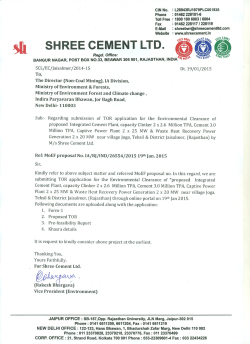

Cairn India - Moneycontrol

22 January 2015

3QFY15 Results Update | Sector: Oil & Gas

Cairn India

BSE SENSEX

29,006

Bloomberg

S&P CNX

8,761

CAIR IN

Equity Shares (m)

1,874.8

M.Cap. (INR b) / (USD b) 447.5/7.3

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

385/228

-9/-42/-62

Avg Val (INR M)/Vol ‘000 842/2,687

Free float (%)

40.1

Financials & Valuation (INR Billion)

Y/E MAR

2015E 2016E 2017E

Sales

EBITDA

Adj. PAT

Adj. EPS

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

Payout (%)

Valuation

P/E (x)

P/BV (x)

EV/EBITDA

Div. Yield

148.3

98.1

73.1

39.0

-40.1

326

12.3

12.3

38.2

134.4

73.2

42.0

22.4

-42.6

333

6.8

7.3

24.6

153.8

84.3

43.3

23.1

3.1

351

6.7

8.4

24.6

6.1

0.7

2.9

5.2

10.7

0.7

4.1

1.9

10.3

0.7

3.0

2.0

Estimate change

TP change

Rating change

26%

9%

CMP: INR239

TP: INR250 (+5%)

Neutral

EBITDA beat, higher tax impacts PAT; cut oil price assumptions and estimates

EBITDA beat, PAT below estimate: CAIR’s 3QFY15 sales at INR35b (est. INR32b,

-30% YoY, -12% QoQ) were above estimate led by higher Ravva production at

28kboepd (est. 23kboepd, +35% QoQ) and lower profit petroleum at INR9.5b (v/s

est. of INR12b). However, PAT was below estimate at INR13.5b (est. INR14.3b,

-53% YoY, -41% QoQ) due to higher tax rate at 22% (v/s last eight-quarter average

of 3.9%). Lower-than-expected other income at INR1.6b (v/s est. INR3.9b, +16%

YoY, -53% QoQ) was compensated by higher forex gain at INR3.5b (v/s est.

INR1.3b).

Post 2QFY15 maintenance, Rajasthan 3QFY15 averaged 180kbpd, +10% QoQ:

Increased contribution from satellite fields and Aishwariya ramp-up to 30bpd

aided Rajasthan production to reach 180kbpd (-3% YoY, +10% QoQ). While the

earlier production guidance is a three-year CAGR of 7-10%, it will be updated in

4QFY15 results.

Rajasthan realization at USD68.3/bbl implies 10.8% discount to Brent (v/s 10.2% in

2QFY15). IOR/EOR on track with first polymer injected in October 2014.

Guides to remain free cash flow positive and maintain absolute dividend: Despite

the 55% crude price decline in the last six months and similar earnings impact,

management indicated its intention to maintain the absolute dividend (implies

~40% payout v/s policy of 20%). In our view, CAIR’s guidance to remain free cash

flow positive could entail some capex program cuts.

Valuation and view

We lower the Brent price assumption for FY16E/17E from USD75/85/bbl to

USD60/70/bbl, resulting in 26% cut in FY16E/17E estimates. We maintain the

absolute dividend estimate of INR12.5/sh in FY15E but continue to model 20%

payout from FY16E.

The stock trades at 10.7x FY16E EPS of INR22.4 and has a dividend yield of ~5%

(based on fixed payout). Our SOTP-based fair value stands at INR250 (v/s INR275

earlier). Maintain Neutral.

Harshad Borawake (HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Cairn India

Takeaways from the Earnings Concall

Cairn indicated that it has ability to maintain absolute dividend despite fall in

earnings subject to board approval. Management clarified that its dividend

policy of 20% is the minimum payout policy. It also clarified that if need arises it

could use balance sheet reserves to pay the dividend.

Aishwariya production reached 30kbpd as per approved plan.

Reported forex gain in the income statement also includes exchange fluctuation

gain from the USD1.25b loan given to the parent.

