Document 372967

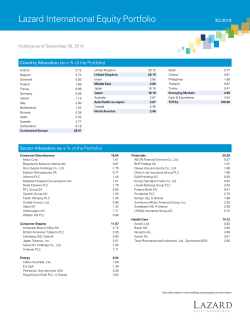

Daily Calls October 28, 2014 Market Outlook Domestic Indices Indices Close Change Change% 26752.90 -98.15 -0.37 7991.70 -22.85 -0.29 7998.00 -25.85 -0.32 10214.15 9592.09 -40.55 -80.94 -0.40 -0.84 10642.69 -19.96 -0.19 Indices Close 16817.94 Dow Jones Nasdaq 4485.93 6363.46 FTSE DAX 8902.61 Hang Seng 23256.68 Nikkei 15363.18 8025.00 SGX Nifty * Asian Market at 7:30 am.IST Change 12.53 2.22 -25.27 -85.19 144.04 -28.47 29.00 Change% 0.07 0.05 -0.40 -0.95 0.62 -0.19 0.36 S&P BSE Sensex CNX Nifty Nifty future S&PBSE 500 S&PBSE Midcap S&PBSE Smallcap Sensex: We said, "The bias can turn negative with a close below the previous candle..." The index opened 144 points higher but weakened 268 points intra-day and finished 98 points or 0.3% lower. Hindustan Unilever, down 4.7%, and oil & gas majors kept the Sensex under pressure. The Realty Index also lost 3.7% while the A/D ratio turned negative 1:2 in tune. The action formed an Engulfing Line Bear candle at 81% retracement level to the channelled 14-day fall from 27257 to 25911. The bottom of the candle is seen testing last Wednesday's gap-up area, which offers immediate technical support. However, further negative options can open up if bulls fail to take advantage of the gap-up support. Exhibit 1: Sensex – Daily Candlestick Chart Global Indices Market Breadth 23 114 Unchg NSE BSE 697 Decline 448 Advance 0 1610 1244 500 1000 1500 2000 Recommendations for the day 1. Sell Nifty Oct Future in range of 8030-8035 2. Buy Union Bank of India above 227.50 3. Buy Hindustan Zinc in range of 167.50-168.00 4. Sell Century Textile below 523.00 5. Sell RCom in range of 101.00-101.50 *All recommendations are of October Future Source: ASA, ICICIdirect.com Research ICICI Securities Ltd. | Retail Equity Research Exhibit 2: Nifty Future – Daily Candlestick Chart CNX Nifty (Cash Levels) Technical Picture Nifty Trend Intraday Rangebound Short Term Up Support 7975-7950 7650 Resistance 8025-8050 8200 Trend Reversal 7650 20 Days EMA 7933 200 days EMA 7288 Nifty Future Recommendations CMP : 7998.00 Comment : ‘Nov Future premium decreased from 53 points to 51.Reacts lower from the Neckline levels, testing last Wed’s gap-up area. Reverse if holds 7975-85 or 8000-10 Action : Sell in the range of 8030-8035 Targets : 8000/7980/Lower Stop-loss : 8050.00 Source: ASA, ICICIdirect.com Research ICICI Securities Ltd. | Retail Equity Research Page 2 Trend Scanner Global Currencies Spot Positive Trends Close Prev.close % Chg Rupee (|) 61.280 61.281 -0.04 Scrip Name Dollar Index 85.543 85.495 0.05 Bajaj Finserv Ltd Euro 1.271 1.270 0.10 British Pound 1.613 1.612 Japanese Yen 107.860 Australian ($) 0.882 Swiss Franc 0.949 Candlestick Patterns Close % Change 10-day SMA Delivery (%) 1067.60 3.12 1048.63 54.53 Mahindra & Mahindra Financial Services L 289.50 3.01 281.52 54.86 0.06 BEML Ltd 682.35 5.28 604.28 19.29 107.820 -0.06 Voltas Ltd 245.30 1.66 234.23 34.13 0.880 0.20 0.950 0.08 Global Treasury Yields Closing Yield (%) Previous Yield (%) 8.32 8.32 US 10 Year 2.26 2.26 EURO 10 Year 0.87 0.89 GBP 10 Year 2.21 2.23 JPY 10 Year 0.47 0.47 Commodities Close Prev. Close %Chg 1230.38 1226.62 0.25 Copper /ton 6797 6762 0.55 Brent Crude/barrel 85.25 85.83 -0.68 Scrip Name Close Reliance Communications Ltd % Change 99.50 Tata Steel Ltd Just Dial Cash Segment (| Cr) 27-Oct-14 FII 49.1 DII 9.6 23-Oct-14 -12.4 10.9 22-Oct-14 7.5 375.6 21-Oct-14 32.4 68.9 20-Oct-14 1,040.1 -166.1 Scrip Name TBZ Close 169.0 -3.59 10-day SMA 101.03 Delivery (%) 31.24 450.50 -1.87 452.11 42.22 1452.15 -10.48 1627.37 48.15 Scrip Name Close Punj Lloyd 35.9 Praj Industries 62.4 Bearish Continuation pattern 221.0 Cairn India 276.7 BHEL 253.2 DLF 110.0 M&M Finance 290.0 Hindustan Unilever 716.0 178.5 Yes Bank 644.5 Crompton Greaves Union Bank 228.8 HDIL 74.4 Evening Star Adani Ports 263.3 Jindal Steel & Power 152.0 Note: For Candlestick pattern description refer towards the end of the report. Overbought Stocks Oversold Stocks Stocks hitting 52 week high Stocks rising for 5 days & stochastic overbought Stocks falling for 5 days & stochastic oversold Scrip Name Scrip Name Scrip Name Ashok Leyland IDFC Petronet LNG Institutional Activity Bearish Engulfing Ambuja Cement US Dollar Gold/ounce Bearish Candlestick Formations Bullish Engulfing Bullish Continuation pattern Negative Trends India 10 year Bullish Candlestick Formations ICICI Securities Ltd. | Retail Equity Research LTP Stochastic 144.5 83.08 195 81.4 IOC LTP Stochastic 352.5 11.65 Divi's Laboratories LTP 45.8 1809.85 ENIL 485.05 GAIL 487.35 Symphony 1771 Yes Bank 642.9 Page 3 Stock recommendations for the day Exhibit 3: Union Bank of India (UNIBAN) Daily Candlestick Chart Price breakout of the major short term range in the daily chart signalling continuation of positive trend in the short term Union Bank of India (UNIBAN) October Future CMP 227.95 Comment : Price breakout above major short term range and MACD giving buy signal moving above trigger line in the daily chart Action : Buy above 227.50 Targets : 231/233/Higher Stop-loss : 225.20 MACD giving buy signal in the daily chart moving above trigger line thus supports positive trend in price Source: Bloomberg, ICICIdirect.com Research ICICI Securities Ltd. | Retail Equity Research Page 4 Exhibit 4: Hindustan Zinc (HINZIN) Daily Candlestick Chart Price trading in a rising channel and sustaining above the 13 days EMA suggesting continuation of positive trend in short term Hindustan Zinc (HINZIN) October Future CMP 168.45 Comment : Price taking support at the lower band of the rising channel and sustaining above 13 days EMA and RSI giving buy signal in the daily chart Action : Buy in the range of 167.50-168.00 Targets : 170.75/172.25/Higher Stop-loss : 166.10 13 days EMA RSI giving buy signal forming higher high in the daily chart Source: Bloomberg, ICICIdirect.com Research ICICI Securities Ltd. | Retail Equity Research Page 5 Exhibit 5: Century Textiles (CENTEX) Daily Candlestick Chart 21 days EMA Century Textiles (CENTEX) October Future CMP 523.60 Comment : Price taking resistance near the 21 days EMA and 38.2% retracement of the previous up move and stochastic giving sell signal in the dialy chart Action : Sell below 523.00 Targets : 514/510/Lower Stop-loss : 527.50 Price taking resistance at the 38.2% retracement of the immediate previous decline and 21 days EMA signalling bearish bias to continue in the coming sessions Stochastic giving sell signal in the daily chart Source: Bloomberg , ICICIdirect.com Research ICICI Securities Ltd. | Retail