ax Major Trends & Developments in Business Taxation

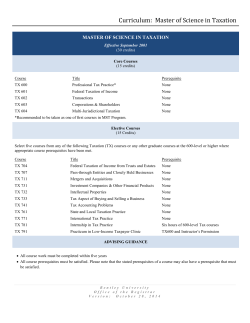

Ohio Tax Major Trends & Developments in Business Taxation Legislative Business Tax Trends in the States; Expansion of Tax Incentives & Credits to Maintain Competitiveness Globally; Federal Legislative Initiatives & Marketplace Fairness Act; Increased Enforcement; Affordable Care Act Tax Provisions & The Aftermath of the Gillette Case: A Lively & Free-Wheeling Panel Discussion Jeffrey N. Saviano, Americas Director, Indirect, SALT Services, Ernst & Young LLP, Boston, MA Douglas L. Lindholm, President & Executive Director, Council on State Taxation, Washington, DC Joe B. Huddleston, Executive Director, Multistate Tax Commission, Washington, DC Gale Garriott, Executive Director, Federation of Tax Administrators, Washington, DC Tuesday, January 28, 2014 8:40 a.m. to 9:45 a.m. Biographical Information Jeff Saviano, Partner/Principal, Ernst & Young 200 Clarendon St. Boston, MA 02116-5072 jeffrey.saviano@ey.com 617-375-3702 Jeff is the global EY organization’s Americas Director of Indirect and State / Local Tax Services. Jeff leads a practice that helps companies manage their state and local taxes in the United States and their non-income-based taxes globally. He also advises clients on state tax policy matters affecting corporate taxpayers. Jeff has more than 22 years of indirect and state / local tax experience. He has a wealth of experience in the tax legislative and policy area, as well as in tax controversies, planning, FIN 48 analysis, and the tax implications of transactions. Jeff is a member of the Board of Directors of the Associated Industries of Massachusetts, the Massachusetts Taxpayers Foundation and the Boston Municipal Research Bureau; and, he is a member of the Editorial Advisory Board for CCH’s Corporate Business Taxation Monthly, and a member of BNA’s State Tax Advisory Board. Jeff is also a former professor of state and local taxation at Suffolk University’s Sawyer Business School. Douglas L. Lindholm, President & Executive Director, Council on State Taxation 122 C Street NW, Suite 330, Washington, D.C. 20001 dlindholm@statetax.org 202.484.5212 Fax 202.484.5229 Douglas L. Lindholm, Esq. is President and Executive Director of the Council On State Taxation (COST). COST, with a membership of nearly 600 multistate corporations, is dedicated to preserving and promoting equitable and nondiscriminatory state taxation of multi-jurisdictional entities. Prior to taking the helm at COST, Mr. Lindholm served as Counsel, State Tax Policy for the General Electric Company in Washington, DC, and as Sr. Manager in the Washington National Tax Office of Price Waterhouse LLP. He has written numerous articles on federal, state and local tax issues in a wide variety of publications; testifies frequently before state legislatures and Congress on state tax issues; offers commentary on radio and television; and is a frequent speaker at national tax conferences and seminars. Mr. Lindholm currently serves on the NYU State and Local Taxation Advisory Board; the Advisory Board of the Paul J. Hartman State and Local Tax Forum; the Advisory Board of the National Multistate Tax Symposium; and the Editorial Advisory Board of Tax Management, Inc. He is a former member of the National Tax Association’s Board of Directors and the Advisory Board of the Georgetown University Law Center State and Local Tax Institute. He is a member of the US Supreme Court and District of Columbia Bars. In 2006, Mr. Lindholm was named to the Tax Business 50 list of most influential tax professionals on the globe, and is the recipient of the 2009 New York University Award for Outstanding Achievement in State and Local Taxation. He was also named to the “All-Decade State Tax Team” by State Tax Notes in January, 2010. He is a graduate of American University’s Washington College of Law in Washington, DC, and Lynchburg College (BA in Accounting) in Lynchburg, Virginia. Biographical Information Joe Huddleston, Executive Director, Multistate Tax Commission 444 N Capitol St NW Suite # 425, Washington D.C., DC 20001 jhuddleston@MTC.gov 202.624.8699 Fax 202.624.8819 Dr. Huddleston is the Executive Director of the Multistate Tax Commission. Prior to joining the