Management clarified that based on change in the investment multiple

government profit sharing trend could also reverse (i.e. it could again fall back to

lower level). While Rajasthan PSC allows such reversal, no such provision exists

in Raava or Cambay PSC.

Despite the crude price fall, management guided that it aims to remain free cash

flow positive implying cuts in the exploration / development plans

Mangala IOR/EOR project is on schedule with first polymer injected on October

1, 2014 and critical package construction is in advanced stage. Production

contribution is expected from 1QFY16.

Other key highlights

22 January 2015

Profit petroleum in 3QFY15 stood at INR9.5b (v/s INR12.8b in 3QFY14 and

INR11.3b in 2QFY15). The current government share in DA1 is 40% and DA2 is

30%.

Rajasthan royalty share stood at INR6.9b (v/s INR11.1b in 3QFY14 and INR9.1b

in 2QFY15).

Other income stood at INR1.6b (v/s INR1.4b 3QFY14 and INR3.5b in 2QFY15).

Sharp QoQ fall in other income is due to non-booking of mark-to-market gains

on investments as per IFRS standards.

Effective tax rate (PBT before forex changes) was higher in 3QFY15 at 22.8% (vs

last 8 quarter average of 3.9%) led by lower MAT credit on account of lower

crude price.

Foreign exchange gain stood at INR3.5b (v/s loss of INR1.3b in 3QFY14 and gain

of INR2.4b in 2QFY15).

Gross cumulative Rajasthan capex stands at USD4.9b (89% in DA1 and 11% in

DA2). 3QFY15 capex share stood at of USD247m.

2

Cairn India

Exhibit 1: Cairn India: Operating Performance

FY12

3Q

4Q

1Q

FY13

2Q

3Q

4Q

1Q

FY14

2Q

3Q

4Q

1Q

FY15

2Q

3QFY15 (%)

3Q YoY QoQ

Gross oil production (kbpd)

Ravva

26.3 25.0 23.5 21.6 21.5 20.8 21.9 22.6 21.9 18.8 19.5 20.5 23.4

7.1 14.2

Cambay

4.8

5.1

4.7

4.3

4.6

4.5

8.6

6.8

8.2

7.3

8.4

8.4

8.9

8.4

6.7

Rajasthan

125.1 137.6 167.1 171.8 170.0 168.6 172.8 175.5 186.4 190.9 183.2 163.3 180.0 (3.4) 10.3

Sub-total

156.2 167.7 195.4 197.7 196.0 193.9 203.3 205.0 216.5 217.1 211.1 192.1 212.3 (1.9) 10.5

Gross gas production (mmscmd)

Ravva

1.8

1.7

1.5

1.2

1.1

1.1

1.1

1.1

1.0

0.9

0.7

0.0

0.7 (27.0) 2,530

Cambay

0.5

0.5

0.4

0.4

0.4

0.3

0.4

0.3

0.3

0.3

0.4

0.4

0.4

6.8 (6.8)

Rajasthan

0.1

0.1

0.1

0.3

0.2

0.2

0.2 98.5

0.0

Sub-total

2.3

2.2

2.0

1.6

1.5

1.4

1.6

1.4

1.4

1.3

1.2

0.4

1.1 (18.5) 162.3

Gross total (kboepd)

169.6 180.3 207.0 207.2 205.0 202.0 211.8 213.3 224.5 224.4 217.9 194.5 218.9 (2.5) 12.5

Net oil production (kbpd)

Ravva (22.5%)

Cambay (40%)

Rajasthan (70%)

Sub-total

Net gas production (mmscmd)

Ravva (22.5%)

Cambay (40%)

Rajasthan (70%)

Sub-total

5.9

5.6

5.3

4.9

4.8

4.7

4.9

5.1

4.9

4.2

4.4

4.6

5.3

1.9

2.0

1.9

1.7

1.8

1.8

3.4

2.7

3.3

2.9

3.4

3.4

3.6

87.6 96.3 117.0 120.3 119.0 118.0 121.0 122.8 130.5 133.6 128.2 114.3 126.0

95.4 104.0 124.2 126.8 125.7 124.5 129.3 130.7 138.7 140.8 136.0 122.2 134.8

0.4

0.2

0.4

0.2

0.3

0.2

0.3

0.2

0.3

0.2

0.2

0.1

0.6

0.6

0.5

0.4

0.4

0.4

0.2

0.1

0.1

0.5

0.2

0.1

0.1

0.5

7.1

8.4

(3.4)

