A cost effective way to set up an investment fund

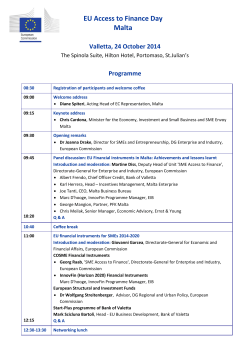

A cost effective way to set up an investment fund You focus on what’s important: Your investments, Your Clients We worry about the rest: Regulations, Compliance, Risk and Operations 2 About Comino Platform The Comino Umbrella SICAV Platform As an EU member, Malta has become is a third party fund sponsor and a preferred choice for many asset management company. We offer an managers seeking to domicile their efficient and cost effective path to investment vehicle on shore. We can launching Professional Investor Funds afford you the opportunity to join (PIF’s) through a collective investment our Comino SICAV platform so you scheme infrastructure. The Comino can enjoy the benefits of sharing the Platform is fully regulated by the services of our fund management Malta Financial Services Authority company, to manage your client’s assets (MFSA) providing a one-stop shop for in an affordable and efficient manner. independent managers. 3 Comino Platform Benefits Launching your fund in the EU Launching your fund quickly - Malta is a regulated and respected onshore jurisdiction; -We endeavor to have your fund operational - Increased investor demand for EU domiciled funds; - We maintain high levels of integrity and professional service; within 6-12 weeks; -We expedite the process. - Our partners are the most respected names in the business. A cost effective approach Flexibility - Low start up costs; The structure’s flexibility allows for numerous strategies such -Efficient annual running costs; as hedge funds, long-only, property and private equity funds. -Underlying service suppliers offering best rates; -Maltese funds are not taxed. 4 The Professional Investor Fund (PIF) Benefits Minimal investment restrictions provide greater flexibility: The PIF structure is optimal for: Compared to UCITS funds PIF’s are more flexible Asset managers wanting an EU regulated cost and tax regarding strategies, liquidity, leverage and efficient fund. diversification requirements. Financial advisors that want to convert their model portfolio PIF’s can invest in nearly an unlimited variety of movable into a single fund. and immovable assets, from financial securities and instruments to assets such as art collections, vintage cars High net worth individuals who want to convert their and watches e.t.c. investments into a single, tax efficient structure. Up to 100% leverage is permitted. Family offices and other small institutions wanting their own fund for auditing, reporting and tax efficiency. Marketable within the EU and many outside jurisdictions: PIF’s are on-shore EU regulated investment vehicles that can be distributed globally. “The name of your fund does not have to reflect that it is a sub-fund of the Comino Platform.” 5 The Comino SICAV Umbrella Structure brella Fund SIC o Um AV n i plc m o . C Your Sub-fund (A) Your Sub-fund (B) Your Sub-fund (C) Broker Investors Investors Investors Custody Advisor Audit Legal Admin FMG (Malta) Ltd. The Investment Manager Sub-Management or Sub-Advisory Agreement You, the Sub-Manager or Sub-Advisor Selected by You Open Architecture of Service Providers 6 The Process We consult with you to understand your needs: Set-up process: •We ascertain whether you are regulated by a recognized •Due diligence is carried out; jurisdiction. If ‘yes’ you will be engaged as a sub- •Legal work is conducted; manager, if ‘not’ you will be appointed a ‘sub-advisor’; •We certify that agreements are in place with service •We verify that the investment strategy falls within the PIF framework; •We discuss potential service providers available to you. • We validate the structure; providers; •We submit offering documents and liaise with regulatory authorities; •You will consult with the Comino SICAV investment committee. We review the fund agreement between the Comino SICAV and yourself: Process is complete, your fund is approved and ready •We decide upon the applicable service providers to be to launch. utilized and agreed upon fee schedule; •We discuss duties and obligations of each party; •The relationship between the parties is formalized and the set-up process is launched. 7 At a Glance •We handle the submission of all documentation required by the regulator. • We manage regulatory and fund administration duties and closely monitor compliance requirements. • We supervise necessary trade execution and money management issues. • We allow you to concentrate on what you do best — asset and portfolio management. • The Comino Platform is entrusted with the day-to-day management of your fund. Particulars Set up Cost From EUR 10,000 Set up Time 6 - 12 weeks Min Launch AUM EUR 1,000,000 Min Subscription EUR 10,000 Fund Structure SICAV (PIF) Domicile Malta Base Currency EUR, USD or GBP Trade Frequency Daily, weekly, monthly or quarterly 8 Facts About Malta Fund Sector Domiciled Funds total: 578 Professional Investor Funds (PIF): 460 Recognised Fund Administrators: 26 (30th September 2012) Fund Managers: Approx. 70 Regulation & Legislation: Investment Services Act, Investment Services Rules Country Official Name: Republic of Malta Capital: Valletta Location: Southern Europe Population: 416,046 (2010) Time: 1 hour ahead of GMT Languages: English ,Maltese Finance Centre Contribution to GDP: 12 per cent Employs: 10,000 people Banks: 27 Bank Assets: 50 billion euro Double Taxation Treaties: 62 Regulator: Malta Financial Services Authority (MFSA), www.mfsa.com.mt GDP Composition by sector: Agriculture 2%, Industry 23%, Services 75% Sovereign Rating: BBB+/A-2 (Standard & Poor’s 2013), A+ (Fitch, 2011) Accounting Standard: IFRS Fund/AUM Trends 12 10.3 billion 10 8 6 4 2 0 Economy Total GDP (EUR) 2010: 6.2 billion GDP per Capita (EUR) 2010: 14,982 GDP Growth in real terms 2010: 3.7% 5 billion 578 165 2006 No. Funds Today AUM Source: Finance Malta 9 Contact Comino Platform Airways House 6th Floor Gaiety Lane, Sliema SLM 1549, Malta Telephone: +356 21314011 Fax: +356 20141203 Email:launchyourfund@cominoplatform.com Website:www.cominoplatform.com Legal Disclaimer The information available in this presentation is for information purposes only and is provided in good faith. Whilst every care has been taken to ensure that the content of this presentation is correct, no responsibility will be accepted for any errors which it may contain. The information in this presentation may be updated or altered at any time, without FMG (Malta) Ltd. (“FMG”) having to give prior notice. Opinions or estimates reflect FMG’s judgement at the date of the issuance of the information, and such opinions and estimates are also subject to change without notice. Neither this presentation, nor any of the information it contains, constitutes or will form the basis of a representation, contract or term of any contract. It is essential that before proceeding with any course of action, you take relevant professional advice, particularly professional advice on individual tax, estate planning, wealth management, exchange control or legal matters in your country of residence, nationality and/or domicile. Information in the presentation and FMG logos and trademarks (whether licensed or unlicensed) belong to FMG and may not be copied, reproduced or transmitted without the prior written consent of FMG. Comino Umbrella Fund SICAV plc is licenced by the Malta Financial Services Authority as a Professional Investor Fund. The Malta Financial Services Authority has made no assessment or value judgement on the soundness of the company or on the accuracy or completeness of the statements made, or opinions expressed, in this presentation.

© Copyright 2025