Engro Corporation - Investor Guide Pakistan

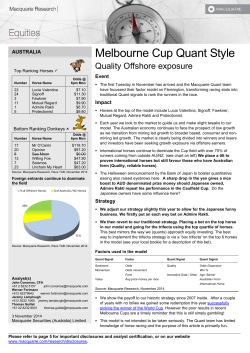

PAKISTAN ENGRO PA Price (at 13:41, 08 Jan 2015 GMT) Valuation Outperform Rs248.63 Rs 291.60 Engro Corporation Gaining Momentum Event - Sum of Parts 12-month target Rs 291.60 Upside/Downside % +17.3 12-month TSR % +18.9 Volatility Index Medium GICS sector Materials Market cap Rsm 130,229 Market cap US$m 1,293 30-day avg turnover US$m 10.1 Number shares on issue m 523.8 Revenue EBIT EBIT growth Reported profit EPS rep EPS rep growth PER rep Total DPS Total div yield ROA ROE EV/EBITDA Net debt/equity P/BV 2013A 2014E 2015E 2016E bn bn % bn Rs % x Rs % % % x % x 155.4 23.1 54.3 8.2 15.62 513.8 15.9 0.00 0.0 11.6 18.3 6.2 138.4 2.6 (ENGRO) amid the improving dynamics of its fertilizer and food businesses. Further, curtailed losses of its subsidiary Engro Eximp and commencement of Engro Elengy will augment CY15 earnings, in our view. Extended flows of diverted gas from Guddu beyond December 2015, and material development on Sindh Engro Coal Mining Corporation (SECMC) could further improve stock attractiveness. We reiterate our Outperform rating and raise our target price from Rs152.70 to Rs291.60. Impact Investment fundamentals Year end 31 Dec We believe the coming months look promising for Engro Corporation 171.4 19.1 -17.2 6.5 12.49 -20.0 19.9 1.00 0.4 9.0 12.3 7.1 93.6 2.4 185.1 30.9 62.0 16.6 31.68 153.6 7.8 4.00 1.6 14.6 26.6 4.9 46.7 1.9 198.5 32.9 6.4 18.8 35.82 13.1 6.9 8.00 3.2 15.8 24.4 4.7 24.4 1.5 ENGRO PA rel Pakistan KSE 100 Share performance, & rec history Improved gas scenario: The Economic Coordination Committee (ECC) has extended Guddu power plant supply to Engro Fertilizer (EFERT) until December 2015 to reciprocate for its commitment to install a gas booster compressor for the 747MW Guddu Power Plant (GENCO-II). We believe this will allow the company to operate both plants at ~75% capacity in CY15 vs our estimate of 53%. This should lead to incremental earnings of Rs4.5/sh after incorporating the cost of installing gas compressors (US$15.36m), in addition to the impact of concessionary gas and deleveraging. EFOODS recuperating from lean patch: Engro Foods’ (EFOODS) focus on resolution of supply chain issues is likely to rejuvenate volumes. Improving volumes along with reduction in fuel and distribution cost (on the back of plummeting oil prices) would likely to improve the margins in CY15. Further strength to our case comes from registration of “Omung” as a ‘Dairy Drink’ at Federal level that may resolve its issue with the Punjab Food Authority (PFA). Volte-face on Eximp business: Despite healthy trading margins in its DAP Note: Recommendation timeline - if not a continuous line, then there was no Macquarie coverage at the time or there was an embargo period. Source: FactSet, Macquarie Research, January 2015 (all figures in PKR unless noted) segment on the back of timely purchases, the company incurred a Rs5.14/sh loss during the first nine months. As per latest financials, the substantial loss mainly comes from its rice business as a result of higher inventory of rice paddy procured at elevated prices. However, we estimate this segment will be back in the black in CY15, due to lower inventory levels of both rice and DAP. Earnings and target price revision We cut our reported EPS by 48% for CY14, given: 1) decline in margins of EFOODS along with the loss on sale of the North American business; and, 2) the loss at EXIMP. However, we lift our CY15 estimates by 31%, on the back of improved gas scenario along with improving margins of food business. Subsequently, we increase our TP to Rs291.6/sh from Rs152.7. Analyst(s) James Hubbard, CFA +852 3922 1226 james.hubbard@macquarie.com Price catalyst 12-month price target: Rs291.60 based on a Sum of Parts methodology. Foundation Securities Nauman Khan +92 21 3561-2290-94 nauman.khan@fs.com.pk Ext 338 Mohammad Awais Ashraf +92 21 3561-2290-94 m.awais@fs.com.pk Ext 339 \ 9 January 2015 Catalyst: 1) Further extension in flows from Guddu, 2) recovery in Omung sales and 3) materialization of SECMC and Engro Elengy terminal. Action and recommendation We reiterate our Outperform stance, given positive earnings outlook on the back of continued flows from Guddu and improved EFOODS margins. Macquarie Capital Securities Limited Please refer to page 4 for important disclosures and analyst certification, or on our website www.macquarie.com/research/disclosures. Macquarie Research Engro Corporation Macquarie Quant View 190/254 Global Alpha Model Sector Rank % of BUY recommendations Number of Price Target downgrades Number of Price Target upgrades