The Global Macro Analyst Why Is EM Under Fire? Global

MORGAN STANLEY RESEARCH

Global Economics Team

Coordinators of this publication

Joachim Fels

Joachim.Fels@morganstanley.com

+44 (0)20 7425 6138

Manoj Pradhan

April 24, 2013

Global

Manoj.Pradhan@morganstanley.com

+44 (0)20 7425 3805

The Global Macro Analyst

Patryk Drozdzik

Patryk.Drozdzik@morganstanley.com

+44 (0)20 7425 7483

Why Is EM Under Fire?

Sung Woen Kang

Sung.Woen.Kang@morganstanley.com

+44 (0)20 7425 8995

This has been a strange EM recovery: Since EM

growth bottomed in 2H12, EM markets and growth

recoveries have faltered, as have commodity prices.

Although Japan’s policy-makers have spurred another

round of EM monetary policy easing, China and Brazil

have already seen monetary policy tighten. Why? In

today’s note, Manoj Pradhan and Patryk Drozdzik

argue that structural issues have reached a tipping

point just as the risk/reward trade-off of using cyclical

policy tools has deteriorated.

Taking a deeper dive into China, Russia, Brazil and

India, they ask: Have EM growth issues been

diagnosed and treated correctly? What specifically are

the main impediments to growth in the structurally

challenged economies of China, Russia and Brazil? Why

is India not among the most structurally challenged

economies? Why have the usual cyclical tools been

ineffective in this cycle in these economies?

p2

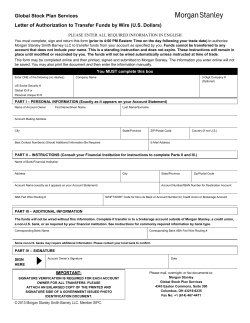

EM Giants Facing Difficult Structural Problems

Structural challenges facing EM economies

Most challenged

Brazil, China, Russia, S. Africa

Moderately

challenged

Chile, Czech Rep., India*, Korea,

Malaysia, Mexico*

Least challenged

Colombia, Indonesia, Peru,

Philippines, Poland, Turkey^

Source: Morgan Stanley Research; *Enacting structural reforms; ^Relative to the high

volatility of its economy

Global Economics Forecasts

Real GDP (%)

CPI inflation (%)

2012E

2013E

2014E

2012E

2013E

Global Economy

3.1

3.2

3.9

3.3

3.3

2014E

3.3

G10

1.3

0.9

1.8

1.9

1.6

1.7

Emerging Markets

4.9

5.4

5.8

4.8

5.0

4.7

Source: Morgan Stanley Research forecasts

Spotlight

Euro Area: Deciphering Draghi

Like many investors, we’re still somewhat bemused by

the noticeable shift in tone at the last ECB press

conference. We benchmark the shift against the

language ahead of past ECB rate cuts and discuss

possible economic, financial and political motivations

for the shift. On balance, we conclude that our previous

outside scenario of an ECB refi rate cut in one of the

next two meetings has now become our base case,

and we now expect a 25bp rate cut by June.

p6

The Morgan Stanley Global Economics View

Global Macro Watch

US: What Would Winston Do?................................p 9

Japan: BoJ Watch: April Outlook Preview ..............p 9

UK: 1Q GDP: A Negative Print Likely ...................p 10

N. Zealand: Defying the Great Monetary Easing..p 10

China: Too Early to Turn Pessimistic ...................p 11

Korea: Downside Risks to Growth?......................p 11

Asia Pacific: Growth Entering a Soft Patch .........p 12

Brazil: A Dovish Hike?..........................................p 12

p7

For important disclosures, refer to the

Disclosures Section, located at the end of

this report.

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

Why Is EM Under Fire?

Manoj Pradhan (44 20) 7425 3805

Patryk Drozdzik (44 20) 7425 7483

The bottoming of EM growth towards the end of 2012 has

produced some surprising dynamics. Normally, at this early

stage of the economic recovery, EM risk markets should be

surging and outperforming their DM counterparts, growth

indicators should be showing above-trend growth (coming from

a below-trend level of output), commodity markets should be

booming and monetary policy should be on cruise control,

waiting for signs of inflation to start worrying again. Instead, the

EM markets and growth recoveries have faltered, as have

commodity prices. Although Japan’s policy-makers have

spurred another round of EM monetary policy easing, China

and Brazil have already seen monetary policy tighten. Why?

In our view, these dynamics are asserting themselves

because structural issues have reached a tipping point just as

the risk/reward trade-off of using cyclical policy tools has

deteriorated.

The Brazilian canary in the coalmine: The first real

demonstration of this difficult dynamic came when Brazilian

growth continued to tumble even as the central bank cut

policy rates by a massive 525bp. Economic growth finally

bottomed in 2Q12, but the recovery has remained sluggish.

The beleaguered manufacturing sector has seen scant

improvement. Instead, bank lending and consumption are

driving economic growth, worsening the ‘Growth Mismatch’ of

weak supply and strong demand that our Brazil team has long

pointed out. To complete the misery, the central bank has

already hiked policy rates to curb the elevated inflation

expectations that it raised by easing policy so aggressively.

Some better cyclical news is on the way: Cyclically, the

weakness in commodity prices and the (partly endogenous)

response from EM central banks should help growth to

improve in 2H13. Beyond responding to the effects of Japan’s

policy actions, soft global growth and inflation risks pushed

further out thanks to lower commodity prices will likely lead to

easier EM monetary policy or keep the stance easy for longer

(i.e., China and Brazil will tighten by less).

Better structural news will need structural reforms… As

we have highlighted many times, only Mexico and India have

delivered on structural reforms so far. Mexico’s proposed

labour, energy and telecom reforms and prospective finance

reforms have been rightly seen as possibly heralding a new

era of growth – ‘Mexico’s Moment’, as our colleagues Gray

Newman and Luis Arcentales call it.

But there is hope, given notable changes over the last year.

We have previously pointed out the structural roadblocks in

the EM world (see Emerging Issues: The Broken EM Growth

Model, June 27, 2012), and attention of policy-makers in the

major EM economies has slowly but surely shifted to

structural reforms. We believe that this attention has to

translate into action.

…and industrial policy to direct resources: One feature of

growth in China, Russia, Brazil and India is that the lagging

sector in each economy is the one that needs to drive growth

in the future (consumption in China, manufacturing in Russia

and Brazil and investment in India). Standard macro tools

cannot address such sectoral imbalances, but modern

industrial policy can (see The Global Macro Analyst: Time to

Build More Shenzhens, October 17, 2012). It is on this count

that India’s policy reforms stand out as the ‘right’ kind of

measures. They have specifically targeted fast-tracking of

investment and faster provision of infrastructure and energy to

support investment specifically.

In today's note, we examine why EM growth is under fire.

Specifically, we ask: Have EM growth issues been

diagnosed and treated correctly? What specifically are the

main impediments to growth in the structurally challenged

economies of China, Russia and Brazil? Why is India not

among the most structurally challenged economies? Why

have the usual cyclical tools been ineffective in this cycle in

these economies?

The Malaise Affecting EM Growth: Misdiagnosed

and Mistreated

The misdiagnosis… Brazil’s predicament is an extreme

reflection of the difficulties facing many EM giants. The primary

EM problem is a structural one: of allocation of capital to a

strategy whose time has passed. The redirection of that capital

towards more productive uses and the release of productivity

through reforms is a structural issue that needs structural tools

and changes. However, we believe that this structural problem

has been repeatedly misdiagnosed as a cyclical one.

…the mistreatment… As a result, cyclical tools have been

used in the past (and continue to be used even now in many

places) to treat a structural malaise. In 2009/10, EM

economies deployed massive doses of monetary and fiscal

easing to protect growth. Yet, we know from the wrenching

experience of the crises in the US and euro area that such

policies can support growth temporarily but not solve

underlying structural problems.

