Carbon Capture & Storage What & Why Rae Cronmiller, Environmental Counsel

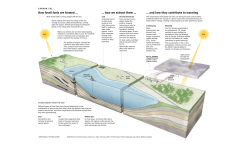

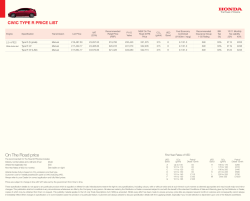

Carbon Capture & Storage What & Why Rae Cronmiller, Environmental Counsel NRECA CCS is not an existing emissions control CCS: A system of many on and offsite components Why Now? • • • April 2012 EPA NSPS Proposed Rule Identified “best system of emission reduction” (BSER) for coal and natural gas base-load generation as Natural Gas Combined Cycle Refused to identify any BSER for coal September 2013 EPA NSPS Proposed Rule Based on cost, feasibility, emission reduction and technology, partial CCS is BSER Status of Technology for CO2 Capture & Storage Dr. Jeffrey N. Phillips Senior Program Manager Washington, DC September 30, 2013 Key Takeaways • CO2 capture and storage (CCS) has been tested for about a year at small scale in fossil fuel power plants, and over longer times at larger scale in non-power applications • Most of the experience with CO2 storage involves enhanced oil recovery (EOR) projects – Storage in deep saline formations has different challenges and less experience • No insurmountable technical hurdles have been uncovered, but high costs limit deployment DOE, EPRI and others are working to bring down costs but it will take time and sustained R&D © 2013 Electric Power Research Institute, Inc. All rights reserved. 6 Largest CO2 Capture System Ever Operated on a Coal Power Plant • 400,000 ton/yr CO2 from 100 MW Lubbock Power & Light power plant • Operational 1983-1984 for EOR Floods • Dow Amine Technology Photo courtesy Gas Processing Solutions LLC © 2013 Electric Power Research Institute, Inc. All rights reserved. 7 CO2 Capture System on a Natural Gas Combined Cycle Plant – Bellingham, Mass. Photo from Google Maps Tanks for storing liquid CO2 Fin-fan coolers for capture system CO2 absorber vent Exhaust duct going to capture system Combined exhaust stack for two W501D gas turbines Captured ~100,000 tons/year for carbonated beverages – no longer in operation © 2013 Electric Power Research Institute, Inc. All rights reserved. 8 AEP-Alstom CCS Demo Project Overview • Alstom’s chilled ammonia CO2 post-combustion capture – ~20-MWe demonstration at AEP’s Mountaineer Plant in WV Alstom’s Chilled Ammonia Process at AEP’s Mountaineer – Designed for ~100,000 Property of Alstom Power and/or AEP tons-CO2/year – Injection occurred in saline reservoir using two on-site wells – Capture started in September 2009 and storage in October 2009; ~57,000 tons were captured and ~42,000 tons stored – Capture project was completed in May 2011 – Location of the injected CO2 continues to be monitored per AEP’s injection permit Power consumption was 22% less than generic amine technology © 2013 Electric Power Research Institute, Inc. All rights reserved. 9 Southern-MHI CCS Demo Project Overview • MHI KM-CDR advanced amine CO2 combustion capture post- – ~25-MWe demonstration at Alabama Power’s Plant Barry in AL MHI’s KM-CDR Process at Plant Barry – ~150,000 tons-CO2/year Property of MHI and/or Southern – Capture started on June 3, 2011; over 200,000 tons captured so far – Injection is occurring in the Citronelle dome ~10 miles away and started on August 20, 2012; over 83,000 tons stored so far – Plan is to continue capturing CO2 through 2014 with the goal to store at least 100,000 tons in geologic sequestration – Monitoring of the CO2 will continue after injection ceases – Storage project is part of US DOE’s Regional Sequestration Program Currently only coal power plant in the world capturing & storing CO2 © 2013 Electric Power Research Institute, Inc. All rights reserved. 10 Key Lessons Learned from Demos to Date • Even best technologies which have been tested would be very expensive to implement at commercial scale – A 235 MW follow-on to the Mountaineer demo was estimated by AEP to cost $1.065 billion ($4500/kW) • Permitting for CO2 storage could be a lengthy process – The regulating authority needs to learn about the technology before it will be comfortable in permitting it • Integrated operation of CO2 capture, transportation and storage at 20-25 MW scale has revealed no insurmountable technical barriers © 2013 Electric Power Research Institute, Inc. All rights reserved. 