Argus Asia-Pacific Products prices At glAnce Overview

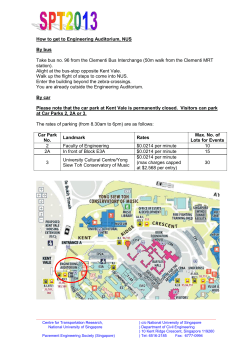

Argus Asia-Pacific Products Prices and analysis Issue 13A - 211 | Monday 4 November 2013 Overview prices At glance Product prices fall on lower crude values. Jet fuel term negotiations are ongoing in the Mideast Gulf. More gasoil headed from India to Brazil. An influx of Colombian and US fuel oil likely lifted demand for low-density blendstocks. Singapore gasoline 92R vs naphtha swaps 20 €/t $/t Naphtha swap month 1 = 0 18 Singapore $/bl Diff to Mops Low High Low High ± 97R gasoline - - 113.35 113.55 -2.45 95R gasoline +0.60 +0.80 112.20 112.40 -2.45 92R gasoline +0.40 +0.60 108.95 109.15 -2.00 Naphtha +1.70 +1.90 102.80 102.95 -1.18 -2.40 Jet-kerosine +0.65 +0.85 121.70 121.90 Gasoil 0.5% -0.25 -0.05 120.80 121.00 -2.55 Gasoil 0.25% +0.65 +0.85 121.70 121.90 -2.55 16 Gasoil 0.05% +1.20 +1.40 122.25 122.45 -2.55 14 Gasoil 0.005% +2.45 +2.65 123.50 123.70 -2.50 12 hhh 10 8 Gasoil 0.001% +2.90 +3.10 123.95 124.15 -2.50 HSFO 180cst $/t +5.00 +6.00 617.25 618.25 -0.50 HSFO 380cst $/t +5.00 +6.00 609.00 610.00 -0.50 South Korea 6 4 2 Aug 13 4 Sep 13 3 Oct 13 Fuel oil crack spreads -8 4 Nov 13 $/bl Dubai crude = 0 Low High -10 -11 -12 8 Oct 13 23 Oct 13 4 Nov 13 contents Prices at a glance, Overview 1 Gasoline commentary and prices2 Naphtha commentary and prices3 Jet-kerosine commentary and prices4 Gasoil commentary and prices 5 Fuel oil and LSWR commentary and prices 6 China fuel oil, bunkers and marine fuels 8 Freight rates 9 Crack spreads and deals done 10 Tenders, methodology and announcements 11 Market news 12 Copyright © 2013 Argus Media Ltd ± Jet-kerosine +0.30 +0.50 121.35 121.55 -2.45 Gasoil 0.05% +0.00 +0.20 121.05 121.25 -2.55 Gasoil 0.001% (10ppm) +0.95 +1.15 122.00 122.20 -2.55 - - 628.25 629.25 -0.50 Diff to Mopag Low High Low High HSFO 180cst $/t Mideast Gulf -9 -13 24 Sep 13 $/bl Diff to Mops Low High $/bl ± 95R gasoline +0.80 +1.00 110.10 110.30 -2.45 92R gasoline +0.50 +0.70 106.85 107.05 -2.00 Naphtha LR1 $/t +27.00 +29.00 896.05 905.55 -10.38 Naphtha LR2 $/t - - 899.30 908.80 -10.38 Jet-kerosine +1.70 +1.90 119.25 119.45 -2.40 Gasoil 0.2% +2.30 +2.50 119.05 119.25 -2.55 Gasoil 0.05% (500ppm) +2.90 +3.10 119.65 119.85 -2.55 Gasoil 0.001% (10ppm) +3.40 +3.60 120.15 120.35 -2.55 HSFO 180cst $/t - - 601.85 602.85 -0.05 HSFO 380cst $/t +6.50 +8.50 593.60 594.60 -0.05 Diff to Mopj Low High Low High ± 927.00 123.95 936.50 124.15 -10.38 -2.40 Japan Naphtha $/t Jet-kerosine $/bl +13.00 - +15.00 - Gasoil 0.005% - - 124.10 124.30 -2.55 HSFO 180cst $/t - - 628.20 629.20 -0.50 Diff to Pertamina Low High Low High ± 108.73 108.93 +0.00 Indonesia LSWR V-1250 $/bl +15.90 +16.10 Issue 13A - 211 | Monday 4 November 2013 Argus Asia-Pacific Products gasoline Singapore gasoline prices fell along with lower crude values. Vietnam’s Petrolimex bought a small spot cargo. There were two deals concluded during afternoon online trading in Singapore. Vitol sold a 92R cargo loading on 30 November-4 December at $108.90/bl to Unipec, while PetroChina sold a 95R cargo for 19-23 November loading at $112.40/bl to Glencore. The 92R gasoline’s margin relative to Brent crude rose to its highest level in a week at $2.60/bl, up from $1.90/bl during the previous session. But the reforming spread, or the product’s value over naphtha, weakened for the fifth successive session to close $0.80/bl lower at $6.20/bl on Monday. Vietnam provided scant demand support with Petrolimex buying just 5,000t (42,000 bl) of 95R gasoline loading over 20-28 November from Singapore at a premium around $0.70/bl to Mops. The size of the cargo suggests that it will be re-exported to neighbouring Cambodia instead of being consumed domestically. Petrolimex has otherwise yet to show any buying interest for spot supplies despite not having bought third-quarter cargoes. Pakistan shipped in 164,410t of gasoline during October, down by 14pc from a month earlier as demand weakened due to an increase in retail prices and higher inventories. Gasoline imports are expected to rebound in November, as the start of winter will exacerbate shortages of compressed natural gas, which is widely used as vehicle fuel in Pakistan. The government will likely divert gas supplies to the domestic sector and industries. Trading interest in the Singapore gasoline cash market softened for the second successive month to 1.3mn bl in October, falling from 1.6mn bl a month ago. 92R gasoline accounted for slightly over half or 750,000 bl of total transactions, while 