2

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

…and the inevitable unintended consequences:

Misdiagnosis and mistreatment has created two important

unintended consequences:

Worse starting points: As if the challenge of structural

change wasn’t enough, the use of monetary and fiscal

palliatives reinforced the existing growth strategy, thereby

creating a worse starting point for rebalancing. As my

colleague Chetan Ahya has pointed out eloquently, China

needed consumption but pursued investment, while India

needed investment but pursued consumption, making it

harder for both of them to rebalance. Most commodityproducing economies also committed too many resources to

the commodity sector, which has made a shift away from

commodities and into manufacturing that much harder.

A worse risk/reward trade-off of using cyclical tools:

Aggressive use of these tools in the past has created many

of the problems that prevent their use in the present. China’s

aggressive credit growth in the past has forced policymakers to follow a more moderate path now. Brazil’s rate

cuts in 2011 have raised inflation expectations, which have

already forced a policy rate hike. India’s loose fiscal policy

has raised inflation, which has forced both monetary and

fiscal policy-makers to maintain a prudent stance. Using

cyclical tools isn’t as straightforward as it was in the past.

A deeper dive into structural challenges and cyclical

constraints facing China, Russia, Brazil and India: We see

little point in another general note without specifics about the

structural challenges facing these EM giants. Among these

four, we argue that China, Russia and Brazil have the

toughest structural challenges to solve, while India’s problem

is a deep cyclically downturn. In each economy, we show how

the path leading to rebalancing is a difficult one thanks to the

risk of unintended consequences.

Exhibit 1

EM Giants Facing Difficult Structural Problems

Structural challenges facing EM economies

Most challenged

Brazil, China, Russia, S. Africa

Moderately challenged

Chile, Czech Rep., India*, Korea,

Malaysia, Mexico*

Least challenged

Colombia, Indonesia, Peru,

Philippines, Poland, Turkey^

Source: Morgan Stanley Research; *Enacting structural reforms; ^Relative to the high

volatility of its economy

China: A Tricky Rebalancing in the Offing

Rebalancing consequences: The Chinese economy is

likely to remain in transition for a considerable period,

keeping the volatility and downside risks to growth that are

associated with economies in transition in play as well.

China’s transition from an investment-led economy to a

consumption-led one requires continued liberalisation of its

interest rate markets. Faced with a dearth of vehicles to

protect their savings, China’s households save more than they

‘should’. A liberalised interest rate market can deliver better

ways to protect and reward savings, reducing the incentive to

over-save. The higher real interest rates that such

liberalisation is already generating should incentivise betterquality investment.

Unintended consequences... That’s the theory. However, in

practice, rapid changes along any of these fronts are likely to

produce unintended consequences.

…of a faster liberalisation of interest rate markets: Partial

liberalisation of the interest rate market started a decade ago

but has really picked up steam only recently. However, the

pace with which some products have grown (corporate bond

issuance is up 70% in 2012, wealth management products

could be c.10% of deposits) has created some unintended

consequences. According to our banks analyst, Richard Xu,

an inadequate regulatory structure allowed non-standard

credit assets to be classified as interbank loans rather than

corporate loans (which requires 4-5 times the risk-weighting).

That has led to rapid M2 growth and a risk of misallocation of

resources, with the possibility of funds going towards the nonproductive housing sector rather than productive investment.

These loopholes are being addressed via new regulations, but

the risk is that they tighten credit conditions by too much at a

very early stage of the business cycle.

Because of the impact of higher real interest rates on

investment and unintended consequences like the one above,

a faster liberalisation of the interest rate market seems

unlikely to us.

…of a faster move to consumption-led growth: If

liberalisation is slow, household savings will continue to

‘finance’ an implicit ‘subsidy’, either to firms or to banks (which

in turn could be asked to support SOE investment). Now, if

consumption as a share of GDP rises very rapidly, household

savings as a share of GDP will fall. Economic rebalancing

may appear to be closer, but the decline in household savings

will erode the ‘subsidy’ and could lead to too rapid a decline in

investment and growth. A rapid rebalancing towards

consumption-led growth is thus not salutary.

3

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

…of ‘better’ investment via urbanisation: The quality of

investment has to improve, but more urgently, given slow

rebalancing and oncoming demographic issues. China’s

urbanisation drive has the potential to do just that by creating

synergies and a demand for services. Just the process of

taking people out of agriculture and into modern production of

goods and services has the potential to raise productivity by

multiples.

However, the history of urbanisation suggests that clustering

has followed growth. Rivers, natural resources and

innovations like the industrial revolution have attracted people

to try to extract profits from such sources of growth.

China’s urbanisation strategy carries the risk associated with

an attempt to preserve correlation while reversing causality. It

may work, but the risk that the correlation no longer holds if

the causality is reversed is an important one to bear in mind.

In other words, urbanisation may happen, but growth may not

follow everywhere. Rather, urbanisation of Tier-2 and Tier-3

cities may prompt a partial reversal of the great migration,

raising the pressure on urban wages and on corporate bottom

lines.

Thus far, good news out of Beijing… The best news to

come out of Beijing has been the pragmatism of the new

administration. The emphasis has remained on structural

reforms, deregulation and lowering corruption and wasteful

public spending. Guidance out of Beijing has shown

increasing comfort around slower growth that is of better

quality while showing less concern about volatility along the

path to rebalancing.

…partly reflecting the poor risk/reward from the use of

counter-cyclical tools: Reluctance to use standard cyclical

tools aggressively so far is understandable, given significant

downside risks of their use. Aggressive credit growth in 200910 supported growth but it made the starting point for

rebalancing worse thanks to a spike in investment and took

China’s credit/GDP ratio to around 125%, significantly raising

the risk of NPLs. As a result, using credit growth as a countercyclical policy measure now is very difficult, particularly since

part of the recent surge of ‘innovative’ credit growth has likely

gone more into the unproductive housing sector and not as

much into investment as policy-makers would have liked.

The upshot? Thanks to the risks of unintended

consequences, the Chinese economy is likely to remain in

transition for a considerable period of time, keeping the

volatility and downside risks to growth that are associated with

economies in transition in play as well.

The Dutch Disease in Russia and Brazil

Cases of Dutch Disease: The Dutch Disease is a hard

problem to solve. Until policy-makers in both places take

the message from commodity prices and structural reforms

more seriously, the downside risks to growth that are

already showing will likely continue to assert themselves.

Unintended consequences of China’s growth: The

commodity price boom that China’s investment-led growth set

off also created a surge in commodity-oriented investment,

exposing both economies to the risk of the Dutch Disease.

While Russia has succumbed over a longer period, given the

historical preponderance of hydrocarbons in that economy,

Brazil’s capitulation is far more dramatic, given that it is a

relatively closed economy and is among the least commodityoriented economies in Latin America.

What does the Dutch Disease entail? An overemphasis on

commodity-led growth always runs the risk of the Dutch

Disease. The Dutch discovered large gas fields in 1959 and

suddenly faced a large terms of trade shock and a commodity

boom in the domestic economy. The rapidly expanding

commodity sector attracted both capital and labour and bid up

their prices. As unemployment fell and wages rose, a richer

household sector spent freely, which benefitted services but

also created inflation in that sector.

There was one unambiguous benefit from the commodity story

– both economies have lowered their indebtedness during the

commodity boom. Debt/GDP ratios in both countries are now at

more benign levels – 46% in Russia and 58% in Brazil.

So, what’s the problem? The problem was that the

manufacturing sector could not compete against the twin

forces of exchange rate appreciation and high wages,

particularly since the price of manufactured goods is set

globally. In other words, the manufacturing sector faces a real

exchange rate appreciation (see “Brazil: The Growth

Mismatch Intensifies”, Week Ahead in Latin America, May 25,

2012). The expansion of the commodity sector thus came at

the expense of the manufacturing sector.