Attractive Displays where the company’s ranked based on the fundamental consensus Price Target and Macquarie’s Quantitative Alpha model. The rankings are displayed relative to the sector and country. Fundamentals The quant model currently holds a reasonably negative view on Engro Corporation. The strongest style exposure is Price Momentum, indicating this stock has had strong medium to long term returns which often persist into the future. The weakest style exposure is Profitability, indicating this stock is not efficiently converting its investments to earnings as proxied by ratios such as ROE, ROA etc. Quant Rank within Country 100% (6/6) 1 1 Rank within Sector Macquarie Alpha Model ranking Factors driving the Alpha Model A list of comparable companies and their Macquarie Alpha model score (higher is better). For the comparable firms this chart shows the key underlying styles and their contribution to the current overall Alpha score. Lucky Cement Lucky Cement 1.8 Fatima Fertilizer Fatima Fertilizer 0.9 Engro Corporation Engro Corporation -0.8 -3.0 -2.0 -1.0 0.0 1.0 2.0 3.0 -100% -80% Valuations -60% Growth -40% -20% Profitability 0% 20% Earnings Momentum 40% 60% Price Momentum 80% 100% Quality Macquarie Earnings Sentiment Indicator Drivers of Stock Return The Macquarie Sentiment Indicator is an enhanced earnings revisions signal that favours analysts who have more timely and higher conviction revisions. Current score shown below. Breakdown of 1 year total return (local currency) into returns from dividends, changes in forward earnings estimates and the resulting change in earnings multiple. Lucky Cement Lucky Cement 1.3 Fatima Fertilizer Fatima Fertilizer 0.4 Engro Corporation Engro Corporation 0.0 -3.0 -2.0 -1.0 0.0 1.0 2.0 3.0 -70% -50% Dividend Return -30% -10% Multiple Return 10% 30% Earnings Outlook 50% What drove this Company in the last 5 years How it looks on the Alpha model Which factor score has had the greatest correlation with the company’s returns over the last 5 years. A more granular view of the underlying style scores that drive the alpha (higher is better) and the percentile rank relative to the sector and country ⇐ Negatives Positives ⇒ Price to Book NTM BPS Growth FY1 28% Price to Book FY1 24% Price to Sales NTM 21% Merton Score -15% Profit Margin NTM -15% Profit Margin FY1 -17% EBITDA Revisions 3 Month -40% Normalized Score 31% -21% -20% 0% 20% 40% Alpha Model Score Valuation Growth Profitability Earnings Momentum Price Momentum Quality Capital & Funding Liquidity Risk Technicals & Trading 0 Percentile relative to sector(/254) 70% 1Yr Total Return Percentile relative to country(/5) -0.77 -0.70 0.97 -0.86 -0.56 1.30 -0.56 0.23 -0.13 -1.52 -0.48 0 0 1 50 100 0 50 1 100 For more details on the Macquarie Alpha model or for more customised analysis and screens, please contact the Macquarie Global Quantitative/Custom Products Group (cpg@macquarie.com) 9 January 2015 2 Macquarie Research Engro Corporation Engro Corporation (ENGRO PA, Outperform, Target Price: Rs291.60) Interim Results 1H/14A 2H/14E 1H/15E 2H/15E Profit & Loss 2013A 2014E 2015E 2016E Revenue Gross Profit Cost of Goods Sold EBITDA Depreciation Amortisation of Goodwill Other Amortisation EBIT Net Interest Income Associates Exceptionals Forex Gains / Losses Other Pre-Tax Income Pre-Tax Profit Tax Expense Net Profit Minority Interests m m m m m m m m m m m m m m m m m 77,541 16,770 60,771 12,176 3,496 0 0 8,680 -3,690 0 0 0 362 5,351 -2,188 3,163 -480 93,864 18,356 75,508 15,662 5,243 0 0 10,419 -3,063 0 0 0 604 7,960 -2,779 5,181 -1,321 74,060 20,181 53,879 15,955 3,579 0 0 12,376 -1,518 0 0 0 469 11,328 -3,430 7,898 -1,402 111,090 30,272 80,818 23,932 5,368 0 0 18,564 -2,277 0 0 0 525 16,813 -5,145 11,668 -1,569 Revenue Gross Profit Cost of Goods Sold EBITDA Depreciation Amortisation of Goodwill Other Amortisation EBIT Net Interest Income Associates Exceptionals Forex Gains / Losses Other Pre-Tax Income Pre-Tax Profit Tax Expense Net Profit Minority Interests m m m m m m m m m m m m m m m m m 155,360 40,597 114,763 31,633 8,565 0 0 23,068 -10,415 0 0 0 610 13,263 -4,573 8,690 -507 171,405 35,125 136,280 27,838 8,739 0 0 19,099 -6,753 0 0 0 966 13,312 -4,967 8,344 -1,800 185,150 50,453 134,697 39,887 8,947 0 0 30,940 -3,794 0 0 0 995 28,140 -8,575 19,566 -2,971 198,503 51,555 146,948 42,077 9,160 0 0 32,917 -2,714 0 0 0 1,025 31,228 -9,114 22,113 -3,350 Reported Earnings Adjusted Earnings m m 2,684 2,684 3,860 3,860 6,496 6,496 10,099 10,099 Reported Earnings Adjusted Earnings m m 8,183 8,183 6,544 6,544 16,595 16,595 18,763 18,763 EPS (rep) EPS (adj) EPS Growth yoy (adj) % 5.12 5.12 -22.0 7.37 