500,000 bl of the 95R grade and only one 97R cargo changed hands. Sietco, a typical importer of highoctane gasoline, emerged as the largest seller of the 95R and 97R grades with 350,000 bl sold. Singapore naphtha and gasoline crack spreads 15 Naphtha 97R 95R $/bl Singapore Low Low High High ± 97R gasoline - - 113.35 113.55 -2.45 95R gasoline +0.60 +0.80 112.20 112.40 -2.45 92R gasoline +0.40 +0.60 108.95 109.15 -2.00 Mideast Gulf $/bl Diff to Mopag Low High ± +1.00 110.10 110.30 -2.45 +0.70 106.85 107.05 -2.00 Low High 95R gasoline +0.80 92R gasoline +0.50 Singapore reforming spread $/bl Today Previous ± 97R gasoline 10.58 11.85 -1.27 95R gasoline 9.43 10.70 -1.27 92R gasoline 6.18 7.00 -0.82 Gasoline 91R NWE fob vs 92R Singapore 75 $/t Gasoline 92R Singapore = 0 50 25 0 -25 -50 -75 31 Jul 13 3 Sep 13 2 Oct 13 Gasoline 92R vs Singapore naphtha swaps 18 92R $/bl Diff to Mops 1 Nov 13 $/bl Naphtha Singapore swap month 1 = 0 16 10 14 5 12 0 10 -5 8 -10 -15 27 Aug 13 18 Sep 13 Copyright © 2013 Argus Media Ltd 10 Oct 13 4 Nov 13 6 2 Aug 13 Page 2 of 13 4 Sep 13 3 Oct 13 4 Nov 13 Issue 13A - 211 | Monday 4 November 2013 Argus Asia-Pacific Products naphtha Asia-Pacific naphtha prices fell for the first time in six sessions on the back of sharp crude losses. Naphtha buyers resisted paying steep differentials for term cargoes even as fundamentals firmed. An active afternoon online trade session generated four deals. Glencore sold a first-half January delivering cargo at $936/t apiece to Itochu and Socar, while Sietco sold to MRI Trading two first-half January/second-half January timespreads at $8.50/t. Naphtha’s crack spread for first-half January firmed up for the fifth successive session to a more than eight-month high at $138.15/t, up from $129.85/t. The value of cfr Japan for second-half December over second-half January narrowed by $0.50/t to $16/t in backwardation on Monday. Trading activity in northeast Asia was subdued at the start of the week, but regional demand is expected to stay strong, with importers to remain highly dependent on naphtha as cracking feedstock as economics to switch to LPG were largely unviable. Bahraini producer Bapco sold a 50,000t (445,000 bl) B210 grade spot cargo for end-November loading from Sitra likely at about low-$30s/t premium to Mopag, but this could not be confirmed. It could have last sold an identical cargo for 17-20 October lifting at a weaker differential at about $27-28/t to Mopag. Term customers though were unwilling to lock in a year-long’s supplies at the steep premiums, forcing Bapco to lower its offer for its B210 grade naphtha lifting across January-December 2014 to $27.50/t above Mopag, down from its initial indication at $30/t premium to Mopag. Discussions are expected to continue into the week. Regional supply tightened even as Mideast Gulf producers continue to sell into the market either through tenders or via private negotiations, as arbitrage inflows were generally expected to decline during the final months of the year. Japan naphtha vs Ice Brent 150 $/t Singapore Naphtha Naphtha +1.70 +1.90 Low High ± 102.80 102.95 -1.18 $/t Low High +13.00 +15.00 Low High ± 927.00 936.50 -10.38 Mideast Gulf $/t Diff to Mopag Low High ± Low High Naphtha LR1 +27.00 +29.00 896.05 905.55 -10.38 Naphtha LR2 - - 899.30 908.80 -10.38 Japan open-specification naphtha forward prices $/t Low High 16-31 Dec 943.00 944.00 -10.75 1-15 Jan 935.50 936.50 -10.50 16-31 Jan 927.00 928.00 -10.25 Low High Nov 102.05 102.25 -1.05 Dec 101.80 102.00 -1.00 Jan 101.55 101.75 -1.00 Singapore naphtha swaps 130 20 120 10 ± $/bl Naphtha: Japan vs NWE 30 ± $/t Naphtha NWE cif = 0 0 100 -10 90 -20 80 70 2 Aug 13 High Diff to Mopj 140 110 Low Japan 40 Ice Brent month 1 = 0 $/bl Diff to Mops 4 Sep 13 Copyright © 2013 Argus Media Ltd 3 Oct 13 4 Nov 13 -30 31 Jul 13 Page 3 of 13 3 Sep 13 2 Oct 13 1 Nov 13 Issue 13A - 211 | Monday 4 November 2013 Argus Asia-Pacific Products jet-kerosine Asia-Pacific jet-kerosine prices fell on crude and paper losses. Term negotiations for 2014 jet fuel loading from the Mideast Gulf were ongoing. There were no physical deals done during afternoon trading in Singapore. Gunvor posted the sole bid at Mops +$0.75/bl for 250,000 bl loading 19-23 November. Spot differentials of fob Korea cargoes for Decemberloading showed signs of strengthening compared to November-loading cargoes. First-half December loading cargoes were heard offered at $0.50/bl premium over Singapore spot quotes compared to earlier November-loading deal done