Dominance of commodity firms and banks in the stock

market: Commodity firms and banks usually tend to dominate

the stock market, making it relatively easy for them to raise

capital compared to the manufacturing sector. This puts the

manufacturing sector at an even bigger disadvantage.

Russia and Brazil do have unique problems beyond the

Dutch Disease: There are differences too. In Russia, the

corporate sector is dominated by state-run companies. The

efficiency and flexibility that the private sector tends to provide

4

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

is thus missing in Russia Inc. In Brazil, the conundrum of

subsidised public lending creates a real rigidity in the interest

rate market. Since real rates are high, some subsidised

lending can be justified. Yet, since the Treasury finances

subsidised lending, the pool of resources left for private

borrowers is smaller, perpetuating higher real interest rates.

Macro policy tools are ill-equipped to deal with the

leading/lagging economic structure… Dutch Disease

economies typically see the commodity and consumeroriented sectors lead while the manufacturing sector lags.

Standard macro tools like monetary policy easing can simply

lift all sectors up or down, but not help one sector in particular

outperform any other.

…and their use creates unintended consequences: 525bp

of policy rate cuts in Brazil eased borrowing conditions for

everyone, which has spurred bank lending to consumers and

inflation expectations, precisely the two things that Brazil’s

economy did not need. In the meantime, global demand has

weakened terms of trade for commodity exporters, leading

headline growth lower. While Russia’s cyclical position is

better than Brazil’s, oil prices continue to fall and growth

concerns are already apparent. Brazil’s sobering experience

should be a case study for Russia’s policy-makers to assess

the effectiveness and unintended consequences of using

cyclical tools to solve a structural problem.

Will lower commodity prices help more than hurt? While

lower commodity prices will hurt growth at the cyclical horizon,

they are making policy-makers far less complacent in both

countries. The Dutch Disease is a hard problem to solve. Until

policy-makers in both places take the message from

commodity prices and structural reforms more seriously, the

downside risks to growth that are already showing will likely

continue to assert themselves.

Why Is India Not Among the Most Structurally

Challenged Economies?

Structural reforms to kick-start growth: After a difficult

period embedded with corruption scandals and investment

activity slowing down sharply, the administration introduced

structural reforms on a regular basis. These have been

very well directed, and should have a salutary impact on

investment and growth over time.

India does face structural issues, and serious ones at that, but

it falls into a category of more moderately structurally

challenged economies for two reasons: i) Because its

structural issues are in line with its low per capita GDP; and ii)

More importantly, its prices, wages, interest rates and

exchange rate are predominantly market-determined.

Compared to China (where the exchange rate is fixed, and

interest rates are only partly determined by markets), Russia

(where state capitalism is unlikely to be as flexible as a private

corporate sector) and Brazil (where subsidies create distortions

in the real interest rate structure), India’s market-oriented

approach to prices forces an earlier resolution of the problem.

India’s main structural problems are: i) Its archaic labour laws

and regulations; ii) Energy and agricultural subsidies; and iii)

Its fragmented political system. Employment growth in India

has largely occurred in sectors where labour regulations are

not as stringent. Subsidies to energy are relatively small and

are being addressed by the administration. The fragmentation

of the political structure and the intrinsic inertia of coalition

politics remain the biggest structural risk in India.

Deep cyclical issues are the main concern: Yet, we argue

that the biggest drag on growth in India is a deep cyclical

downturn from which India is likely to recover only very slowly.

Policy action in 2009/10 created unintended

consequences… Aggressive fiscal easing supported

consumption and economic growth during the Great

Recession. However, the lack of support for investment meant

that productive activities did not benefit from the government’s

initiative. The result? A widening of the fiscal and current

account deficits along with a deterioration of what our

colleague Chetan Ahya calls the ‘productive dynamic’. This

poor productive dynamic helped to produce an inflation

problem that appears to be ebbing only now.

…which prevent the use of cyclical policy tools now…

The central bank has rightly traced the roots of the inflation

problem to ill-directed fiscal policy, keeping the administration

from using fiscal measures to support growth.

…giving the administration little choice but to use

structural reforms to kick-start growth: India’s structural

reforms have taken the form of industrial policy aimed solely

at reviving investment in the economy. To this end, fasttracking of projects and investment in infrastructure and

energy should pay dividends over time (see Tracking the

Improvement in the Growth Mix, February 21, 2013).

Summary

The malaise affecting EM growth has been misdiagnosed as a

cyclical rather than a structural one. Even where structural

reforms appear to be on the agenda, the delivery of the ‘right’

kind of structural reforms has been lacking except in Mexico

and India. As growth slowly grinds lower, we expect that policymakers will pay more attention to these reforms and to the use

of industrial policy to direct resources to the right activities.

5

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

Spotlight: Euro Area: Deciphering Draghi

Elga Bartsch (44 20) 7425 5434

Like many investors, we’re still somewhat bemused by the

noticeable shift in tone at the last ECB press conference:

We benchmark the shift against the language ahead of past

ECB rate cuts and discuss possible economic, financial and

political motivations for the shift. On balance, we conclude

that our previous outside scenario of an ECB refi rate cut in

one of the next two meetings has now become our base case,

and we now expect a 25bp rate cut by June.

As the reason given by the ECB for the shift, i.e., potential

downside risks to a 2H recovery, is not entirely

convincing us, the future course of policy action is not

entirely clear to us either: The most likely motive for

reopening the debate on ECB rate cuts seems to be a desire

to take out insurance against a renewed strengthening of

EUR, or against a sudden jump in money market rates if

excess liquidity continues to ease, or indeed against a soft

patch in 2Q activity that seems to show globally now.

Given that, at least so far, the reasons for the ECB’s shift

are not entirely clear, we also discuss some alternative

policy scenarios – in particular: (i) a larger 50bp rate cut, a

negative deposit rate and possibly even getting ready for QE,

as well as (ii) limited near-term policy rate reductions

combined with more aggressive forward guidance. While we

have discussed a negative depo rate and QE in the past, a

move towards forward guidance would be a first for the ECB.

For a synopsis of investment implications across rates, foreign

exchange, equities and credit, see the full report, Economics

and Strategy: Deciphering Draghi, April 22, 2013.

Base case: Small refi rate cut, no depo rate cut: One could

argue that it would be difficult for the ECB not to cut rates in

one of the next two meetings after the strong language used

at the April press conference. By June at the latest, the ECB

Governing Council needs to decide whether the 2H recovery

is really being called into question by recent events, political

uncertainty and reform fatigue. In the run-up to the next few

ECB meetings, we think incoming data will still be important in

determining the timing and size of the rate cut. However, a

cut in the deposit rate would seem unlikely to us after ECB

President Draghi spoke of the unintended consequences of a

negative deposit rate in March. Hence, our base case would

be for a 25bp cut in the refi rate and a 50bp reduction in the

marginal lending rate to keep the corridor around the refi rate

symmetric. Over time, the ECB might also announce some

small-scale changes to its market operations in order to

further support the credit flow, such as tweaks to the collateral

framework or some form of support for ABS markets.

Alternative scenario #1: A bolder rate cut including depo

rate cut, possibly even getting ready for QE: A 50bp rate

cut would reduce policy rates to the lowest possible level, we

think. On balance, we would expect such a step to be

complemented by a reduction in the deposit rate – even though

to a smaller extent. Once the ECB has officially reached the

zero boundary, the market would likely start to wonder if and

when the Governing Council would embark on full-blown QE.

In our view, hurdles to such a step are very high – especially for

broad-based purchases of government bonds – due to the

blurring between the multinational monetary policy conducted

by the ECB and the national fiscal policy set out by national

governments. Effectively, QE creates a sizeable risk transfer

between the private sector and public sector and a rapid rise

of jointly guaranteed liabilities on the ECB balance sheet. As

such, QE could have a significant impact on the outcome of the

German elections in September, where Chancellor Merkel is

seeking to get re-elected – especially in the face of the newly

founded anti-euro party in Germany, which could potentially

upset the electoral arithmetic. In an extreme case, where

neither the incumbent coalition nor the main opposition parties

gain enough votes, Germany could become subject to a

serious political stalemate, not just between the two houses of

parliament but also within the Bundestag itself.

