HIRING AN INDEPENDENT CAREGIVER

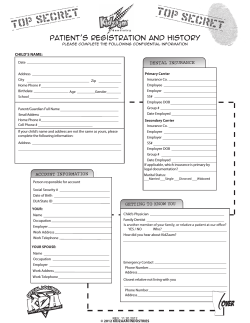

A Series of Guides from MetLife in Cooperation with the National Alliance for Caregiving HIRING AN INDEPENDENT CAREGIVER ABOUT THE SUBJECT s people age—or due to a life-changing event such as a stroke—the ability to live independently may change. Over 12 million Americans spend time caring for family members or friends who can no longer live on their own.1 Often a family member or friend steps in to assist the person with their activities of daily living, such as getting in or out of a shower, getting dressed, helping with the everyday chores of laundry, or preparing a meal. The need for more assistance often increases, which, in turn, increases the time commitment from family and friends. Individuals often desire to remain in their own home, even though they need more help to stay there. It is frequently at this point that caregivers must begin to look at sources beyond the family to assist with care. The home care industry is growing in response to the increased need for help in the home. A caregiver can be hired from an agency or they can be hired as a private or independent caregiver. When you hire a private or independent caregiver, the individual becomes your employee and you become the employer. Frequently, families may utilize a privately hired individual for these reasons: They can hire whom they choose based on their best judgment. They have more control and choice in the care plan, which may provide more flexibility for the family. The cost is typically lower than that of an agency. There may be more flexibility in terms of the caregiving schedule. THINGS YOU NEED TO KNOW If you decide to hire an independent caregiver you should be prepared to: Locate potential caregivers Screen applications Conduct interviews Run background checks Administrate payroll, including social security and other taxes Locating a Caregiver One of the first resources to access is the ElderCare Locator. The number is located in Resources to Get You Started. The ElderCare Locator is a free public service from the U.S. Administration on Aging that will help you to locate your local Area Agency on Aging. The Caregivers face many challenges as they search for information and make decisions about how best to provide care to their loved ones. To help meet their needs, MetLife offers CareMatters—a series of guides which provide practical suggestions and useful tools on a variety of specific care-related subjects. local agency may have a list of caregivers in your area that are available. Your primary physician may have recommendations for caregivers, or be able to suggest a local social worker to assist you. If the person in need is presently in a hospital or nursing home/rehabilitation facility, ask the facility’s discharge planner or social worker for recommendations. Check with your local senior center or senior clubs as they may have a list of individual caregivers. Speak to the director of your church, synagogue or religious or spiritual affiliation; they may be able to help in your search for a caregiver. Friends, neighbors and perhaps other family members may have recommendations or sources that they have used and found helpful for such care. You can check the local paper in the classified section and look for individuals who offer home care services. You can also place your own ad in the paper, listing your requirements for a caregiver. Make your ad as specific as possible. Be sure to include the information about general responsibilities, hours of employment, smoking policy, driving, and language requirements. Include your phone number and the hours you’re available to receive their call (see attached sample ad copy). The Interview Once you have candidates for the position, you will need to conduct interviews. You can narrow the field by first conducting a telephone interview. During the conversation confirm: Number of days per week and hours per day you will expect them to work Caregiving duties and expectations Salary and benefits Language requirements Valid driver’s license Smoking policy After successfully screening applicants over the phone, you will want to meet them for a more in-depth interview. Each caregiving situation is unique, so questions should reflect your personal situation and position requirements. It is helpful if you have another person with you during this stage of the interview process, so you can compare notes once the meeting is complete. Examples of some questions you may want to ask are: What is your prior work experience? Have you worked with people with similar impairments? What are your qualifications? Do you have a résumé with a detailed work history? Do you have references from past positions? Can they be contacted? Are you bonded? Do you have any health restrictions that would limit your ability to do the job? Do you own a car and have a valid driver’s license? (This is important if you expect the caregiver to provide transportation for doctor’s visits, etc.). Are you able to prepare basic meals? Can