Relaxo Footwears NEUTRAL Performance Highlights

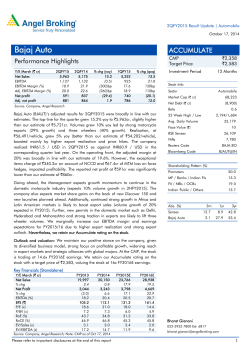

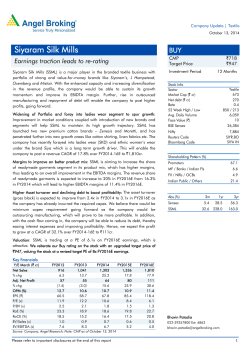

2QFY2015 Result Update | Footwear November 5, 2014 Relaxo Footwears NEUTRAL Performance Highlights CMP Target Price Y/E March (` cr) 2QFY2015 2QFY2014 % chg (yoy) 1QFY2015 % chg (qoq) 332 263 26.0 372 (10.8) 37 26 40.5 46 (21.1) 11.0 9.9 114 12.5 (144) 17 12 48.4 23 (25.1) Total Income EBITDA EBITDA margin (%) Reported PAT Source: Company, Angel Research Relaxo Footwears (Relaxo) reported a decent set of numbers for 2QFY2015. The revenue for the quarter grew by an impressive 26% yoy to `332cr, driven by volume growth across major brands and by premiumization. With an increase in traded goods during the quarter, the gross margin declined by 75bp yoy to 56%. However, owing to lower employee cost and other expenses as a percent of net sales on a yoy basis, the operating margin improved by 114bp yoy to 11%, although the same is below our estimate of 12.1%. Further, a decline in interest outgo and a lower tax rate enabled the company to report a net profit of `17cr, 48.4% higher yoy, but 13.1% lower than our estimate of `20cr. Product premiumization to drive growth: With steady volume growth through improving retail distribution and expansion, the company will be able to post a revenue CAGR of 20.7% over FY2014-16E to `1,756cr in FY2016E. Further, focus on premiumization of high value products will improve the product mix, thereby improving realization and margins going ahead. Realization per pair is expected to improve from `111.8 in FY2014 to `134.5 in FY2016E. The EBIDTA is expected to grow at a CAGR of 24.1% over FY2014-16E to `216cr in FY2016E, while the EBIDTA margin is expected to improve by ~67bp over the same period to 12.3%. Resultantly, the company’s profit growth is expected to be higher than revenue growth. We expect profit to grow at a CAGR of 34.4% over FY2014-16 to `119cr in FY2016E. `520 - Investment Period - Stock Info Sector Market Cap (` cr) Beta Net debt (` cr) 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Footwear 3,123 0.1 157 545 / 164 5,617 1 27,916 Nifty Reuters Code Bloomberg Code 8,338 RLXO.BO RLXF IN Shareholding Pattern (%) Promoters 75.0 MF / Banks / Indian Fls 0.1 FII / NRIs / OCBs 18.6 Indian Public / Others 6.3 Abs.(%) 3m 1yr 3yr Sensex 8.0 31.2 59.0 Relaxo 30.6 202.0 523.1 Outlook and valuation: We remain positive on the company with the growth triggers in place, which include – 1) sufficient capacity to cater to increasing demand, 2) improving product mix and 3) optimized cost expenses. However, at the CMP of `513, the stock is trading at 26.3x FY2016E earnings which we believe is fair, and hence recommend a Neutral rating on the stock. Key financials Y/E March (` cr) Net sales % chg Net profit % chg EBITDA margin (%) Adj. EPS (Post stock split) (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x) FY2012 FY2013 FY2014 FY2015E FY2016E 860 25.0 40 49.4 10.5 6.7 78.3 18.1 26.0 19.5 3.8 36.3 1,005 16.8 45 12.3 10.4 7.5 69.7 14.6 23.2 17.6 3.3 31.7 1,206 20.0 66 46.5 11.7 10.9 47.6 11.3 26.7 23.1 2.7 23.3 1,462 21.2 89 35.6 