(2.8)

14.2

6.7

10.3

10.3

0.2

0.1

0.2

0.1

0.2

0.2

0.0

0.2

0.2 (27.0) 2,530

0.1

6.8 (6.8)

0.4

0.3

0.3

0.2

0.3 (14.3)

91.2

Net oil + gas production

(kboepd)

Ravva (22.5%)

Cambay (40%)

Rajasthan (70%)

Net Total (kboepd)

8.2

7.9

7.3

6.4

6.4

6.1

6.4

6.6

6.3

5.5

5.4

4.6

6.3

3.2

3.1

2.9

2.7

2.7

2.5

4.3

3.5

4.1

3.7

4.3

4.3

4.4

87.6 96.3 117.0 120.3 119.0 118.0 121.5 123.8 131.5 134.8 129.3 114.3 126.0

99.0 107.3 127.2 129.4 128.1 126.6 132.1 133.8 141.9 144.0 139.0 123.2 136.7

(0.3)

8.1

(4.2)

(3.7)

34.9

4.3

10.3

11.0

Key Operating Metrics

Fx rate (INR/USD)

51.0

(0.3)

2.1

50.2

54.2

55.5

54.2

54.2

55.9

62.5

62.0

62.0

59.8

60.5

61.8

Brent (USD/bbl)

109.3 118.8 108.7 110.0 110.0 113.5 102.8 110.6 109.2 107.7 109.7 102.0

Rajasthan realization (USD/bbl)

Disc. to Brent (%)

100.3 108.5 100.5 97.6 95.6 99.7 94.3 96.0 95.6 95.2 97.5 91.5 68.3 (28.6) (25.4)

(8.2) (8.7) (7.6) (11.3) (13.1) (12.2) (8.3) (13.2) (12.5) (11.6) (11.1) (10.3) (10.8) (13.3)

4.9

76.0 (30.4) (25.5)

Natural gas (USD/mmbtu)

Average realization (USD/boe)

Average realisation (INR/boe)

4.3

4.3

4.4

4.5

4.5

5.0

4.8

5.7

5.7

5.9

5.4

7.1

6.1

6.8 (13.7)

98.3 106.7 99.3 96.7 95.0 99.5 93.3 95.3 94.9 94.4 93.3 95.3 68.1 (28.2) (28.5)

5,015 5,352 5,382 5,365 5,147 5,388 5,215 5,956 5,884 5,853 5,577 5,766 4,209 (28.5) (27.0)

Source: MOSL, Company

22 January 2015

3

Cairn India

Exhibit 2: CAIRN QUARTERLY P&L (INRb)

INR B

Gross revenues

Less: Profit Petroleum

FY12

3Q

4Q

1Q

43.0 49.5 59.9

5.7

6.5

6.8

FY13

2Q

3Q

61.0 58.5

7.0

7.2

FY14

4Q

1Q

2Q

3Q

59.4 59.9 69.8 73.9

7.2 10.5 12.4 12.8

4Q

73.5

12.0

1Q

73.3

17.8

FY15

2Q

60.2

11.3

Less: Levies (Cess + Royalty)

Net Revenues

Less: Opex

EBITDA

Less: Exploration w/off

Less: D,D&A

EBIT

Less: Interest

Add: Other Income

PBT prior to FX fluctuations

9.2

28.0

2.5

25.5

1.8

3.8

19.9

0.2

1.1

20.8

15.6

37.5

2.5

34.9

0.4

4.4

30.2

0.3

1.0

30.9

16.8

37.3

2.7

34.5

0.3

4.5

29.7

0.2

2.2

31.8

15.6

35.7

2.8

32.9

0.3

4.8

27.8

0.1

1.8

29.5

15.5

36.8

4.2

32.6

3.7

4.7

24.2

0.2

2.2

26.2

17.8

43.7

5.2

38.4

1.6

6.4

30.5

0.1

4.1

34.4

18.0

37.5

4.5

33.1

2.5

7.2

23.3

0.0

4.2

27.5

15.6

33.3

5.4

27.9

1.3

7.0

19.5

0.1

3.5

22.9

8.7

(7.9)

2.4

(0.0)

Forex gain / (loss)

PBT

Tax

Tax rate (%)