7.37 -18.6 12.40 12.40 142.1 19.28 19.28 161.6 EPS (rep) EPS (adj) EPS Growth (adj) PE (rep) PE (adj) % x x 15.62 15.62 513.8 15.9 15.9 12.49 12.49 -20.0 19.9 19.9 31.68 31.68 153.6 7.8 7.8 35.82 35.82 13.1 6.9 6.9 EBITDA Margin EBIT Margin Earnings Split Revenue Growth EBIT Growth % % % % % 15.7 11.2 41.0 16.0 -17.5 16.7 11.1 59.0 6.1 -16.9 21.5 16.7 39.1 -4.5 42.6 21.5 16.7 60.9 18.4 78.2 Total DPS Total Div Yield Basic Shares Outstanding Diluted Shares Outstanding % m m 0.00 0.0 524 524 1.00 0.4 524 524 4.00 1.6 524 524 8.00 3.2 524 524 2013A 2014E 2015E 2016E 2013A 2014E 2015E 2016E 31,633 -4,573 9,802 0 -9,913 26,950 0 -8,413 0 -15,610 -24,023 0 0 -7,066 6,375 -691 27,838 -4,967 6,777 0 -5,787 23,860 0 -10,134 0 -758 -10,893 0 0 -11,113 -210 -11,323 39,887 -8,575 2,455 0 -2,800 30,967 0 -1,248 0 -1,440 -2,688 -524 0 -15,184 -15,373 -31,080 42,077 -9,114 405 0 -1,689 31,679 0 -2,629 0 -7,546 -10,175 -2,095 0 -15,594 -1,889 -19,578 Profit and Loss Ratios Revenue Growth EBITDA Growth EBIT Growth Gross Profit Margin EBITDA Margin EBIT Margin Net Profit Margin Payout Ratio EV/EBITDA EV/EBIT % % % % % % % % x x 24.1 36.3 54.3 26.1 20.4 14.8 5.3 0.0 6.2 8.6 10.3 -12.0 -17.2 20.5 16.2 11.1 3.8 8.0 7.1 10.3 8.0 43.3 62.0 27.2 21.5 16.7 9.0 12.6 4.9 6.4 7.2 5.5 6.4 26.0 21.2 16.6 9.5 22.3 4.7 6.0 Balance Sheet Ratios ROE ROA ROIC Net Debt/Equity Interest Cover Price/Book Book Value per Share % % % % x x 18.3 11.6 12.8 138.4 2.2 2.6 97.1 12.3 9.0 8.9 93.6 2.8 2.4 105.2 26.6 14.6 17.3 46.7 8.2 1.9 132.7 24.4 15.8 19.4 24.4 12.1 1.5 160.5 Cashflow Analysis EBITDA Tax Paid Chgs in Working Cap Net Interest Paid Other Operating Cashflow Acquisitions Capex Asset Sales Other Investing Cashflow Dividend (Ordinary) Equity Raised Debt Movements Other Financing Cashflow m m m m m m m m m m m m m m m m Net Chg in Cash/Debt m 2,236 1,645 -2,801 1,926 Free Cashflow m 18,536 13,726 29,720 29,050 2013A 2014E 2015E 2016E 6,899 3,033 27,738 21,674 132,686 808 14,069 206,907 40,129 6,380 78,321 0 25,874 150,704 32,466 5,319 18,418 56,203 206,907 8,545 5,429 31,526 21,740 134,172 316 16,172 217,899 53,205 7,590 61,166 0 31,618 153,579 38,486 9,222 16,613 64,321 217,899 5,745 3,615 32,934 23,353 126,659 316 12,411 205,033 53,830 8,000 35,894 0 25,598 123,322 52,986 12,193 16,532 81,711 205,033 7,671 3,876 35,309 31,057 120,250 316 12,692 211,170 57,712 8,000 23,935 0 21,889 111,536 67,559 15,543 16,532 99,634 211,170 Balance Sheet Cash Receivables Inventories Investments Fixed Assets Intangibles Other Assets Total Assets Payables Short Term Debt Long Term Debt Provisions Other Liabilities Total Liabilities Shareholders' Funds Minority Interests Other Total S/H Equity Total Liab & S/H Funds m m m m m m m m m m m m m m m m m m m All figures in PKR unless noted. Source: Company data, Macquarie Research, January 2015 9 January 2015 3 Macquarie Research Engro Corporation Important disclosures: Recommendation definitions Volatility index definition* Financial definitions Macquarie - Australia/New Zealand Outperform – return >3% in excess of benchmark return Neutral – return within 3% of benchmark return Underperform – return >3% below benchmark return This is calculated from the volatility of historical price movements. All "Adjusted" data items have had the following adjustments made: Added back: goodwill amortisation, provision for catastrophe reserves, IFRS derivatives & hedging, IFRS impairments & IFRS interest expense Excluded: non recurring items, asset revals, property revals, appraisal value uplift, preference dividends & minority interests Benchmark return is determined by long term nominal GDP growth plus 12 month forward market dividend yield Macquarie – Asia/Europe Outperform – expected return >+10% Neutral – expected return from -10% to +10% Underperform – expected return <-10% Macquarie First South - South Africa Outperform – expected return >+10% Neutral – expected return from -10% to +10% Underperform – expected return <-10% Macquarie - Canada Outperform – return >5% in excess of benchmark return Neutral – return within 5% of benchmark return Underperform – return >5% below benchmark return Macquarie - USA Outperform (Buy) – return >5% in excess of Russell 3000 index return Neutral (Hold) – return within 5% of Russell 3000 index return Underperform (Sell)– return >5% below Russell 3000 index return Very high–highest risk – Stock should be expected to move up or down 60–100% in a year – investors should be aware this stock is highly speculative. High – stock should be expected to move up or down at least 40–60% in a year – investors should be aware this stock could be speculative. Medium – stock should be expected to move up or down at least 30–40% in a year. Low–medium – stock should be expected to move up or down at least 25–30% in a year. Low – stock should be expected to move up or down at least 15–25% in a year. * Applicable to Asia/Australian/NZ/Canada stocks only EPS = adjusted net profit / efpowa* ROA = adjusted ebit / average total assets ROA Banks/Insurance = adjusted net profit /average total assets ROE = adjusted net profit / average shareholders funds Gross cashflow = adjusted net profit + depreciation *equivalent fully paid ordinary weighted average number of shares All Reported numbers for Australian/NZ listed stocks are modelled under IFRS (International Financial Reporting Standards). Recommendations – 12 months Note: Quant recommendations may differ from Fundamental Analyst recommendations Recommendation proportions – For quarter ending 31 December 2014 Outperform Neutral Underperform AU/NZ 51.80% 31.80% 16.39% Asia 58.06% 27.37% 14.57% RSA 45.07% 30.99% 23.94% USA 44.42% 50.10% 5.48% CA 60.54% 35.37% 4.08% EUR 46.81% (for US coverage by MCUSA, 5.29% of stocks followed are investment banking clients) 33.51% (for US coverage by MCUSA, 3.08% of stocks followed are investment banking clients) 19.68% (for US coverage by MCUSA, 0.44% of stocks followed are investment banking clients) ENGRO PA vs Pakistan KSE 100 Share, & rec history (all figures in PKR currency unless noted) Note: Recommendation timeline – if not a continuous line, then there was no Macquarie coverage at the time or there was an embargo period. Source: FactSet, Macquarie Research, January 2015 12-month target price methodology ENGRO PA: Rs291.60 based on a Sum of Parts methodology Company-specific disclosures: Important disclosure information regarding the subject companies covered in this report is available at www.macquarie.com/disclosures. Date 13-Aug-2012 Stock Code (BBG code) ENGRO PA Recommendation Outperform Target Price Rs152.70 Target price risk disclosures: ENGRO PA: Any inability to compete successfully in their markets may harm the business. This could be a result of many factors which may include geographic mix and introduction of improved products or service offerings by competitors. The results of operations may be materially affected by global economic conditions generally, including conditions in financial markets. The company is exposed to market risks, such as changes in interest rates, foreign exchange rates and input prices. From time to time, the company will enter into transactions, including transactions in derivative instruments, to manage certain of these exposures. Analyst certification: The views expressed in this research accurately reflect the personal views of the Macquarie analyst(s) and Foundation Securities analyst(s) about the subject securities or issuers and no part of the compensation of the analyst(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views expressed by the analyst(s) in this research. The Macquarie analyst principally responsible for the preparation of this research receives compensation based on overall revenues of Macquarie Group Ltd ABN 94 122 169 279 (AFSLNo. 318062) (MGL) and its related entities (the Macquarie Group) and has taken reasonable care to achieve and maintain independence and objectivity in making any recommendations. General disclaimers: Macquarie Securities (Australia) Ltd; Macquarie Capital (Europe) Ltd; Macquarie Capital Markets Canada Ltd; Macquarie Capital Markets North America Ltd; Macquarie Capital (USA) Inc; Macquarie Capital Securities Ltd and its Taiwan branch; Macquarie Capital Securities (Singapore) Pte Ltd; Macquarie Securities (NZ) Ltd; Macquarie First South Securities (Pty) Limited; Macquarie Capital Securities (India) Pvt Ltd; Macquarie Capital Securities (Malaysia) Sdn Bhd; Macquarie Securities Korea Limited and Macquarie Securities (Thailand) Ltd are not authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia), and their obligations do not represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (MBL) or MGL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of any of the above mentioned entities. MGL provides a guarantee to the Monetary Authority of Singapore in respect of the obligations and liabilities of Macquarie Capital Securities (Singapore) Pte Ltd for up to SGD 35 million. This research has been prepared for the general use of the wholesale clients of the Macquarie 9 January 2015 4 Macquarie Research Engro Corporation Group and must not be copied, either in whole or in part, or distributed to any other person. If you are not the intended recipient you must not use or