Letters of Credits Tools to Mitigate Risk, Performance Requirement May 15, 2013

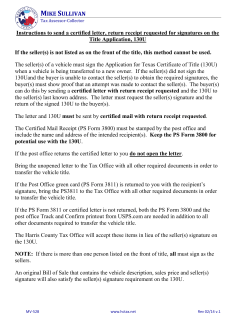

Letters of Credits Tools to Mitigate Risk, Expand Your Market and Satisfy Performance Requirement May 15, 2013 Speakers Dennis Brown Senior Advisor Silicon Valley Bank Jimmy Gan Senior Director and Business Manager Silicon Valley Bank 2 Agenda Letter of Credit: Definition Standby Letters of Credit Commercial Letters of Credit Case Studies 3 Poll Question Have you experienced using a letter of credit before? A. Yes B. No 4 Letter of Credit Definition Uniform Commercial Code (UCC) Definition: “Letter of Credit" means a definite undertaking that satisfies the requirements by an issuer to a beneficiary at the request or for the account of an applicant or, in the case of a financial institution, to itself or for its own account, to honor a documentary presentation by payment or delivery of an item of value. (The issuing party substitutes its credit for that of the applicant) 5 Understanding Your Role in a Letter of Credit Transaction Applicant Buyer Importer Tenant Bidder Borrower Beneficiary Seller Exporter Landlord Auctioneer Lender 6 Parties to a Letter of Credit - Domestic y Applicant Issuing Bank Beneficiary 7 Parties to a Letter of Credit - International Issuing Bank Applicant y Beneficiary Advising Bank 8 Irrevocable Or Revocable Types of Letter of Credit Financial Letters of Credit Standby Letters of Credit Performance Letters of Credit Import Letters of Credit Commercial Letters of Credit Export Letters of Credit 9 Standby Letters of Credit Standby Letters of Credit - Overview Not a primary source of payment Not meant to be drawn upon Support an obligation Financial Performance Subject to either ISP98 or UCP600 11 Purpose of Standby LCs Domestic International Rent or lease obligations Customs bonds Bid VAT (Value-Added-Tax) bond Performance Rent or lease obligations Advance payment Bid Warranty Performance (project of financial) Workman’s Comp Advance Payment Commercial paper Tax liabilities Securitizing assets/credit Warranty enhancement Credit support / loans Credit support / loans Acquisitions Acquisitions Environmental liabilities Environmental liabilities 12 Standby L/Cs – Typical Required Documents Draft drawn on issuing bank Signed statement from the beneficiary certifying one or more conditions specified below: Applicant has failed to perform its obligations under the lease agreement dated XXX. Applicant has failed to pay invoices within 30 days and are now past due. Applicant has not complied with the terms and conditions of contract no. XXXX. Applicant has been awarded the bid but has failed to sign the contract or has failed to provide the required performance bond. 13 Benefits of Standby Letter of Credit Allows clients to fulfill contractual and governmental obligations Acceptable substitute for bid, performance bonds and warranty bonds Serves and supports a bank guarantee Applicable for domestic and international transactions 14 Commercial Letters of Credit Important Factors to Consider Cost Incoterms Payment terms Risk 16 Incoterms 2010 17 Incoterms 2010 18 Payment Terms Sight Instrument payable upon presentation or demand Extended Payment Terms Deferred Enables the buyer to take possession of the title documents and the goods by agreeing to pay the issuing bank at a fixed time in the future Usance or Time Draft Payment available against acceptance of a term bill of exchange or in certain usages by deferred payment Mix Payment Any combination of sight and/or extended payment terms 19 Payment Risk Hierarchy High Low Cash Advance Letters of Credit Seller / Exporter Buyer / Importer Documentary Collections Open Account High Low 20 Cash in Advance Process Negotiate Sale 1 2 Buyer 3 Send Title Documents Seller 21 Open Account Process Negotiate Sale 3 1 Buyer 2 Send Title Documents Seller 22 Documentary Collection Process Negotiate Sale Buyer Seller 1 6 2 5 Send Payment Send Payment 8 4 3 Presenting/ Collecting Bank 7 Send Payment Remitting Bank 23 Letter of Credit Issuance Process Buyer Seller Issuing Bank Advising/Confirming Bank 24 Letter of Credit Settlement Process Buyer Seller Send Payment Send Payment Send Payment Issuing Bank Advising/Confirming/ Negotiating Bank 25 Commercial Letters of Credit - Overview Primary payment instrument Involves goods or services including licensing rights (media/software) Domestic or International Subject to UCP600 26 Typical Required Documents of Commercial Letters of Credit Draft drawn on issuing bank