12.0 14.8 35.1 8.7 28.0 25.4 2.2 18.3 1,756 20.1 119 33.2 12.3 19.8 26.3 6.6 28.4 28.5 1.8 14.5 Source: Company, Angel Research, CMP as on November 5, 2014 Please refer to important disclosures at the end of this report Bhavin Patadia 39357800 ext: 6868 bhavin.patadia@angelbroking.com 1 2QFY2015 Result Update | Relaxo Footwears Exhibit 1: 2QFY2015 performance Y/E March (` cr) Net Sales 2QFY2015 2QFY2014 % chg (yoy) 4QFY2014 % chg (qoq) 1HFY2015 1HFY2014 % chg 332 263 26.0 372 (10.8) 704 576 22.3 28.2 171 (14.5) 25.6 Net raw material 146 114 (% of Sales) 44.0 43.3 31 27 Staff Costs (% of Sales) 317 252 45.0 43.8 (5.0) 64 58 9.1 10.0 (3.3) 240 197 45.9 14.3 33 22.9 122 9.5 10.4 Other Expenses 118 96 (% of Sales) 35.5 36.4 34.0 34.2 Total Expenditure 295 237 24.4 326 (9.3) 621 507 22.5 37 26 40.5 46 (21.1) 83 69 20.3 11.0 9.9 114bp 12.5 (144)bp 11.8 12.0 (19)bp 4 6 (27.9) 5 (15.1) 9 11 (18.7) Depreciation 10 7 33.1 10 (4.5) 20 15 39.2 Other Income 2 4 (53.9) 2 11.0 4 6 (36.6) PBT 25 17 42.7 33 (25.5) 57 49 16.6 (% of Sales) 7.4 6.5 8.2 8.6 7 6 17 16 EBITDA EBITDA (%) Interest Tax (% of PBT) 8.9 11.9 32.7 8.9 30.6 10 (26.4) 29.8 21.7 6.2 29.4 32.2 29.6 32.5 Reported PAT 17 12 48.4 23 (25.1) 40 33 21.6 PATM (%) 5.2 4.4 79bp 6.2 (100)bp 5.7 5.8 (3)bp Source: Company, Angel Research Revenues in line, however margins and PAT disappoint Relaxo reported a decent set of numbers for 2QFY2015. The revenue for the quarter grew by an impressive 26% yoy and stood at `332cr, in line with our expectation of `338cr. With an increase in traded goods during the quarter, the gross margin declined by 75bp yoy and came in at 56%. However, owing to lower employee cost and other expenses as a percent of net sales on a yoy basis, the operating margin improved by 114bp yoy to 11%, although the same is below our estimate of 12.1%. Further, a decline in interest outgo and a lower tax rate enabled the company to report a net profit of `17cr, 48.4% higher yoy, but 13.1% lower than our estimate of `20cr. Exhibit 2: Actual vs Estimates Y/E March (` cr) Net sales EBITDA EBITDA margin (%) Reported PAT 2QFY15 Angel est. % diff 332 338 (1.8) 37 41 (10.6) 11.0 12.1 (109)bp 17 20 (13.1) Source: Company, Angel Research November 5, 2014 2 2QFY2015 Result Update | Relaxo Footwears Source: Company, Angel Research 11.8 14 12.5 11.0 12 25 8 20 6 15 36.6 46.4 43.7 27.9 5 4 26.0 10 (%) 10 2 2QFY15 1QFY15 0 4QFY14 0 3QFY14 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY14 3QFY13 0 2QFY13 0 5 10.8 8.4 2QFY14 332 372 371 259 263 312 291 223 50 242 100 30 16 EBITDA margin (RHS) 9.9 43.0 10 9.9 1QFY14 150 35 11.0 32.2 15 8.7 9.2 13.8 18.8 200 EBITDA (LHS) 45 2QFY13 250 20 (` cr) 19.1 16.2 50 40 (%) (` cr) 300 26.0 25 20.6 21.6 30 3QFY13 25.8 350 yoy growth (RHS) 27.3 24.0 Revenue (LHS) 400 Exhibit 4: ...but EBIDTA margin disappoints 4QFY14 Exhibit 3: Impressive sales growth... Source: Company, Angel Research Investment rationale Celebrity endorsement and retail expansion to strengthen brand visibility Relaxo has successfully established 'Flite' and 'Sparx' brands, which has enabled it to gain respectable market share in the specialized