levels of $0.20/bl premium. Tighter supplies resulting from lower refinery runs and a seasonal switch to kerosine production to meet year-end heating needs helped to support the Asia jet fuel market. Vietnam’s Petrolimex bought through a tender 5,000t of kerosine for 20-28 November loading from Singapore at $0.90/bl premium over Singapore spot quotes. Petrolimex last bought a similar cargo for 1-10 August loading at around Mops -$0.20/bl, fob Thailand basis. Such small shipments are usually meant for re-export to Cambodia and the small cargo size also meant that the buyer has to pay a higher premium than for the more typical medium-range size cargoes. Term negotiations for 2014 term jet fuel loading from the Mideast Gulf were ongoing. Bahrain’s Bapco is said to be targeting levels similar to 2013’s term premium in the low-$2s/bl. Buying ideas were heard at below $2/bl. Buyers cited new refining capacity coming up in the Mideast Gulf next year as a factor weighing down on jet fuel term premiums. Jet fuel headed from the Mideast Gulf to northwest Europe. A long range 2 size vessel was seen fixed to load 90,000t of jet fuel from the Mideast Gulf on 5 November to head to Europe. Another tanker was booked to load 40,000t of jet fuel from New-Mangalore in mid-November to head to either the Mediterranean or northwest Europe. Singapore jet-kerosine November swaps fell by $2.45/ bl to $121.30/bl. The November-December intermonth time was stable at $0.70/bl in backwardation. The balanceNovember regrade fell to a $0.30/bl discount. Jet-kerosine’s crack spread, or the product’s premium to Dubai crude, narrowed by around $0.45/bl to $17.26/bl. Singapore $/bl Diff to Mops Jet-kerosine Low High +0.65 +0.85 Low High ± 121.70 121.90 -2.40 South Korea $/bl Diff to Mops Jet-kerosine Low High +0.30 +0.50 Low High ± 121.35 121.55 -2.45 Mideast Gulf $/bl Diff to Mopag Jet-kerosine Low High +1.70 +1.90 Low High ± 119.25 119.45 -2.40 Low High 123.95 124.15 Japan $/bl Jet-kerosine Singapore jet-kerosine swaps ± -2.40 $/bl Low High Nov 121.20 121.40 -2.45 Dec 120.50 120.70 -2.45 Jan 120.10 120.30 -2.40 1Q14 119.70 119.90 -2.45 2Q14 118.45 118.65 -2.35 3Q14 117.75 117.95 -2.40 Singapore jet-kerosine regrade 0.80 ± $/bl Gasoil swaps = 0 0.70 0.60 0.50 0.40 0.30 0.20 0.10 0.00 20 Sep 13 Copyright © 2013 Argus Media Ltd Page 4 of 13 4 Oct 13 21 Oct 13 4 Nov 13 Issue 13A - 211 | Monday 4 November 2013 Argus Asia-Pacific Products gasoil Asia-Pacific gasoil prices fell on crude and paper losses. Term negotiations for 2014 supplies loading from the Mideast Gulf were ongoing. There were no physical deals done during afternoon trading in Singapore. Vitol posted two offers for the 500ppm grade, both at $1/bl premium over Singapore spot quotes for 150,000 bl loading each on 20-24 November and 24-28 November. Regional demand continued to support spot differentials for the 500ppm sulphur grade at above $1/bl. Indonesia’s Petral was due to conclude on Monday a tender to buy up to 1.5mn bl of spot gasoil for November delivery into Tuban and Balongan. The unusually strong demand was attributed to refinery turnarounds and possibly lower exports from South Korea where poor refinery margins had forced run cuts. Petral also buys on a term basis around 2-3mn bl of term gasoil. It had agreed to buy fourth quarter delivery gasoil at premiums of $1.05/bl, $1.15/bl and $1.90/bl over Singapore quotes for delivery into Balongan, Tuban and Kotabaru respectively. Arbitrage economics to ship gasoil from Asia to Europe were unviable but more cargoes headed to Africa. The Yang Li Hu is fixed to load 80,000t of gasoil from South Korea in mid-November to head to west Africa. Trafigura was thought to be the charterer. The Ratna Namrata was placed on subjects to load 80,000t gasoil from the Mideast Gulf with east Africa as a possible destination. The Freight Margie was placed on subjects to load 60,000t gasoil from Sikka on 22 November with east Africa as a possible destination. More gasoil was also seen to have headed from India to Brazil, according to shipping fixtures. Around 550,000t was due to load from India in October to head to Brazil, compared to average monthly volumes of around 300,000t. Brazil uses 1800ppm sulphur gasoil in rural gasoil but is due to change that sulphur requirement to 500ppm by end of the year. It is unclear with the increase in October’s shipments from India to Brazil is linked to the specification change as the gasoil volume on this route has been volatile in the past. Brazil only imports the high