Alternative scenario #2: Limited action, but much more

active communication towards forward guidance: One of

the key passages has been moved from the Q&A in March to

the introductory statement in April. This has been seen by some

investors as a first attempt at forward guidance. Contrary to the

Fed’s forward guidance, it does not have a time stamp on it.

Or at least not yet. The logic of forward guidance is that the

central bank via a verbal commitment in its communication

can affect market expectations for its future policy path. As a

result, forward rates as well as bond yields should come down

further, allowing the central bank to become more expansionary

even if policy rates are constrained by the zero boundary. In a

speech entitled “The Role of Monetary Policy in Addressing

the Crisis in the Euro Area”, ECB President Draghi – for the

first time to our knowledge – explicitly mentions forward

guidance as one of the main types of unconventional

measures next to large-scale asset purchases.

Euro Area: Revised ECB Rate Forecasts, 2013-14E

Current Jun 13E Sep 13E Dec 13E Jun 14E Dec 14E

EURO AREA

ECB Deposit (Floor) Rate

0.00

0.00

0.00

0.00

0.00

0.00

ECB Refi Rate (EoP)

0.75

0.50

0.50

0.50

0.50

0.50

1.50

1.00

1.00

1.00

1.00

1.00

ECB Marginal Lending (Ceiling) Rat

3M Money market rate and futures

0.21

0.20

0.22

0.25

0.31

0.40

Source: Reuters, Morgan Stanley Research; E = Morgan Stanley Research estimates

6

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

The Morgan Stanley Global Economics View

Our Core Global Views

Key Macro Risk Events

Global economy stuck in the ‘twilight zone’: While the growth momentum is now on

the up, the global economy remains stuck in the twilight zone thanks to a fiscal drag in

the US and Europe and a hesitant recovery in the EM.

May 1, 2013

US FOMC meeting

May 2, 2013

From twilight to daylight: However, we see global growth reaccelerating to 4% in 2H

and 2014 as US private sector heals and re-leverages, the recession in the euro area

ends and the central banks stay supportive (led by Japan) despite the cyclical upturn.

Eurozone not out of the woods yet: We think that resolution of the euro area

sovereign and banking crisis requires both a fiscal union and a banking union coupled

with the ECB being willing and able to be the lender of last resort to governments.

While the ECB has taken a decisive step towards fulfilling this role, progress on fiscal

and banking union remains painfully slow and full of setbacks. Eurozone break-up,

although not our central case, remains conceivable.

Fiscal dominance: Don’t expect DM central banks to tighten soon – they are locked

into a regime of fiscal dominance, where increases in the real interest rate worsen

government debt sustainability, inflation targeting becomes unfeasible and monetary

policy is forced to remain super-accommodative.

ECB council meeting and press conference

May 9, 2013

Bank of England MPC meeting

June 24, 2013

Nabiullina to take over as the new governor of the CBR

July 4, 2013

Mark Carney’s first MPC meeting as governor of the

Bank of England

July 11, 2013

Japan upper house of the National Diet elections

September 22, 2013

Financial repression and inflation: Part of the solution to high government debt

levels can be imposing artificially low, or even negative, real returns on captive investor

groups – financial repression. Inflation – allowed by central banks constrained by fiscal

dominance into a passive monetary stance – could be part of this solution, too.

EM growth model broken – needs structural reform: EM economies face external

and internal challenges that render the old, export-led model of growth defunct. Weak

DM consumers, onshoring of DM manufacturing and risks to external funding all work

against EMs externally. Internally, the focus on export-led growth has meant that

important sources of domestic demand have been neglected. Aggressive policy

stimulus will probably make imbalances worse. For potential output growth to rise,

policy stimulus needs to go to the ‘right’ sources of domestic demand. There is some

progress in India and to lesser extent in Brazil, but the key remains China.

German parliamentary elections

February 1, 2014

Term begins for new chairperson of the US Federal

Reserve

March 1, 2014

ECB expected to assume supervisory tasks within Single

Supervisory Mechanism by March 1, 2014

Regional Themes

Chart of the Week

Asia ex Japan: India and China need internal rebalancing – China needs to boost

consumption, India investment. This would be part of global rebalancing, too. India’s

administration has unveiled some reforms that go in the right direction. However, the

rebalancing is likely to be a drawn-out process in both countries.

EM Giants Facing Difficult Structural

Problems

Latin America: Greater divergence in Latin America, with Brazil and Mexico

reaccelerating, Colombia, Chile and Peru slowing and Argentina and Venezuela

recently suffering from weaker domestic conditions and weaker commodity prices.

Recent policy measures from Brazil and especially Mexico are encouraging, but

implementation remains a key risk.

CEEMEA: Slowing everywhere except for Turkey, where growth dynamics have been

improving and credit growth has been picking up pace. Russia’s performance will

depend on delivery of President Putin’s pro-investment economic strategy, CEE’s on

developments in the euro area.

Structural challenges facing EM economies

Brazil, China, Russia, S. Africa

Most

challenged

Moderately

challenged

Chile, Czech Rep., India*, Korea,

Malaysia, Mexico*

Least

challenged

Colombia, Indonesia, Peru,

Philippines, Poland, Turkey^

Source: Morgan Stanley Research; *Enacting structural reforms; ^Relative

to the high volatility of its economy

For our global forecasts, see Spring Global Macro Outlook: From Twilight to Daylight, March 12, 2013.

For our cross-asset views, see Global Debates Playbook: Hope Springs Eternal, April 18, 2013.

7

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

Key Forecast Profile

Global Economics Team

Quarterly

2012

Real GDP (%Q, SAAR)

1Q

2Q

3Q

Annual

2013

2014

4QE

1QE

2QE

3QE

4QE

1QE

2QE

3QE

4QE

2012E

2013E

2014E

3.9

Global**

3.0

2.3

2.9

2.3

3.1

3.3

4.0

3.8

3.7

3.5

4.0

3.7

3.1

3.2

G10

1.8

0.3

1.2

-0.5

1.5

1.0

1.8

2.0

2.0

1.4

1.9

2.1

1.3

0.9

1.8

US

2.0

1.3

3.1

0.4

2.7*

1.0

2.2

2.6

2.6

2.6

2.7

2.8

2.2

1.6

2.5

Euro Area

-0.2

-0.7

-0.3

-2.3

-1.0

-0.6

0.6

1.0

1.0

1.0

1.2

1.2

-0.5

-0.7

0.9

Japan

6.1

-0.9

-3.7

0.2

3.1

3.9

3.3

2.8

2.4

-2.8

-0.1

1.0

2.0

1.6

1.3

UK

-0.3

-1.5

3.8

-1.2

0.8

0.4

1.2

1.4

1.2

1.2

1.6

1.6

0.3

0.7

1.3

EM (%Y)

5.3

5.0

4.5

4.9

4.8

5.2

5.6

5.7

5.8

5.8

5.9

5.9

4.9

5.4

5.8

China (%Y)

8.1

7.6

7.4

7.9

7.7

8.4

8.5

8.0

8.1

7.8

7.8

7.8

7.8

8.2

7.9

India (%Y)

5.3

5.5

5.3

4.5

5.1

5.6

6.3

6.3

6.0

6.6

7.2

7.3

5.1

5.9

6.8

Brazil (%Y)

0.8

0.5

0.9

1.4

2.3

2.5

3.1

3.4

2.8

3.1

3.8

3.8

0.9

2.8

3.4

Russia (%Y)

4.8

4.3

3.0

2.1

1.7

2.0

3.1

4.1

4.5

4.3

3.1

2.3

3.4

2.9

3.4

3.3

Consumer price inflation (%Y)