Equity Research Page 6 Exhibit 6: Reliance Communication (RELCOM) Daily Candlestick Chart Price taking resistance from 21 days EMA and rising support line joining immediate lows breached in the daily chart suggesting continuation of negative trend in the coming sessions Reliance Communication (RELCOM) October Future CMP 99.55 Comment : Price taking resistance from the 21 days EMA and has given a trendline breakdown in the daily chart and RSI giving sell signal in the daily chart Action : Sell in the range of 101.00-101.50 Targets : 99.25/98.20/Lower Stop-loss : 102.35 Bearish crossover of the 14 periods RSI in the daily chart Source: Bloomberg , ICICIdirect.com Research ICICI Securities Ltd. | Retail Equity Research Page 7 Previous Day’s Performance Scrip Nifty Divis Laboratories Tata Chemical Tata global Product Future Future Future Future Strategy Buy Buy Buy Buy Recommended Price In range of 7995-8000 In range of 1815-1817 above 410.50 In range of 157.75-158.30 Targets 8030/8050/+ 1841/1855/+ 418/422/+ 161/162.5/+ SL 7980.00 1802.00 406.50 156.50 Gain/Loss %* -0.95 -1.00 Comment No Trade No Trade (Opened at Target) Stoploss triggered Stoploss triggered * Return Opportunity Nifty Points gained for the day: 0 points Gains over last 131 days: 460 points Stock profits: Avg -1.00% per trade (Cum. Profits over last 131 days:154.25%) Strike Rate for the day: 0/2 (Cum strike rate over 131 days: 164/291 NOTE: The follow-up and performance review table of the strategies indicates the profit opportunity that was available in the strategies. Individual profits may vary, depending upon the entry and exit price and stop losses ICICI Securities Ltd. | Retail Equity Research Page 8 Support and Resistance Table (Cash Levels) SCRIP CLOSE S1 S2 S3 R1 R2 R3 TREND SENSEX 26752.9 26654.85 26619.1 26583.35 26788.9 26855.95 26922.95 -ve NIFTY 7991.70 7963.45 7954.45 7945.50 8002.80 8022.50 8042.20 -ve ACC 1460.10 1450.40 1447.65 1444.90 1463.95 1470.70 1477.45 -ve 463.75 457.85 456.65 455.45 465.55 469.45 473.30 -ve -ve ADANI ENTER. ADANI POWER ADITYA BIRLA ALLAHABAD BANK ANDHRA BANK 45.40 44.90 44.70 44.55 45.60 45.95 46.30 1667.85 1642.75 1635.80 1628.90 1671.50 1685.85 1700.25 107.40 106.75 105.95 105.65 108.35 109.15 109.45 -ve Neutral 77.10 77.00 76.20 75.35 78.65 78.95 79.20 +ve 1089.15 1088.75 1080.10 1071.45 1106.05 1109.20 1112.40 +ve APOLLO TYRES 215.75 212.25 211.50 210.80 216.20 218.15 220.15 -ve ARVIND 295.50 291.50 290.85 290.20 296.75 299.40 302.00 -ve APOLLO HOSPITALS ASHOK LEYLAND 45.75 45.80 45.55 45.35 46.30 46.65 47.00 ASIAN PAINTS 648.75 644.35 641.50 638.60 650.15 653.05 655.95 -ve AUROBINDO PHARMA 942.90 929.75 926.25 922.80 946.65 955.10 963.55 -ve 2517.45 2498.05 2485.30 2472.55 2519.50 2530.20 2540.90 905.65 903.40 896.00 888.60 918.20 919.80 921.40 +ve +ve BAJAJ AUTO BOB BOI +ve -ve 271.45 270.60 268.25 265.90 275.25 276.35 277.40 1236.75 1223.70 1219.15 1214.60 1240.95 1249.55 1258.20 -ve BHARAT FORGE 766.90 759.40 756.15 752.90 769.25 774.20 779.10 -ve BPCL 686.15 677.80 676.75 675.70 686.45 690.80 695.15 -ve +ve BATA INDIA BHARTI AIRTEL 414.55 414.35 412.90 411.45 417.25 418.50 419.80 BIOCON 469.85 464.95 463.60 462.25 471.65 475.05 478.40 -ve CAIRNS INDIA 277.35 272.35 271.50 270.65 279.25 282.70 286.15 -ve CANARA BANK 388.40 388.80 