high-value products. Post endorsement by the Bollywood stars - Salman Khan (Hawaii) and Akshay Kumar (Sparx), the demand for the company’s product offerings has risen. Most of the revenue growth happened on the back of robust performance displayed by these brands. Branding has also helped Relaxo push its higher margin products and get a better price per pair sold. The company continues to invest significantly behind its brands with the aim of creating brand awareness and enhancing visibility. Following the strategy, the company has roped in Bollywood star Sonakshi Sinha as the brand ambassador for Flite. The company is expected to continue its growth trajectory in the South and West regions of India. The company’s total count of owned retail outlets as of 2QFY2015 stands at 197. Breakeven of Relaxo Shoppe and Online presence to aid profitability We believe that retail expansion along with brand visibility will help the company in expanding business. Additionally, the company is aggressively working towards closing/dislocating non-performing Relaxo Shoppe, which will reduce pressure on inventory and EBIDTA margin. Also, the retail division rationalization has started giving positive results on the margin front and we expect most of the retail outlets to break-even by 2HFY2015, adding directly to the profitability of the company. Relaxo has also made early strides in the online business and will focus on enhancing the same, which will aid profitability. Capacity expansion in place to cater to increasing demand The company’s business is scalable as it operates in a growing industry dominated by hundreds of small unorganized players who are gradually losing market share to the large, organized ones. The company’s production capacity has increased from 4.54 lakh pairs to 5.35 lakh pairs per day. With the expansion of rubber and Eva slippers capacity at Bhiwadi and the central warehousing facility at Bahadurgarh, the company is well poised to cater to growing demand and in turn November 5, 2014 3 2QFY2015 Result Update | Relaxo Footwears increase its market share. Further, it would help to drive logistics and warehousing efficiencies in addition to cost savings in rentals. The export market is also expected to improve, driven by the EU and the US markets on account of signs of improvement in quality and technology in Indian footwear industry. Presently, India exports only 5% of its production; thus there is a huge opportunity to enter the untapped export markets. Exhibit 5: Market segmentation Exhibit 6: Unorganised vs Organised footwear market Kids, 10% Women, 30% Organised, 45% Unorganised, 55% Men, 60% Source: Company, Angel Research Source: Company, Angel Research Changing revenue mix to drive profit The company’s product mix over the years has changed, resulting in better top-line growth along with margin expansion. Flite, Hawaii and Sparx contribute one-third each to the revenue while the mix is expected to change to ~40%, 25% and 35%, respectively going ahead; this will help in driving profitability for the company. Realization has improved from ~`113.1 per pair in 1QFY2015 to ~`122.9 