Commission he was Vice President of Tax Solutions for Liquid Engines, Inc., a tax software firm focused on advanced state income tax planning models and methodologies for multi-state and multi-national companies. Before joining Liquid Engines, he was a partner and national director for state and local tax for Grant Thornton LLP. Huddleston served as commissioner of the Tennessee Department of Revenue from 1987 to 1995. He was responsible for development of a $25 million integrated tax system (RITS) for the state of Tennessee. During his tenure as commissioner, he was president of both the Federation of Tax Administrators and the Southeast Association of Tax Administrators. Immediately after leaving the Tennessee Department of Revenue, Huddleston became chief financial officer for the Metropolitan Government of Nashville and Davidson County. In that position, he was responsible for all of the city's financial affairs, including more than $1 billion in annual expenditures. Huddleston also worked as an Internal Revenue Service revenue officer, in private practice, and from 1984-1987 at the District Attorney General's office in Cookeville, Tennessee. Huddleston serves on numerous state tax related boards, and is a founding trustee of the Paul Hartman Tax Forum at Vanderbilt University Law School in Nashville, Tennessee. Additionally, Joe has served as a US state tax expert to the European Union, providing testimony on the CCCTB (Combined Consolidated Corporate Tax Base) for the European Commission, Taxation and Customs Union DirectorateGeneral in Brussels, Belgium. A graduate of the University of South Carolina, he received his J.D. from the Nashville School of Law and was awarded the Doctor of Laws from the University of South Carolina in 2009. Huddleston is a member of both the Tennessee and American Bar Associations and their respective tax sections. Gale Garriott, Executive Director, Federation of Tax Administrators 444 N. Capitol St. NW Washington, DC 20001 gale.garriott@taxadmin.org 202.624.5891 Gale Garriott is the Executive Director of the Federation of Tax Administrators. Previously, he was the Director of the Arizona Department of Revenue for six years and was the Deputy Director of the Department for two years. Gale's law degree is from the Valparaiso University School of Law and he also obtained a Master of Laws in Taxation from the University of Florida College of Law. His other public service includes twelve years at the Arizona Attorney General's Office where he was the Chief Counsel of the Tax Section and then Chief Counsel of the Civil Division. Additionally, he served as a Hearing Officer for the Arizona Department of Revenue and as a Staff Attorney for the Arizona Court of Appeals. He also spent several years in private practice with the Phoenix law firm Lewis and Roca. Gale's service in the United States Army included fifteen months as an Honor Guard at the Tomb of the Unknown Soldier, Arlington National Cemetery. Jeff Saviano, Ernst & Young Doug Lindholm, Council On State Taxation Joe Huddleston, Multistate Tax Commission Gale Garriott, Federation of Tax Administrators Ohio Tax Conference January 28, 2014 Rebound in taxes, budget surpluses, “tax fairness” debates, change in party/one‐party control of state houses Responding to political base Why the move away from income based taxes? ◦ Republicans pushing reduction of rates/elimination of entire taxes with emphasis on economic development ◦ Democrats pushing fairness, increased progressivity, base expansion, restoration of spending cuts due to recession ◦ ◦ ◦ ◦ ◦ Uncertainty of federal income tax changes – decoupling complexities State tax competition – everyone wants to be like Texas Improved state tax rankings Reduced tax volatility Increasing share of income from pass through businesses More general tax policy objective of shift to consumption taxes ◦ Sales tax has its limitations ◦ Alternative forms of business entity taxes? Failed attempts to expand the sales tax base to services Click‐through/affiliate sales and use tax nexus expansion Rate increases and decreases – sales/use, corporate and individual income taxes Property tax relief Targeted incentives (e.g., jobs, R&D, investment) States’ reaction to Gillette case Move toward