you commit to the days and hours required? Will you submit to a background check and drug test? When you complete the interviews, make it clear that employment is dependent on passing a thorough background check. Confirm a telephone number and address where the candidate can be reached for follow up. Let them know you will call them as soon as the interviews have been completed. Background Check It is always necessary to conduct a background check to verify past employment, criminal violations, driving infractions and that they are licensed if they say they are. Call the past employers that the candidate listed as references. Ask: How long was the person employed? Why were their services terminated? Were they dependable? Would you rehire them? If you have Internet access, you may be able to locate a company that will perform a background check on-line for you for a minimal fee. Examples of such companies are: www.knowx.com www.informus.com www.crimcheckinc.com www.docusearch.com Additional information beyond the basic search is sometimes offered at an additional cost. Your local yellow pages may offer names of companies that perform background checks. These may be found under “Investigators” or “Detective Agencies.” Ask the local police department if they can perform a criminal background check. If they do not, they may be able to refer you to an agency or person that does background checks. If the candidate states they are a certified nurse assistant (CNA), confirm in which state they hold the certificate. Obtain the certificate number and Social Security number of the candidate and call the state’s Board of Nursing to confirm certification. If the person is a home health aide (HHA), four states, as of January 2002, have HHA registries—California, Indiana, Minnesota, and New Jersey. Again, you will need the certificate number and Social Security number to confirm certification. *Note: You will need a signed release from the potential employee stating that they agree to a background check. There should also be a place for their Social Security number on the release. Hiring a Caregiver Once you have reviewed all of the interview material, completed background checks and contacted references, you can make your decision. Call the person as soon as possible to confirm the job position. You should make an appointment to meet with them to review the job responsibilities and sign a written contract (see attached sample of contract). Prepare two copies of the contract so you each retain a signed original. In this written contract be sure to clearly explain the following items: Starting date of position The hours and days of employment Time off/vacation policy Pay scale, benefits and pay periods Acceptable and non-acceptable behavior The person responsible for supervision and job performance monitoring Reasons for termination HELPFUL HINTS Here are some items that should be reviewed with the caregiver when they begin their employment: In a notebook placed next to the phone, list the name of current doctors, pharmacies, local hospital, your cell phone and work numbers, and the names, addresses and phone numbers of a neighbor or friend. In the notebook, include a local street map and write down the phone number, street address and directions to your home. Note the location of your home’s water shut off, breaker boxes, smoke alarms and fire extinguishers in the notebook and acquaint the caregiver with their locations. Some items to remember as an employer are: Protect all valuables by moving them to less conspicuous places or placing them in a safe. Make an inventory list with pictures and dates for future reference. Be sure that payroll records, which include social security and other taxes, are kept current and accurate. Be prepared to make unannounced and unexpected visits to the home when the caregiver is there. Watch for any signs of abuse or neglect and take action immediately. All the checklists, interviews, and résumés cannot ensure safe, quality care. Personal references from other caregivers and your own instincts are ultimately the best indicators of the appropriate person to care for a family member or friend. You may have to hire several caregivers before you find the perfect fit. 1 Caregivers, Caregiving and Home Care Workers Administration on Aging U.S. Department of Health & Human Services Washington, D.C. July 14, 2000 RESOURCES TO GET YOU STARTED Books and Publications A/PACT: Aging Parents and Children Together. This is a series of articles on such topics as older adults and fraud, making a home safer, caregiver tips, legal issues etc. The series can be ordered from: The Consumer Response Center, Federal Trade Commission, Washington, D.C., 20580 202-382-4357, TDD 202-326-2502 or on the Internet at www.ftc.gov/bcp/conline/ pubs/services/apact. How to Care for Aging Parents A compassionate, single-volume reference to the many topics associated with caring for aging parents, covering practical matters including emotional, financial and legal issues. Morris, V. (1996). New York, NY: Workman Publishing Company, $15.95 ISBN: 1563954353. Resources for Caregivers – 2001 Edition Available at no cost from the MetLife Mature Market Institute, 203-221-6580 or e-mail MatureMarketInstitute@metlife.com. The Comfort of Home: An Illustrated Step-byStep Guide for Caregivers A guide that starts with the basics and contains information that caregivers can use at all stages of caregiving. Meyer, M.M. (1998). Portland, OR: Caretrust Publications, $23.00 ISBN: 0966476700. Internet Resources AARP AARP is a nonprofit organization that offers educational programs, services and support for adults 50 and older. The AARP Web site contains an extensive caregiver section that provides information on caregiver support, long-term care, home care and housing. Publications are available online and can also be mailed free upon request. Write AARP, 601 E Street, NW, Washington, DC 20049, call 800-424-3410 TTY: 877-434-7598, e-mail member@aarp.org, or access their Web site at www.aarp.org. Administration on Aging This site is maintained by the U.S. Department of Health and Human Services and provides resources, news and developments and information for older adults. www.aoa.dhhs.gov National Alliance for Caregiving (NAC) Established in 1996, the National Alliance for Caregiving is a nonprofit coalition of national organizations that focuses on issues of family caregiving. The Alliance was created to conduct research, do policy analysis, develop national programs and increase public awareness of family caregiving issues. The Web site has a clearinghouse with over 1,000 consumer materials, books and videos. National Alliance for Caregiving (NAC) 4720 Montgomery Lane, Fifth Floor, Bethesda, MD 20814 www.caregiving.org National Association of Area Agencies on Aging (N4A) The National Association of Area Agencies on Aging is the umbrella organization for the 655 Area Agencies on Aging throughout the United States which provide information and services, and coordinate and administer programs for older adults. The Federally-funded Eldercare Locator, established by the U.S. Administration on Aging in 1991, and administered by N4A, provides callers with information about local services by zip code. Call 800-677-1116, 9:00 a.m.-8:00 p.m. ET, or go to www.n4a.org. USEFUL TOOLS Enclosed are four tools to assist you with hiring a caregiver. They are: Sample Ad US Department of Justice Employment Eligibility Verification, Form I-9 (Rev. 11-2191)N Form W-4 Sample Caregiver Contract ABOUT THE AUTHORS OF CAREMATTERS CAREMATTERS guides are prepared by the MetLife Mature Market Institute in cooperation with the National Alliance for Caregiving and MetLife’s Nurse Care Managers. MetLife Mature Market InstituteSM is the company’s information and policy resource center on issues related to aging, retirement, long-term care and the mature market. MetLife Nurse Care Managers are available to MetLife’s long-term care customers and their caregivers, on a daily basis, to help identify and resolve caregiving questions and concerns through counseling and referral. National Alliance for Caregiving is a non-profit coalition of 38 national organizations that focuses on issues of family caregiving. Mature Market Institute MetLife 57 Greens Farms Road Westport, CT 06880 E-Mail – MatureMarketInstitute@metlife.com www.maturemarketinstitute.com National Alliance for Caregiving 4720 Montgomery Lane, Fifth Floor Bethesda, MD 20814 www.caregiving.org MetLife, a subsidiary of MetLife, Inc. (NYSE:MET), is a leading provider of insurance and other financial services to individual and institutional customers. The MetLife companies serve approximately 10 million individual households in the U.S. and companies and institutions with 33 million employees and members. This information is general in nature. It is not a substitute for obtaining guidance from a health care, financial or other professional. MMI00009 ©2002 Metropolitan Life Insurance Company, New York, NY L02084GEI(exp1206)MLIC-LD SAMPLE NEWSPAPER ADS ★ Help Wanted ★ Companion Wanted: I am seeking an experienced, compassionate and dependable companion for my (person) in (location) for (days/hours/times per week). A valid driver’s license and a car are essential. Please provide a résumé that outlines previous experience with older adults, qualifications and three references, which will be checked. Salary and benefits commensurate with expertise. Please call (phone number) at (fill in times). ★ Help Wanted ★ Aide Wanted: I am seeking an experienced, licensed and compassionate personal care aide for my (person) in (location) for (days/hours/times per week). A valid driver’s license and a car are essential. Please provide a résumé that outlines previous training and experience, qualifications and three references, which will be checked. Salary and benefits commensurate with expertise. Please call (phone number) at (fill in times). MMI00009 ©2002 Metropolitan Life Insurance Company, New York, NY L02084GEI(exp1206)MLIC-LD CAREGIVER AGREEMENT and agree to the following (Name of Caregiver) on , 20 (Name of Employer) . Employment as a caregiver to (date) will commence on (name of care recipient) and shall end on , 20 , 20 . (date) , with a period of probationary employment agreed upon by the employer and the caregiver (date) to last until , 20 . Either party may terminate employment during the above specified time period, provided (date) that party provides notice of days. Care will be provided at (address) Care will be provided on (list days) Care will commence on days specified at (circle one) am/pm and will end at The employer will pay the caregiver the sum of $ rendered will take place on (circle one) am/pm on those days. (circle one) per hour/week/bi-weekly/monthly. Payment for services (time and day). Responsibilities to the care recipient are as follows (list responsibilities): This agreement can be terminated by either party, after the specified period of probation, provided either party gives weeks’ notice Automatic termination will occur if the following are noted: • Smoking in the home while on duty • Use of drugs or alcohol on duty • Repeated tardiness MMI00009 (Signature of Caregiver) (date) (Signature of Employer) (date) ©2002 Metropolitan Life Insurance Company, New York, NY , 20 . , 20 . L02084GEI(exp1206)MLIC-LD OMB No. 1115-0136 U.S. Department of Justice Immigration and Naturalization Service Employment Eligibility Verification INSTRUCTIONS PLEASE READ ALL INSTRUCTIONS CAREFULLY BEFORE COMPLETING THIS FORM. Anti-Discrimination Notice. It is illegal to discriminate against any individual (other than an alien not authorized to work in the U.S.) in hiring, discharging, or recruiting or referring for a fee because of that individual's national origin or citizenship status. It is illegal to discriminate against work eligible individuals. Employers CANNOT specify which document(s) they will accept from an employee. The refusal to hire an individual because of a future expiration date may also constitute illegal discrimination. Section 1 - Employee. All employees, citizens and noncitizens, hired after November 6, 1986, must complete Section 1 of this form at the time of hire, which is the actual beginning of employment. The employer is responsible for ensuring that Section 1 is timely and properly completed. Preparer/Translator Certification. The Preparer/Translator Certification must be completed if Section 1 is prepared by a person other than the employee. A preparer/translator may be used only when the employee is unable to complete Section 1 on his/her own. However, the employee must still sign Section 1. Section 2 - Employer. For the purpose of completing this form, the term "employer" includes those recruiters and referrers for a fee who are agricultural associations, agricultural employers or farm labor contractors. Employers must complete Section 2 by examining evidence of identity and employment eligibility within three (3) business days of the date employment begins. If employees are authorized to work, but are unable to present the required document(s) within three business days, they must present a receipt for the application of the document(s) within three business days and the actual document(s) within ninety (90) days. However, if employers hire individuals for a duration of less than three business days, Section 2 must be completed at the time employment begins. Employers must record: 1) document title; 2) issuing authority; 3) document number, 4) expiration date, if any; and 5) the date employment begins. Employers must sign and date the certification. Employees must present original documents. Employers may, but are not required to, photocopy the document(s) presented. These photocopies may only be used for the verification process and must be retained with the I-9. However, employers are still responsible for completing the I-9. Section 3 - Updating and Reverification. Employers must complete Section 3 when updating and/or reverifying the I-9. Employers must reverify employment eligibility of their employees on or before the expiration date recorded in Section 1. Employers CANNOT specify which document(s) they will accept from an employee. If an employee's name has changed at the time this form is being updated/ reverified, complete Block A. If an employee is rehired within three (3) years of the date this form was originally completed and the employee is still eligible to be employed on the same basis as previously indicated on this form (updating), complete Block B and the signature block. If an employee is rehired within three (3) years of the date this form was originally completed and the employee's work authorization has expired or if a current employee's work authorization is about to expire (reverification), complete Block B and: examine any document that reflects that the employee is authorized to work in the U.S. (see List A or C), record the document title, document number and expiration date (if any) in Block C, and complete the signature block. Photocopying and Retaining Form I-9. A blank I-9 may be reproduced, provided both sides are copied. The