disclose the information in this research in any way. If you received it in error, please tell us immediately by return e-mail and delete the document. We do not guarantee the integrity of any e-mails or attached files and are not responsible for any changes made to them by any other person. MGL has established and implemented a conflicts policy at group level (which may be revised and updated from time to time) (the "Conflicts Policy") pursuant to regulatory requirements (including the FCA Rules) which sets out how we must seek to identify and manage all material conflicts of interest. Nothing in this research shall be construed as a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction. In preparing this research, we did not take into account your investment objectives, financial situation or particular needs. Macquarie salespeople, traders and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions which are contrary to the opinions expressed in this research. Macquarie Research produces a variety of research products including, but not limited to, fundamental analysis, macro-economic analysis, quantitative analysis, and trade ideas. Recommendations contained in one type of research product may differ from recommendations contained in other types of research, whether as a result of differing time horizons, methodologies, or otherwise. Before making an investment decision on the basis of this research, you need to consider, with or without the assistance of an adviser, whether the advice is appropriate in light of your particular investment needs, objectives and financial circumstances. There are risks involved in securities trading. The price of securities can and does fluctuate, and an individual security may even become valueless. International investors are reminded of the additional risks inherent in international investments, such as currency fluctuations and international stock market or economic conditions, which may adversely affect the value of the investment. This research is based on information obtained from sources believed to be reliable but we do not make any representation or warranty that it is accurate, complete or up to date. We accept no obligation to correct or update the information or opinions in it. Opinions expressed are subject to change without notice. No member of the Macquarie Group accepts any liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this research and/or further communication in relation to this research. Clients should contact analysts at, and execute transactions through, a Macquarie Group entity in their home jurisdiction unless governing law permits otherwise. The date and timestamp for above share price and market cap is the closed price of the price date. #CLOSE is the final price at which the security is traded in the relevant exchange on the date indicated. Country-specific disclaimers: Australia: In Australia, research is issued and distributed by Macquarie Securities (Australia) Ltd (AFSL No. 238947), a participating organisation of the Australian Securities Exchange. New Zealand: In New Zealand, research is issued and distributed by Macquarie Securities (NZ) Ltd, a NZX Firm. Canada: In Canada, research is prepared, approved and distributed by Macquarie Capital Markets Canada Ltd, a participating organisation of the Toronto Stock Exchange, TSX Venture Exchange & Montréal Exchange. Macquarie Capital Markets North America Ltd., which is a registered brokerdealer and member of FINRA, accepts responsibility for the contents of reports issued by Macquarie Capital Markets Canada Ltd in the United States and sent to US persons. Any US person wishing to effect transactions in the securities described in the reports issued by Macquarie Capital Markets Canada Ltd should do so with Macquarie Capital Markets North America Ltd. The Research Distribution Policy of Macquarie Capital Markets Canada Ltd is to allow all clients that are entitled to have equal access to our research. United Kingdom: In the United Kingdom, research is issued and distributed by Macquarie Capital (Europe) Ltd, which is authorised and regulated by the Financial Conduct Authority (No. 193905). Germany: In Germany, this research is issued and/or distributed by Macquarie Capital (Europe) Limited, Niederlassung Deutschland, which is authorised and regulated by the UK Financial Conduct Authority (No. 193905). and in Germany by BaFin. France: In France, research is issued and distributed by Macquarie Capital (Europe) Ltd, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority (No. 193905). Hong Kong & Mainland China: In Hong Kong, research is issued and