per pair in 2QFY2015. We expect realization to improve further to ~`128.9 per pair in 2HFY2015E as compared to `117.5 per pair in 1HFY2015. Thus, we expect average realization to be `123.1 per pair in FY2015E and improve further to `134.5 per pair by FY2016E, driven by change in the product mix. Exhibit 7: Realizations to improve No. of footwear (LHS) Average Realizations (RHS) 134.5 65.7 79.5 93.1 100.3 111.8 120.0 100.0 80.0 6.0 60.0 13.06 11.87 10.79 10.02 9.25 2.0 8.66 4.0 8.43 (No. of pairs in crores) 10.0 8.0 140.0 123.1 12.0 160.0 (`) 14.0 - 40.0 20.0 0.0 FY2010 FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E Source: Company, Angel Research November 5, 2014 4 2QFY2015 Result Update | Relaxo Footwears New launches across categories To meet the growing demand and growing fashion-consciousness of consumers, the company keeps on launching new designs across all brands at regular intervals. The colorful slippers, Hi-Fashion under Hawaii brand with premium pricing, have successfully gained attention and demand in the market. We also believe that the company will be able to maintain its market share in the mass segment through the Hawaii brand and penetrate further in the lower and upper-middle class segments through existing products and upcoming launches of Flite and Sparx brands. Hawaii, being a mass brand, adds to the volume, while Sparx and Flite help in improving the company’s profitability. November 5, 2014 5 2QFY2015 Result Update | Relaxo Footwears Financial performance Assumptions Exhibit 8: Key assumptions Assumptions FY2015E FY2016E Volume Growth 10.0 10.0 Realization Growth 10.2 9.2 Ethyl Vinyl Acetate (EVA) 10.0 6.0 Rubber -4.0 0.0 Change in raw material prices (%) Source: Angel Research Exhibit 9: Change in estimates Y/E March Earlier estimates Revised estimates % chg FY2015E FY2016E FY2015E FY2016E Net sales (` cr) FY2015E FY2016E 1,439 1,707 1,462 1,756 1.6 2.8 OPM (%) 12.6 12.7 12.0 12.3 (60)bp (41)bp Adj. PAT 94.5 122.5 89.0 118.6 (5.8) (3.2) Source: Angel Research As we remain positive on the company’s performance, we revise our revenue estimates marginally upwards for FY2015E and FY2016E. We expect revenue to grow at a CAGR of 20.7% over FY2014-16E to `1,756cr, mainly on the back of the prevailing growth triggers, which include – 1) improving brand visibility and brand recall, 2) improvement in realizations on the back of a shift in the revenue mix to higher priced premium products and 3) sufficient capacity to cater to increasing demand. 15.0 40 Source: Company, Angel Research Revenue growth (RHS) 7.0 11.1 10.8 9.6 EBITDAM 9.5 9.2 9.2 FY2016E 0 10.0 12.3 FY2015E 9.0 12.0 10.4 FY2013 10 10.5 FY2014 9.9 11.0 FY2012 20 FY2010 1,756 20.1 FY2016E 1,206 FY2014 1,005 FY2013 860 FY2012 688 FY2011 554 Revenue (LHS) 21.2 1,462 20.0 16.8 11.7 FY2011 30 25.0 FY2015E 24.3 13.8 13.0 (%) 35.9 FY2010 2,000 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 Exhibit 11: Margin to improve with decreasing employee cost (%) (` cr) Exhibit 10: Healthy revenue growth to continue Emloyee cost/net sales Source: Company, Angel Research We expect the margin to improve from 11.7% reported