Signed commercial invoice Packing List Transport document Ocean Bills of Lading Airway Bills Courier Receipt 27 Letter of Credit Characteristics A Letter of Credit by its nature is a separate transaction from the sale or other contract on which it may be based Banks deal with documents and not with goods, services or performance to which the documents may relate Adheres to independence principles 28 Export Letters of Credit SVB client functions as the Beneficiary Sight or Extended Term (30 days, 60 days, 90 days etc.) Payments for goods or services Domestic or International 29 Import Letters of Credit SVB client functions as the Applicant Sight or Extended Terms (30 days, 60 days, 90 days etc.) Payment for goods or services Domestic or International 30 Benefits of Export Letters of Credit Excellent cash forecasting instrument Exporter controls payment Risk-mitigation tool Substitute buyer risk with foreign bank risk Irrevocable Non-cancellable unless all parties agrees Financing Vehicle Discounting of accepted draft 31 Benefits of Import Letters of Credit Applicant has control on conditions of payment Applicant dictates documentary requirements and conditions on the letter of credit Risk-mitigation tool Bank pays only upon submission of complying documents Keeps the supply chain healthy Assurance that shipments have occurred as evidenced on the documents 32 Case Studies Case Study 1 Background: International Private Equity had a deal to purchase a division of a large Chinese company. The seller wanted the buyer to set up an escrow account for the full purchase price of $ 200 million. Need: The CFO of International Private Equity wanted to manage cash carefully and only disburse funds at closing. Concern: The seller needed some assurance that the buyer was serious about the purchase. Solution: International Private Equity requested SVB to provide the seller a Standby Letter of Credit for $50 million to assure buyer that they are serious about the purchase. 34 Case Study 2 Background: Amazingly.com has expanded operations and is looking for office space in Australia to house about 50 new employees. Need: Landlord requires the tenant to provide security in the form of either cash or a bank guarantee from a local Australian bank. Concern: The CFO wants some assurance that they can get their deposit back when no longer needed. He also does not want to deal with a foreign entity to retrieve the security deposit. Solution: Amazingly.com provides the landlord with a bank guarantee backed by Silicon Valley Bank’s Standby Letter of Credit to satisfy the landlord and at the same time provide satisfaction to the CFO that he can get his cash back when the Standby Letter of Credit expires. 35 Case Study 3 Background: Nicely Tailored.com sells high-end dresses on line. The CFO wanted open term arrangements while the suppliers required pre-payment. Need: The CFO wanted to manage cash and mitigate delivery risks. He needed a solution that will assure the supplier payment protection. Solution: The CFO requested Silicon Valley Bank to issue an Import Commercial Letter of Credit as form of payment for products shipped 36 Case Study 4 Background: Screenwaver has a subsidiary in China with a buy/sell operation. They are completely committed to supporting the subsidiary. Need: The subsidiary needed about $ 1 million in working capital to support their operations. Concern: Strict exchange controls in China may prevent the CFO from repatriating their USD back if sent over to the subsidiary. Solution: SVB issued a Standby Letter of Credit on behalf of Screenwaver in favor of Shanghai Pudong Development Bank to support an RMB credit facility for the subsidiary to pay for bills and payroll. Screensaver is able to keep the USD in the US. 37 Case Study 5 Background: Alpine Semiconductor sells analog chips globally. They have a few clients that don’t carry the credit profile to warrant open account terms. Need: Alpine Semiconductor needs to mitigate their buyers payment risks. Issue: Some buyers are pushing back on pre-payment terms that Alpine Semiconductor has been requiring. Solution: Alpine Semiconductor required their buyers to issue Export Commercial Letters of Credit in their favor through Silicon Valley Bank. 38 Case Study 6 Background: Super Software has an interest in bidding on a project in Qatar to provide mobile banking solutions. Need: Super Software needs to provide a bid security in the form of cash, cashiers check or bank guarantee in local currency to the Qatar customer. Issue: CEO would like to avoid dealing with currency risk and fluctuations on having to convert it back to USD. Solution: Super Software requested Silicon Valley Bank to issue a Standby Letter of Credit to a correspondent bank in Qatar to support the bank guarantee that will act as bid security. 