PAT

EPS

3.0

23.8

1.2

5.0

22.6

11.8

10.5

32.5

2.7

29.8

0.6

4.0

25.1

0.3

0.9

25.8

(2.2)

23.6

1.7

7.4

21.9

11.4

39.5 23.9

1.3 0.7

3.2 2.9

38.3 23.2

20.0 12.2

31.9 26.2

0.3

0.6

1.0

2.2

31.6 25.6

16.5 13.4

15.9

33.5

3.4

30.1

1.0

5.2

23.9

0.1

1.3

25.1

18.3

39.2

3.9

35.3

0.5

5.5

29.3

0.1

1.1

30.3

18.9

42.3

5.3

36.9

1.0

5.9

30.0

0.1

1.4

31.3

6.8

4.3

(1.3)

31.9 34.6 30.0

0.6

0.8

1.2

1.9

2.3

3.8

31.3 33.9 28.8

16.4 17.7 15.1

(2.4)

32.0

1.6

5.1

30.4

15.9

1.0

2.4

28.5

1.3

4.5

27.2

14.2

25.3

2.6

10.1

22.8

11.9

3QFY15 (%)

3Q

YoY QoQ

51.5 (30.4) (14.5)

9.5 (25.8) (16.2)

14.2

27.8

5.9

21.8

1.6

8.9

11.4

0.1

1.6

12.9

(24.7) (9.1)

(34.3) (16.5)

10.9 10.5

(40.8) (21.7)

56.8 17.3

49.8 26.8

(62.1) (41.8)

(7.5) 64.8

16.1 (52.9)

(58.7) (43.7)

3.5 (374.0) 47.2

16.4

2.9

17.9

13.5

7.1

(45.2) (35.1)

155.5 14.9

366.1 77.2

(53.2) (40.8)

(53.2) (40.8)

Source: Company, MOSL

Exhibit 3: CAIRN QUARTERLY P&L (USD/bbl)

USD/bbl

Gross revenues

Less: Profit Petroleum

FY12

FY13

FY14

3Q

4Q

1Q

2Q

3Q

4Q

1Q

2Q

3Q

4Q

92.6 101.0 95.5 92.3 91.7 96.2 89.1 90.8 91.3 91.5

12.3 13.2 10.9 10.6 11.3 11.6 15.7 16.1 15.8 14.9

1Q

97.0

23.5

FY15

2Q

87.8

16.5

3QFY15 (%)

3Q YoY QoQ

66.2 (27.5) (24.6)

12.2 (22.7) (26.1)

Less: Levies (Cess + Royalty)

19.9

22.2

23.8

22.8

18.3 (21.5) (19.8)

Net Revenues

Less: Opex

EBITDA

Less: Exploration w/off

60.3 66.4 59.7 56.4 55.9 59.6 49.8 51.0 52.2 54.3

5.5

5.6

4.0

4.2

4.4

6.8

5.1

5.0

6.6

6.5

54.8 60.9 55.7 52.2 51.5 52.8 44.8 45.9 45.6 47.8

3.8

1.3

0.6

0.4

0.4

5.9

1.5

0.7

1.2

2.0

49.7

5.9

43.8

3.4

48.5

7.8

40.7

2.0

35.7 (31.6) (26.4)

7.6 15.5 (2.5)

28.1 (38.4) (30.9)

2.0 63.2

3.4

Less: D,D&A

EBIT

Less: Interest

Add: Other Income

PBT prior to FX fluctuations

8.2

42.9

0.5

2.4

44.8

8.2

51.4

0.6

1.9

52.6

9.5

30.9

0.0

5.5

36.4

10.3

28.5

0.1

5.0

33.5

11.5 56.0 11.8

14.6 (60.5) (48.7)

0.1 (3.6) 45.4

2.1 20.9 (58.5)

16.6 (57.0) (50.4)

6.5

(4.4)

13.8 (11.9)

51.3

2.5

10.7

48.7

48.2

3.5

15.0

44.6

63.0

2.0

5.1

61.0

Forex gain / (loss)

PBT

Tax

Tax rate (%)

PAT

21.4

24.9

7.0

48.1

0.5

1.5

49.2

25.4

6.8

45.0

0.3

3.4

48.1

36.2

1.1

4.4

35.1

24.4

25.1

7.6

43.5

0.1

2.9

46.3

7.7

39.2

0.2

3.6

42.5

3.7

(0.0)

