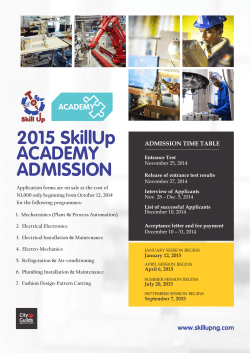

Training