 14.08. 01.08. 24.07. 10.07. 26.06. 12.06. 17.04. 20.03. 06.02. 16.01. 02.01. 0 Figure 3. Resulting values of the spot rate and long-term interest rate for Vasicek model 1159 Session 1.4 Macroeconomic Policy and Investment In the CIR model the spot rate moves from the lowest value of 1.0853% on 17th July to the highest value of 6.241% on 13th March. On the same dates we record the lowest and the highest value of the spot rate obtained by the Vasicek model, 1.0846% and 6.241%. The long-term interest rate in the CIR model fluctuates within the range between 5.8241% on 18th December and 15.7575% on 16th January. In the Vasicek model the lowest long-term interest rate is obtained also on 18th December in the amount of 5.9358%, while the highest is obtained on 16th January in the amount of 15.7786%. The long-term interest rate is always higher than the short-term one, which in the CIR model means that in all the cases we obtain normal i.e. rising yield curve. In the Vasicek model, the 1 r2 monotonously rising yield curve is obtained when r ( t ) £ R¥ . That condition is met in 4 a2 all the cases. Sometimes it is only a slight increase of interest rate with time to maturity, as for instance on 27th March when the difference between the long-term and the very short-term interest rate was only 1.947% in the CIR model, or 2.022% in the Vasicek model. The highest rise of the interest rate is recorded on 16th January when the difference between the very short-term and the long-term interest rate was 9.531% in the CIR model and 9.552% in the Vasicek model. Throughout the observed time the obtained yield curves were the rising ones, which by all means is a desirable situation. As we already stated, instead of the term rising yield curve the more frequently used one is normal yield curve, because such a curve reflects the desired situation in an economy when with the increase of time to maturity the appropriate yield to maturity is also increased, by which the longer time to maturity is actually stimulated. When an economy is in recession or on the verge of it, such analysis should result in inverse, i.e. falling yield curve or at least in the straight yield curve. Such yield curves reflect insecurity in long-term investment when there is actually no stimulation of saving by the amount of interest rate. It would be really good if the results obtained here reflected some positive trends in the Croatian economy. However, such explanation in this case could be doubtful. Namely, in the yield curve approximation we used only a small number of data on prices achieved at auctions of treasury notes with the longest maturity date of six months. These were actually the only available data valid for such analysis. In the Croatian security market there are simply no government securities (in national currency) with longer time to maturity (for instance 10, 15, 20 or more years) which could be intensively traded on the secondary market. Therefore we have no data indicating whether long-term investment is stimulated and at what interest rate. Consequently, these results should be taken with reserve if used to interpret the Croatian economic situation. The obtained parameter values are now inserted into the price formula P( t , T , r ) for both models and for the desired time to maturity we calculate the model price of the zero-coupon bond. Using Excel, for each date for which the parameter values are estimated, we work out 1160 Fifth International Conference on “Enterprise in Transition” the quarterly prices and yield to maturity for six years. According to the obtained results we can draw the appropriate yield curve of the CIR and Vasicek model. The Figure 4 presents the anticipated fluctuation of interest rate by the CIR model on particular dates in 2001. 27. 11. 27. 09. 21. 08. 01. 08. 17. 07. 0,15 26. 06. 0,1 05. 06. 20. 03. 0,05 30. 01. 02. 01. 0 Figure 4. Term structure of interest rates on Croatian government securities market in 2001 according to CIR model. This way of presenting the term structure of interest rates enables us to read a number of data in the course of time and for every single date. All the data may not be read with great precision; therefore we shall not use this presentation when we need the accurate value of some interest rate at a given moment. Then we need the two-dimensional "classic" presentation of the yield curve. We choose the desired date and simply draw the yield curve according to the obtained results. Thus the Figure 5 presents the yield curve estimated by the Vasicek model on 18th September 2001. 1161 Session 1.4 Macroeconomic Policy and Investment 0,09 0,08 0,07 0,06 0,05 0,04 0,03 0,02 0,01 0 0 1 2 3 4 5 6 Figure 5. Yield curve estimated by Vasicek model on 18th September 2001 for the time of six years6. Such presentation of yield curve is usual popular on the financial markets of developed countries. Anybody involved in financial market activities will ask for reliable results of this type. Particularly appreciated is the information on relationship of the yield to maturity and time to maturity, or the relationship between short-term and long-term interest rates. The results of term structure interest rate models are also very important in portfolio immunisation, evaluation of securities with variable interest rate, and in evaluation of any interest rate sensitive security or portfolio. Thus, for instance, models for evaluation of options regularly rely on term structure of interest rates models. There is also a number of interesting yield curve applications that are not the product of mathematical finance. Based on