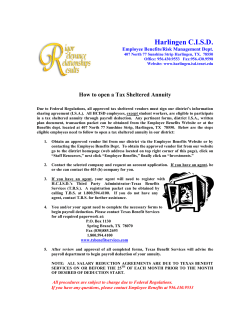

809 Financial Education Stephen D. Froikin,