sulphur grade from the US but is known to have imported the 500ppm and 10ppm sulphur grade from several places including the India, Mideast Gulf and South Korea. In the Mideast Gulf, Bahrain’s Bapco is in the midst of term negotiations for 2014-loading supplies. Bapco was said to be targeting a premium of $2.85/bl over Mideast Gulf quotes but buying ideas were heard pegged at $2 to low$2s/bl. Buyers cited new refining capacity coming up in the Mideast Gulf next year as a factor weighing down on gasoil term premiums. Singapore gasoil November swaps fell by $2.40/bl to $121.60/bl. The intermonth spread for November and December gasoil swaps were stable at $1.40/bl in back- Copyright © 2013 Argus Media Ltd Singapore $/bl Diff to Mops Low High Low High ± Gasoil 0.5% -0.25 -0.05 120.80 121.00 -2.55 Gasoil 0.25% +0.65 +0.85 121.70 121.90 -2.55 Gasoil 0.05% (500ppm) +1.20 +1.40 122.25 122.45 -2.55 Gasoil 0.005% (50ppm) +2.45 +2.65 123.50 123.70 -2.50 Gasoil 0.001% (10ppm) +2.90 +3.10 123.95 124.15 -2.50 South Korea $/bl Diff to Mops Low High Low High ± Gasoil 0.05% +0.00 +0.20 121.05 121.25 -2.55 Gasoil 0.001% (10ppm) +0.95 +1.15 122.00 122.20 -2.55 Mideast Gulf $/bl Diff to Mopag Low High ± +2.50 119.05 119.25 -2.55 +2.90 +3.10 119.65 119.85 -2.55 +3.40 +3.60 120.15 120.35 -2.55 Low High 124.10 124.30 Low High Nov 121.50 121.70 -2.40 Dec 120.10 120.30 -2.40 Jan 119.50 119.70 -2.40 1Q14 119.30 119.50 -2.45 2Q14 118.70 118.90 -2.35 3Q14 117.55 117.75 -2.35 Low High Gasoil 0.2% +2.30 Gasoil 0.05% (500ppm) Gasoil 0.001% (10ppm) Japan Gasoil 0.005% (50ppm) $/bl Singapore gasoil swaps Gasoil arbitrage East-west Nov spread ± -2.55 $/bl ± $/t -7.11 East-west Dec spread -9.56 Singapore Nov vs Ice Dec gasoil +0.89 Singapore Nov vs Ice Jan gasoil +3.89 wardation. Gasoil’s crack spread, or its premium relative to Dubai crude for November, fell by $0.40/bl to $16.86/bl. Page 5 of 13 Issue 13A - 211 | Monday 4 November 2013 Argus Asia-Pacific Products fuel oil, bunkers and lswr Singapore 180cst HSFO prices fell on crude and paper losses. Afternoon online trade in Singapore yielded three physical deals. Brightoil bought two cargoes of 20,000t 180cst HSFO, at $611/t from Philips 66 for 24-28 November loading and at $610/t from Mercuria for 29 November – 3 December loading. Kuo Oil bought from Vitol a 20,000t 380cst HSFO cargo for 19-23 November loading at $601/t. Results of a term tender by PTT Global Chemical (PTTGC) to sell two cargoes of 35,000t 380cst fuel oil of density 0.97kg/m3 monthly from January to December 2014 on a fob Mab Ta Phut basis were not yet available. PTT was possibly one of the two buyers of the previous term tender at around Mops +$5.80-$6/t. PTT and Chevron often co-load MR-sized cargoes from PTT GC who exports monthly around 10,000-15,000t bunker-grade fuel oil from the 150,000 b/d Star Petroleum Refining Company, a joint venture between Chevron and PTT, for better freight economics. IRPC and Bangchak Petroleum, the only two Thai refiners which export LSWR, are likely to shut their respective refineries for scheduled maintenance for around 2-6 weeks next year. The 120,000 b/d Bangchak refinery is likely to undergo scheduled maintenance for around 45 days from 1 May to mid-June in 2014. Bangchak typically offers monthly MR-sized LSWR cargo. But a change of crude oil feedstock grade sometimes sees the refiner exporting VGO as well. The 215,000 b/d IRPC refinery is likely to undergo scheduled maintenance for around 15 days from end- March to mid- April 2014. IRPC typically offers monthly a MR-sized 380cst HSFO cargo with high metals content every two months. Trading firm Mercuria is a regular buyer of these cargoes. Korea Western Power sought through a tender for a 45,000t cargo of 540cst maximum 2.59pc sulphur HSFO for delivery to Pyeongtaek between 2-6 December. Offers are to be submitted by 11 November and remain valid till 14 November. The utility last bought 90,000t of similar specifications fuel oil for November delivery to Pyong Taek. India’s MRPL last week sold through a tender 80,000t of 380cst HSFO of density 0.97kg/m3 loading from New Mangalore on 25-27 December to Mitsui at Mops +$6.15/t. Mitsui has been paying record-high premiums of $6-8/t over Mops 380cst for December-loading 380cst HSFO cargoes from MRPL due to a dearth of low density blendstock in the market. Mitsui and Vitol were thought to have been won the 12month long term contracts starting July 2013 to buy 840,000 bl of 400-500cst Columbian fuel oil monthly at around Mops Copyright © 2013 Argus