HR N C Employment Law

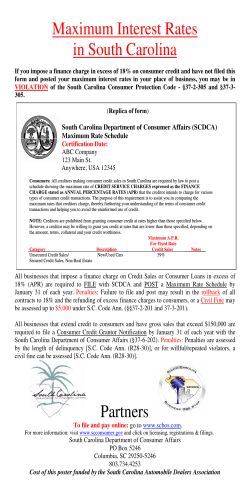

HR SPECIALIST NORTH CAROLINA Employment Law Trusted compliance advice for NC employers In The News ... Discrimination claims are up 15% in North Carolina North Carolinians filed 15% more discrimination complaints in 2007 than they did in 2006, according to the director of the EEOC’s Charlotte office. Reuben Daniels Jr., a North Carolina native who heads up EEOC enforcement in the state, said the office received nearly 1,900 complaints in 2007, up from just 1,650 the year before and 1,625 in 2005. Daniels said while race discrimination charges predominated, the fastest-growing kind of complaint involved national origin discrimination. He attributed that to the EEOC’s expanded outreach in the Hispanic community. He also pointed out that some complaints charged discrimination that favored Hispanics. Daniels blamed the overall growth in complaints on a poor job market and several mass layoffs. Beware legal risk of jotting nasty notes in customers’ files In a classic Seinfeld episode, Elaine’s actions at her doctor’s office cause the doctor to make a note on her chart that says she is “difficult.” Do your employees make similar editorial comments about customers’ quirks in your internal files? If so, be careful. A recent lawsuit shows the potential legal dangers. Continued on bottom of page 5 North Carolina Employment Law is published by HR Specialist and is edited by William H. Sturges, a partner in the employment and labor law practice of Shumaker, Loop & Kendrick, LLP in Charlotte. You can contact him at wsturges@slk-law.com or at (704) 375-0057. (800) 543-2055 • October 2008 Special Issue Editors: William H. Sturges, Esq. and Frederick M. Thurman Jr., Esq., Shumaker, Loop & Kendrick, LLP, Charlotte Altering time sheets can mean personal liability responsible for approving Itoftimeyou’re sheets or signing off on alterations the hours reported by employees, take note: It’s not just your organization that risks a big fine and costly litigation. Your personal assets are also at risk, as a new court ruling shows. That’s because the Fair Labor Standards Act allows employees to sue their bosses, execs and HR professionals for personal liability for altering pay records. For that reason, make sure supervisors don’t tolerate—or, worse, encourage— off-the-clock work or altering of records. Recent case: A group of “living assistants” (hourly workers) at a home for the disabled worked 48-hour weekend shifts. They had to check on each resident every two hours, around the clock. When they turned in their time sheets, managers routinely deducted eight hours because each living assistant supposedly got two four-hour breaks. The CEO then signed off. The problem: The employees couldn’t leave the building during “breaks.” Because the time wasn’t their own, the court said it must be compensated. The kicker: The court held the CEO personally liable, ordering him and the company to pay more than $500,000 to the employees. (Chao v. Self-Pride, No. 06-1203, 4th Cir.) N.C. employees can win bigger lawsuit windfall n North Carolina, it’s not just sexual harassment lawsuits brought under Ifederal law that you have to worry about. Your organization could face state tort law claims, such as “intentional infliction of emotional distress” or “negligent supervision,” if an employee’s behavior is extreme enough and management doesn’t take steps to stop it. That can be a bigger problem than the federal claim. Why? Monetary damages are capped under federal law (Title VII). But state tort claims such as intentional infliction of emotional distress and negligent supervision don’t have caps. That’s all the more reason to establish a strong anti-harassment policy, train your employees regularly and thoroughly investigate all complaints. Recent case: EDS employee Caryn Testa progressed up the corporate ladder until, she said, a new male supervisor propositioned her, left her suggestive Continued on bottom of page 2 Free report How to solve ‘he said/she said’ disputes For help in sorting out the truth in employees’ conflicting stories of harassment or name-calling, access our free white paper, Investigating Harassment: How to Determine Credibility, at www. theHRSpecialist.com/whitepaper. IN THIS ISSUE Recent N.C. employment law cases and advice . . 1-3 Know when to pay hourly employees for travel time . . 7 Top 10 things to know about the N.C. Wage and Hour Act . . 6 The Mailbag: Your questions answered . . . . . . . . . . 8 www.theHRSpecialist.com/NC National Institute of Business Management Can you hand out stricter discipline to bosses than rank-and-file staff? LEGAL BRIEF Pay correct, timely wages in N.C. or risk double damages North Carolina’s Wage and Hour Act (NCWHA) says that if you fail to pay workers what they’re due, they can sue for those unpaid (or late) wages, plus a penalty of double what was due. Your only defense to double damages: proof that you acted in good faith and reasonably—a tough task. That’s why it’s vital for employers not to fall behind on wage payments and to be absolutely sure of the legality of any deductions or withholdings from an employee’s wages. Recent case: Richard Mason worked in North Carolina under a written contract that called for a $300,000 base salary and a one-year-salary severance-pay package. After being fired, Mason sued for the severance. He also said the NCWHA applied and demanded his payment be doubled. The court agreed Mason was owed the severance. It sent the double-damages issue to trial, where the employer will have to prove it acted in good faith when it withheld the severance. (Mason v. ILS Technology, No. 3:04-CV-139, WD NC) ll employees are not equal in the eyes of the courts. You can (and should) hold supervisors to higher behavioral standards than rank-and-file workers. You don’t have to treat them the same if they break the same rules. As the following case shows, you can fire supervisors who get into fights with subordinates, even if you use softer discipline on employees who get into similar confrontations. Recent case: Gerald Forrest, a supervisor for