Instructions must be available to all employees completing this form. Employers must retain completed I-9s for three (3) years after the date of hire or one (1) year after the date employment ends, whichever is later. For more detailed information, you may refer to the INS Handbook for Employers, (Form M-274). You may obtain the handbook at your local INS office. Privacy Act Notice. The authority for collecting this information is the Immigration Reform and Control Act of 1986, Pub. L. 99-603 (8 USC 1324a). This information is for employers to verify the eligibility of individuals for employment to preclude the unlawful hiring, or recruiting or referring for a fee, of aliens who are not authorized to work in the United States. This information will be used by employers as a record of their basis for determining eligibility of an employee to work in the United States. The form will be kept by the employer and made available for inspection by officials of the U.S. Immigration and Naturalization Service, the Department of Labor and the Office of Special Counsel for Immigration Related Unfair Employment Practices. Submission of the information required in this form is voluntary. However, an individual may not begin employment unless this form is completed, since employers are subject to civil or criminal penalties if they do not comply with the Immigration Reform and Control Act of 1986. Reporting Burden. We try to create forms and instructions that are accurate, can be easily understood and which impose the least possible burden on you to provide us with information. Often this is difficult because some immigration laws are very complex. Accordingly, the reporting burden for this collection of information is computed as follows: 1) learning about this form, 5 minutes; 2) completing the form, 5 minutes; and 3) assembling and filing (recordkeeping) the form, 5 minutes, for an average of 15 minutes per response. If you have comments regarding the accuracy of this burden estimate, or suggestions for making this form simpler, you can write to the Immigration and Naturalization Service, HQPDI, 425 I Street, N.W., Room 4034, Washington, DC 20536. OMB No. 1115-0136. EMPLOYERS MUST RETAIN COMPLETED FORM I-9 PLEASE DO NOT MAIL COMPLETED FORM I-9 TO INS Form I-9 (Rev. 11-21-91)N OMB No. 1115-0136 U.S. Department of Justice Immigration and Naturalization Service Employment Eligibility Verification Please read instructions carefully before completing this form. The instructions must be available during completion of this form. ANTI-DISCRIMINATION NOTICE: It is illegal to discriminate against work eligible individuals. Employers CANNOT specify which document(s) they will accept from an employee. The refusal to hire an individual because of a future expiration date may also constitute illegal discrimination. Section 1. Employee Information and Verification. Print Name: Last To be completed and signed by employee at the time employment begins. First Address (Street Name and Number) State City I am aware that federal law provides for imprisonment and/or fines for false statements or use of false documents in connection with the completion of this form. Middle Initial Maiden Name Apt. # Date of Birth (month/day/year) Zip Code Social Security # I attest, under penalty of perjury, that I am (check one of the following): A citizen or national of the United States A Lawful Permanent Resident (Alien # A / / An alien authorized to work until (Alien # or Admission #) Date (month/day/year) Employee's Signature Preparer and/or Translator Certification. (To be completed and signed if Section 1 is prepared by a person other than the employee.) I attest, under penalty of perjury, that I have assisted in the completion of this form and that to the best of my knowledge the information is true and correct. Preparer's/Translator's Signature Print Name Address (Street Name and Number, City, State, Zip Code) Date (month/day/year) Section 2. Employer Review and Verification. To be completed and signed by employer. Examine one document from List A OR examine one document from List B and one from List C, as listed on the reverse of this form, and record the title, number and expiration date, if any, of the document(s) List A List B OR List C AND Document title: Issuing authority: Document #: Expiration Date (if any): / / / / / / / / Document #: Expiration Date (if any): CERTIFICATION - I attest, under penalty of perjury, that I have examined the document(s) presented by the above-named employee, that the above-listed document(s) appear to be genuine and to relate to the employee named, that the and that to the best of my knowledge the employee / / employee began employment on (month/day/year) is eligible to work in the United States. (State employment agencies may omit the date the employee began employment.) Signature of Employer or Authorized Representative Business or Organization Name Print Name Title Date (month/day/year) Address (Street Name and Number, City, State, Zip Code) Section 3. Updating and Reverification. To be