Media Ltd Singapore $/t Diff to Mops Low High ± +6.00 617.25 618.25 -0.50 +6.00 609.00 610.00 -0.50 Low High HSFO 180cst +5.00 HSFO 380cst +5.00 Mideast Gulf $/t Diff to Mopag Low High ± - 601.85 602.85 -0.05 +8.50 593.60 594.60 -0.05 Low High 628.25 629.25 Low High HSFO 180cst - HSFO 380cst +6.50 South Korea $/t HSFO 180cst Japan -0.50 $/t HSFO 180cst Low High 628.20 629.20 Indonesia ± -0.50 $/bl Diff to Pertamina LSWR V-1250 ± Low High +15.90 +16.10 Low High ± 108.73 108.93 +0.00 Singapore $/t Low High Nov 614.00 615.00 +0.00 Dec 607.50 608.50 +0.00 Jan 604.75 605.75 +0.00 1Q14 604.25 605.25 +0.00 2Q14 603.08 604.08 +0.00 3Q14 602.25 603.25 +0.00 Low High Nov 605.75 606.75 +0.00 Dec 599.25 600.25 +0.00 Jan 596.25 597.25 +0.00 HSFO 180cst swaps Singapore HSFO 380cst swaps ± $/t ± -$49/t on a fob Mamonal basis. This high-viscosity and high density Colombian fuel oil is typically co-loaded with fuel oil from the US gulf coast via ship-to-ship transfer at Aruba to head to Singapore. Draft depth restrictions limit loading at Mamonal to Panamax-size vessels of only around 60,000t Page 6 of 13 Issue 13A - 211 | Monday 4 November 2013 Argus Asia-Pacific Products fuel oil. A key end-user outlet for this fuel oil is the bunker fuels market in Singapore but the cargoes have to have their viscosity and density blended down first. In the paper market, November swaps fell by $7.50/t to $607/t. The November-December time spread narrowed by $1/t to $5.50/t in backwardation, while the DecemberJanuary time spread widened by $0.25/t to $3/t in backwardation. The November front-month 180/380cst viscosity spread widened by $0.50/t to $8.75/t, while fuel oil’s discount to Dubai crude narrowed by $0.97/bl to a discount of $10.10/bl. 4th Argus Mideast Gulf and India Ocean Oil Conference 2013 25-27 November 2013 JW Marriot Marquis Dubai, UAE www.argusmedia.com/amgio Copyright © 2013 Argus Media Ltd Page 7 of 13 Issue 13A - 211 | Monday 4 November 2013 Argus Asia-Pacific Products china fuel oil, bunkers and marine fuels Spot prices of 180cst HSFO were unchanged at 4,350-4,400 yuan/t in south China and Yn4,550-4,600/t in east China, despite a fall in crude futures and Singapore bunker prices on Friday. Suppliers mostly kept offers firm and operated cautiously with low inventories. A sharp fall in Singapore bunker prices at the end of last week hit market sentiment. Some suppliers in the east considered reducing offers in the coming days if crude futures did not recover. A slight fall in blending costs in the previous week maintained margins at suppliers. But a rise in China’s official purchasing managers’ index (PMI) published on Friday strengthened market confidence. In the straight-run fuel oil market, premiums for Russian M100 cargoes to be delivered in 15-30 days stayed flat at $95-97/t on a cfr China basis after an increase of $4/t on Friday. Premiums are in line with the estimated $95/t premium at which BP agreed to buy Russian M100 from Rosneft over 14 months starting in November. The NDRC cut product price ceilings by Yn75/t for gasoline effective on Friday, prompting some teakettles to lower offers by around Yn3050/t. Falls in ex-refinery gasoline prices and fluctuating Russia M100 prices reduced refining margins at teakettles’ combined units running M100 by Yn89/t from 8-29 October, and narrowed the premium to Shengli crude refining margins by Yn66/t to Yn147/t. Shengli crude refining margins at combined units earlier this month improved to above parity because of a fall in Shengli crude prices to Yn5,004/t for November deliveries. Refining margins had stayed negative for the whole of October. Four lots of the April 2014 contract were traded on the Shanghai Futures Exchange, with the contract settling up by Yn111/t at Yn4,398/t. The February contract settled lower by Yn7/t at Yn4,150/t while the May, June, July, October and November contracts settled higher by Yn116-122/t at Yn4,618-4,859/t in line with exchange rules that provide for price changes even if there are no trades. Open interest rose to 44 lots, as the April contract contributed four lots. Fuel oil stocks at nominated storage terminals to meet physical delivery have been unchanged at 15,600t since 15 July. Prices in the bonded bunker market fell by up to $7/t at all three ports in China. Sharp falls in Singapore bunker prices since Friday turned sentiment bearish and weighed on prices in the Chinese bonded bunker market. South China fuel oil fob HSFO 180cst barge STS High ± 4,350.00 4,400.00 +0.00 South China fuel oil fob