Transit Management of Charlotte, got into a physical altercation with one of his subordinates. The employer then gave Forrest a choice: resign or be fired. Forrest, who is black, shot off a race discrimination lawsuit. He argued that two white employees weren’t fired after they got into a similar argument and physical confrontation. The court dismissed his case, reasoning that it was quite a different matter A to have a supervisor pushing a subordinate around than two co-workers doing the same thing. Forrest also tried to argue that a white supervisor wasn’t fired for a similar pushing incident. But the white supervisor and Forrest did not work for the same boss. And company rules gave disciplinary discretion to managers. The court said those who work for different supervisors aren’t a fair comparison. (Forrest v. Transit Management of Charlotte, et al., No. 06-2245, 4th Cir.) Free white paper What your discipline policy should say The best way to protect against wrongfuldismissal lawsuits is to establish a clear progressive discipline policy. Access a five-step policy model in our free white paper, Designing a Progressive Discipline Policy, at www.theHRSpecialist.com/ whitepaper. You can require employees to undergo medical evaluations N.C. employees (Cont. from page 1) voice mails and got angry when she refused his advances. She reported this to HR but got no response. After being transferred, Testa eventually quit following two years of being ostracized by managers. She sued under North Carolina tort law, alleging infliction of emotional distress and negligent supervision. The court said she had enough evidence to warrant a trial. Under North Carolina law, persistent sexual advances and remarks that cause an emotional or mental condition diagnosed by a medical professional can be extreme enough to be the infliction of emotional distress. An employer’s failure to stop the harassment can make the company liable. Plus, failing to rein in the harasser can be deemed negligent supervision. (Testa v. EDS, No. 3:07CV-165, WD NC) 2 North Carolina Employment Law • October 2008 ave you ever suspected that one of your employees was not quite as injured or ill as he says? Employers certainly can insist on a medical examination to determine the exact nature and extent of workers’ medical problems— and any appropriate work restrictions. Just make certain you treat all injured employees the same—don’t select some for more extensive testing and let others slide. Recent case: Tommy Allen, who is black, worked for BMW on the assembly line and complained that he had carpal tunnel syndrome. Allen’s doctor agreed and placed him on medical restrictions that prevented him from returning to work at the plant. BMW then sent Allen to another doctor, who could find no physical evidence of carpal tunnel syndrome. The company then scheduled a follow-up appointment H to see whether he could return to work, and whether he needed any restrictions at all. Allen missed the appointment. BMW then warned Allen if he didn’t keep a new appointment, he would be fired. Allen showed, but refused to be examined. Instead, he asked the doctor to excuse him from work. When BMW found out Allen had refused the exam, it fired him. Allen sued for race discrimination, alleging a white employee with a similar condition had not been fired for refusing to cooperate with medical evaluation procedures. But the 4th Circuit Court of Appeals rejected his claims. It said the white co-worker had cooperated and did receive a carpal tunnel diagnosis after his doctor and the company’s selected doctor both examined him. (Allen v. BMW Manufacturing, No. 07-1626, 4th Cir., 2007) (800) 543-2055 FMLA Start FMLA certification ASAP to avoid ‘leave stacking’ mployees eligible for FMLA leave cannot stack their 12 weeks of unpaid EFMLA leave on top other paid leaves if your organization chooses to run FMLA leave concurrently with paid leave (as it should). But here’s the key point: You must tell employees that you intend to run FMLA leave concurrently with paid leave. If you don’t, they can take the FMLA leave later and extend their time off and other FMLA job protections. It’s your obligation to designate leave as FMLA-qualifying whenever you become aware of an FMLAqualifying condition. It’s not up to your employees to pick when they want FMLA time, even if they have sick leave in the bank. That’s why it’s important to start the FMLA certification process as soon as possible after you know the employee is absent for a covered reason. Let them USERRA know the leave will run concurrently with their paid sick leave (make sure your FMLA policy allows for this). Recent case: Willie Gladden has diabetes, high blood pressure and other “serious” conditions that would qualify him for FMLA leave. He started taking paid leave on Jan. 4. His employer didn’t request FMLA certification until Feb. 11. The company then made his FMLA leave retroactive to Jan. 4. It fired Gladden about a month after his 12 weeks of FMLA leave would have expired, counting back to Jan. 4. Gladden sued, claiming his FMLA leave truly didn’t start until he received notice that his employer was applying his FMLA eligibility. Using that later receipt date, Gladden still would have been on his job-protected FMLA leave when he was fired. The court sided with Gladden and allowed the case to go trial. He has a good chance to win if he can prove that he wasn’t notified of his FMLA leave until Feb. 11. (Gladden v. Winston Salem State University, No. 1:05-CV01032, MD NC) Final tip: Make sure to track your requests for FMLA certification and let the employee know when his or her FMLA leave starts and ends. Also, track receipt of FMLA correspondence, either by requiring a signature or using a delivery service that can verify delivery time and day. Then, count forward from that day. Free report How to Wipe Out Fraud and Abuse Under FMLA For an 11-step process to prevent fraud by FMLA users, access our threepage primer, How to Wipe Out Fraud and Abuse Under FMLA, at www. theHRSpecialist.com/whitepaper. Returning soldiers aren’t at-will employees … temporarily f you