11 CO2 “Capture-to-Storage” Projects in Operation SECARB Map courtesy Global CCS Institute (with additions by EPRI) ~10 projects worldwide – SECARB is only one at a power plant © 2013 Electric Power Research Institute, Inc. All rights reserved. 12 Large-scale CCS projects operating in North America 1. Weyburn EOR – CO2 from coal gasifier in ND, 2.8 million ton/yr Map & data from Global CCS Institute 2. Shute Creek EOR – CO2 from natural gas processing, 7 million ton/yr 1 3. Enid EOR – CO2 from fertilizer production, 0.7 million ton/yr 2 5 4 3 4. Val Verde EOR – CO2 from nat. gas processing, 1 million ton/yr 6 5. Century Plant EOR – CO2 from nat. gas processing, 8 million ton/yr A new 650 MW coal power plant would need to capture ~1.8 million tons CO2 per year to meet NSPS © 2013 Electric Power Research Institute, Inc. All rights reserved. 13 6. Port Arthur EOR – CO2 from steam methane reformer (US DOE project), 1 million ton/yr Starting up in 2014 • Boundary Dam: 90% CO2 capture retrofitted to 150 MW coal power plant, ~1 million tons CO2 per year for EOR Map from Global CCS Institute Boundary Dam • Kemper County: new 582 MW IGCC with ~65% CO2 capture, ~3 million tons CO2 per year for EOR Kemper Both receiving large government subsidies. Will give power industry “real life” experience in operating large-scale CCS © 2013 Electric Power Research Institute, Inc. All rights reserved. 14 Saline Storage or Enhanced Oil Recovery (EOR)? • EOR: Injected CO2 pushes oil out •Saline: Injected CO2 pushes saline to the side •EOR: Geology already wellknown because of many years of oil production •Saline: Geology typically not well-known Could take 3-5 years and approx. $50 million to characterize a saline formation for CO2 storage – and result could be it is not a good site Graphic from DOE CO2 Atlas © 2013 Electric Power Research Institute, Inc. All rights reserved. 15 Enhanced Oil Recovery • The red regions from DOE’s CO2 Atlas show oil fields with potential for CO2 enhanced oil recovery (EOR) Map from US DOE NATCARB website Current US CO2 Pipeline Network EOR not located everywhere we will need power plants © 2013 Electric Power Research Institute, Inc. All rights reserved. 16 U.S. Saline Formations • The U.S. Department of Energy has conducted a preliminary assessment of U.S. geology Map from US DOE NATCARB website © 2013 Electric Power Research Institute, Inc. All rights reserved. 17 Critical Challenges • Reducing capture energy penalty and equipment costs – There is much potential for improvement • Demonstrating CO2 storage capacity & permanence • Lack of economic driver for implementing CO2 Capture and Storage This is a marathon and the race has only begun. © 2013 Electric Power Research Institute, Inc. All rights reserved. 18 Together…Shaping the Future of Electricity © 2013 Electric Power Research Institute, Inc. All rights reserved. 19 The Status of Carbon Capture and Storage Congressional Staff Briefing September 30, 2013 Kemper County IGCC Brian D. Toth R&D Portfolio: Carbon Capture and Storage University Training Program Biomineralization Study National Carbon Capture Center 1 MW Solid Sorbent Pilot Geologic Suitability Study Coal Seam Injection Study Kemper County IGCC Underground Carbon Injection Groundwater Impacts Study Pilot Capture Demo 25 MW CCS UAB Cap Rock Lab R&D Portfolio: Carbon Capture and Storage University Training Program Biomineralization Study National Carbon Capture Center 1 MW Solid Sorbent Pilot Geologic Suitability Study Coal Seam Injection Study Kemper County IGCC Underground Carbon Injection Groundwater Impacts Study Pilot Capture Demo 25 MW CCS UAB Cap Rock Lab Kemper County IGCC Kemper County IGCC 21st Century Technology • 15+ years of development at the NCCC • 582 MW • Integrated Gasification Combined Cycle • Fuel: Mississippi Lignite, ~4 million tons/year • CO2 Capture: at least 65% - to be used for Enhanced Oil Recovery (EOR) • Zero Liquid Discharge (ZLD) plus treated effluent from City of Meridian, MS and moisture from coal drying as makeup water • Construction jobs: ~12,000 direct/indirect • Permanent