Global

3.7

3.3

3.2

3.2

3.3

3.4

3.4

3.3

3.1

3.3

3.4

3.3

3.3

3.3

G10

2.4

1.8

1.7

1.8

1.5

1.7

1.6

1.6

1.4

1.7

1.8

1.9

1.9

1.6

1.7

US

2.8

1.9

1.7

1.9

1.7

2.0

1.8

1.6

1.3

1.5

1.6

1.7

2.1

1.8

1.5

Euro Area

2.7

2.5

2.5

2.5

1.9

1.7

1.6

1.6

1.6

1.6

1.7

1.7

2.5

1.5

1.6

Japan

0.1

0.0

-0.2

-0.1

-0.3

0.0

0.4

0.5

0.6

2.2

2.2

2.3

-0.1

0.2

1.8

UK

3.5

2.8

2.4

2.7

2.8

3.0

3.2

2.9

2.9

2.9

2.8

2.7

2.8

3.0

2.8

EM

5.0

4.9

4.6

4.6

5.0

5.0

5.2

5.0

4.7

4.8

4.8

4.5

4.8

5.0

4.7

China

3.8

2.9

1.9

2.1

2.4

3.2

3.8

3.7

3.2

3.4

3.6

3.0

2.6

3.2

3.3

India

7.2

10.1

9.8

10.1

11.5

9.0

8.0

7.3

7.3

7.4

6.9

6.6

9.3

8.9

7.1

Brazil

5.8

5.0

5.2

5.6

6.4

6.3

6.4

5.8

5.5

5.7

5.6

6.1

5.4

6.2

5.7

Russia

3.9

3.8

6.0

6.5

7.1

7.0

6.1

5.5

5.2

5.0

5.1

5.2

5.1

6.7

5.4

3.1

Monetary policy rate (% p.a.)

Global

3.2

3.1

3.0

2.9

2.9

2.9

2.9

2.9

3.0

3.0

3.1

3.1

2.9

2.9

G10

0.6

0.5

0.5

0.5

0.5

0.4

0.4

0.4

0.4

0.4

0.4

0.4

0.5

0.4

0.4

US

0.15

0.15

0.15

0.15

0.15

0.15

0.15

0.15

0.15

0.15

0.15

0.15

0.15

0.15

0.15

Euro Area

1.00

1.00

0.75

0.75

0.75

0.50

0.50

0.50

0.50

0.50

0.50

0.50

0.75

0.50

0.50

Japan

0.05

0.05

0.05

0.05

0.05

0.025

0.025

0.025

0.025

0.025

0.025

0.025

0.05

0.025

0.025

UK

0.50

0.50

0.50

0.50

0.50

0.50

0.50

0.50

0.50

0.50

0.50

0.75

0.50

0.50

0.75

EM

6.1

5.9

5.7

5.6

5.5

5.4

5.5

5.6

5.6

5.7

5.8

5.8

5.6

5.6

5.8

China

6.56

6.31

6.00

6.00

6.00

6.00

6.00

6.25

6.25

6.50

6.75

6.75

6.00

6.25

6.75

India

8.50

8.00

8.00

8.00

7.50

7.25

7.25

7.25

7.00

7.00

7.00

7.00

8.00

7.25

7.00

Brazil

9.75

8.50

7.50

7.25

7.25

7.75

8.25

8.25

8.25

8.25

8.25

8.25

7.25

8.25

8.25

Russia

5.25

5.25

5.50

5.50

5.50

5.50

5.50

5.25

5.00

4.75

4.50

4.50

5.50

5.25

4.50

Note: Global and regional aggregates are GDP-weighted averages, using PPPs. Japan policy rate is a range from 0.00-0.10%, with 0.05% as the midpoint; CPI numbers are period averages. *US

GDP forecast for the current quarter is a tracking estimate. **G10+BRICs+Korea

Source: Morgan Stanley Research forecasts

8

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

Global Macro Watch

US: What Would Winston Do?

Vincent Reinhart (1 212) 761 3537

The minutes of the Fed meeting got more attention for

their release than their content: There are a few points to

understand about the former, but what will matter over time is

the latter, the substance – or lack thereof – in the FOMC’s

deliberations. First, the unfortunate miscue of hitting the ‘send’

button 19 hours too soon has drawn attention to the way that

sensitive information is handled. Second, and more

consequential for Fed policy, was the dog that did not bark in

the Fed minutes. The minutes tell us that Fed officials made

no obvious progress in bringing their balance-sheet decisions

into their overall communications strategy. Fed officials have

not successfully severed the link between tapering purchases

and tightening the policy rate. As a result, when they do the

former, they will pull forward expectations of the latter.

What could or should or may they do to improve their

communication and execution of QE which would sever

that link? For that, we need only consult a dog that does

bark, my basset hound, Winston. In October 2010 I described

one possible rule for balance-sheet expansion in Barron’s

magazine. The idea was to link balance sheet action to

systematic deviations in the Fed’s outlook from its goals. In

the event, more attention was directed to the photo of Winston

that ran in the article than the proposal itself.

What would Winston do? Not over-think: Having ruled out

sales, the balance sheet between now and the first rate hike

will likely move in three stages: Continue QE at its current pace;

taper those purchases to zero; and let the balance sheet shrink

organically. The SEP shows that most policy-makers expect

the first rate move to occur in 2015. If that is planned for midyear, as in our forecast, that is 18 meetings from now. Divide

those three stages evenly through time and the FOMC is on

track to continue QE at its current pace through the end of the

year, spend the first three quarters of 2014 tapering off, and

three quarters after that shrink the balance sheet through

redemptions. The Committee could explain that, given its

thresholds for the unemployment and inflation rates, it

currently expects to keep the policy rate near zero until mid2015. It will use the time before then to begin the process of

balance-sheet renormalisation. As considerable slack remains

and it is appropriate to only adjust purchases gradually, it will

split the time in advance of rate action evenly. If economic

events require adjusting the date of expected tightening, it will

redistribute the sequence of balance-sheet actions

accordingly. Bernanke’s parting gift to his successor might

well be explaining this sequence at Jackson Hole in August.

For full details, see US Macro Dashboard, April 12, 2013.

Japan: BoJ Watch: April Outlook Report

Preview: Changing From Wish Report to

Outlook Report?

Takeshi Yamaguchi (81 3) 5424 5387

We expect no monetary policy changes: The BoJ decided

on large-scale quantitative and qualitative monetary easing on

April 4, and on April 25 we expect unanimous agreement on

maintaining the status quo in terms of monetary policy.

Governor Kuroda stated at the press conference after the last

meeting that all necessary steps had been taken and there

would be no sequential deployment of tools. We anticipate no

change in monetary policy for the time being.

We expect the BoJ to raise F3/15 price outlook to upper

1% level: The next MPM will bring the first announcement

under Governor Kuroda of the outlook for the economy and

prices (The Outlook Report), which the BoJ publishes in April

and October. We expect the board members’ median forecast

for the Japan-style core CPI (excl. fresh food) in F3/15 to be

raised sharply from the last figure released in the January

interim review (+0.9%Y) to around +1.6%Y on a basis that

excludes effects of a consumption tax hike from April 2014.

We expect the median forecast for the annual average CPI

growth for F3/15 to fall short of 2%Y because we think many

board members probably view the target of 2% within two

years as a flexible one allowing a certain amount of latitude,

to be reached at end-F3/15 (March 2015).