plan to terminate an employee who recently returned from military Iduty, you need a clear, business-based reason for your action. You can’t fall back on “at-will status” as a reason for firing in such cases. Reason: You may know that federal law—the Uniformed Services Employment and Reemployment Rights Act, or USERRA—provides job protection to soldiers and reservists returning from active duty or training. But you may not realize that USERRA temporarily cancels the returning employee’s at-will status. That means if you want to terminate a returning reservist or soldier, you can do so only “for cause” and must be able to point to a solid job-based reason. How long till at-will status returns? USERRA says returning soldiers who are gone more than 180 days receive that extra protection for one year. Those gone for 30 to 180 days get six months’ worth of extra protection. www.theHRSpecialist.com/NC Recent case: A computer tech at Booz Allen Hamilton faced frequent discipline for tardiness and violating the company’s professionalism code. She also served in the U.S. Naval Reserve. The company fired her for continued tardiness soon after she returned from a military deployment. She fired off a USERRA lawsuit alleging the company didn’t have just cause for its actions. But the appeals court disagreed, saying she’d been warned and that the firing reasons rose to the level of “just cause.” (Francis v. Booz Allen Hamilton, No. 05-1523, 4th Cir.) Final tip: In USERRA cases, employers have the burden of proof and must show their actions were “reasonable.” That means employees who file USERRA lawsuits will likely have their cases heard by a jury and not dismissed earlier in the process. That makes each case potentially very expensive, even if you ultimately win. Establish ‘just cause’ for firings after military leave USERRA prohibits you from terminating employees who are returning from active duty or reservist leave unless: • You can point to “just cause,” even if the employee previously was an at-will employee who could be fired for any reason. (That just-cause status continues for one year if the person served on military duty for more than 180 days. The status extends six months for people on military leave between 30 and 180 days.) • You can prove the soldier/employee knew (or was notified that) his or her actions could constitute just cause for discharge. That means you have a duty to give warnings first. • You can prove the termination was “reasonable.” That means the rules you accused the employee of violating were reasonable workplace rules. October 2008 • North Carolina Employment Law 3 National Roundup Ethnic name isn’t a ‘head-start’ to bias claim MISSOURI Mohammed Hussein, who was born in Fiji, worked as a pilot during the Sept. 11 attacks. When flights were grounded that day, Hussein went to his hotel’s bar and allegedly hoisted a toast when the TV showed the collapsing Twin Towers. The airline fired him for breaking the “no drinking while in uniform” rule. He sued, arguing that his name triggered the firing. The court disagreed, saying it takes more than an ethnic name to infer that an employer would fire someone based on prejudice. Employees must show some level of discriminatory intent, action or motive by the employer. (EEOC v. Trans States Airlines, 8th Cir.) Advice: Employees whose names people associate with a particular religion, origin or ethnicity can’t automatically claim that their names led to discrimination. If that were the case, anyone with such a name would have a leg up on other employees in every discrimination case. ‘Excellent’ evaluation can still be retaliation MARYLAND A government employee filed several race-bias complaints that were settled. When he transferred to a new position, he earned an “excellent” rating, plus a pay hike. But he still filed another race-bias suit. Why? His rating wasn’t high enough to also earn a bonus that year. The rating, he said, was retaliation for earlier lawsuits. A federal court let his case go to trial, saying he should have a chance to prove the rating was still retaliation. (Webster v. Rumsfeld) Advice: Always document evaluations and bonus decisions with tangible job performance data. Avoid vague generalities such as “excellent employee” or “bad attitude.” Instead, use measurements such as sales numbers, work quality, productivity and other valid business reasons for all decisions. As this case shows, high praise can be deemed retaliation if Compliance lessons from other states the review is worse than a previous one and hurts the employee’s ability to earn a bonus or a promotion. Pay for car-pooling time? Only if you require it NEW MEXICO A group of gas rig employees always drove to work together because the wells were in a remote location with limited parking. During the drive, they often discussed work issues. They filed a Fair Labor Standards Act lawsuit demanding pay for that commute. But the court said no, noting that all workers were free to drive their own cars and spend their car-pooling time as they chose. So they weren’t performing “work.” (Smith, et al., v. Aztec Well Services Company, 10th Cir.) Advice: Unless you mandate that employees travel together, it’s unlikely that their travel time will be compensable work time. But if you insist that employees carpool or make certain work-related stops along the way, you’ll pay. Listen for clues that count as FMLA ‘notice’ ILLINOIS A janitor told his boss that he had visited the doctor due to a weak bladder. He then revealed that a prostate test showed the need for a biopsy. He also told the boss he’d commit suicide if he had prostate cancer. The company fired the janitor for performance problems. He sued, citing interference with his right to take FMLA leave. The company said he never pointed to a serious condition, so it wasn’t obligated to let him know how to take FMLA leave. The court disagreed, saying that although the janitor didn’t look sick, he clearly let his boss know he was having medical problems. (Burnett v. LFW, 7th Cir.) Advice: Employees don’t have to say something as explicit as “I need FMLA leave due to ‘X’ illness” to provide legitimate notice of a need for FMLA leave. It’s the employer’s duty to judge whether a person’s condition rises to the “serious” level. Teach supervisors to pay attention to employees’ clues. r 2008 Octobe l Issue Specia STAFF NA TH CAROLI OR HR NEmployment Law SPECIALIST rs employe Publisher: Phillip Ash Copy Editors: Nancy Baldino, Cal Butera Contributing Editor: Anniken Davenport, Esq., Production Editor: Dan Royer HRNCeditor@NIBM.net Production Assistant: Nancy Asman Associate Publisher: Adam Goldstein Editorial Director: Patrick DiDomenico Senior Editor: John Wilcox, (703) 905-4506, jwilcox@NIBM.net Customer Service: (800) 543-2055, customer@NIBM.net HR Specialist: North Carolina Employment Law (ISSN 1937-8432) is published monthly by the National Institute of Business Management Inc., 7600A Leesburg Pike, West Building, Suite 300, Falls Church, VA 22043-2004, (800) 543-2055, www.NIBM.net. Annual subscription price: $299. © 2008, National Institute of Business Management. All rights reserved. Duplication in any form, including photocopying or electronic reproduction, without permission is strictly prohibited and is subject to legal action. For permission to photocopy or use material electronically from HR Specialist: North Carolina Employment Law, please visit www.copyright.com or contact the Copyright Clearance Center Inc., 222 Rosewood Dr., Danvers, MA. 01923, (978) 750-8400. Fax: (978) 646-8600. This publication is designed to provide accurate and authoritative information regarding the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal service. If you require legal advice, please seek the services of an attorney. 4 North Carolina Employment Law • October 2008 Frederick M. Thurman Shumake r, Loop & Kendrick , LLP, Charlotte H. Sturges, on to check They hadhours, around nd shifts. two weeke t every ing time each residen approv in their ed sible for on alterations the clock. they turned ly deduct respon off When f you’re ers routine living assisor signingby employees,ation manag e each time sheets reported sheets, na becaus two four-hour ion your organiz on. hours off. eight hours edly got not just costly litigati to the Discriminat in North Caroli signed couldn’t and 15% filed 15% more dis- they take note: It’s risk, as tant suppos CEO then ees than are up a big fine are also at . The : The employ s.” ans of in 2007 breaks that risks al assets “break North Carolinicomplaints to the director The problem g during their own, the tion ng Your person ruling shows. Labor Standcrimina buildin accordi office. . court e the Fair to sue their leave the the time wasn’t nsated a new did in 2006, Charlotte Carolina becaus yees for se be compe the CEO That’s emplo ment Becau sionals Jr., a North must the EEOC’s held it . enforce allows HR profes court Daniels and the : The court said ards Act and pay records Reuben heads up EEOC received nearly g him , execs altering supervisors just who office orderin $500,000 to The kicker bosses liability for native up from 2005. said the sure ally liable,more than al age— in ide, , make in the state, ints in 2007, person . person ny to pay reason worse, encour v. Self-Pr and 1,625 ination compla that records before For 1,900 compa year e—or, altering of yees. (Chao race discrim grow1,650 the the emplo 3, 4th Cir.) don’t tolerat work or of “living said while the fastest- l -clock group at a home Daniels nationa inated, No. 06-120 off-the t case: A s) predom involved ed that charges of complaint Recen (hourly worker48-hour the He attribut d nts” ing kind ination. ed outreach in out d worke assista pointed idisable origin discrim expand He also EEOC’s for the hly to the community. charged discrim thoroug c ly and Hispani complaints cs. Danielsints regular ees Hispani ints. that some favored in compla that your employall compla employee Caryn nation the overall growthseveral mass gate EDS sexual ate ladder and investi corpor t case: blamed job market not just isor Recen ssed up the na, it’s t under to a poor male superv tive Caroli brough progre about. ts new Testa n North layoffs. said, a left her sugges page 2 to worry ment lawsui buying of her, you have face state tort until, she harass money posters itioned Continued on bottom law that federal ation could ional inflic-ent propos Don’t wasteforms and are alertas “intent or “neglig s Your organiz , such s” or workplace ent agenciedon’t need to solve behavi nal distres law claims governm they How to emotio an employee’s ement required Several es s owners Free report tion of if posters manag ision,” said’ disput in emces. ing busines forms and superv e enough and workpla most it. said/she out the truth e free stop ‘he harasspay for than to of ed in their often availabl m is extrem in sorting steps our free t take a bigger proble ary damto be display nts are For help ’ conflicting stories access doesn’ docume be ment: sites. Monet ployees name-calling, Those in “.gov” ent web That can claim. Why? law (Title ating Harass at www. federal ment or Investig on governm Web sites endingent sites. as intenpaper, ine Credibility, aper. the federalcapped under such note: governm white s and Take to sell /whitep Determ ages are state tort claims nal distres ies try only official How to pecialist.com 5 are the compan of page VII). But have caps. sh private on of emotio theHRS d on bottom Some inflicti ision don’t to establi Continue tional nt superv more reason pubis train time . . 4 neglige all the ment Law E nt policy, s for travel . . . 8 That’s ISSU rassme a Employ and is edited employee .... HIS anti-ha Carolin list the to pay hourly s answered . . . IN T North Specia a partner in a strong Know when , by HR ent e of lished Your question . . 1-3 Managem H. Sturges law practic and advice . . 