50.0

0.5

1.6

49.5

42.5

0.9

3.6

41.5

23.6

7.7

35.6

0.2

1.9

37.3

23.8

23.3

7.1

38.2

0.1

1.4

39.4

7.4

37.0

0.1

1.7

38.7

7.9

37.9

0.1

5.1

42.9

10.1

5.6

(1.6)

(3.0)

1.3

3.5

47.4

0.9

2.8

46.5

45.0

1.0

3.0

44.0

37.1

1.4

4.7

35.6

39.8

2.0

6.4

37.8

37.7

1.7

5.9

36.0

37.0

3.7

14.7

33.2

4.5 (385.3)

21.2

3.8

23.0

17.4

29.8

(42.9) (42.8)

166.1

1.4

385.4 56.3

(51.3) (47.7)

Source: Company, MOSL

22 January 2015

4

Cairn India

180.0

183.2

1QFY15

163.3

190.9

175.5

2QFY14

4QFY14

172.8

1QFY14

186.4

168.6

4QFY13

3QFY14

170.0

3QFY13

125.1

3QFY12

171.8

125.3

2QFY12

2QFY13

125.1

1QFY12

167.1

118.0

4QFY11

1QFY13

124.9

3QFY11

137.6

116.1

3QFY15

2QFY15

4QFY12

4QFY10

44.7

3QFY10

2QFY11

17.5

2QFY10

1QFY11

6.0

15.4

1QFY10

Exhibit 4: Rajasthan Gross Production averaged 180kbpd, up 10% QoQ led by maintenance

shutdown in 2QFY15

Source: Company, MOSL

Exhibit 5: CAIRN Net O+G Production up QoQ led by Rajasthan (kboepd)

Ravva (22.5%)

Cambay (40%)

94

45

25 26

16 19

31

0 4 11 12

1QFY10

4QFY10

100

94

100 99 99

Rajasthan (70%)

Net Total (kboepd)

142 144 139

137

134

132

129

128 127

127

123

107

96

81 87 83 88 88 88

3QFY11

2QFY12

117 120 119 118 122 124

1QFY13

4QFY13

131 135 129

3QFY14

114

126

2QFY15

Source: Company, MOSL

Exhibit 6: Increasing production contribution from satellite fields

Source: Company, MOSL

22 January 2015

5

Cairn India

Rajasthan discount to Brent at ~10.8%

Rajasthan realization stood at ~USD68.3/bbl (29% YoY, -25% QoQ), implying

discount to Brent at ~10.8% (v/s 12.5% in 3QFY14 and 10.2% in 2QFY15).

Cairn continues to guide Rajasthan realization discount to Brent between 8-13%.

Exhibit 7: Rajasthan discount to Brent at 10.8% in 3QFY15 v/s 10.2% in 3QFY15

16%

14%

12%

10%

8%

6%

3QFY15

2QFY15

1QFY15

4QFY14

3QFY14

2QFY14

1QFY14

4QFY13

3QFY13

2QFY13

1QFY13

4QFY12

3QFY12

2QFY12

1QFY12

4QFY11

3QFY11

2QFY11

1QFY11

4%

Source: Company, MOSL

Exploration and development program on track

Cairn had planned to spend USD3b over the next three years of which USD2.4b

will be spent on Rajasthan, with 81% to be spent in FY15 and FY16.

Fall in the crude price will definitely lead to realignment of the Cairn’s capex

program. Management has indicated that low oil price gives them optionality to

be selective about growth projects.

CAIR in 1QFY15 increased in-place oil and gas resources at Rajasthan from 7b

boe (4bboe discovered + 3bboe under exploration) to 10bboe and the current

FY14-16 exploration program is targeting the initial 7bboe resource base.

Cairn tested ~50% of the undiscovered 3bboe reserves and in the ongoing

exploration program it has reported 11 discoveries of the 36 wells drilled.

It plans to test the remaining 50% of 3bboe resources by FY16 and beyond FY16

will be targeting to test the newly added 3bboe of resources.