BoJ’s dilemma: At the last MPM, the BoJ strengthened its

commitment, by explicitly stating that it will “continue with

quantitative and qualitative monetary easing, aiming to achieve

the price stability target of 2%, as long as it is necessary for

maintaining that target in a stable manner”. For this to work

effectively, we think it is essential that the BoJ indicates its

own long-term outlook for prices and the economy. Unlike the

Fed, the BoJ’s forecasting period is short, covering a maximum

of 2.5 years. We think that extending the forecasting period to

cover around the next five years, and presenting more

realistic forecasts, would be helpful in not only strengthening

the duration effect but also lowering market volatility. That

said, the BoJ now faces a difficult dilemma, as it has already

committed to the two-year period within which the 2% price

target is achieved before it publishes its price outlook.

Aside from the extension of the forecast period, if the BoJ

provides a reference indication for the US-style core CPI,

which excludes energy and food and is more conservative, we

would expect to see a positive effect on asset markets.

For full details, see BoJ Watch: April Outlook Report Preview:

Changing From Wish Report to Outlook Report? April 17,

2013.

9

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

Global Macro Watch

UK: 1Q GDP: A Negative Print Likely

Jonathan Ashworth (44 20) 7425 1820

Melanie Baker (44 20) 7425 8607

We now forecast that UK GDP will contract by 0.3%Q in

1Q when the preliminary estimate is published tomorrow:

This would imply that the UK has experienced a ‘triple dip’

recession and compares with our previous forecast of a

0.2%Q gain. Another major decline in the volatile construction

sector is the key downward driver. If the GDP print comes in

line with our expectations, our central case scenario would be

for £25 billion QE in May. It will be a very close call, though,

and renewed asset purchases are not a done deal.

This would make QE our central case in May: If GDP

comes in line with our expectations in 1Q (or even at -0.2%Q),

we would expect a majority of the MPC to vote for more QE.

It’s not solely the GDP number that makes us think that a

couple of the QE ‘holdouts’ will change their votes: i)

Employment unexpectedly dropped in the three months to

February, which contrasts with robust quarterly gains seen in

2012. The strength of the labour market has been a major

source of comfort to the MPC; ii) According to our US team,

the economy is in a ‘soft patch’ at present and the data are

likely to be weak ahead of the May MPC meeting. One

suspects that this may raise some doubts among the MPC

about the strength of the US upturn; iii) Assuming that the

stabilisation in sterling since early March continues, this

should help to assuage fears about the risk of a pronounced

downward move in the currency; and iv) Average earnings

growth continues to drift lower, which should further reduce

MPC concerns about domestically generated inflation.

QE not a done deal though: While growth is weak at present,

there is little evidence of material downward momentum. In

addition, a modest negative print on GDP is unlikely to be a

major surprise to the MPC. The minutes of the March meeting

suggested: “Business surveys remained consistent with roughly

flat output in the first quarter, with a small increase or decline in

activity equally likely.” Moreover, the data have not been

uniformly poor over the last several weeks. The key PMI

services survey has continued to improve and its forwardlooking components are at their highest level since May 2012.

The improving trend has also continued on the consumer side,

with retail sales increasing by 0.5% in 1Q. Further improvement

in the PMIs in April would likely increase confidence about the

prospects for a 2H recovery, which could persuade the MPC

to overlook the GDP data. In addition, an FLS extension

seems likely to us and now sooner rather than later. Some on

the MPC might see this as a partial substitute for more QE.

New Zealand: Defying the Great Monetary

Easing

Sung Woen Kang (44 20) 7425 8995

Defying GME gravity: The RBNZ left the OCR unchanged at

2.50% at the April 24 announcement, and kept the outlook for

monetary policy consistent with that described in the March

Monetary Policy Statement. We believe that the RBNZ will

continue to defy the Great Monetary Easing theme despite an

uneven domestic recovery and the global economy lingering

in twilight.

Policy dilemma calls for policy mix: The RBNZ again

highlighted housing market pressures as a concern from both

a financial and price stability perspective. However, given the

current economic backdrop, we believe that it will retain easy

monetary conditions by keeping rates on hold and deal with

the upside risk of housing prices and excessive credit growth

via cautious implementation of macro-prudential policies.

On hold until daylight: We see the RBNZ keeping the OCR

on hold at 2.50% through 2013, with an eventual hike likely to

arrive in 1Q14 amid a rebounding global economy and

emerging inflationary pressures. Thereafter, we forecast the

OCR stepping up to reach 3.25% by the end of 2014.

Risks to our call include a sluggish global recovery and

continued undershooting of inflationary pressures, or

persistently negative domestic economic conditions, such as

a worsening drought. In such scenarios, we believe that the

RBNZ would be likely to leave rates anchored at 2.50% and

push back rate hikes further into 2014. On the other hand, an

early rate hike cannot be ruled out, although we do not think

that the RBNZ will do so at this juncture. Housing pressure

spillovers to other regions outside Christchurch and Auckland,

and a reversal in the trend for household deleveraging, would

give the RBNZ reason to consider carefully such action.

For more details and FX implications, see New Zealand:

Defying the Great Monetary Easing, April 23, 2013.

10

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

Global Macro Watch

China: Too Early to Turn Pessimistic

Korea: Downside Risks to Growth?

Helen Qiao (852) 2848 6511

Yuande Zhu (852) 2239 7820

Jason Liu (852) 2848 6882

Sharon Lam (852) 2848 8927

Our latest policy trip to Beijing showed a mixed picture

regarding the macro backdrop.

Korea to report 1Q13 GDP; downside risks likely: Korea

will report preliminary 1Q13 GDP data on April 25. We forecast

GDP to expand by 1.8%Y in 1Q, an increase from 1.5%Y in

4Q12, driven by the improving export sector. Exports rose by

0.5%Y in 1Q13 (-0.4%Y in 4Q12), the first positive growth in a

year. However, downside risks are likely as capex investment

and consumption remained weak. Consumption growth could

have eased in 1Q as households front-loaded their spending

in 4Q with the early arrival of a cold winter. Capex investment

is the weakest link of the economy, as business sentiment

remained weak, with lingering uncertainties over the global

economy. Construction investment could still underperform

due to weak property transactions.

Good news: 1Q growth data was likely understated due to

some temporary shocks (e.g., late Lunar New Year and the

leap year) and biased by statistical sampling changes. In

addition, our investigation seems to suggest that the adverse

impact of the recent banking regulation and property policy

tightening measures on liquidity and real estate investment

will likely remain limited.

Bad news: Compared to a year ago, top decision-makers now

have a higher tolerance level for lower growth, which implies

limited room for policy easing (including the anti-extravagance

campaign) in the near term. Furthermore, exchange rate,

energy price and income distribution reforms the government

plans to roll out will likely push up production costs in China

further and add cyclical headwinds to the recovery.

We reckon that there are downside risks to our real GDP

growth forecast of 8.2% this year, with a higher probability

to tip the risk towards our bear case than before. Nevertheless,

we still believe that, with a time lag of around three months,

the credit expansion in 1Q will help growth rebound in 2Q.

We have just spotted some green shoots in upstream

sectors since the last week of March: Bottom-up channel

checks showed higher cement prices, lower steel inventory

and better electricity production in the last few weeks,

possibly influenced by unfavourable seasonality due to the

late LNY this year.

The answers to a number of questions will determine

whether and how fast we return to the recovery track:

These include: Whether the new government implements

reforms to streamline infrastructure financing in the short term;

whether property and infrastructure investment growth could

ultimately motivate the private sector to re-leverage and boost

the income/consumption growth. In our full report, we

summarise the most important questions from clients on our

policy trip to Beijing post the March/1Q data release, and offer

our answers along with policy-makers’ perspectives.

For full details, see China Economics: Too Early To Turn

Pessimistic, April 22, 2013.

1Q is behind us, what about 2Q? While Korea’s GDP in 1Q

could surprise to the downside, we think it could turn slightly

more positive when looking ahead. We think the downside

risks to Korea’s economy could be capped in 2Q due to:

i) Government’s swift stimulus package: The government’s

stimulus package was effective in supporting the economy

during the global financial crisis in 2008-09, and we think that

it will be effective again this time.

ii) Positive consumer sentiment and lower commodity

prices to support consumption recovery from 2Q: While

sentiment may ease in April, we think it may stay in positive

territory and support Korea’s consumption recovery from 2Q.

iii) Fixed investment could begin to recover with

government support: Capex was the weakest link in 1Q as

both export and consumption have bottomed out but capex

dropped further. Capex should recover when we see more

solid signs of export demand.