distributed by Macquarie Capital Securities Ltd, which is licensed and regulated by the Securities and Futures Commission. In Mainland China, Macquarie Securities (Australia) Limited Shanghai Representative Office only engages in nonbusiness operational activities excluding issuing and distributing research. Only non-A share research is distributed into Mainland China by Macquarie Capital Securities Ltd. Japan: In Japan, research is issued and distributed by Macquarie Capital Securities (Japan) Limited, a member of the Tokyo Stock Exchange, Inc. and Osaka Securities Exchange Co. Ltd (Financial Instruments Firm, Kanto Financial Bureau (kin-sho) No. 231, a member of Japan Securities Dealers Association and The Financial Futures Association of Japan and Japan Investment Advisers Association). India: In India, research is issued and distributed by Macquarie Capital Securities (India) Pvt. Ltd. (CIN: U65920MH1995PTC090696), formerly known as Macquarie Capital (India) Pvt. Ltd., 92, Level 9, 2 North Avenue, Maker Maxity, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051, India, which is a SEBI registered stockbroker having membership with National Stock Exchange of India Limited (INB231246738) and BSE Limited (INB011246734). Malaysia: In Malaysia, research is issued and distributed by Macquarie Capital Securities (Malaysia) Sdn. Bhd. (Company registration number: 463469W) which is a Participating Organisation of Bursa Malaysia Berhad and a holder of Capital Markets Services License issued by the Securities Commission. Taiwan: In Taiwan, research is issued and distributed by Macquarie Capital Securities Ltd, Taiwan Branch, which is licensed and regulated by the Financial Supervisory Commission. No portion of the report may be reproduced or quoted by the press or any other person without authorisation from Macquarie. Nothing in this research shall be construed as a solicitation to buy or sell any security or product. Research Associate(s) in this report who are registered as Clerks only assist in the preparation of research and are not engaged in writing the research. Thailand: In Thailand, research is produced with the contribution of Kasikorn Securities Public Company Limited, issued and distributed by Macquarie Securities (Thailand) Ltd. Macquarie Securities (Thailand) Ltd. is a licensed securities company that is authorized by the Ministry of Finance, regulated by the Securities and Exchange Commission of Thailand and is an exchange member of the Stock Exchange of Thailand. Macquarie Securities (Thailand) Limited and Kasikorn Securities Public Company Limited have entered into an exclusive strategic alliance agreement to broaden and deepen the scope of services provided to each parties respective clients. The strategic alliance does not constitute a joint venture. The Thai Institute of Directors Association has disclosed the Corporate Governance Report of Thai Listed Companies made pursuant to the policy of the Securities and Exchange Commission of Thailand. Macquarie Securities (Thailand) Ltd does not endorse the result of the Corporate Governance Report of Thai Listed Companies but this Report can be accessed at: http://www.thai-iod.com/en/publications.asp?type=4. South Korea: In South Korea, unless otherwise stated, research is prepared, issued and distributed by Macquarie Securities Korea Limited, which is regulated by the Financial Supervisory Services. Information on analysts in MSKL is disclosed at http://dis.kofia.or.kr/websquare/index.jsp?w2xPath=/wq/fundMgr/DISFundMgrAnalystStut.xml&divisionId=MDIS03002001000000&serviceId=SDIS03002 001000. South Africa: In South Africa, research is issued and distributed by Macquarie First South Securities (Pty) Limited, a member of the JSE Limited. Singapore: In Singapore, research is issued and distributed by Macquarie Capital Securities (Singapore) Pte Ltd (Company Registration Number: 198702912C), a Capital Markets Services license holder under the Securities and Futures Act to deal in securities and provide custodial services in Singapore. Pursuant to the Financial Advisers (Amendment) Regulations 2005, Macquarie Capital Securities (Singapore) Pte Ltd is exempt from complying with sections 25, 27 and 36 of the Financial Advisers Act. All Singapore-based recipients of research produced by Macquarie Capital (Europe) Limited, Macquarie Capital Markets Canada Ltd, Macquarie First South Securities (Pty) Limited and Macquarie Capital (USA) Inc. represent and warrant that they are institutional investors as defined in the Securities and Futures Act. United States: In the United States, research is issued and distributed by Macquarie