386.35 383.90 393.70 394.65 395.60 +ve CENTURY TEXT. 523.70 517.25 516.05 514.85 526.05 530.45 534.85 -ve CESC 671.70 659.05 656.15 653.25 673.85 681.25 688.65 61.35 61.60 60.85 60.10 63.15 63.45 63.80 CIPLA 628.10 621.75 619.45 617.10 627.25 630.00 632.75 -ve COAL INDIA 356.50 355.50 352.65 349.75 361.25 362.65 364.05 +ve CHAMBAL FERT. COLGATE PALM. -ve +ve 1722.70 1718.05 1711.80 1709.25 1730.55 1736.75 1739.35 CROMPTON GREAVES 178.55 174.05 173.50 172.95 180.25 183.35 186.45 -ve DABUR INDIA 209.40 197.45 196.95 196.40 208.95 214.70 220.40 -ve 56.60 56.15 55.80 55.60 56.85 57.15 57.35 DISH TV ICICI Securities Ltd. | Retail Equity Research Neutral Neutral Page 9 SCRIP DIVI'S LAB. CLOSE S1 S2 S3 R1 R2 R3 TREND 1803.35 1777.90 1769.15 1760.40 1806.20 1820.30 1834.45 110.50 107.65 106.10 104.50 111.15 112.90 114.65 3105.80 3114.75 3085.95 3057.20 3172.30 3183.00 3193.70 EXIDE IND. 156.40 153.85 152.60 151.35 157.35 159.10 160.80 -ve FEDERAL BANK 138.35 136.05 135.85 135.65 138.90 140.30 141.70 -ve DLF DR.REDDY'S LAB. -ve -ve +ve FUTURE RETAIL 111.50 109.65 109.20 108.70 111.80 112.90 113.95 -ve GAIL 486.55 486.90 483.25 479.65 494.15 495.15 496.20 +ve 5279.00 5198.45 5180.50 5162.55 5286.10 5329.95 5373.80 715.60 716.80 713.30 709.85 723.75 726.85 730.00 GLAXO SMITH.C.H. GLENMARK PHARMA. GMR INFRA. GODREJ CONSUMER GODREJ IND. GRASIM AMBUJA CEMENT HAVELL'S INDIA HCL TECH HDFC BANK 20.50 20.00 19.95 19.85 20.65 20.95 21.25 -ve 914.25 898.65 895.55 892.45 918.45 928.35 938.25 -ve -ve 289.70 286.30 285.25 284.20 290.65 292.85 295.00 3395.65 3373.95 3362.80 3351.70 3399.30 3412.00 3424.70 221.35 220.70 219.45 218.15 223.25 223.65 224.05 +ve -ve -ve 269.70 266.15 264.70 263.25 270.15 272.15 274.15 1496.75 1476.50 1471.05 1465.60 1502.00 1514.75 1527.50 897.25 898.40 895.10 891.85 905.00 906.45 907.90 +ve +ve HDFC 1036.75 1041.00 1032.55 1024.10 1057.90 1060.20 1062.45 HERO MOTO 3082.95 3054.35 3042.35 3030.35 3087.30 3103.80 3120.30 189.50 188.65 186.75 184.85 192.45 192.95 193.45 HEXAWARE TECH. -ve +ve -ve -ve +ve HINDALCO 147.35 145.45 145.05 144.70 147.90 149.15 150.40 -ve HIND. UNILEVER 720.45 701.95 699.60 697.25 727.20 739.85 752.50 -ve HPCL 515.85 508.70 507.25 505.75 517.50 521.90 526.30 -ve HINDUSTAN ZINC 168.30 167.70 166.55 165.35 170.10 170.60 171.15 +ve HDIL ICICI BANK IDBI 74.30 72.90 72.65 72.40 74.70 75.55 76.45 -ve 1573.05 1564.50 1561.20 1557.85 1574.65 1579.75 1584.80 -ve 68.35 68.20 67.80 67.40 69.05 69.25 69.45 IDEA CELLULAR 156.85 154.90 154.60 154.25 157.50 158.75 160.05 -ve NSE INFRA DEV FINANC 144.20 142.85 142.60 142.35 144.70 145.65 146.60 -ve IFCI +ve 35.60 35.55 35.35 35.10 36.05 36.10 36.20 +ve 3203.20 3200.50 3189.30 3178.10 3222.90 3234.10 3245.35 +ve INDUSIND BANK 696.80 697.95 693.80 689.65 706.25 710.70 715.15 +ve INDIA CEMENTS 107.30 104.75 104.45 104.10 108.30 110.10 111.85 -ve INDRAPRASTHA GAS 402.05 396.00 394.40 392.75 403.65 407.50 411.30 -ve ORACLE FIN. ICICI Securities Ltd. | Retail Equity Research Page 10 SCRIP CLOSE S1 S2 S3 R1 R2 R3 TREND IOC 353.10 347.85 347.10 346.30 354.95 358.50 362.05 IOB 61.00 60.40 59.90 59.70 61.40 61.95 62.15 Neutral IB REAL ESTATE 63.95 62.70 62.45 62.20 64.35 65.20 66.00 -ve INFOSYS -ve 3803.05 3790.45 3773.50 3769.15 3824.35 3841.30 3845.65 IRB INFRA. 