completed and signed by employer. A. New Name (if applicable) B. Date of rehire (month/day/year) (if applicable) C. If employee's previous grant of work authorization has expired, provide the information below for the document that establishes current employment eligibility. Document Title: Document #: Expiration Date (if any): / / l attest, under penalty of perjury, that to the best of my knowledge, this employee is eligible to work in the United States, and if the employee presented document(s), the document(s) l have examined appear to be genuine and to relate to the individual. Signature of Employer or Authorized Representative Date (month/day/year) Form I-9 (Rev. 11-21-91)N Page 2 LISTS OF ACCEPTABLE DOCUMENTS LIST A Documents that Establish Both Identity and Employment Eligibility Documents that Establish Identity OR 1. U.S. Passport (unexpired or expired) 2. Certificate of U.S. Citizenship (INS Form N-560 or N-561) 3. Certificate of Naturalization (INS Form N-550 or N-570) 4. Unexpired foreign passport, with I-551 stamp or attached INS Form I-94 indicating unexpired employment authorization 5. LIST C LIST B Permanent Resident Card or Alien Registration Receipt Card with photograph (INS Form I-151 or I-551) 6. Unexpired Temporary Resident Card (INS Form I-688) 7. Unexpired Employment Authorization Card (INS Form I-688A) 8. Unexpired Reentry Permit (INS Form I-327) 9. Unexpired Refugee Travel Document (INS Form I-571) 10. Unexpired Employment Authorization Document issued by the INS which contains a photograph (INS Form I-688B) AND 1. Driver's license or ID card issued by a state or outlying possession of the United States provided it contains a photograph or information such as name, date of birth, gender, height, eye color and address 2. ID card issued by federal, state or local government agencies or entities, provided it contains a photograph or information such as name, date of birth, gender, height, eye color and address 3. School ID card with a photograph 4. Voter's registration card Documents that Establish Employment Eligibility 1. U.S. social security card issued by the Social Security Administration (other than a card stating it is not valid for employment) 2. Certification of Birth Abroad issued by the Department of State (Form FS-545 or Form DS-1350) 3. Original or certified copy of a birth certificate issued by a state, county, municipal authority or outlying possession of the United States bearing an official seal 5. U.S. Military card or draft record 6. Military dependent's ID card 7. U.S. Coast Guard Merchant Mariner Card 8. Native American tribal document 9. Driver's license issued by a Canadian government authority For persons under age 18 who are unable to present a document listed above: 10. School record or report card 11. Clinic, doctor or hospital record 4. Native American tribal document 5. U.S. Citizen ID Card (INS Form I-197) 6. ID Card for use of Resident Citizen in the United States (INS Form I-179) 7. Unexpired employment authorization document issued by the INS (other than those listed under List A) 12. Day-care or nursery school record Illustrations of many of these documents appear in Part 8 of the Handbook for Employers (M-274) Form I-9 (Rev. 10/4/00)Y Page 3 Form W-4 (2002) Purpose. Complete Form W-4 so your employer can withhold the correct Federal income tax from your pay. Because your tax situation may change, you may want to refigure your withholding each year. Exemption from withholding. If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. Your exemption for 2002 expires February 16, 2003. See Pub. 505, Tax Withholding and Estimated Tax. Note: You cannot claim exemption from withholding if (a) your income exceeds $750 and includes more than $250 of unearned income (e.g., interest and dividends) and (b) another person can claim you as a dependent on their tax return. Basic instructions. If you are not exempt, complete the Personal Allowances Worksheet below. The worksheets on page 2 adjust your withholding allowances based on itemized deductions, certain credits, adjustments to income, or two-earner/two-job situations. Complete all worksheets that apply. However, you may claim fewer (or zero) allowances. Head of household. Generally, you may claim head of household filing status on your tax return only if you are unmarried and pay more than 50% of the costs of keeping up a home for yourself and your dependent(s) or other qualifying individuals. See line E below. Tax credits. You can take projected tax credits into account in figuring your allowable number of withholding allowances. Credits for child or dependent care expenses and the child tax credit may be claimed using the Personal Allowances Worksheet below. See Pub. 919, How Do I Adjust My Tax Withholding? for information on converting your other credits into withholding allowances. Nonwage income. If you have a large amount of nonwage income, such as interest or dividends, consider making estimated tax payments using Form 1040-ES, Estimated Tax for Individuals. Otherwise, you may owe