differentials $/t Diff to Mops ± Low High M100 C+F east China +95.00 +97.00 +0.00 M100 C+F south China +95.00 +97.00 +0.00 East China fuel oil fob $/t Low High ± 713.25 714.25 -0.50 Low High ± Nov 628.25 630.25 +0.00 Dec 621.75 623.75 +0.00 Jan 619.00 621.00 +0.00 Low High ± Singapore 621.00 623.00 +0.00 South Korea 659.00 661.00 +0.00 Fujairah 644.00 646.00 +0.00 na na na HSFO east China South China fuel oil c+f $/t Bunkers 180cst Russian far east $/t Bunkers 380cst $/t Low High ± Singapore 610.00 612.00 +0.00 South Korea 637.00 639.00 +0.00 Fujairah 617.00 619.00 +0.00 Hong Kong 615.00 617.00 +0.00 Shanghai 637.00 639.00 +0.00 Qingdao 636.00 638.00 +0.00 Low High ± Singapore 915.00 925.00 +0.00 South Korea 935.00 945.00 +0.00 Fujairah 965.00 975.00 +0.00 Marine diesel $/t Marine gasoil $/t Low High ± Singapore 925.00 935.00 +0.00 South Korea 945.00 955.00 +0.00 Fujairah 975.00 985.00 +0.00 na na na Russian far east Copyright © 2013 Argus Media Ltd yuan/t Low Page 8 of 13 Issue 13A - 211 | Monday 4 November 2013 Argus Asia-Pacific Products freight routes Spot freight rates Mideast Gulf-Japan Mideast Gulf-Singapore Fuel oil Size t $/t Naphtha 80,000 15.39 Naphtha Mideast Gulf-Singapore Gasoline Mideast Gulf-Singapore Size t $/bl 35,000 2.08 Size t $/bl Gasoil 55,000 2.58 Jet 55,000 2.44 Size t $/t 55,000 30.96 75,000 27.72 Singapore-Japan Clean products Singapore-Japan Size t $/t 30,000 17.65 Size t $/bl Gasoil 30,000 2.37 Jet 30,000 2.24 *Freight rates are taken from Argus Freight Indonesia-Japan Fuel oil Fuel oil margin -8 Size t $/t 80,000 10.97 $/bl LSWR vs Duri crude 6 Dubai crude = 0 $/bl Duri = 0 4 -9 2 0 -10 -2 -11 -4 -6 -12 -13 24 Sep 13 -8 8 Oct 13 Copyright © 2013 Argus Media Ltd 23 Oct 13 4 Nov 13 -10 27 Aug 13 Page 9 of 13 18 Sep 13 10 Oct 13 4 Nov 13 Issue 13A - 211 | Monday 4 November 2013 Argus Asia-Pacific Products Refining MARGINS Refining margins Gasoil and jet-kero refining margins 18.5 Gasoil $/bl Jet-kerosine Period $/bl Dubai swaps Singapore fuel oil 180cst 18.0 Dec -9.08 Singapore gasoil Dec +16.86 Singapore jet Dec +17.26 Japan naphtha c+f half month 1 16-31 Dec +145.20 Japan naphtha c+f half month 2 1-15 Jan +138.15 Japan naphtha c+f half month 3 16-31 Jan +129.65 Ice Brent crude 17.5 17.0 16.5 24 Sep 13 Ice Brent crude Dubai crude = 0 8 Oct 13 23 Oct 13 Naphtha and gasoline refining margins 15 $/t Naphtha 97R 95R 4 Nov 13 $/bl Singapore naphtha fob spot - -3.56 Singapore 97R gasoline - +7.01 Singapore 95R gasoline - +5.86 Singapore 92R gasoline - +2.61 Singapore HSFO vs Indonesia LSWR 150 92R $/bl $/t HSFO 180cst cargo Singapore = 0 140 10 130 5 120 0 110 -5 100 -10 -15 27 Aug 13 18 Sep 13 10 Oct 13 4 Nov 13 90 2 Aug 13 4 Sep 13 3 Oct 13 4 Nov 13 methodology Argus Asia-Pacific products price assessments represent the market over the course of the entire trading day. Argus believes that a fair and representative price will include trade throughout the day. If the market shows high intra-day volatility, Argus will weight the assessments towards trading activity at the end of the working day. Price assessments rely on a wide variety of sources and platforms for information, including discussion with refiners, marketers, importers, traders and brokers, to reflect a daily consensus on the price of the day. Copyright © 2013 Argus Media Ltd Argus works to verify all deal prices, counterparties, and volumes. Argus values transparency, so we publish as much price, volume, and specification information as we discover. This allows you to cross-check and verify the deals against the published prices. The details of our methodology are available at: www.argusmedia.com or by calling any Argus office. Page 10 of 13 Issue 13A - 211 | Monday 4 November 2013 Argus Asia-Pacific Products deals and tenders Issued tenders Issuer Trade Timing fob/cfr location Close Valid Ceyeptco Buy 150kb 0.25pc sulphur gasoil and 160kb jet fuel 26-27 Nov cfr Colombo 5 Nov 8 Nov SOMO Buy 48,000t jet fuel 1 Nov - 31 Dec cif Khor Al- Zubair 10 Oct 30 Oct Exxon Sell 80,000-90,000t 650cst HSFO 7-9 November fob Yanbu 22 Oct 24 Oct KPC Sell 80,000t 380cst HSFO 26-27 November fob Shuaiba 23 Oct 25 Oct CPC buy 35,000t of naphtha 1-25 December cfr Kaoshiung 30 Oct 31 Oct CAO Buy 1.2mn bl jet fuel Nov- Dec fob selected ports in NE and SE Asia 30 Oct 31 Oct Tanzania Buy 160,259t 500ppm sulphur gasoil and 10,047t jet fuel Dec cfr Dar es Salaam 31 Oct 15 Nov BPC Sell 170,000 bl of naphtha 13-15 Nov fob Chittagong 4 Nov 7 Nov Jopetrol Buy 25,000t jet fuel 1-5 Dec cfr Aqaba 5 Nov 12 Nov ONGC Sell 