3 The Mailbag: in of Business by William and labor k, LLP Institute ent law cases ourAct ment National & Kendrichim at employm employ rthCarolina WageandH ker, Loop Recent N.C. Shuma You can contactor at (704) stoknowabouttheNo te. m Top10thing Charlot -law.co es@slk wsturg C 57. .com/N 375-00 ecialist heHRSp 55 • www.t (800) 543-20 Trusted Editor: William H. Sturges, Esq., Frederick M. Thurman Jr., Esq., (704) 375-0057, Shumaker, Loop & Kendrick, LLP, Charlotte Jr., Esq., onal liability mean pers sheets can Esq. and complian ce advice for NC s ... In The Newclaims Editors: William Altering time I NC employe I bigger es can win lawsuit win dfall ✓ Yes, I want to begin my subscription to ❒ North Carolina Employment Law for only $179 per year (nearly 40% off the normal price). Name_______________________________________ Company____________________________________ Address_____________________________________ City, State, ZIP_______________________________________________ Phone___________________E-mail_________________________ Payment Method: Fax this coupon ❒ Credit card ❒ Visa/MC ❒ AMEX ❒ Discover to (703) 905-8040 Card #_____________________________________Exp. date______________ Signature_________________________________________________________ ❒ Check/money order Mail to: North Carolina Employment Law, P.O. Box 9070, McLean, VA 22102-0070 ❒ Bill me Contact our Customer Service Center at (800) 543-2055 or customer@NIBM.net. NC2007 (800) 543-2055 In The News … Don’t waste money buying workplace forms and posters Several government agencies are alerting business owners they don’t need to pay for most forms and posters required to be displayed in their workplaces. Those documents are often available free on government web sites. Take note: Web sites ending in “.gov” are the only official government sites. Some private companies try to sell posters and government documents using official-looking sites. Advice: You can download most required federal posters free at the U.S. Department of Labor’s main poster page, www.dol.gov/osbp/sbrefa/poster. You can download mandatory North Carolina posters, including the new minimum wage poster, at www. nclabor.com/posters/posters.htm. Settlement in race case despite employee’s ‘scandalous’ record Boda Plumbing of Monroe has agreed to pay $18,500 to Anthrone Cunningham to settle an EEOC racial discrimination lawsuit. Before settling, Boda Plumbing asked the court to consider that Cunningham has “an extensive criminal record including multiple convictions related to fraud in employment matters.” U.S. District Judge Frank Whitney Notes in customers’ files Continued from page 1 The case: A drugstore customer asked the pharmacist not to mention the types of drugs she was picking up at the counter. The pharmacist made note of her request in the internal computer system, but added in his notes: “CrAzY!!” and “She’s really a psycho!!” When a friend picked up the woman’s prescription, the printout receipt accidentally included these comments. The woman sued for libel, noting the comments were available to every pharmacist in the drugstore’s chain. Advice: Use this example to remind employees to avoid writing down their personal comments about customers. www.theHRSpecialist.com/NC ruled that Cunningham’s criminal record was “certainly scandalous, but … also irrelevant to the question of whether he suffered racially discriminatory behavior.” As part of the settlement, Boda agreed to provide a positive reference letter to Cunningham and to adopt a formal anti-discrimination policy. 4 supervisors arrested after ICE raids S.C. poultry plant Federal Immigration and Customs Enforcement (ICE) agents arrested four supervisors at the House of Raeford Farms poultry plant in Greenville, S.C. Assistant U.S. Attorney Kevin McDonald said agents found apparently false information on employment records at the plant. Former supervisors at the Raeford, N.C.-based company said managers knew they were employing illegal immigrants. To avoid safety violations, know N.C.’s top targets The North Carolina Department of Labor’s Occupational Safety and Health Division found serious violations in about 5,000 workplaces last year. Here are the 10 most frequently cited serious violations in private-sector general industry, followed by the specific OSHA standard: 1. Machine guarding, 1910.212(a)(1) 2. General duty clause (Employers shall provide a workplace free from recognized hazards), NC General Statute 95-129(1) 3. Abrasive wheel machine guarding exposure adjustments, 1910.215(b)(9) 4. Continuous grounding path, 1910.304(f)(4) 5. Eye and body drenching or flushing facilities, 1910.151(c) 6. Abrasive wheel machinery work rests, 1910.215(a)(4) New online tool helps employers (and employees) calculate OT pay 7. Eye and face protection, 1910.133(a)(1) The U.S. Department of Labor recently debuted a useful new tool that employees—and you—can use to calculate an employee’s overtime pay. The web-based Fair Labor Standards Act Overtime Calculator Advisor (www.dol. gov/elaws/otcalculator.htm) asks a set of questions about pay periods, hours worked, hourly pay scales and additional compensation. Advice: Employees will be using this tool to check whether you pay them correctly, so you should get to it first. 8. Points of operation guarding, 1910.212(a)(3)(ii) N.C. employers named to Fortune’s ‘best to work for’ list Fortune magazine recently published its 2008 list of the “100 Best Companies to Work For,” and five North Carolina employers made the list. Cary-based SAS Institute was ranked 29th, in part for its outstanding on-site child care program. Kimley-Horn & Associates, also headquartered in Cary, was ranked 38th and was noted for the freedom it gives to new employees in carving out their careers. Cisco Systems and Network Appliance, both in Research Triangle 9. Protection from open-sided floors, platforms and runways, 1910.23(c)(1) 10. Unused openings in electrical boxes or fittings, 1910.305(b)(1) Park, also made the top 100 list, along with Alston & Bird of Charlotte. Bash away! The North Carolina Office of State Personnel has removed from its web site an online copy of its personnel handbook, which included a ban on anti-gay discrimination. North Carolina Representative and Republican House Minority Leader Paul Stam questioned what the ban was doing there when North Carolina law does not prohibit discrimination based on sexual orientation or gender identity. The State Personnel Commission sought to add the prohibition to the handbook in January, but the state regulatory panel refused, saying lawmakers needed to approve the ban before the state changed its policies. October 2008 • North Carolina Employment Law 5 In the Spotlight by Frederick M. Thurman Jr., Esq., Shumaker, Loop & Kendrick, LLP, Charlotte Top 10 things to know about the North Carolina Wage and Hour Act of wages and M 7 Advances employee loans. 