jobs: ~1,000 direct/indirect Plant Site CCS Legal and Regulatory Issues Congressional Staff Briefing, September 30, 2013 Fred Eames Partner Hunton & Williams LLP Insert image here General Topics • Legal issues with development of facilities for geologic sequestration • Regulatory structure and issues for geologic sequestration facilities • Liability issues for geologic sequestration 28 Legal Issues with Geologic Sequestration Facility Development • Aggregation of pore space rights • Infrastructure development issues 29 Map of Possible CO2 Pipeline Corridors for High CCS Case with Greater Use of EOR Source: Current State and Future Direction of Coal-Fired Power in the Eastern Interconnection, EISPC, June 2013 http://naruc.org/Grants/Documents/Final-ICF-ProjectReport071213.pdf 30 North America CO2 Geologic Potential by State Source: Current State and Future Direction of Coal-Fired Power in the Eastern Interconnection, EISPC, June 2013 http://naruc.org/Grants/Documents/Final-ICF-ProjectReport071213.pdf 31 North America CO2 Geologic Potential by State (Continued) Source: Current State and Future Direction of Coal-Fired Power in the Eastern Interconnection, EISPC, June 2013 http://naruc.org/Grants/Documents/Final-ICF-ProjectReport071213.pdf 32 Existing Fossil Generation & Optimal CCS Locations Without Any Drinking Water Resources Location Analysis Note: Optimal Locations are for new plants, not retrofit of existing power plants Source of Map: NatCarb Atlas; Overlay: APPA Optimal Location Criteria Maps without CO2 pipelines 33 Proposed Rule Should Address Legal & Commercial Obstacles to CO2 injection • Local laws banning or limiting fracking or similar drilling practices (Best Management Practices) for CO2 injection • Anti-fracking ordinances • Safe Drinking Water Act and 22 state drinking water laws (see Gablehouse paper) • Resources Conservation and Recovery Act (RCRA) “like kind waste” exemption for oil & gas does not apply to power sector for injecting acid gas • Is CO2 an acid gas subject to Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) litigation? • Who owns and pays for the CO2 monitoring requirements 100 years after the power plant closes under Underground Injection Control (UIC) program? • What is financial assurance or insurance posted under UIC program for CO2 injected for 100 years after power plant closes? How does this affect bond ratings? 34 Proposed Rule Should Address Legal & Commercial Obstacles to CO2 injection • Not all states pool or unitize for oil/gas extraction or CO2 injection • Many states have no distinction between surface and subsurface space and surface owner decides • What happens 10 years into CO2 injection—can a new surface owner oppose and stop the project? • Pore space may not be recognized in all states for CO2 injection • Not all state laws allow for the use of surface water for CO2 injection/water lubrication (farmers/cattlemen) • Not all banks/mortgage companies allow oil and gas leases beneath residential areas—why will CO2 be more promising? 35 APPA CCS White Papers • Retrofitting Carbon Capture Systems on Existing Coal-Fired Power Plants • Will Water Issues/Regulatory Capacity Allow or Prevent Geologic Sequestration for New Power Plants? A Review of the Underground Injection Control Program and Carbon Capture and Storage • Carbon Capture and Storage From Coal-Based Power Plants • Parasitic Power for Carbon Capture • Geologic CO2 Issue Spotting and Analysis • Carbon Capture and Sequestration Legal and Environmental Challenges Ahead Available online at: http://www.publicpower.org/files/HTM/ccs.html 36 Two Matters Must Be Resolved before Coal-Fired Plants with CCS Are Commercially Demonstrated or Finalized 1. Is CO2 as an acid-gas a CERCLA (Superfund) pollutant?1 2. How long would monitoring be required after the power plant closes? 