35,000t of naphtha 2-3 December fob Hazira 6 Nov 7 Nov Banagas Sell 180,000t of B220 naphtha Jan-Dec 2014 fob Sitra 6 Nov 20 Nov Ceypetco Buy 110,000 bl of gasoil and 210,000 bl of gasoline 15-16 Dec cfr Colombo 19 Nov 21 Nov Korea Western Power Buy 45,000t 540cst 2.59pc sulphur HSFO 2-6 Dec cfr Pyong Taek 11 Nov 14 Nov PTTGC Sell two cargoes of 35,000t 380cst HSFO Jan-Dec 2014 fob Mab Ta Phut 31 Oct Deals done Seller Buyer Product Volume Phillips 66 Brightoil Petroleum Fuel oil HS 180 cst cargo Singapore Mercuria Brightoil Petroleum Price $ Timing 20,000t 611.00 1 Nov-5 Nov Fuel oil HS 180 cst cargo Singapore 20,000t 610.00 6 Nov-3 Dec Vitol Fuel oil HS 380 cst cargo Singapore 20,000t 601.00 3 Nov-7 Nov Vitol Unipec Gasoline 92R Singapore 50,000 bl 108.90 7 Nov-4 Dec Petrochina Glencore Gasoline 95R Singapore 50,000 bl 112.40 3 Nov-7 Nov Glencore Itochu Corporation Naphtha forward Japan c+f 25,000t 936.00 4 Jan-4 Jan Glencore Socar Naphtha forward Japan c+f 25,000t 936.00 4 Jan-4 Jan Kuo Oil Singapore Pte Ltd Copyright © 2013 Argus Media Ltd Page 11 of 13 Diff Basis Issue 13A - 211 | Monday 4 November 2013 Argus Asia-Pacific Products News EU proposes cancellation of jet import tariffs| The European Commission today formally proposed exemption from planned customs duties for jet fuel imports originating from all countries. The commission notes the need to provide certainty for traders and give the EU airline industry time to adjust. The commission’s proposed regulation needs now to be adopted by EU member states before entering into force. The proposal ends uncertainty following the revision of the EU’s generalised scheme of preferences (GSP). This removed duty-free access for the six GCC countries as well as India’s refining sector from 1 January 2014. Previously tariffs on jet fuel imports would have been levied at 4.7pc for India’s refinery sector as well as Gulf Cooperation Council (GCC) countries including UAE, Bahrain and Kuwait. GCC countries account for some 35pc of Europe’s import needs, averaging around 225,000 b/d. The proposal also removes from 1 January 2014 existing tariffs levied on limited US jet fuel imports currently at some 25,000 b/d. Jet fuel is the single biggest expense for most airlines, with its proportion of total costs ranging from 30-40pc. And Europe’s reliance on imported jet fuel has risen notably following 2012 refinery closures. In that year, exports from the UAE alone to Europe rose by 50pc, and the GCC countries accounted for around 35pc of Europe’s import needs, averaging around 225,000 b/d. The International Air Transport Association (Iata) said IEA data show 32pc of jet fuel consumed in Europe comes from countries that would not have benefitted from duty free access after 1 January, including the GCC countries, India and the US. PetroChina raises capacity at Urumqi refinery State-controlled oil firm PetroChina has started operations at a new 120,000 b/d crude distillation unit (CDU) at its Urumqi refinery in China’s northwestern Xinjiang region, raising capacity at the plant to 190,000 b/d. The new CDU started trial runs on 26 October and produced on-specification products this week. An older 50,000 b/d CDU has been closed in line with the new unit starting up, resulting in total capacity rising to 190,000 b/d from the previous 120,000 b/d. All units at Urumqi were halted for one month of maintenance starting mid-August in preparation for the expansion. The refinery’s other 70,000 b/d CDU remains off line but is expected to restart soon. PetroChina is targeting throughput of 146,000 b/d in November, up from about 100,000 b/d in October. The upgrade also includes the addition of a 30,000 b/d Copyright © 2013 Argus Media Ltd waxy oil hydrotreater, 12,000 b/d reformer, 24,000 b/d delayed coking unit and a 40,000 b/d gasoil hydrotreating unit. Trials have started at the waxy oil hydrotreater, while the other units came on line in July. The upgrade enables the refinery to produce gasoline meeting the China 4 emissions standard that caps sulphur content at 50ppm. The new standard will become mandatory across China at the end of this year. CAO’s 3Q net profit rises by 65pc Net profit at China Aviation Oil (CAO), the largest physical jet fuel trader in Asia-Pacific, reached $21.8mn for the quarter ended 30 September, 65pc higher than the same period last year on higher trading volumes. The increase in gross profit from CAO’s supply and trading activities helped to grow its January-to-September net profit to $56.7mn this year, 18.1pc higher