242.95 239.60 238.90 238.20 243.30 245.20 247.05 Neutral -ve ITC 349.55 347.90 347.35 346.75 349.60 350.45 351.30 -ve JAIPRAKASH ASS. 29.20 28.30 28.15 28.05 29.25 29.70 30.20 -ve J.P.POWER VENT. 12.40 12.25 12.15 12.10 12.45 12.55 12.70 -ve +ve JAIN IRRIGATION 84.85 84.95 84.30 83.65 86.25 86.70 87.15 JINDAL ST&POW 152.55 149.45 145.95 142.50 153.65 155.75 157.90 -ve 74.40 73.65 73.20 72.75 74.65 75.15 75.65 -ve JSW ENERGY NSE JSW STEEL 1233.40 1232.00 1218.65 1205.35 1258.70 1260.95 1263.25 +ve JUBILANT FOOD 1315.40 1305.90 1300.00 1294.15 1317.45 1323.20 1329.00 -ve KARNATAKA BANK 118.30 117.40 117.00 116.65 118.60 119.20 119.85 KOTAK MAH.BANK 1085.00 1082.80 1076.10 1069.45 1096.15 1100.30 1104.45 +ve L&T 1567.35 1568.50 1563.55 1558.55 1578.50 1582.10 1585.75 +ve 334.20 328.40 327.25 326.15 336.30 340.25 344.20 NSE LUPIN 1393.25 1387.35 1382.90 1379.70 1396.30 1400.80 1404.00 M&M 1256.80 1240.10 1235.85 1231.60 1256.65 1264.90 1273.20 -ve MARUTI SUZUKI 3169.70 3141.25 3120.15 3110.50 3183.50 3204.65 3214.25 Neutral UNITED SPIRITS 2662.20 2645.55 2609.45 2573.35 2717.70 2725.45 2733.15 +ve 251.90 251.50 250.25 248.95 254.05 254.90 255.75 +ve +ve LIC HOUSING MCLEOD RUSSEL M&M FIN.SERV. -ve -ve Neutral 289.50 287.70 282.65 277.55 297.85 299.10 300.30 30742.50 30568.35 30508.30 30448.25 30763.35 30860.85 30958.35 263.85 260.70 260.10 259.50 264.80 266.90 268.95 -ve 19.95 19.75 19.65 19.60 20.00 20.15 20.30 -ve NMDC 163.60 163.15 162.25 161.40 164.90 165.30 165.75 +ve NSE NTPC 145.85 144.45 144.10 143.70 146.15 147.00 147.85 -ve ONGC 394.65 390.15 388.80 387.45 396.35 399.45 402.55 -ve OBC 265.40 265.50 263.30 261.05 269.95 270.60 271.25 +ve MRF ADANI PORTS SEZ NSE NHPC -ve PETRONET LNG 194.60 192.75 192.00 191.25 195.05 196.20 197.35 -ve POWER FINANCE 276.95 277.00 274.95 272.95 281.05 281.70 282.35 +ve POWER GRID 142.05 142.30 141.00 139.65 144.90 145.25 145.55 +ve 85.90 85.25 84.95 84.65 86.05 86.45 86.85 POWER TRADING ICICI Securities Ltd. | Retail Equity Research -ve Page 11 SCRIP CLOSE S1 S2 S3 R1 R2 R3 TREND PNB 932.55 923.35 921.90 920.50 933.60 938.70 943.85 -ve RANBAXY 598.60 594.60 591.75 590.40 600.35 603.20 604.55 Neutral 99.50 97.75 97.55 97.35 100.20 101.40 102.65 -ve REL. CAPITAL 458.45 451.35 450.35 449.35 459.45 463.50 467.55 -ve RELIANCE INFRA. 568.50 562.00 560.80 559.55 570.00 574.00 578.00 -ve RELIANCE 941.35 930.80 928.55 926.35 944.35 951.15 957.95 -ve 71.75 70.95 70.80 70.60 72.00 72.50 73.00 -ve 286.00 286.75 284.90 283.05 290.45 291.45 292.45 82.25 81.50 81.10 80.70 82.35 82.80 83.20 SESA GOA 249.05 249.60 247.80 246.05 253.10 254.40 255.70 SHRIRAM TRANS. 897.55 881.95 877.80 873.65 903.30 914.00 924.70 -ve SIEMENS 859.15 854.70 850.45 847.35 863.25 867.55 870.60 Neutral RCOM RELIANCE POWER REC SAIL SBI +ve -ve +ve 2597.80 2598.70 2588.95 2579.25 2618.15 2623.65 2629.20 SUN PHARMA 805.20 792.70 791.15 789.60 803.85 809.45 815.05 -ve SUN TV 314.70 314.50 311.80 309.05 319.90 321.15 322.35 +ve SYNDICATE BANK 117.05 115.55 115.10 114.60 117.00 117.75 118.45 -ve TATA CHEMICALS 404.00 399.45 397.95 396.45 405.50 408.55 411.60 -ve -ve TATA MOTOR DVR 318.20 314.80 313.70 312.60 319.15 321.35 323.55 TATA MOTORS 503.70 497.95 496.85 495.70 505.85 509.80 513.70 88.45 87.90 87.40 87.10 88.90 89.35 89.70 TATA POWER TATA GLOBAL BEV. +ve -ve Neutral 