Exhibit 8: On land portfolio and concentrated resource base offers Cairn cost advantages over its peers

*Size of the bubble indicates Market Cap (USD Bn)

22 January 2015

Source: Company, MOSL

6

Cairn India

Exhibit 9: Ongoing exploration campaign tested ~50% (1.4bboe) planned resources

Source: Company, MOSL

Exhibit 10: Update on Cairn’s Key Exploration blocks

No. Exploration Blocks

2QFY15 update

3QFY15 update

1 KG-ONN-2003/1 - Management committee approved commerciality

- In November 2014, MC approved extension of

block

declaration on July 9, 2014.

appraisal thus regularising the extended well testing of

(Carin: 49%)

- Operatorship for development transferred to ONGC as per Nagayalanka-1zST and drilling of Nagayalanaka-NW-1z.

the PSC and preparation of Development Plan underway.

2 KG-OSN-2009/3

block

(Carin: 100%)

- Processing of recently acquired 3D seismic survey is

complete and delivery of fast track volume is expected soon.

Planning underway for additional 3D/2D from January 2015.

- Planning a four well drilling campaign.

- 934 sqkm 3D data acquired, interpretation focused

upon building a high quality prospect inventory.

- Upon completion of interpretation, planning for a

four well drilling campaign will begin.

- Site survey data acquisition, required to complete

drilling planning, is expected in mid-2015.

3 MB-DWN-2009/1 - 2,128 line-km of 2D broadband seismic has been acquired - Processing of 2,128 line km of 2D broadband seismic

block (Carin:

and processing of the same has begun.

on track and expected to be delivered in Q4 FY15.

100%)

- Planning to acquire addl 500sqkm of 3D data.

- Regional work is ongoing and options for acquisition

of 3D seismic data are pending the outcomes of the 2D

interpretation.

4 PR-OSN-2004/1

- Excusable delay granted in August 2014 by MoPNG and

- Revised date of the expiry of Phase-1 is expected to

block

further extension of Exploration Phase-1 pending with

be 30th June 2017.

(Carin: 35%)

regulators.

- Planning for three well drilling program is underway

- Planning 3-well program; reprocessing of vintage 503km2 and reprocessing of vintage 503sqkm Palar 3D seismic is

planned for Q4 FY15.

Palar 3D seismic planned for 3QFY15.

5 Srilanka Block SL - Discussions with Sri Lankan govt. over the commercial

2007-01-001

terms still under progress.

(Carin: 100%)

- Commercialization of gas discoveries continues to

present challenges.

- Refining technical evaluation of remaining prospects

that could ultimately add to discovered resource base.

- Cairn plans to commence 3D seismic reprocessing in

the current quarter.

6 South Africa Block - Interpretation of 3D seismic continues and a robust

- Exploration prospects identified based on 2013 3D

1

prospect inventory is now identified.

seismic survey, which covers oil prone outboard portion

(Carin: 60%)

- Focus remains on outboard portion of the block which is of Block 1.

interpreted as oil prone.

- In current quarter, Cairn plans to progress well- Environmental clearances and other planning activities are planning and necessary environmental clearances to

under process to enable exploration drilling by early 2016. enable exploratory drilling in 2016.

Source: Company, MOSL

22 January 2015

7

Cairn India

Valuation and view

Key event to watchout would be CAIR’s realignment of the capex plan in view of

sharp fall in the crude prices and likely impact on the production guidance.

Other events to watch out are (1) Rajasthan production trend, (2) Updates on

reserves and (3) Update on other exploration blocks and (4) clarity on Rajasthan

PSC extension.

With cash at INR178b and USD1.25b loan to parent, to watch out for future cash

utilization.

As against current Rajasthan production of ~180kbps, CAIR’s production

guidance of 7-10% looks challenging and we model ~6% CAGR in our estimates

with FY16/FY17 at 197/215kbpd respectively.

As cut our Brent price assumption for FY16/17 from USD75/85/bbl to

USD60/70/bbl resulting in 26% cut in FY16/17 estimates.

We maintain absolute dividend of INR12.5/sh in FY15 but continue to model

20% payout from FY16.

The stock trades at 10.7x FY16E EPS of INR22.4 and has dividend yield of ~5%

(based on fixed payout). Our SOTP based fair value stands at INR250 (v/s INR275

earlier), Maintain Neutral.