in FY2014 to 12.3% in FY2016E with improving product mix and portfolio management, implementation of cost optimization measures, breakeven of most of the Relaxo Shoppe and better capacity utilization. November 5, 2014 6 2QFY2015 Result Update | Relaxo Footwears We also expect debt to reduce by 20% in FY2015E and by a further 30% in FY2016E with the cash flow coming in, thereby adding to profitability. On account of improved margins, and debt repayment we expect the net profit to grow at a CAGR of 34.4% over FY2014-16E to `119cr. Exhibit 12: PATM to improve going forward... 140 6.1 3.9 3.6 4.6 5.4 4.5 5 4 119 89 66 45 40 27 38 17.56 15.02 10.00 FY2011 FY2012 FY2013 FY2014 ROCE (Pre-tax) PATM Source: Company, Angel Research 28.46 19.46 14.00 FY2016E FY2015E FY2014 FY2013E FY2012E FY2011 PAT (LHS) 25.40 23.08 18.00 0 FY2010 0 23.73 20.90 19.84 2 1 24.70 23.14 22.00 3 40 25.04 26.00 6 60 20 7 (%) (` Cr) 100 80 30.00 8 6.8 120 Exhibit 13: .. leading to improvement in return ratios FY2015E FY2016E ROE Source: Company, Angel Research Outlook and valuation We remain positive on the company with the growth triggers in place, which include – 1) sufficient capacity to cater to increasing demand, 2) improving product mix and 3) optimized cost expenses. We expect Relaxo to post a revenue CAGR of 20.7% over FY2014-16E to `1,756cr with an EBIDTA margin of 12.3% in FY2016E. The profit for the company is expected to grow at a CAGR of 34.4% to `119cr over the same period. However, at the CMP of `520, the stock is trading at 26.3x FY2016E earnings which we believe is fair, and hence recommend a Neutral rating on the stock. Exhibit 14: One-year forward PE 600.0 500.0 (`) 400.0 300.0 200.0 100.0 Price (`) 10x 15x 20x Oct-14 Apr-14 Oct-13 Apr-13 Oct-12 Apr-12 Oct-11 Apr-11 Oct-10 0.0 25x Source: Company, Angel Research November 5, 2014 7 2QFY2015 Result Update | Relaxo Footwears Exhibit 15: Comparative analysis FY2015E Mcap (` cr) 3,123 Sales (` cr) 1,462 OPM (%) 12.0 PAT (` cr) 89 EPS (`) 14.8 RoE (%) 28.0 P/E (x) 35.1 P/BV (x) 8.7 EV/EBITDA (x) 18.3 EV/Sales (x) 2.2 FY2016E 3,123 1,756 12.3 119 19.8 28.4 26.3 6.6 14.5 1.8 CY2014E 8,185 2,338 15.2 224 34.9 23.2 36.5 8.3 13.0 3.4 CY2015E 8,185 2,747 16.4 287 44.8 25.0 28.5 6.9 17.7 2.9 Company Year end Relaxo footwear Bata India* Source: Company, Angel Research, *Bloomberg November 5, 2014 8 2QFY2015 Result Update | Relaxo Footwears Risks Rise in raw material prices and depreciating rupee A rise in the price of key raw materials – EVA and rubber – can adversely impact the profitability of the company. Rubber prices have fallen in the last quarter, which was in favor of the company; however, if they start to head northwards, then the company’s profitability could get hampered. Also, Relaxo imports its entire EVA requirement. Any depreciation in the rupee could pose a serious risk to the EBIDTA margin and thereby impact profitability of the company. Exhibit 16: Rubber price trend Exhibit 17: Rupee depreciation – A concern for EVA 64 230 63 210 194 178 (USD/INR) 169 170 145 150 123 130 60.35 61 60 59 58 57 56 Oct/14 Sep/14 Aug/14 Jul/14 Jun/14 May/14 Apr/14 