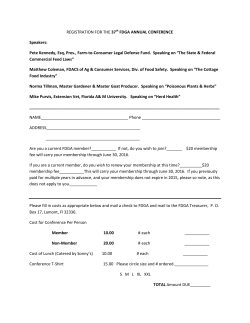

dnb group