additional tax. Two earners/two jobs. If you have a working spouse or more than one job, figure the total number of allowances you are entitled to claim on all jobs using worksheets from only one Form W-4. Your withholding usually will be most accurate when all allowances are claimed on the Form W-4 for the highest paying job and zero allowances are claimed on the others. Nonresident alien. If you are a nonresident alien, see the Instructions for Form 8233 before completing this Form W-4. Check your withholding. After your Form W-4 takes effect, use Pub. 919 to see how the dollar amount you are having withheld compares to your projected total tax for 2002. See Pub. 919, especially if you used the Two-Earner/Two-Job Worksheet on page 2 and your earnings exceed $125,000 (Single) or $175,000 (Married). Recent name change? If your name on line 1 differs from that shown on your social security card, call 1-800-772-1213 for a new social security card. Personal Allowances Worksheet (Keep for your records.) A Enter “1” for yourself if no one else can claim you as a dependent ● You are single and have only one job; or B Enter “1” if: ● You are married, have only one job, and your spouse does not work; or ● Your wages from a second job or your spouse’s wages (or the total of both) are $1,000 or less. 兵 A 其 B C Enter “1” for your spouse. But, you may choose to enter “-0-” if you are married and have either a working spouse or more than one job. (Entering “-0-” may help you avoid having too little tax withheld.) C D Enter number of dependents (other than your spouse or yourself) you will claim on your tax return D E Enter “1” if you will file as head of household on your tax return (see conditions under Head of household above) E F Enter “1” if you have at least $1,500 of child or dependent care expenses for which you plan to claim a credit F (Note: Do not include child support payments. See Pub. 503, Child and Dependent Care Expenses, for details.) G Child Tax Credit (including additional child tax credit): ● If your total income will be between $15,000 and $42,000 ($20,000 and $65,000 if married), enter “1” for each eligible child plus 1 additional if you have three to five eligible children or 2 additional if you have six or more eligible children. ● If your total income will be between $42,000 and $80,000 ($65,000 and $115,000 if married), enter “1” if you have one or two eligible children, “2” if you have three eligible children, “3” if you have four eligible children, or “4” if you have five or more eligible children. G 䊳 H Add lines A through G and enter total here. Note: This may be different from the number of exemptions you claim on your tax return. H ● If you plan to itemize or claim adjustments to income and want to reduce your withholding, see the Deductions and Adjustments Worksheet on page 2. For accuracy, complete all ● If you have more than one job or are married and you and your spouse both work and the combined earnings worksheets from all jobs exceed $35,000, see the Two-Earner/Two-Job Worksheet on page 2 to avoid having too little tax that apply. withheld. ● If neither of the above situations applies, stop here and enter the number from line H on line 5 of Form W-4 below. 兵 Cut here and give Form W-4 to your employer. Keep the top part for your records. Form W-4 Employee’s Withholding Allowance Certificate Department of the Treasury Internal Revenue Service 1 䊳 For Privacy Act and Paperwork Reduction Act Notice, see page 2. Type or print your first name and middle initial Home address (number and street or rural route) City or town, state, and ZIP code Last name 2 OMB No. 1545-0010 2002 Your social security number 3 Single Married Married, but withhold at higher Single rate. Note: If married, but legally separated, or spouse is a nonresident alien, check the “Single” box. 4 If your last name differs from that on your social security card, check here. You must call 1-800-772-1213 for a new card 5 6 7 䊳 5 Total number of allowances you are claiming (from line H above or from the applicable worksheet on page 2) 6 $ Additional amount, if any, you want withheld from each paycheck I claim exemption from withholding for 2002, and I certify that I meet both of the following conditions for exemption: ● Last year I had a right to a refund of all Federal income tax withheld because I had no tax liability and ● This year I expect a refund of all Federal income tax withheld because I expect to have no tax liability. 