Our bear case on the Korean economy: What if the global

soft patch is not just temporary? Our bear case for GDP

growth this year is 2.5%Y versus our base case of 3.3%Y. If

the global economy deteriorates, Korea will not be the only

country to suffer. The Korean economy looks more resilient

due to its export competitiveness, lack of overcapacity

problem and also ample room for stimulus because

government debt level is low. As we saw in 2008-09, Korea

did not register any recession during the global financial crisis.

For full details, see Korea Macro Weekly: Downside Risks to

Growth? April 22, 2013.

11

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

Global Macro Watch

Asia Pacific: Growth Entering a Soft Patch

Brazil: A Dovish Hike?

Chetan Ahya (852) 2239 7812

Derrick Kam (852) 2239 7826

Jenny Zheng (852) 3963 4015

Arthur Carvalho (55 11) 3048 6272

Recent data points indicate a slight deceleration in

growth across the region: External demand has slowed in

March, in line with the weaker data points coming out of the

US, while domestic demand has been impacted by a slightly

tighter fiscal policy stance.

Industrial production: In China, IP growth moderated further

in March, likely reflecting the weaker external demand in the

month. For the region ex China, the underlying trend is likely

to have been softer, due to weaker external demand.

Consumption: Consumer activity in the region ex China has

remained broadly stable. In China, retail sales growth edged

up slightly in March, mainly driven by rural sales.

Investment: Capex activity in the region ex China has

stabilised at low levels. In China, capital spending moderated

in March. FAI for the real estate and infrastructure sectors has

risen, offsetting the weakness in the services sector.

Government spending: Across the region, moderate fiscal

tightening has taken place in recent months after a period of

fiscal expansion late last year. In particular, India’s government

expenditure (as % of GDP) has declined to a four-year low.

External demand: In March, the region’s exports slipped

MoM on a seasonally adjusted basis. Leading indicators point

towards a somewhat mixed outlook for exports.

Challenges, both domestically and externally, will pose

some headwinds to the growth recovery in the near term:

Domestic demand should show only a small improvement

from here due to the relatively slow pace of policy reforms. On

external demand, the soft patch in the US economy should

mean that support from external demand will be relatively

weaker over the next 2-3 months. However, in 2H13, our DM

economics team believes that the growth recovery will

resume, which should help lift external demand back up then.

We believe that the risks to the growth outlook for the region

will be significantly influenced by external demand. In this

context, we will be watching the exports data coming out of

Korea and Taiwan to assess the pace and strength of the

recovery. For our latest thoughts on the growth outlook, see

Asia Pacific Economics: Gradual Recovery Under Way, but

Near-Term Headwinds Remain, March 13, 2013.

For full details, see Asia Pacific Economics: Growth Entering

a Soft Patch, April 22, 2013.

Despite the move by Brazil’s central bank to hike rates

last week by 25bp to 7.5%, we are concerned that the

authorities are unlikely to tackle the underlying problems

behind the inflationary pressures: While the timing of the

hike was sooner than we had previously expected, we fear

that the central bank’s core message – that only a fine-tuning

of rates may be necessary – remains the same. We believe

that a much more aggressive head-on effort is needed and

would imply putting the brakes on wage growth in the months

leading up to Brazil’s next presidential election scheduled for

just a little over a year from now.

Although most members of the administration now seem

to advocate rate hikes publicly, we suspect that broad

support for a hike has always been under the condition

that tightening would not increase unemployment: The

tone has certainly changed, but actions continue to be quite

dovish, in line with our argument against the new-found

perception of a hawkish central bank. Indeed, until shortly

before this week’s meeting decision, markets were pricing in a

tightening cycle of 170bp, starting with a hawkish 50bp hike,

which would have indeed changed the market’s perception of

the central bank’s reaction function.

Following the modest 25bp hike last week, we are moving

our rates call from no hikes in 2013 to a total of four 25bp

hikes this year: We now expect that rates will be 8.25% by

August 2013 and should then remain unchanged through

December 2014. We had previously expected a modest hiking

cycle in early 2014.

Brazil’s inflation problem is deeply structural, resulting

from the country’s low potential GDP rate and artificially

boosted consumption. Eventually, these problems will have to

be tackled, but now seems not to be the time. Hiking interest

rates aggressively would either add too much pressure on the

currency to strengthen or risk slowing wage growth and

complicating the presidential election process.

Unfortunately, we think that the central bank’s message

is clear – it is only willing to fine-tune interest rates

conditional on the ongoing scenario. Although by not starting

to solve the inflation issue now, the bank does increase the

cost of eventually solving it, we do not expect inflation to spiral

out of control in the next year-and-a-half, after which point the

election will be over.

For full details, see “Brazil: A Dovish Hike?” Week Ahead in

Latin America, April 19, 2013.

12

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

Inflation Target Monitor & Next Rate Move

Global Economics Team. Contact: Manoj.Pradhan@morganstanley.com

US

Euro Area

Japan

UK

Canada

Switzerland

Sweden

Inflation target

Latest

month

12M MS

fcast

Next rate

decision

Current

rate

Market

expects

(bp)

MS

expects

(bp)

Risks to our call

2.0% PCE Price Index

1.9%

1.7%*

01 May

0.15

0

0

No risks, same through mid-2015

< 2% HICP (u)

1.7%

1.5%

02 May

0.75

0

-25

Risk that ECB waits until June meeting

2% CPI (u)

-0.3%

0.5%

26 Apr

0.05

0

0

-

2%

2.8%

2.8%

09 May

0.50

-2

0

Risk is for unchanged policy

1-3%

1.4%

1.8%

29 May

1.00

0

0

-

<2% CPI (u)

-0.6%

0.2%

20 Jun

0.00

-

0

-

2.0% CPI

0.0%

1.4%

03 Jul

1.00

-12

0

Balanced risks

Balanced risks

2.5% CPI

1.4%

-

08 May

1.50

-7

0

2-3% over the cycle

2.5%

2.2%

07 May

3.00

-10

0

-

1-3% CPI

0.9%

-

13 Jun

2.50

-1

0

Premature tightening due to housing pressures

Russia

5-6% CPI

7.0%

5.2%

01-15 May

5.50

-

0

-

Poland

2.5% (+/- 1%) CPI

1.0%

1.9%

08 May

3.25

-

0

-

Czech Rep.