Capital (USA) Inc., which is a registered broker-dealer and member of FINRA. Macquarie Capital (USA) Inc, accepts responsibility for the content of each research report prepared by one of its non-US affiliates when the research report is distributed in the United States by Macquarie Capital (USA) Inc. Macquarie Capital (USA) Inc.’s affiliate’s analysts are not registered as research analysts with FINRA, may not be associated persons of Macquarie Capital (USA) Inc., and therefore may not be subject to FINRA rule restrictions on communications with a subject company, public appearances, and trading securities held by a research analyst account. Information regarding futures is provided for reference purposes only and is not a solicitation for purchases or sales of futures. Any persons receiving this report directly from Macquarie Capital (USA) Inc. and wishing to effect a transaction in any security described herein should do so with Macquarie Capital (USA) Inc. Important disclosure information regarding the subject companies covered in this report is available at www.macquarie.com/research/disclosures, or contact your registered representative at 1-888-MAC-STOCK, or write to the Supervisory Analysts, Research Department, Macquarie Securities, 125 W.55th Street, New York, NY 10019. © Macquarie Group 9 January 2015 5 Macquarie Research Engro Corporation Auckland Tel: (649) 377 6433 Bangkok Tel: (662) 694 7999 Calgary Tel: (1 403) 294 9541 Denver Tel: (303) 952 2800 Jakarta Tel: (62 21) 515 1818 Johannesburg Tel: (2711) 583 2000 Kuala Lumpur Tel: (60 3) 2059 8833 London Manila Tel: (44 20) 3037 2000 Tel: (63 2) 857 0888 Melbourne Tel: (613) 9635 8139 Munich New York Tel: (089) 2444 31800 Tel: (1 212) 231 2500 Paris Tel: (33 1) 7842 3823 Perth Tel: (618) 9224 0888 Seoul Tel: (82 2) 3705 8500 Shanghai Singapore Tel: (86 21) 6841 3355 Tel: (65) 6601 1111 Taipei Tokyo Tel: (886 2) 2734 7500 Tel: (81 3) 3512 7900 Toronto Tel: (1 416) 848 3500 Vancouver Tel: (1 604) 605 3944 Sydney Tel: (612) 8232 9555 Frankfurt Geneva Tel: (069) 509 578 000 Tel: (41) 22 818 7777 Hong Kong Tel: (852) 2823 3588 Mumbai Tel: (91 22) 6653 3000 Available to clients on the world wide web at www.macquarieresearch.com and through Thomson Financial, FactSet, Reuters, Bloomberg, and CapitalIQ. 9 January 2015 6 Asia Research Head of Equity Research John O’Connell (Global – Head) Peter Redhead (Asia – Head) Software and Internet (612) 8232 7544 (852) 3922 4836 Automobiles/Auto Parts Janet Lewis (China) Zhixuan Lin (China) Amit Mishra (India) Takuo Katayama (Japan) Michael Sohn (Korea) (852) 3922 5417 (8621) 2412 9006 (9122) 6720 4084 (813) 3512 7856 (822) 3705 8644 Banks and Non-Bank Financials Ismael Pili (Asia, Hong Kong, China) Jian Li (China, Hong Kong) Matthew Smith (China) Suresh Ganapathy (India) Nicolaos Oentung (Indonesia) Alastair Macdonald (Japan) Chan Hwang (Korea) Gilbert Lopez (Philippines) Thomas Stoegner (Singapore) Dexter Hsu (Taiwan) Passakorn Linmaneechote (Thailand) (852) 3922 4774 (852) 3922 3579 (8621) 2412 9022 (9122) 6720 4078 (6221) 2598 8366 (813) 3512 7476 (822) 3705 8643 (632) 857 0892 (65) 6601 0854 (8862) 2734 7530 (662) 694 7728 Conglomerates Gilbert Lopez (Philippines) (632) 857 0892 Consumer and Gaming Linda Huang (China, Hong Kong) Jamie Zhou (China, Hong Kong) Elaine Lai (Hong Kong) Amit Mishra (India) Lyall Taylor (Indonesia) Toby Williams (Japan) HongSuk Na (Korea) Karisa Magpayo (Philippines) Somesh Agarwal (Singapore) Best Waiyanont (Thailand) (852) 3922 4068 (852) 3922 1147 (852) 3922 4749 (9122) 6720 4084 (6221) 2598 8489 (813) 3512 7392 (822) 3705 8678 (632) 857 0899 (65) 6601 0840 (662) 694 7993 Emerging Leaders Jake Lynch (China, Asia) Michael Newman (Japan) Kwang Cho (Korea) (8621) 2412 9007 (813) 3512 7920 (822) 3705 4953 Industrials Janet Lewis (Asia) Patrick Dai (China) Saiyi He (China) Inderjeetsingh Bhatia (India) Andy Lesmana (Indonesia) Kenjin Hotta (Japan) James Hong (Korea) Somesh Agarwal (Singapore) David Gambrill (Thailand) (852) 3922 5417 (8621) 2412 9082 (852) 3922 3585 (9122) 6720 4087 (6221) 2598 8398 (813) 3512 7871 (822) 3705 8661 (65) 6601 0840 (662) 694 7753 Insurance Scott Russell (Asia, Japan) Jian Li (China, Hong Kong) Chan Hwang (Korea) (852) 3922 3567 (852) 3922 3579 (822) 3705 8643 David Gibson (Asia) Jiong Shao (China, Hong Kong) Alice Yang (China, Hong Kong) Hillman Chan (China, Hong Kong) Nitin Mohta (India) Nathan Ramler (Japan) Prem Jearajasingam (Malaysia) Transport & Infrastructure (813) 3512 7880 (852) 3922 3566 (852) 3922 1266 (852) 3922 3716 (9122) 6720 4090 (813) 3512 7875 (603) 2059 8989 Oil, Gas and Petrochemicals James Hubbard (Asia) Aditya Suresh (Hong Kong, China) Abhishek Agarwal (India) Polina Diyachkina (Japan) Anna Park (Korea) Trevor Buchinski (Thailand) (852) 3922 1226 (852) 3922 1265 (9122) 6720 4079 (813) 3512 7886 (822) 3705 8669 (662) 694 7829 Pharmaceuticals and Healthcare John Yung (Hong Kong, China) Abhishek Singhal (India) (852) 3922 1132 (9122) 6720 4086 Property Tuck Yin Soong (Asia, Singapore) David Ng (China, Hong Kong) Raymond Liu (China, Hong Kong) Kai Tan (China) Abhishek Bhandari (India) Andy Lesmana (Indonesia) William Montgomery (Japan) RJ Aguirre (Philippines) Corinne Jian (Taiwan) David Liao (Taiwan) Patti Tomaitrichitr (Thailand) (65) 6601 0838 (852) 3922 1291 (852) 3922 3629 (852) 3922 3720 (9122) 6720 4088 (6221) 2598 8398 (813) 3512 7864 (632) 857 0890 (8862) 2734 7522 (8862) 2734 7518 (662) 694 7727 Janet Lewis (Asia) Andrew Lee (Asia) Corinne Jian (Taiwan) Utilities & Renewables Gary Chiu (Asia) Alan Hon (Hong Kong) Inderjeetsingh Bhatia (India) Prem Jearajasingam (Malaysia) Karisa Magpayo (Philippines) Colin Hamilton (Global) Jim Lennon Matthew Turner Graeme Train Angela Bi Rakesh Arora Peter Eadon-Clarke (Asia, Japan) Richard Gibbs (Australia) Larry Hu (China, Hong Kong) Tanvee Gupta Jain (India) Gurvinder Brar (Global) Burke Lau (Asia) Anthony Ng (Asia) Jason Zhang (Asia) Suni Kim (Japan, Hong Kong) Telecoms Nathan Ramler (Asia, Japan) Danny Chu (China, Hong Kong, Taiwan) David Lee (Korea) Prem Jearajasingam (Malaysia, Singapore) Piyachat Ratanasuvan (Thailand) (813) 3512 7875 (852) 3922 4762 (822) 3705 8686 (4420) 3037 4036 (852) 3922 5494 (852) 3922 1561 (852) 3922 1168 (852) 3922 3342 Special Situations Strategy/Country (8862) 2734 7512 (9122) 6720 4090 (813) 3512 7858 (813) 3512 7877 (813) 3512 7880 (813) 3512 7854 (822) 3705 8641 (822) 3705 8659 (8862) 2734 7524 (8862) 2734 7525 (813) 3512 7850 (612) 8232 3935 (852) 3922 3778 (9122) 6720 4355 Quantitative / CPG Matthew Hook (Asia) Jeffrey Su (Asia, Taiwan) Nitin Mohta (India) Claudio Aritomi (Japan) Damian Thong (Japan) David Gibson (Japan) George Chang (Japan) Daniel Kim (Korea) Soyun Shin (Korea) Ellen Tseng (Taiwan) Tammy Lai (Taiwan) (4420) 3037 4061 (4420) 3037 4271 (4420) 3037 4340 (8621) 2412 9035 (8621) 2412 9086 (9122) 6720 4093 Economics Matty Zhao (Asia, China) Hefei Deng (China) Rakesh Arora (India) Polina Diyachkina (Japan) Anna Park (Korea) David Liao (Taiwan) Technology (852) 3922 1435 (852) 3922 3589 (9122) 6720 4087 (603) 2059 8989 (632) 857 0899 Commodities Resources / Metals and Mining (852) 3922 1293 (852) 3922 1136 (9122) 6720 4093 (813) 3512 7886 (822) 3705 8669 (8862) 2734 7518 (852) 3922 5417 (852) 3922 1167 (8862) 2734 7522 Viktor Shvets (Asia) Chetan Seth (Asia) Joshua van Lin (Asia Micro) Peter Eadon-Clarke (Japan) David Ng (China, Hong Kong) Jiong Shao (China) Rakesh Arora (India) Nicolaos Oentung (Indonesia) Chan Hwang (Korea) Yeonzon Yeow (Malaysia) Gilbert Lopez (Philippines) Conrad Werner (Singapore) David Gambrill (Thailand) (852) 3922 3743 (852) 3922 3883 (852) 3922 4769 (852) 3922 1425 (813) 3512 7850 (852) 3922 1291 (852) 3922 3566 (9122) 6720 4093 (6121) 2598 8366 (822) 3705 8643 (603) 2059 8982 (632) 857 0892 (65) 6601 0182 (662) 694 7753 Find our research at Macquarie: www.macquarie.com.au/research Thomson: www.thomson.com/financial Reuters: www.knowledge.reuters.com Bloomberg: MAC GO Factset: http://www.factset.com/home.aspx CapitalIQ www.capitaliq.com Email macresearch@macquarie.com for access (603) 2059 8989 (662) 694 7982 Asia Sales Regional Heads of Sales Miki Edelman (Asia) Jeffrey Shiu (China & Hong Kong) Thomas Renz (Geneva) Bharat Rawla (India) Riaz Hyder (Indonesia) Mark Chadwick (Japan) John Jay Lee (Korea) Nik Hadi (Malaysia) Eric Roles (New York) Gino C Rojas (Philippines) (813) 3512 7857 (852) 3922 2061 (41) 22 818 7712 (9122) 6720 4100 (6221) 2598 8486 (813) 3512 7827 (822) 3705 9988 (603) 2059 8888 (1 212) 231 2559 (632) 857 0861 Regional Heads of Sales cont’d Sales Trading cont’d Ruben Boopalan (Singapore) Paul Colaco (San Francisco) Erica Wang (Taiwan) Angus Kent (Thailand) Ben Musgrave (UK/Europe) Julien Roux (UK/Europe) Suhaida Samsudin (Malaysia) Michael Santos (Philippines) Kenneth Cheung (Singapore) Chris Reale (New York) Marc Rosa (New York) Isaac Huang (Taiwan) Dominic Shore (Thailand) Mike Keen (UK/Europe) (603) 2059 8888 (1 415) 762 5003 (8862) 2734 7586 (662) 694 7601 (44) 20 3037 4882 (44) 20 3037 4867 Sales Trading Adam Zaki (Asia) Stanley Dunda (Indonesia) (852) 3922 2002 (6221) 515 1555 (603) 2059 8888 (632) 857 0813 (65) 6601 0288 (1 212) 231 2555 (1 212) 231 2555 (8862) 2734 7582 (662) 694 7707 (44) 20 3037 4905

© Copyright 2025