5 Withholdings. any employers are familiar with the basic requirements of federal wage-and-hour law—the minimum wage, how to calculate overtime and who must receive it. But the North Carolina Wage and Hour Act is often a mystery to employers and employees alike. Here are the top 10 things you should know about the act. 1 Where to find the act. The act is codified in the General Statutes, beginning with section 95-25.1 and continuing through section 95-25.25. The act and the North Carolina Department of Labor’s interpretive regulations are both available online at www.nclabor. com/wh/Wage_Hour_Act_Packet.pdf. 2 What is the minimum wage? North Carolina’s minimum wage isn’t simply a regurgitation of the federal minimum. Instead, the act requires paying whichever is higher: $6.15 per hour or the federal minimum wage, which rose to $6.55 per hour on July 24, 2008. 3 Notifications regarding wages. At the time of hire, employers must notify newly hired employees—either orally or in writing—of promised wages and scheduled paydays. Employment practices or policies regarding promised wages must be provided in writing or in a posted notice. Employees must receive at least 24 hours’ advance notice, in writing or in a posted notice, of any reduction in promised wages. For each pay period, employees must receive a written statement that itemizes all deductions made from that period’s paycheck. 4 Method of payment. An employer may select any legal form of payment, as long as payment is made on the designated payday. Acceptable forms of payment include cash, money order, negotiable checks, direct deposit to an institution whose deposits are insured by the federal government or direct deposit to an institution the employee 6 North Carolina Employment Law • October 2008 selects. An employee may be required to accept payment by direct deposit. Handling withholdings, particularly those not required by law, can get complicated. Pay careful attention to both the statutory language (N.C. Gen. Stat. § 95-25.8) and to the interpretive regulations (13 N.C. Admin. Code § 12.0305). Basically, an employer may withhold a portion of an employee’s wages (1) when required or empowered to do so by state or federal law or (2) when the employee has provided a written authorization, signed on or before the payday for the pay period from which the deduction is to be made, indicating the reason for the deduction. An authorization may be specific (when the amount of the deduction is known in advance) or blanket (when the amount of the deduction is not known in advance). “Terminated employees must be paid all wages due on or before the next regular payday following termination.” of withholding 6 Withdrawal authorization. Employees must be allowed at least three calendar days prior to withholding to withdraw specific authorizations, if such deductions are for their convenience. Those deductions include withholding for savings plans, credit union installments, savings bonds, club dues, uniform rental and cleaning, parking and charitable contributions. Before an employer may withhold pursuant to a blanket authorization, the employee must be given notice of the amount of the proposed withholding and allowed at least three calendar days from the date of notice to withdraw the blanket authorization. Advances of wages to an employee or a third party at the employee’s request are considered prepayment. A dated receipt for the advanced wages (signed by the employee) is sufficient to show that the advance was requested and made, and no withholding authorizations are required when the advance is later withheld from a paycheck. In the absence of an executed loan document, the principal of an employee loan is considered an advance of wages. However, withholdings related to interest and other related loan charges require written authorization. 8 Disputed wages. When the amount of wages is in dispute, the employer must nevertheless pay the amount the employer acknowledges is due. An employee’s acceptance of a partial wage payment does not release any claim for the balance of the wages, and the employer may not demand such a release. 9 Last paycheck. A terminated employee must be paid all wages due on or before the next regular payday following termination. However, commissions and bonuses due must be paid on the first regular payday after they become calculable. A final paycheck may be delivered either through regular pay channels or by mail if the employee requests it. If an employee requests sending the paycheck by mail, the employer may require notarized or witnessed consent. Regular pay channels or mail are the only two allowable delivery options. A friend picking up the check is not acceptable. can help if an employer 10 Who is confused? Of course, your attorney is always a good resource when addressing these issues. Also, the state Department of Labor offers some useful basic resources on its web site. Wage and Hour Bureau information can be found at www.nclabor.com/ wh/wh.htm. (800) 543-2055 Nuts & Bolts Rules of the road: Know when to pay hourly employees for travel time don’t need to pay nonexempt emYandouployees for their commuting time to from the workplace. That’s simple. But what if such employees occasionally travel off-site (or even overnight) for work reasons? When to pay nonexempt workers for travel locally or on overnight trips baffles many employers. Mistakes can spark anything from mild complaints to class-action lawsuits—a black eye for you either way. The Fair Labor Standards Act sets rules on compensating hourly employees for travel time. The best way to decipher them is by using a case study. Home-to-work travel Let’s say Robert Smith is a nonexempt employee who sometimes