1 EISPC Report, June 2013, Page 179 37 Contact Info Theresa Pugh Director of Environmental Services tpugh@publicpower.org / 202-467/2943 Desmarie Waterhouse Director of Government Relations and Counsel dwaterhouse@publicpower.org / 202-467/2930 38 Regulatory Structure for Geologic Sequestration Facilities • Safe Drinking Water Act Underground Injection Control (UIC) Program – GS: New Class VI UIC program – Purpose of UIC program: prevent “endangerment” of USDWs – More stringent requirements than any other well class except Class I hazardous waste disposal – Basics: • Injection zone sufficient to hold the volume; confining zone free of faults/fractures • Protective construction, operating, maintenance requirements • Financial assurance requirements (surety, insurance, etc.) • 50-year default post-injection site care 39 Liability Issues • Liability may arise via statute or common law • Applicable/potentially applicable federal statutes – Safe Drinking Water Act (UIC program) – Resource Conservation and Recovery Act – CERCLA (Superfund) • State laws • Potentially applicable common law theories – Negligence or strict liability – Trespass – Nuisance 40 RCRA and CERCLA • RCRA – Could CO2 injectate be considered a “hazardous waste?” How? – EPA proposed conditional exclusion • CERCLA – Could CO2 injectate be considered a “hazardous substance,” or could mobilized materials be considered a “release?” • 107(j) federally permitted release exemption – Potential “upstream” liability consequences 41 Common Law • Negligence – Breaching a duty of ordinary care • Strict liability – Incident = liability, even when taking perfect care • Trespass – Unlawful interference with possessory rights that causes harm • Nuisance – Non-trespassory, substantial interference with the enjoyment of property 42 Unique Legal Issues • Long-term (post-closure) liability – Length of mobile phase may differ by formation – Volumes, other circumstances differ from other industrial activities • “Triple threat” confluence of regulation – Obligation to serve customers – Air regulations limiting emission to atmosphere – UIC regulations prohibiting endangerment of USDW 43 Costs and Incentives for coalfueled power plants with CCS Congressional Staff Briefing September 30, 2013 Ben Yamagata Coal Utilization Research Council (CURC) CURC’s June, 2012 comments on the EPA’s Proposed Rule for New Coal-fueled Power Plants Commenting upon the impact of the proposed rule, CURC stated: • “The impact of this proposal is nothing less than to stop the development of new coal technology, deployment of coal-based capacity in the United States, and frustrate efforts to commercialize carbon capture utilization and storage (CCUS) technology.” • EPA argues that the CCS requirement on new coal-fueled power plants will serve as a “technology driver” • CURC continues to believe that the re-proposed rule will operate to – • Stop coal related technology development • Dissuade deployment of new coal capacity • Frustrate any attempts to further commercialize CCUS The re-proposed rule will not serve as a “technology driver” From DOE’s Clean Coal Research Program : Carbon Capture Technology Program Plan , January, 2013, page 10 “… . There commercially available 1st-Generation capture notare ready for implementation onCO2 coaltechnologies that are currently being used in various industrial based power plants because they havethese applications. However, in their current state of development technologies are not demonstrated ready for implementation on coal-based power not been at appropriate plants because they have not been demonstrated at appropriate scale, require approximately one-third of scale, require approximately one-third of the plant’s steam and plant’s and power to operate, power the to operate, and steam are very expensive. For example, DOE/NETL estimates thatare the very deployment of a current 1st-Generation postand expensive. combustion CO2 capture technology—chemical absorption with anaqueous monoethanolamine solution—on a new PC power plant would increase the COE by ≈80 percent and derate the plant’s net generating capacity by as much as 30 percent. .