the appropriate graphical analysis of yield curve it is possible to make decisions on profitability of investment into particular bonds, i.e., it is possible to find out which bonds are overestimated or underestimated. Also very interesting is the possibility known as “riding the yield curve” that is based on the thesis that in the periods when the yield curve is rising, i.e. when the yield to maturity of long-term bonds is higher than the yield to maturity of short-term bonds, it is profitable to invest into bonds with the time to maturity longer than the one anticipated by the investor with the obligation to sell such a bond prior to its maturity.7 Unfortunately, in Croatia these applications can only be conditional or future, and we can only hope for the more abundant financial instruments and intensification of trading in the secondary market. 6 On the x-axis time to maturity is expressed in quarters. At the moment t = 0 the value of the short-term (spot) interest rate is noted. 7 On these possibilities of yield curve use see more in Prohaska (1994), pp. 60-67. 1162 Fifth International Conference on “Enterprise in Transition” 4. CONCLUSION Analysis of the term structure of interest rates is particularly important on the financial markets of the developed world, where it has been explained or forecast for more than a century. In the recent decades, the term structure analysis has focused onto the "new theory" built by stochastic methods, which has almost completely substituted the traditional theories. This paper deals with two representative models of the new theory. They are single-factor diffusion models, CIR and Vasicek. The application of the single-factor diffusion models of interest rates, especially models presented in this paper, has become a reality in the countries with developed financial markets. For instance, on the Italian market in the last decade we can regularly find yield curves evaluated by the CIR model. What about the financial markets in transition countries? Is there at all any interest for the results of this type? Judging according to the development level and activities on the Croatian financial market we could say that there is really no special interest for the results that can be provided by the new theory of the term structure of interest rates. That is the reason why the either the new term structure theory or the theory of mathematical finance in general are not accepted, developed, or transferred to the student population like in the modern world universities. Consequently, it is clear that in Croatia there is no application of mathematical finance whatsoever. On the other hand, even if there were any interest for results that can be provided by the new term structure theory, it is doubtful whether and how these models can be applied in the Croatian market, i.e. what the available database is like. Although it is perfectly clear that the quality and the quantity of the current financial instruments on the Croatian market are far from what is characteristic for a developed financial market, this paper nevertheless applies the presented term structure models on the Croatian government securities market. For the first time in Croatia the CIR and the Vasicek models are applied parallelly resulting in evaluated yield curves for 30 dates in 2001. As usually done, for model parameters evaluation we used the data on the prices of treasury notes. We used exclusively the cross-sections of prices as recently time series have been rejected in evaluation of interest rate model parameters. Namely, it is believed that the estimation of the future fluctuation of interest rates at a given moment cannot be based on the data from the past. In this paper this was a helpful attitude, since in Croatia it is hard or impossible to find representative time series of data on interest rate values for certain times to maturity. However, neither the cross-section data are very representative in Croatia. At a given moment one can make use with only a small number of data on the interest rate for different times to maturity, and most frequently it is a short-term maturity. In Croatia no treasury notes have been issued denominated in kunas with time to maturity longer than six months. In addition to treasury notes, we could also use data on other government (consequently defaultfree) bonds. However, all the government bonds currently in circulation in Croatia are regularly denominated in euros, and therefore it was better not to include them into the database for evaluation of parameters. They could possibly be used to estimate parallelly the "euro" term structure of interest rates, and by comparison to the "kuna" yield curve achieve the possibility of profitable arbitrage. 1163 Session 1.4 Macroeconomic Policy and Investment For each single date the forecast is given for the time of six years. On the developed markets forecasts are usually given for the time longer than six years. However, here the input data usually cover a much wider range of different maturities than is the case in Croatia. All the obtained curves are rising or normal yield curves. Admittedly, the rise of interest rates with time to maturity is not very high, but it is certainly more desirable to obtain a result with at least slightly rising yield curves than straight or falling, inverse curves. Inverse yield curve reflects insecurity in terms of long-term investment. Interest rates are not such as to attract long-term investors. In the countries with developed financial market results with falling yield curve are rare. When they occur, they reflect insecurity