single sales factor apportionment formula and market based sourcing Revenue continues to grow at a steady rate Tax cuts in states with revenue surpluses Tax/fee increases to fund specific programs, services Tax reform at the state level 2013 trends that will carryover into 2014 Effect of federal tax reform on states 2014 state and federal elections Incumbent Senator Seeking Reelection Incumbent Senator Not Seeking Reelection No Election WA MT OR ME ND MN VT ID SD WI WY MI PA IA NE NV UT IL CA CO WV KS AZ OK NM MO TX HI MA NJ RI DE MD NC TN AR SC AL CT VA KY MS AK OH IN NH NY GA LA FL 21 Dem. seats up v. 14 GOP Republican (includes 2 special elections (HI & DE) Current Senate Makeup: 53 D, 2 Ind, 45 GOP Incumbent Governor Seeking Reelection Incumbent Governor Not Seeking Reelection or Term Limited No Election WA MT OR ME ND MN VT ID SD NH WI WY PA IA NE NV UT IL CA NY MI OH IN WV CO KS AZ OK NM MO KY TX HI NC TN AR SC MS AK VA AL GA LA FL CT MA NJ RI DE MD COST MTC FTA Mississippi ◦ Equifax (Miss. Sup. Ct. June 24, 2013) – Tax Commission’s assessment is presumed correct Taxpayer has burden to prove that the assessment is incorrect, even in case of alternative apportionment Mississippi Supreme Court will not reconsider the case Tennessee ◦ Vodafone Americas Holding, Inc. (Tenn. Ch. Ct. March 19, 2013) – Telecommunications service provider was not allowed to use alternative apportionment method because the proposed method did not fairly represent its business activity in Tennessee Tennessee appellate court heard arguments in November 2013 California ◦ Gillette (Cal. App. Ct. 2 October 2012) – Taxpayers are entitled to elect to use the Compact’s evenly weighted three factor formula in lieu of the California statutorily mandated three factor double weighted sales factor apportionment formula Michigan ◦ IBM (Mich. Ct. of App. 20 November 2012)(unpublished) – Taxpayers could not make the Compact election and had to use the single sales factor formula required by the Michigan Business Tax Act ◦ Michigan Supreme Court heard oral arguments on Jan. 15, 2014 Other ◦ Cases pending in Texas (Graphic Packaging – arguments in Dec. 2013), Oregon (Health Net) and Minnesota (Kimberly‐Clark) Colorado ◦ Direct Marketing Assn. (10th Cir. Ct. App. Aug. 20, 2013) – The Tax Injunction Act prohibits the federal courts from determining whether Colorado's remote seller notification provision is constitutionally permissible DMA has until Feb. 28, 2014 to file cert. petition with US Supreme Court Illinois ◦ Performance Marketing Association Inc. (Ill. Sup. Ct. Oct. 18, 2013) – State’s click‐through nexus sales tax provisions are preempted by the Internet Tax Freedom Act and, therefore, void Court did not consider Commerce Clause challenge New York ◦ Amazon and Overstock (N.Y. Ct. App. March 28, 2013) – Taxpayers failed to demonstrate that New York’s click‐through the statute is facially unconstitutional under either the Commerce or the Due Process Clause US Supreme Court will not review The Marketplace Fairness Act of 2013 (H.R. 684/S. 743) would allow state to require sales/use tax collection by remote retailers that lack physical presence if the state: ◦ Is a Streamlined Sales Tax full‐member state, or ◦ Adopts and implements minimum simplification requirements set forth by the Act Bill contains a small seller exception On May 6, 2013 the Act passed the Senate by a vote of 69‐ 27 ◦ Had by‐passed the Senate Committee process Sept. 18, 2013, House Judiciary Committee Chairman Bob Goodlatte (R‐Va.) issued a state of seven basic principles H.R. 2992 ◦ Business Activity Tax Simplification Act (BATSA) H.R. 1179 and S. 1645 ◦ Mobile Workforce State Income Tax Simplification Act of 2013 H.R. 3724 and S. 1364 ◦ Digital Goods and Services Tax Fairness Act H.R. 3086 and S. 1431 and S. 31 ◦ Permanent Internet Tax Freedom Act; and ◦ Internet Tax Freedom Forever Act Increase in data matching and sharing of taxpayer information Fraud detection/suspicious filers What are states sharing? How far should states go? What are the privacy concerns? Expansion of tax incentives and credits to maintain competitiveness globally Subnational taxation ◦ Inadequacies of property taxes ◦ Effective intergovernmental tax frameworks Questions?

© Copyright 2025