䊳 If you meet both conditions, write “Exempt” here 7 Under penalties of perjury, I certify that I am entitled to the number of withholding allowances claimed on this certificate, or I am entitled to claim exempt status. Employee’s signature (Form is not valid unless you sign it.) 8 䊳 Date Employer’s name and address (Employer: Complete lines 8 and 10 only if sending to the IRS.) Cat. No. 10220Q 9 䊳 Office code (optional) 10 Employer identification number Form W-4 (2002) Page 2 Deductions and Adjustments Worksheet Note: Use this worksheet only if you plan to itemize deductions, claim certain credits, or claim adjustments to income on 1 Enter an estimate of your 2002 itemized deductions. These include qualifying home mortgage interest, charitable contributions, state and local taxes, medical expenses in excess of 7.5% of your income, and miscellaneous deductions. (For 2002, you may have to reduce your itemized deductions if your income 1 is over $137,300 ($68,650 if married filing separately). See Worksheet 3 in Pub. 919 for details.) $7,850 if married filing jointly or qualifying widow(er) $6,900 if head of household 2 2 Enter: $4,700 if single $3,925 if married filing separately 3 Subtract line 2 from line 1. If line 2 is greater than line 1, enter “-0-” 3 4 Enter an estimate of your 2002 adjustments to income, including alimony, deductible IRA contributions, and student loan interest 4 5 Add lines 3 and 4 and enter the total. Include any amount for credits from Worksheet 7 in Pub. 919. 5 6 Enter an estimate of your 2002 nonwage income (such as dividends or interest) 6 7 Subtract line 6 from line 5. Enter the result, but not less than “-0-” 7 8 Divide the amount on line 7 by $3,000 and enter the result here. Drop any fraction 8 9 Enter the number from the Personal Allowances Worksheet, line H, page 1 9 10 Add lines 8 and 9 and enter the total here. If you plan to use the Two-Earner/Two-Job Worksheet, also enter this total on line 1 below. Otherwise, stop here and enter this total on Form W-4, line 5, page 1 10 兵 其 your 2002 tax return. $ $ $ $ $ $ $ Two-Earner/Two-Job Worksheet Note: Use this worksheet only if the instructions under line H on page 1 direct you here. 1 Enter the number from line H, page 1 (or from line 10 above if you used the Deductions and Adjustments Worksheet) 2 Find the number in Table 1 below that applies to the lowest paying job and enter it here If line 1 is more than or equal to line 2, subtract line 2 from line 1. Enter the result here (if zero, enter “-0-”) and on Form W-4, line 5, page 1. Do not use the rest of this worksheet Note: If line 1 is less than line 2, enter “-0-” on Form W-4, line 5, page 1. Complete lines 4–9 below to calculate the additional withholding amount necessary to avoid a year end tax bill. 1 2 3 4 5 6 7 8 9 Enter the number from line 2 of this worksheet 4 Enter the number from line 1 of this worksheet 5 Subtract line 5 from line 4 Find the amount in Table 2 below that applies to the highest paying job and enter it here Multiply line 7 by line 6 and enter the result here. This is the additional annual withholding needed Divide line 8 by the number of pay periods remaining in 2002. For example, divide by 26 if you are paid every two weeks and you complete this form in December 2001. Enter the result here and on Form W-4, line 6, page 1. This is the additional amount to be withheld from each paycheck 3 6 7 8 $ $ 9 $ Table 1: Two-Earner/Two-Job Worksheet Married Filing Jointly If wages from LOWEST paying job are— $0 4,001 9,001 15,001 20,001 25,001 32,001 38,001 - Enter on line 2 above $4,000 9,000 15,000 20,000 25,000 32,000 38,000 44,000 0 1 2 3 4 5 6 7 All Others If wages from LOWEST paying job are— 44,001 50,001 55,001 65,001 80,001 95,001 110,001 125,001 - 50,000 - 55,000 - 65,000 - 80,000 - 95,000 - 110,000 - 125,000 and over Enter on line 2 above 8 9 10 11 12 13 14 15 If wages from LOWEST paying job are— $0 6,001 11,001 17,001 23,001 28,001 38,001 55,001 Enter on line 2 above - $6,000 - 11,000 - 17,000 - 23,000 - 28,000 - 38,000 - 55,000 - 75,000 0 1 2 3 4 5 6 7 If wages from LOWEST paying job are— 75,001 - 95,000 95,001 - 110,000 110,001 and over Enter on line 2 above 8 9 10 Table 2: Two-Earner/Two-Job Worksheet Married Filing Jointly If wages from HIGHEST paying job are— $0 50,001 100,001 150,001 270,001 - $50,000 - 100,000 - 150,000 - 270,000 and over Enter on line 7 above $450 800 900 1,050 1,150 Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. The Internal Revenue Code requires this information under sections 3402(f)(2)(A) and 6109 and their regulations. Failure to provide a properly completed form will result in your being treated as a single person who claims no withholding allowances; providing fraudulent information may also subject you to penalties. Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation, to cities, states, and the District of Columbia for use in administering their tax laws, and using it in the National Directory of New Hires. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB All Others If wages from HIGHEST paying job are— $0 30,001 70,001 140,001 300,001 - $30,000 - 70,000 - 140,000 - 300,000 and over Enter on line 7 above $450 800 900 1,050 1,150 control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. The time needed to complete this form will vary depending on individual circumstances. The estimated average time is: Recordkeeping, 46 min.; Learning about the law or the form, 13 min.; Preparing the form, 59 min. If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA 95743-0001. Do not send the tax form to this address. Instead, give it to your employer.

© Copyright 2025