156.30 155.10 154.45 153.85 156.75 157.55 158.40 TCS 2457.15 2428.15 2424.15 2420.10 2465.55 2484.25 2502.90 -ve -ve TECH MAHINDRA 2326.40 2307.85 2300.25 2292.70 2332.65 2345.05 2357.50 -ve TATA STEEL 450.50 445.75 444.80 443.80 452.15 455.35 458.50 -ve TITAN IND. 400.80 399.50 396.70 393.95 405.05 406.85 408.65 +ve +ve UCO BANK 82.45 82.25 81.50 80.80 83.75 84.10 84.50 2430.60 2405.60 2395.90 2386.20 2430.45 2442.85 2455.30 UBI 228.00 226.85 224.60 222.40 231.30 231.90 232.55 +ve UNITED BREW. 698.00 687.85 680.45 673.05 697.35 702.10 706.85 -ve UNITED PHOSPH. 335.95 331.90 331.20 330.50 336.95 339.50 342.00 -ve 17.15 16.80 16.75 16.70 17.25 17.50 17.70 AXIS BANK 426.80 423.95 421.80 420.80 428.25 430.40 431.40 TATA COMM. 382.50 377.75 376.65 375.55 382.30 384.60 386.85 -ve VOLTAS 245.30 244.70 241.75 238.75 250.60 251.40 252.20 +ve ULTRATECH CEMENT UNITECH ICICI Securities Ltd. | Retail Equity Research -ve -ve Neutral Page 12 SCRIP CLOSE S1 S2 S3 R1 R2 R3 TREND WIPRO 554.80 548.45 540.70 532.90 554.15 557.00 559.80 -ve NSE YES BANK 643.95 640.10 633.40 626.70 653.50 655.10 656.75 +ve ZEE 330.35 321.80 320.60 319.45 330.75 335.20 339.70 -ve NOTES: • • • • • • • Please execute the recommendation within the levels provided in the report Once the recommendation is executed, it is advisable to keep strict stop loss as provided in the report Avoid entering into the recommendation in the first 5 minutes of trade If the recommendation opens near the target levels due to gap up/gap down opening, then the recommendation is considered not initiated The recommendations are valid only for the day and should be squared off by the end of the day Only stocks in derivatives segment have been considered for daily trading Medium to long-term prospects of a stock does not have any bearing on the daily view Trading Portfolio allocation • • • • It is recommended to spread out the trading corpus in a proportionate manner between the various technical research products. Please avoid allocating the entire trading corpus to a single stock or a single product segment Within each product segment it is advisable to allocate equal amount to each recommendation. For example: The ‘Daily Calls’ product carries 3 to 4 intraday recommendations. It is advisable to allocate equal amount to each recommendation ICICI Securities Ltd. | Retail Equity Research Page 13 Recommended Trading Portfolio allocation Products Allocations Product wise Max allocation allocation in 1 stock Return Objective Number of Calls Frontline Stocks Mid-cap stocks Duration Daily Calls 8% 2-3% 3-4 Stocks 0.50-1% 2-3% Intraday Short term Delivery 6% 3-5% 7-10 p.m 4-5% 7-10% Opportunity based Weekly Calls 8% 3-5% 1-2 Stocks 5-7% 7-10% 1 Week Weekly Technical 8% 3-5% 1-2 Stocks 5-7% 7-10% 1 Week Monthly Call 15% 5% 2-3 Stocks 7-10% 10-15% 1 Month Monthly Technical 15% 2-4% 5-8 Stocks 7-10% 10-15% 1 Month Techno Funda 15% 5-10% 1-2 Stocks 10% and above 15% and above 6 Months Technical Breakout 15% 5-10% 1-2 Stocks 10% and above 15% and above 3-6 Months Cash in Hand 10% - - - - - 100% ICICI Securities Ltd. | Retail Equity Research Page 14 Candlesticks Glossary: Candlestick patterns describe the market sentiment for the specified period. Some of the formations suggest reversal of sentiment (trend) and, therefore, are