travels for work. It’s clear that you don’t need to pay for his commute to work; the Portalto-Portal Act of 1947 covers that. But suppose you ask Robert to pick up some company documents on his way in to work. In that case, you’d pay him from the time he picks up the documents. The law says that if the travel is for the company’s benefit, it’s compensable. If it’s purely commuting, it’s not. Working at different locations The U.S. Department of Labor says travel time spent by employees as part of their principal activity, such as travel among job sites during the workday, is considered “work time” and must be paid. For example, say Robert reports to headquarters before making his rounds to visit other company locations. In that case, the commute to headquarters is commuting time, but all travel from headquarters until his last stop is paid time. Time from the last stop to home is unpaid commuting time. Any travel that is a regular part of the employee’s job is paid time. Out-of-town day trips Generally, time spent traveling to and returning from the other city is work time. You can exclude the employee’s regular commuting time and meal breaks. For example, say Robert drives to the airport and takes a 6 a.m. flight to a seminar in Chicago. He arrives at 8:30 a.m. and takes a cab to the seminar. The seminar runs from 9 to 5, with an hour lunch break. After the seminar, he chats with friends for an hour before taking a cab back to the airport. He flies back to his base city and drives home. Which hours count as “compensable” time? You don’t have to pay Robert for his trip to the airport; that’s commuting time. But you do have to pay him from the time he arrives at the airport through his flight, cab ride and during the Chicago seminar. (You don’t have to pay for his lunch period.) Do you pay for Robert’s chatting time with friends? If there are no other flights home until later, yes. But if Robert simply opts for a later flight to swap stories with his buddies, the answer is no. The cab back to the Chicago airport and the flight home are paid time. The drive home from the airport is considered unpaid commuting time. Final tip: Make sure nonexempt employees understand when they will be paid before they travel. Spell out the rules clearly in your employee policies. Next Nuts & Bolts: Interview questions Coming soon: The FMLA Know the FLSA rules for rest periods, on-call time, training and more In addition to travel time, employers face many other questions about what counts as “compensable time” under the federal Fair Labor Standards Act (FLSA). Here are answers to some of the stickier issues: ON-CALL TIME. Employees required to remain on call on the employer’s premises are considered working while on call. Employees required to remain on call at home (or who can leave a message where they can be reached) are considered not working (in most cases) while on call. WAITING TIME. Employees are paid for waiting time when they are “engaged to wait.” Employees fall under that definition if they’re required to be at a work site while waiting to perform work. REST AND MEAL PERIODS. You typically must pay employees for short rest periods, usually 20 minutes or less. You generally don’t need to pay employees for bona fide meal periods (typically 30 minutes or more). Employees must be completely relieved from duty during unpaid breaks and meal periods. Example: If you require your assistant to eat lunch at her desk in case a call comes in, she must be paid because she hasn’t been fully relieved of her duties. SLEEPING TIME. Employees required to be on duty for less than 24 hours are considered “working,” even if they’re permitted to sleep. Employees required to be on duty for 24 hours or more may agree with their employer to exclude from hours worked any scheduled sleeping periods of eight hours or less. TRAINING PROGRAMS AND MEETINGS. You don’t have to pay employees for time spent at training programs, lectures or similar activities as long as they meet the following four criteria: (1) The event is outside normal hours. (2) It’s voluntary. (3) It’s not job-related. (4) No work is performed during that time. Source: Adapted from U.S. Department of Labor fact sheet No. 22, www.dol.gov/esa/regs/compliance/whd/whdfs22.htm. www.theHRSpecialist.com/NC October 2008 • North Carolina Employment Law 7 by Frederick M. Thurman Jr., Esq., Shumaker, Loop & Kendrick, LLP, Charlotte Is there any requirement to offer vacation benefits? Q • Provides continuation coverage under a group health insurance plan for up to 18 months • Requires that employees be allowed no fewer than 60 days to elect continuation coverage • Allows for the charging of up to 102% of premiums to electing participants The North Carolina act, however, does not include dental, vision care, prescription drug benefits “or any other benefits provided under the group policy in addition to its hospital, surgical, or major medical benefits.” Must I offer vacation time to my employees? If I do, must I pay terminated employees for their unused vacation time? No and yes (but maybe not). The North Carolina Wage and Hour Act expressly provides, “No employer is required to provide vacation pay plans for employees.” When a vacation benefit is provided, terminated employees are generally entitled to be paid any accrued but unused vacation time. In order for the vacation time to be forfeited upon termination, employees must be notified in advance of the forfeiture policy, either in writing or through posted notices. What does ‘right to work’ mean in North Carolina? Injured while playing on company team Q A Q If an employee is injured at a company-sponsored softball game, where participation is purely voluntary, is the injury compensable under workers’ compensation? Probably not. The North Carolina Supreme Court recently weighed in on this subject and found an injury resulting from a go-kart accident during an employer-sponsored “Fun Day” was noncompensable. For an injury to be compensable under North Carolina’s Workers’ Compensation Act, it must be an injury “arising out of and in the course of the employment.” Citing