…” These data are based on the EIA’s most recent Annual Energy Outlook. They show which systems are “capital intensive” (coal, nuclear), versus “fuel intensive” (gas); and the impact of adding current CCS technologies. Clearly, if coal is to play a role in a carbon constrained world, the cost of CCS technologies must be greatly reduced. Major U.S./Canada Demonstrations Using Existing Infrastructure, Creating New Markets CCPI “Learning first-generation CO Capture from Ethanol Plant Post Combustion CO Capture & EOR by doing” scaling ICCS Areaup 1 CO Stored in Saline Reservoir ~$1.24B Total; ~$240 M Canada Gov’t $208M Total; $141M DOE FutureGen 2.0 EOR – 1.0M TPY 2014 start technologies SALINE – ~1 M TPY 2013 start International Project Evidence of CCS w/EOR opportunities viable FutureGen 2.0 Large-Scale Testing of Oxy-Combustion w/ CO Capture business case & Sequestration in Saline Formation ~$1.3B Total; ~$1.0B DOE CCS MVA best practices SALINE –Validate 1.3M TPY 2016 start SaskPower Boundary Dam Archer Daniels Midland 2 2 2 2 Summit TX Clean Energy Southern Company However . . . Kemper County IGCC Project IGCC-Transport Gasifier w/Carbon Capture • First-generation capture technologies energy ~$2.67B Total; $270M DOE penalty ~30% and > $100/tonne CO2 captured EOR – 3 M TPY 2014 start Hydrogen Energy California • Requires government subsidies $$$ + polygeneration Commercial Demo of Advanced IGCC w/ Full Carbon Capture + chemicals) + EOR ~$4B Total; $408M(power DOE Leucadia Energy Commercial Demo of Advanced IGCC w/ Full Carbon Capture ~$1.7B Total; $450M DOE EOR – 3M TPY 2014 start EOR – 3M TPY 2018 start NRG W.A. Parish Generating Station Post Combustion CO2 Capture $339M Total; $167M DOE EOR – 1.4M TPY 2014 start Air Products and Chemicals, Inc. CO2 Capture from Steam Methane Reformers EOR in Eastern TX Oilfields $431M – Total, $284M – DOE EOR – 1M TPY 2013 start CO2 Capture from Methanol Plant EOR in Eastern TX Oilfields $436M - Total, $261M – DOE EOR – 4.5 M TPY 2015 start EIA’s Projection: Modest to No new Coal Through 2040 Historic Forecast Source: DOE/NETL Historic Data: Ventyx Velocity Suite; Forecasted Data: EIA AEO 2013 DOE has similar RD&D programs for retrofitting existing units and for gasification (e.g. IGCC) Commercial availability for next generation (lower costs) systems may be too late Source: Clean Coal Research Program U.S. DOE/ Office of Fossil Energy, Carbon Capture Technology Program Plan ,January, 2013 President & Congress Coal Budgets 450 400 350 millions $ 300 250 200 President's Request 150 Annual funding levels called for in the CURC/EPRI Technology Roadmap Expect decreasing coal R&D budgets as overall spending by the federal government decreases and coal is perceived to be of lesser importance as a needed energy options in the U.S. Enacted by Congress FY 2014 100 50 0 FY08 FY09 FY10 FY11 FY12 FY13 FY14 Senate $268M House ~$ 295 M EPA’s Rationale for Requiring partial CCS on new coal power plants EPA’s Rationale Four DOE (and Canadian) supported CCS coal power plant demonstrations so technology “adequately demonstrated” No new coal builds for several decades Regulation will serve as a “technology driver” Questions about the Rationale Demonstrations are heavily subsidized No certainty that all demonstrations will be undertaken Inadequate R&D funding support, no plans to support any further 1st generation projects, What happens when there is no near term market? • The R&D pipeline dries up 3-Part Technology Program taking Coal from 2013 to 2050+ Efficiency, reliability, flexibility of the Near- term program – existing coal fleet Support coal-fueled facilities (CTL, SNG, chemicals, electricity) that capture CO2 to recover crude oil Incentivize the construction of 10GW advanced coal power plants that will install CCS when commercially available Improve today’s coal-use technologies ( target costs & performance) Develop “transformational” technologies (create new ways to use coal) 2013 2025 Mid-term program Longer term program 2050 Brief Review of the 3-Part Program Coal’s contribution to the “all of the above” and a part of the clean energy future of the U.S. A program that recommends technology applications from 2013 to 2050 and beyond Near-term technology for existing coal plants Mid-term construction of advanced coal plants and coalfueled plants that capture and sell CO2 for enhanced oil recovery Longer-term RD&D technology programs to use our vast, domestic energy resource – coal Thank you Contact information: Ben Yamagta 202-298-1800 www.coal.org

© Copyright 2025