Mar/14 Feb/14 Jan/14 Dec/13 Nov/13 Oct/14 Jul/14 Apr/14 Jan/14 Oct/13 Jul/13 Apr/13 Jan/13 Oct/12 Jul/12 Apr/12 Source: Capitaline, Angel Research Oct/13 55 110 Sep/13 (`/Kg) 61.4 62 193 190 62.61 Source: Reuters, Angel Research Competition from both - organised and unorganised sector Relaxo faces competition from both branded as well as unbranded players. It competes with listed peers like Bata and Liberty and non-listed peers like Lakhani and Paragon. Hawaii, the mass market product, faces stiff competition from the unorganised market. On the other hand, Sparx faces competition from branded shoes. Though the company has competitively priced its products, however, any price cut by competitors can put pressure on its sales and margin. The company Relaxo is one of the leading players in the Indian footwear industry engaged in manufacturing and trading of footwear and other articles. It has 8 manufacturing units, a portfolio of ~10 brands and ~50,000 retailers and distributors. The company presently has 190 company-owned outlets across India, with a concentrated presence in Delhi, Rajasthan, Gujarat, Haryana, Punjab, Uttar Pradesh and Uttarakhand. It has 8 manufacturing plants, 6 in Bahadurgarh (Haryana) and one each in Bhiwadi (Rajasthan) and Haridwar (Uttaranchal). Currently, the company sells its products under three major brands – Hawaii, Flite and Sparx. November 5, 2014 9 2QFY2015 Result Update | Relaxo Footwears Profit & Loss Statement (Standalone) Y/E March (` cr) FY2012 FY2013 FY2014 FY2015E FY2016E Total operating income 860 1,005 1,206 1,462 1,756 % chg 25.0 16.8 20.0 21.2 20.1 Net Raw Materials 459 469 551 658 783 % chg 22.3 2.2 17.4 19.4 19.0 Other Mfg costs 107 144 175 213 255 % chg 13.1 35.0 21.7 21.9 19.3 Personnel 82 111 115 134 162 % chg 10.6 35.1 3.0 17.3 20.1 Other 122 176 225 280 340 % chg 62.2 43.5 27.9 24.8 21.3 Total Expenditure 770 900 1065 1286 1539 EBITDA 90 105 141 176 216 % chg 31.6 16.7 33.9 24.9 23.2 (% of Net Sales) 10.5 10.4 11.7 12.0 12.3 Depreciation 23 25 31 42 46 EBIT 67 79 109 133 171 % chg 41.0 18.8 37.7 21.9 27.9 (% of Net Sales) 7.8 7.9 9.1 9.1 9.7 Interest & other Charges 19 18 23 15 11 Other Income (% of sales) Recurring PBT 6 9 10 12 0.6 0.7 0.7 0.7 48 62 87 119 160 52.9 28.1 40.5 36.9 34.3 Extraordinary Expense/(Inc.) 0.0 0.0 0.0 0.0 0.0 PBT (reported) 53 68 96 129 172 Tax 14 23 30 40 53 % chg (% of PBT) 25.4 33.8 31.3 31.0 31.0 PAT (reported) 40 45 66 89 119 ADJ. PAT 40 45 66 89 119 49.4 12.3 46.5 35.6 33.2 4.6 4.5 5.4 6.1 6.8 33.3 37.3 10.9 14.8 19.8 6.7 7.5 10.9 14.8 19.8 49.4 12.3 46.5 35.6 33.2 % chg (% of Net Sales) Basic EPS (`) Adj. EPS (`) (Post stock split) % chg Dividend Retained Earning November 5, 2014 5 0.6 2 2 3 5 5 38 42 63 85 114 10 2QFY2015 Result Update | Relaxo Footwears Balance Sheet (Standalone) Y/E March (` cr) FY2012 FY2013 FY2014 FY2015E FY2016E SOURCES OF FUNDS Equity Share Capital 6 6 6 6 6 Reserves& Surplus 166 208 271 354 468 Shareholder’s Funds 172 214 277 360 474 Total Loans 146 205 163 130 91 0 6 6 6 6 Other Long Term Liabilities Long Term Provisions 3 3 3 3 3 22 24 26 26 26 344 452.501 474 525 600 Gross Block 379 458 