2.0% (+/-1%) CPI

1.7%

1.8%

02 May

0.05

-

0

-

Hungary

3.0% CPI

2.2%

3.6%

28 May

4.75

-

-25

-

Romania

3.0% (+/-1%) CPI

5.3%

4.0%

02 May

5.25

-

0

-

5%

7.3%

5.8%

16 May

5.00

0

0

-

Israel

1-3%

1.3%

2.0%

27 May

1.75

-

-25

-

S. Africa

Norway

Australia

New Zealand

Turkey

3-6%

5.9%

5.8%

23 May

5.00

-

0

SARB GDP downgrade ushers in rate cut

Nigeria

-

8.6%

10.0%

21 May

12.00

-

0

CPI decline seen as sustainable, easing starts in 1H13

Ghana

9% +/-2%

10.0%

9.7%

08 May

15.00

-

0

-

China

-

2.1%

3.2%

N/A

6.00

-

0

Premature policy tightening and external demand weakening

India

-

6.0%

6.2%

03 May

7.50

-25

0

Faster-than-expected moderation in CPI inflation

Hong Kong

-

3.6%

4.5%

01 May

0.50

-

-

-

2.5-3.5%

1.3%

2.7%

09 May

2.75

-

0

Rate cut due to weak domestic demand

S. Korea

Taiwan

-

1.4%

1.5%

20 Jun

1.875

-

0

Rate cut due to weak business and consumer sentiment

Indonesia

4.5% +/- 1.0%

5.9%

5.4%

14 May

5.75

-

0

Evenly balanced

Malaysia

-

1.6%

2.7%

09 May

3.00

-

0

Downside risks

Thailand

0.5-3.0% core CPI

2.7%

3.4%

29 May

2.75

-

0

Downside risks

Brazil

4.5% +/-2.0% IPCA

6.6%

5.6%

29 May

7.50

-

25

A double dip recession

Further FX strength could lead to rate cut

Mexico

Argentina

Chile

3% +/-1% CPI

4.3%

4.1%

26 Apr

4.00

0

0

15.5-24.2% M2 growth

10.6%

10.4%

NA

15.19

-

-

-

3% +/-1% CPI

1.5%

3.3%

16 May

5.00

0

0

Buoyant domestic demand pressuring inflation

Peru

2% +/-1% CPI

2.6%

2.2%

09 May

4.25

0

0

-

Colombia

3% +/-1% CPI

1.9%

2.5%

26 Apr

3.25

0

-25

-

(u) = unofficial

Notes: Inflation numbers in red indicate values above target; MS expectations in red (green) indicate our rate forecasts are above (below) market expectations. Japan policy rate is an interval of

0.00-0.10%; *Core measure.

Source: National central banks, Morgan Stanley Research forecasts

13

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

Global Monetary Policy Rate Forecasts

Current

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Expected unconventional measures

United States

0.15

0.15

0.15

0.15

0.15

0.15

0.15

0.15

Outright purchases of Treasuries/MBS at $85bn/month in 2013

Euro Area

0.75

0.50

0.50

0.50

0.50

0.50

0.50

0.50

No credit easing expected yet

Japan

0.05

0.025

0.025

0.025

0.025

0.025

0.025

0.025

BoJ’s CPI forecast will be revised up in the Outlook Report

United Kingdom

0.50

0.50

0.50

0.50

0.50

0.50

0.50

0.75

£25bn QE

Canada

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

-

Switzerland

0.00

0.00

0.00

0.00

0.00

0.00

0.25

0.50

-

Sweden

1.00

1.00

1.00

1.00

1.00

1.00

1.25

1.50

-

Norway

1.50

1.50

1.75

1.75

2.00

2.25

2.25

2.50

-

Australia

3.00

3.00

3.00

3.00

3.00

3.00

3.00

3.00

-

New Zealand

2.50

2.50

2.50

2.50

2.75

3.00

3.25

3.25

-

Russia

5.50

5.50

5.50

5.25

5.00

4.75

4.50

4.50

-

Poland

3.25

3.25

3.25

3.25

3.25

3.25

3.50

3.75

-

Czech Republic

0.05

0.05

0.05

0.05

0.25

0.50

0.75

1.00

-

Hungary

4.75

4.50

4.50

4.50

4.50

4.50

4.50

4.50

-

Romania

5.25

5.25

5.25

5.25

5.25

5.25

5.25

5.25

-

Turkey

5.00

5.00

5.00

5.00

5.00

5.50

5.75

5.75

O/N rate might be cut, RRR and ROC to rise

Israel

1.75

1.50

1.50

1.50

2.00

2.50

2.50

2.50

-

South Africa

5.00

5.00

5.00

5.00

5.00

5.00

5.00

5.00

-

Nigeria

12.00

12.00

12.00

11.00

9.50

9.50

9.50

9.50

Possible tweaks to liquidity requirements

Ghana

15.00

15.00

15.00

15.00

15.00

15.00

15.00

15.00

Reserve ratios, liquidity requirements

China

6.00

6.00

6.00

6.25

6.25

6.50

6.75

6.75

-

India

7.50

7.25

7.25

7.25

7.00

7.00

7.00

7.00

-

Hong Kong

0.50

0.50

0.50

0.50

0.50

0.50

0.50

0.50

-

S. Korea

2.75

2.75

2.75

2.75

3.00

3.25

3.50

3.50

-

Taiwan

1.875

1.875

1.875

2.00

2.125

2.25

2.375

2.375

-

Indonesia

5.75

5.75

5.75

5.75

5.75

5.75

5.75

5.75

-

Malaysia

3.00

3.00

3.00

3.00

3.00

3.00

3.00

3.00

-

Thailand

2.75

2.75

2.75

3.25

3.50

3.50

3.50

3.50

-

Brazil

7.50

7.75

8.25

8.25

8.25

8.25

8.25

8.25

-

Mexico

4.00

4.00

4.00

4.00

4.00

4.00

4.00

4.00

-

Chile

5.00

5.00

5.00

5.00

5.50

5.50

5.50

5.50

FX intervention cannot be ruled out

Peru

4.25

4.25

4.25

4.25

4.50

4.75

4.75

4.75

-

Colombia

3.25

2.50

2.50

2.50

3.25

4.00

4.75

5.00

-

Source: National Central Banks, Morgan Stanley Research forecasts; Note: Japan policy rate is an interval of 0.00-0.10%.

Fed and Eurosystem Balance Sheet Monitor

3,500

3,500

Federal Reserve (Bil.$)

3,000

3,000

2,500

2,500

Eurosystem (Bil.€)

2,000

2,000

1,500

1,500

Size of B/S

1,000

Total Reserves

1,000

Size of B/S

500

Excess Reserves

0

Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13

Source: Haver Analytics

500

0

Jan08

Jul08

Jan09

Jul09

Jan10

Jul10

Jan11

Jul11

Jan12

Jul12

Jan13

Source: Haver Analytics

14

MORGAN STANLEY RESEARCH

April 24, 2013

The Global Macro Analyst

Global GDP and Inflation Forecasts

Real GDP (%)

CPI inflation (%)

2011

2012E

2013E

2014E

2011

2012E

2013E

Global Economy

3.9

3.1

3.2

3.9

4.4

3.3

3.3

2014E

3.3

G10

1.4

1.3

0.9

1.8

2.7

1.9

1.6

1.7

1.5

US

1.8

2.2

1.6

2.5

3.1

2.1

1.8

Euro Area

1.5

-0.5

-0.7

0.9

2.7

2.5

1.5

1.6

3.0

0.7

0.5

1.6

2.0

2.0

1.6

1.6

Germany

France

1.7

0.0

-0.3

0.6

2.1

2.0

1.2

1.6

Italy

0.6

-2.2

-1.7

0.4

2.8

3.0

1.7

2.0

0.4

-1.4

-1.5

0.8

3.2

2.4

2.2

1.1

Japan

Spain

-0.6

2.0

1.6

1.3

-0.3

-0.1

0.2

1.8

UK

1.0

0.3

0.7

1.3

4.5

2.8

3.0

2.8

Canada

2.4

2.0

1.8

2.4

2.9

1.5

1.5

1.8

Sweden

3.8

0.8

1.3

2.1

3.0

0.9

0.5

1.5

Australia

2.4

3.6

3.0

3.1

3.3

1.8

2.5

2.4

6.5

4.9

5.4

5.8

6.2

4.8

5.0

4.7

5.1

2.7

3.0

3.9

6.9

5.7

5.7

5.3

Emerging Markets

CEEMEA

Russia

4.3

3.4

2.9

3.4

8.5

5.1

6.7

5.4

Poland

4.3

2.1

1.3

3.0

4.3

3.7

1.4

1.8

Czech Rep

1.9

-1.2

-0.1

2.3

1.9

3.3

2.0

1.7

Hungary

1.7

-1.7

-0.5

1.3

3.9

5.7

2.9

3.6

Ukraine

5.2

0.2

0.8

4.0

8.0

0.6

2.8

7.4

Kazakhstan

7.5

5.0

5.3

6.2