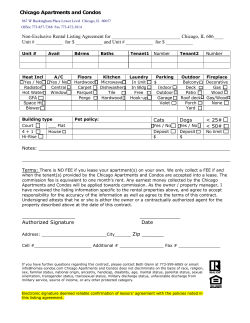

Document 298325