important for a chart reader. By themselves, the patterns do not carry any price target but only an indication of change in market behaviour. More importance needs to be given to the placement of the pattern within larger trend Bullish Engulfing Line: A potential bottom reversal pattern. This pattern typically appears at the culmination of a decline or downtrend. The market falls, and a black candle forms (ideally a small black candle). Next, a white real body wraps around the prior session’s black body. Low of the pattern becomes short term support for prices Piercing Line: Potential bottom reversal pattern. A black body forms in the downtrend. The market continues moving south on the next session’s open but that session culminates in a white real body that closes (e.g. pierces) than half way or more into the prior black body. Lowest low between two candles is referred to as technical support for prices Hammer: A candlestick line which, during a downtrend, has a very long lower shadow and small real body (black or white) at the top end of the session’s range. There should be no, or a very small, upper shadow. Pattern suggests buying support during declines and needs confirmation in terms of sustainability of prices above head of the Hammer in following session Bearish Engulfing Line: Potential top reversal signal. This two candlestick pattern emerges during a rally. A black candle real body wraps around a white real body (classically a small white candle) Highest high between two candles becomes resistance level for prices for future reference Dark Cloud cover: A dark cloud cover forms a top reversal pattern. The first session should be a strong, white real body. The second session’s price opens over the prior session’s high (or above the prior session’s close). By the end of the second session, it closes near the low of the session and should fall well into the prior session’s white body. Pattern suggests that market has a poor chance of rising immediately Shooting Star: A single candlestick line during a rally in which there is a small real body (white or black) at the bottom end of the session's range and a very long upper shadow. The candle line should also have little or no lower shadow. Pattern suggest the trouble for prices overhead ICICI Securities Ltd. | Retail Equity Research Page 15 Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com ICICIdirect.com Research Desk, ICICI Securities Limited, 1st Floor, Akruti Trade Centre, Road No 7, MIDC Andheri (East) Mumbai – 400 093 research@icicidirect.com Disclaimer The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities Ltd (I-Sec). The author may be holding a small number of shares/position in the above-referred companies as on date of release of this report. I-Sec may be holding a small number of shares/position in the above-referred companies as on date of release of this report. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This report may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Actual results may differ materially from those set forth in projections. I-Sec may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject I-Sec and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. ICICI Securities Ltd. | Retail Equity Research Page 16

© Copyright 2025