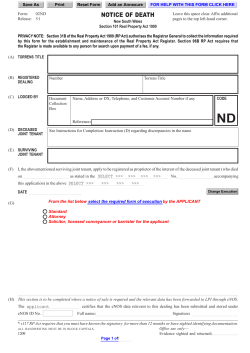

U.S. DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT NOTICE: H 2013-06 Issued: