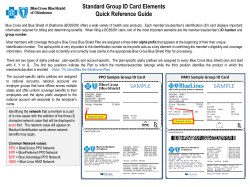

The BlueCard Program Provider Manual