than the same period last year. Although jet fuel supply and trading volume was largely unchanged at 7.85mn t in the first nine months of this year, trading volume of other oil products surged by 1.36mn t to 3.94mn t. Products that CAO traded more actively included fuel oil, gasoil and petrochemical products. CAO, which started out as a jet fuel importer into China, has been diversifying its trading portfolio to other products since 2008 as the country turns into a net jet fuel exporter. CAO notes that while China’s jet fuel consumption has grown in tandem with its civil aviation industry, the country’s jet fuel demand is dependent on the volume of domestic jet fuel output, which has risen sharply along with rising refining capacity. CAO will “continue to focus on building on its jet fuel supply and trading business outside China”, the company said. Ethylene supplies reach Iranian petchem plant Ethylene for Iran’s Tabriz petrochemical plant in the eastern province of Ilam has been received through the western ethylene pipeline, the world’s longest such pipeline. The first phase at the petrochemical plant will start up imminently, energy ministry news service Shana quoted Iran’s state-owned National Petrochemical (NPC) as saying. NPC said the plant is in the pre-commissioning phase and the necessary feedstock has been supplied. The 2,700km pipeline is designed to carry 150,000 t/yr of ethylene to Tabriz as well as other downstream petrochemical facilities at Lorestan, Mahabad and Kurdestan in the west of the country. The pipeline will provide ethylene feedstock to 14 petrochemical plants located along its route. Page 12 of 13 Issue 13A - 211 | Monday 4 November 2013 Argus Asia-Pacific Products Argus direct Upcoming Conferences in Asia Argus ESPO Conference 2013 Exports to China and Asia-Pacific — Will Russia deliver? 13 - 14 November 2013, Singapore Argus Mideast Gulf and Indian Ocean Oil Conference 2013 25 - 27 November 2013, Dubai Web | Mobile | Alerts Argus Direct is the next generation platform from Argus Media. It is the premium way to access our reports, prices, market insight, fundamentals data and markets. Market Reporting Consulting Register today: www.argusmedia.com/Events/Argus-Events/Asia Events argusmedia.com/direct Argus Asia-Pacific Products is published by Argus Media Ltd. Registered office Argus House, 175 St John St, London, EC1V 4LW Tel: +44 20 7780 4200 Fax: +44 870 868 4338 email: sales@argusmedia.com ISSN: 1368-7689 Copyright notice Copyright © 2013 Argus Media Ltd. All rights reserved. All intellectual property rights in this publication and the information published herein are the exclusive property of Argus and and/or its licensors and may only be used under licence from Argus. Without limiting the foregoing, by reading this publication you agree that you will not copy or reproduce any part of its contents (including, but not limited to, single prices or any other individual items of data) in any form or for any purpose whatsoever without the prior written consent of Argus. Trademark notice ARGUS, ARGUS MEDIA, the ARGUS logo, ARGUS ASIA-PACIFIC PRODUCTS, other ARGUS publication titles and ARGUS index names are trademarks of Argus Media Ltd. Visit www.argusmedia.com/ trademarks for more information. Publisher Adrian Binks Disclaimer The data and other information published herein (the “Data”) are provided on an “as is” basis. Argus makes no warranties, express or implied, as to the accuracy, adequacy, timeliness, or completeness of the Data or fitness for any particular purpose. Argus shall not be liable for any loss or damage arising from any party’s reliance on the Data and disclaims any and all liability related to or arising out of use of the Data to the full extent permissible by law. Commercial manager Jo Loudiadis Beijing, China Tel: + 86 10 6515 6512 Editor in chief Ian Bourne Moscow, Russia Tel: +7 495 933 7571 Managing editor, Global Cindy Galvin Singapore Tel: +65 6496 9966 Chief operating officer Neil Bradford Global compliance officer Jeffrey Amos Editor Ng Han Wei Tel: +65 6496 9966 asiapacificproducts@argusmedia.com Customer support and sales Technical queries – technicalsupport@argusmedia.com All other queries – support@argusmedia.com London, UK Tel: +44 20 7780 4200 Astana, Kazakhstan Tel: +7 7172 54 04 60 Dubai Tel: +971 4434 5112 Rio de Janeiro, Brazil Tel: +55 21 3514 1402 Tokyo, Japan Tel: +81 3 3561 1805 Argus Media Inc, Houston, US Tel: +1 713 968 0000 Argus Media Inc, New York, US Tel: +1 646 376 6130

© Copyright 2025