527 569 620 Less: Acc. Depreciation 107 130 160 202 248 Net Block 272 327 367 367 372 21 23 23 10 10 Lease adjustment 0 0 0 0 0 Goodwill 0 0 0 0 0 Investments 0 0 0 0 0 12 15 13 13 13 1 1 0 0 0 169 221 254 322 428 1 3 6 34 79 15 20 13 20 28 Inventory 128 159 164 183 215 Debtors 23 36 68 80 96 Deferred Tax (Net) Total Liabilities APPLICATION OF FUNDS Capital Work-in-Progress Long Term Loans and adv. Other Non-current asset Current Assets Cash Loans & Advances Other current assets Current liabilities Net Current Assets Misc. Exp. not written off Total Assets November 5, 2014 2 3 3 4 9 131 135 183 187 223 38 87 71 135 204 0 0 0 0 0 344 452 474 525 600 11 2QFY2015 Result Update | Relaxo Footwears Cash Flow (Standalone) Y/E March (` cr) FY2012 FY2013 FY2014 FY2015E FY2016E Profit before tax 53 68 96 129 172 Depreciation 23 25 31 42 46 Change in Working Capital (4) (46) 18 (36) (24) (14) (23) (30) (40) (53) Direct taxes paid Others 14 (6) (9) (10) (12) Cash Flow from Operations 73 18 106 85 128 (Inc.)/Dec. in Fixed Assets (46) (81) (69) (29) (51) (Inc.)/Dec. in Investments 0 0 0 0 0 (Inc.)/Dec. in LT loans & adv. 1 3 (2) 0 0 Others (2) 6 9 10 12 (47) (73) (62) (19) (39) 0 0 0 0 0 (11) 59 (42) (33) (39) (2) (3) (4) (5) (5) Others (14) (0) 4 0 0 Cash Flow from Financing (27) 56 (41) (38) (44) (1) 2 3 29 45 Opening Cash balances 2 1 3 6 34 Closing Cash balances 1 3 6 34 79 Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Inc./(Dec.) in Cash November 5, 2014 12 2QFY2015 Result Update | Relaxo Footwears Standalone Key Ratios Y/E March FY2012 FY2013 FY2014 FY2015E FY2016E P/E (on FDEPS) 78.3 69.7 47.6 35.1 26.3 P/CEPS 49.6 44.4 32.3 23.8 19.0 P/BV 18.1 14.6 11.3 8.7 6.6 0.1 0.1 0.1 0.1 0.1 Valuation Ratio (x) Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets 3.8 3.3 2.7 2.2 1.8 36.3 31.7 23.3 18.3 14.5 9.5 7.3 6.9 6.1 5.2 33.3 37.3 10.9 14.8 19.8 Per Share Data (`) EPS (Basic) EPS (fully diluted) 6.7 7.5 10.9 14.8 19.8 10.5 11.7 16.1 21.9 27.4 0.3 0.4 0.5 0.8 0.8 28.7 35.7 46.1 60.0 78.9 EBIT margin 7.8 7.9 9.1 9.1 9.7 Tax retention ratio 0.7 0.7 0.7 0.7 0.7 Asset turnover (x) 2.7 2.4 2.7 3.0 3.4 15.5 12.3 16.9 19.1 23.1 9.6 5.7 9.6 7.8 8.4 Cash EPS (fully diluted) DPS Book Value Dupont Analysis ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) 1.0 0.9 0.8 0.4 0.1 21.4 18.2 22.4 23.9 25.2 ROCE (Pre-tax) 19.5 17.6 23.1 25.4 28.5 Angel ROIC (Pre-tax) 20.8 18.6 24.6 27.7 33.4 ROE 26.0 23.2 26.7 28.0 28.4 Asset Turnover 2.4 2.4 2.5 2.7 3.0 Inventory / Sales (days) 52 52 49 43 41 Receivables (days) 10 11 16 20 20 Payables (days) 60 54 54 53 53 WC (ex-cash) (days) 15 22 23 21 23 Net debt to equity 0.8 0.9 0.6 0.3 0.0 Net debt to EBITDA 1.6 1.9 1.1 0.5 0.1 Interest Coverage 3.6 4.5 4.8 9.1 15.4 Operating ROE Returns (%) Turnover ratios (x) Solvency ratios (x) November 5, 2014 13 2QFY2015 Result Update | Relaxo Footwears Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement Relaxo Footwears 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors Ratings (Returns): November 5, 2014 Buy (> 15%) Reduce (-5% to -15%) Accumulate (5% to 15%) Sell (< -15%) Neutral (-5 to 5%) 14

© Copyright 2025