older authority, the court wrote: “Where, as a matter of good will, an employer at his own expense provides an occasion for recreation or an outing for his employees and invites them to participate, but does not require them to do so, and an employee is injured while engaged in the activities incident thereto, such injury does not arise out of the employment.” A Must small businesses provide COBRA-like continuation health coverage? Q My company has fewer than 20 employees. Must my group health insurance policy still provide COBRAlike continuation coverage to terminated employees? Yes, although COBRA does not apply. The North Carolina Group Health Insurance Continuation and Conversion Privileges Act, which has provisions similar to the federal COBRA Act, does include small employers. Like COBRA, it: A FYI Workers feel underpaid? They may be ‘overtitled’ Nearly 50% of people believe that they are underpaid in their current jobs, according to a new Salary.com survey. But an analysis of those employees’ jobs and wages reveals that less than 22% actually were paid below the fair market value for their jobs. “Overtitling” is the biggest factor. “We found that 30% of respondents were likely overtitled,” says Bill Coleman, senior VP of compensation at Salary.com. 8 North Carolina Employment Law • October 2008 I always hear North Carolina is a “right to work” state. Does that mean there are limitations on how or why I may be fired? Does that have anything to do with “employment at will?” Although they sound similar, “right to work” and “employment at will” are different concepts that do not contradict each other. “Right to work” generally means that membership in a recognized union may not be a condition of hire or continued employment. Thus, if your workplace is unionized in North Carolina, you cannot be required to join the union. “Employment at will” is a common law concept that provides—absent a written employment agreement or collectivebargaining agreement—that either you or your employer may terminate the employment relationship at will, at any time, with or without notice and for any reason, as long as the reason is not made unlawful by statute (such as the federal Civil Rights Act) or other laws. A Hiring for the nonsmoking workplace Q Can I refuse to hire a smoker? A Probably not. For private employers with three or more regular employees, it is unlawful in North Carolina to discriminate against an employee or prospective employee because he engages in or has engaged in “the lawful use of lawful products if the activity occurs off the premises of the employer during nonworking hours and does not adversely affect the employee’s job performance or the person’s ability to properly fulfill the responsibilities of the position in question or the safety of other employees.” Frederick M. Thurman Jr. practices employment law at the Charlotte office of Shumaker, Loop & Kendrick, LLP. He is the current Chair of the Labor and Employment Law Section of the North Carolina Bar Association and has more than 12 years’ experience counseling employers on compliance and policies, representing employers in litigation and speaking on employment law topics. You can contact him at (704) 375-0057 or at fthurman@slk-law.com. To submit your question to North Carolina Employment Law, e-mail it to HRNCeditor@NIBM.net or fax it to (703) 905-8042. (800) 543-2055 HRNC-SIS-003 The Mailbag HR SPECIALIST CHARTER DISCOUNT CERTIFICATE NORTH CAROLINA Employment Law To receive your Charter Discount Price, use this customer code: Cover Price You Save Charter Discount Price $299 $120 $179 DP6397 Name_______________________________________________________ Title/Company________________________________________________ ■ Order online at www.theHRSpecialist.com/NC and receive your Online Bonus instantly! Address_____________________________________________________ City________________________________________________________ OR: ■ Check enclosed (payable to HR Specialist: North Carolina) ■ Bill me later ■ Please charge my: ■ VISA ■ MasterCard ■ AMEX ■ Discover State____________________________ ZIP________________________ Phone______________________________________________________ E-mail______________________________________________________ Card No. (We will never sell your e-mail to other companies) Exp. Date All rates and guarantees apply to a 12-issue subscription. Your subscription may be tax deductible if used for business purposes. Signature DETACH UPPER PORTION AND RETURN BENEFITS PRICE 12 Issues of North Carolina Employment Law $179 Each monthly issue is packed with critical survival strategies: • Business-focused briefings on state and local HR laws Included • Practical guidance on lawsuit-proofing your policies, pay and practices Included • Early-warning alerts on new pitfalls and legal trends • Plain-English guidance on complicated federal employment laws Included Included Web Site Included Access to free reports and in-depth advice at our new web site: www.theHRSpecialist.com Weekly E-Letter Included Latest news and best practices from the HR world when you sign up for our free HR Weekly e-letter HR Legal Alerts Included E-mail alerts when immediate HR action is required Online Bonus North Carolina’s 10 Most Critical Employment Laws It’s a $49.95 value, yours FREE. Our exclusive Special Report makes North Carolina law work for you— not against you. It’s FREE with your paid subscription. Download today when you order online at www.theHRSpecialist.com/NC Included 100% MONEY-BACK GUARANTEE NORTH CAROLINA EMPLOYMENT LAW guarantees that you’ll have new control over your business and new power to defuse National Institute of Business Management 7600A Leesburg Pike • West Building, Suite 300 • Falls Church, VA 22043-2004 (800) 543-2055 • Fax (703) 905-8040 • www.theHRSpecialist.com/NC HRNC-ODF-SIS legal land mines before they explode into million-dollar lawsuits. If you are ever dissatisfied with the real-world value of this service, we’ll refund everything you paid. Your issues and your FREE SPECIAL REPORT are yours to keep, no matter what. — Phillip A. Ash, Publisher

© Copyright 2025