and are excellent heralds of recession. For example, Moriconi (1994) using the CIR model and the cross-section data evaluates the yield curve for every week from 9th January 1990 to 21st July 1992 on the Italian market of government bonds. Each week the interest rates are forecasted for the time of the following six years. Until the end of 1990, the resulting yield curves had a rising form, they were straight in the course of 1991, while from January 1992 they had a falling form. Inverse yield curve emerged before economic recession in Italy and well reflected the situation of instability and confidence crisis. Namely, suspicion appeared that government bonds were not risk-free. The risk of default from the government is admittedly not included in singlefactor diffusion models, but it is probably included through rational expectations in formation of market interest rates and in such way is reflected in the resulting yield curves. In our analysis rising yield curves were obtained throughout the observed time. The rising yield curve reflects the desirable condition of some economy, where with the increase of time to maturity the appropriate yield to maturity is also increased, and where long-term investment is actually stimulated. However, due to some reasons in our case, we have to be reserved in using these results to illustrate the conditions on the Croatian market. All the yield curves are evaluated on the basis of a small number of data on prices achieved exclusively at auctions of treasury notes with the longest time to maturity of six months. The limited number of data, lack of data from the secondary market, and a short span of terms are the reasons that make us take the obtained results with reserve. It would indeed be difficult to state that the obtained results reflect a stable situation in the Croatian economy, the situation of security and upswing. Besides illustrating the macroeconomic conditions yield curves are an indispensable tool of every financial intermediary. Information on the relationship between the short-term and longterm interest rates will determine the benefit of investment or borrowing at some fixed term. Furthermore, models for evaluation of securities sensitive to change in interest rate regularly rely on the interest rate term structure estimated by a single-factor diffuse model. In any case, evaluation of yield curve is for many reasons a standard on the developed capital markets. In the last decade the use of single-factor diffusion models has become common in forecasting the term structure of interest rates. Here the new term structure theory is only one of the numerous areas of mathematical finance that are currently widely applied and intensively developed. Even in Croatia, which in term of financial market development is trailing behind some other countries in transition, regular evaluation of yield curve by the new theory models can and 1164 Fifth International Conference on “Enterprise in Transition” should become a standard. During the last year some progress has been noticed in the Croatian market. Market solution of the government debt problem, both in its narrower and wider sense, is increasingly becoming a practice in Croatia. On the secondary market nowadays five issues of the public sector bonds are traded, unlike the situation two years ago when there was no a single bond on the market. There is an increasing need for the issue of corporate bonds, and at the beginning of 2002 the first corporate bond issue was recorded. Among the instruments of monetary policy the domination of obligatory reserve is reduced in favour of the application of market oriented instruments. To intensify trading on the secondary market, the Croatian National Bank reduces the terms and number of auctions of kuna treasury notes. In that way banks are not forced to direct their investments only to the primary market, but can look for solutions on the secondary market as well. Also, implementation of the pension reform poses a number of requirements to the financial market. Pension funds investment portfolio limitations are determined by law: short-term securities of the Republic of Croatia and the Croatian National Bank (<5%), long-term securities of the Republic of Croatia and the Croatian National Bank (>50%), long-term securities issued by local government (<30%) and the long-term corporate securities (<30%). Clearly, to provide quality investment for pension funds aiming at safe and profitable investment of insurees' money it is necessary to develop the national bond market. Anyway, positive trends on the Croatian financial market are obvious. Given the more abundant instruments and the more intensive development of the Croatian financial market, there will be more interest in the results of this type, and also the results based on a larger database will be more reliable. BIBLIOGRAPHY Aljinović, Z. (1999): The term structure of interest rates, Master thesis, Faculty of Economics, University of Zagreb (in Croatian) Aljinović, Z. (2002): Diffusion models in analysis of Croatian Government securities market, Ph.D. thesis, Faculty of Economics, University of Zagreb (in Croatian) Cox, J. C.; Ingersoll, S. A.; Ross, S. A. (1985): A Theory of the Term Structure of Interest Rates, Econometrica, 53: 385-406. Kohn, M. (1994): Financial Institutions and Markets, Mc Graw-Hill, New York Prohaska, Z. (1994): Upravljanje vrijednosnim papirima, Poslovna knjiga, Infoinvest, Zagreb Vasicek, O. (1977): An equilibrium characterization of the term structure, Journal of Financial Economics, 5: 177-188. 1165

© Copyright 2025