39 Summary Definition of a letter of credit Types of letters of credit Understanding your role in the transaction Look for terms such as “bonds”, “bank guarantees”, “VAT-taxes”, “customer”, “vendor”, “supplier” Reach out to your Product Advisor 40 Questions? Biographies Dennis Brown Dennis Brown functions as a Senior Trade Finance Advisor in the International Group responsible for providing guidance and delivering tools to clients as they venture into cross-border markets. Brown joined Silicon Valley Bank in 2010. He has experience in both trade operations and business development from the beginning of his banking career in 1981 as an export letter of credit analyst. He later cross-trained to other international functions including import letters of credit, standby letters of credit, and bankers acceptances. In 1997, Brown settled to a business development role and has since remained in this field. Dennis Brown , Senior Trade Finance Advisor, Silicon Valley Bank dbrown@svb.com 949.754.0838 Brown obtained a Bachelors of Science from the University of San Francisco. He resides in Cypress, CA but makes the Bay Area his second home. 43 Jimmy Gan Jimmy Gan, Senior Director and Business Manager, is responsible for the Global Trade Finance Division at Silicon Valley Bank. With 39 years of Trade Finance experience, he heads a team of highly qualified professionals committed to providing business active in global trade markets with a value-added service offering. Jimmy Gan, Senior Director and Business Manager, Silicon Valley Bank jgan@svb.com 408.654.7110 Gan joined Silicon Valley Bank in 1997. During various mergers, acquisitions and alliances among Wells Fargo, HSBC Trade Bank N.A, Standard Chartered Bank, First Interstate Bank of California and United California Bank, he spent 16 years as a Vice President in their Trade Finance groups. He started his trade banking career at China Banking Corporation, Manila, Philippines. Gan obtained a Bachelors of Science Degree in Industrial Management Engineering with a minor in Mechanical Engineering from De La Salle University, Manila, Philippines. 44 Contacts Silicon Valley Bank - Letter of Credit Team Managers Jimmy Gan Sr. Director / Bus Mgr Gbl Trade Tel. no. 408-654-7110 Email: jgan@svb.com Alice Daluz Market Manager Tel. no. 408-654-7120 Email: adaluz@svb.com John Dossantos Trade Finance Manager Tel. no. 408-654-6274 Email: jdossant@svb.com Ravi Kiran Goli Trade Finance Manager Tel. no. 408-654-7777 Email: gkiran@svb.com Advisors Standby Letter Credit Commercial Letter of Credit Sivaram Eswaran Tel. no. 408-654-5545 Email: seswaran@svb.com Ray Robles – Advising/Amendment Tel. no. 408-654-5083 Email: rrobles@svb.com Enrico Nicolas Tel. no. 408-654-7127 Email: enicolas@svb.com Linda Wu Tel. no. 408-654-7716 Email: lwu@svb.com Evelio Barairo Tel. no. 408-654-3035 Email: ebarairo@svb.com Margaret Wong-Document Examination Tel. no. 408-654-7788 Email: mwong@svb.com Jing Yu – Document Examination Tel. no. 408-654-7176 Email: jyu@svb.com Edmund Juri – Document Examination Tel. no. 408-654-5079 Email: ejuri@svb.com Cesar Agoncillo Tel. no. 408-654-7268 Email: cagoncillo@svb.com 46 SVB – Product Advisory Team Senior Advisors Ed Sauve esauve@svb.com 949-754-0816 Associates Justine Nguyen jbguyen@svb.com 949-754-0821 Carla Winfield cwinfield@svb.com 617-630-4154 Tim Ferris tferris@svb.com 617-630-4198 Dennis Brown dbrown@svb.com 949-754-0838 47 Disclaimers This material, including without limitation the statistical information herein, is provided for informational purposes only. The material is based in part upon information from thirdparty sources that we believe to be reliable, but which has not been independently verified by us and, as such, we do not represent that the information is accurate or complete. The information should not be viewed as tax, investment, legal or other advice nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation or offer, or recommendation, to acquire or dispose of any investment or to engage in any other transaction. ©2013 SVB Financial Group. All rights reserved. Silicon Valley Bank is a member of FDIC and Federal Reserve System. SVB>, SVB>Find a way, SVB Financial Group, and Silicon Valley Bank are registered trademark. 48

© Copyright 2025