Exhibit 11: Cairn India: Key Assumptions

Y End: March 31

Exchange Rate (USD/INR)

Brent Crude Price (USD/bbl)

Disc. for Rajasthan Crude (USD/bbl)

Rajasthan net realization (USD/bbl)

FY11

45.6

86.7

12.0%

76.3

FY12

47.9

114.5

9.4%

103.7

FY13

54.5

110.5

11.0%

98.3

FY14

60.6

107.6

11.4%

95.3

FY15E

61.0

84.5

10.6%

75.5

FY16E

62.0

60.0

10.6%

53.6

FY17E

62.0

70.0

10.6%

62.6

Rajasthan gross production (kbpd)

Rajasthan Cess (INR/MT)

Govt. sharing (%)

99

2,625

0%

128

2,625

10%

170

4,635

20%

181

4,635

30%

177

197

215

4,635 4,635 4,635

40%

40%

40%

Source: Company, MOSL

Exhibit 12: Cairn India SOTP: We value Cairn at INR250/sh

Source: MOSL

22 January 2015

8

Cairn India

Story in Charts

Exhibit 13: Well diversified portfolio with assets ranging from Exhibit 14: Cairn’s pipeline gives access to majority of

exportation to production as well as 2 overseas assets

domestic refineries as well as export option

Source: Company, MOSL

Source: Company, MOSL

Exhibit 15: Cairn has continually upgraded in-place

resource base

Source: Company, MOSL

22 January 2015

Exhibit 16: …as well as estimated

(mmboe)

ultimate

recovery

Source: Company, MOSL

9

Cairn India

Exhibit 17: …however Mangala decline, slower Bhagyam

ramp-up, halted Rajasthan production ramp-up in FY15

170

181

197

177

Exhibit 18: Management vision to produce 300kbpd at

Rajasthan

215

300

128

170

99

99

181

177

197

215

128

9

FY12

FY13

FY14

FY15E

FY16E

FY17E

FY10 FY11 FY12 FY13 FY14 FY15EFY16EFY17E

Source: Company, MOSL

Exhibit 19: Cairn’s Rajasthan

discoveries till date

block

has

reported

30

Vision

Source: Company, MOSL

Exhibit 20: Correlation between Cairn stock price and Brent

Crude Price

400

Cairn stock price (INR/sh)

Brent (USD/bbl) - RHS

200

300

150

200

100

100

50

-

Jan-07

Jan-11

Jan-09

Jan-13

Source: Company, MOSL

Target Price

Exhibit 22: 1 Yr Fwd Cairn India P/B Chart

Source: Company, MOSL

22 January 2015

0.7

0.7

May-14

Oct-13

Mar-13

Jul-12

0.6

Dec-11

250

1.6

1.2

0.9

Apr-11

7.7

Avg(x)

1.2

1.2

Sep-10

0

8

Peak(x)

Min(x)

1.5

Feb-10

0.0

0.3

PB (x)

Median(x)

1.8

Jun-09

INR/sh

128

3

2

75

(34)

242

Nov-08

Rajasthan (incl. Barmer Hill)

Ravva

Cambay

Investments

Less: Net Debt / Add (Cash)

Base Value

Potential Upsides

Rajasthan resources (Prospective)

KG-Onland (Discovered)

USDb

3.9

0.1

0.1

2.3

(1.0)

7.5

Source: Company, MOSL

Mar-08

Exhibit 21: We value Cairn on SOTP basis at INR250/sh

Jan-15

Jan-15

FY11

Source: Company, MOSL

10

Cairn India

Corporate profile

Company description

Exhibit 23: Sensex rebased

Cairn India, an E&P company, listed in January 2007

through an IPO after it spun off from its parent Cairn

Energy Plc. Cairn Energy sold its majority stake to

Vedanta group making it a parent with ~60% stake. Cairn

has working interest in 9 E&P blocks. Ravva and Cambay

blocks produce about 34kboepd (Cairn WI 9.2kbpd). The

Rajasthan block, which accounts for ~80% of Cairn’s

reserves, produced at ~191kbpd (Cairn WI ~ 134kbpd) in

4QFY14.

Exhibit 24: Shareholding pattern (%)

Dec-14

Exhibit 25: Top holders

Sep-14

Dec-13

Promoter

59.9

59.9

58.8

DII

10.7

9.8

10.4

FII

15.3

16.8

16.3

Others

14.1

13.5

14.6

Holder Name

% Holding

Cairn UK Holdings Ltd

LIC of India

9.8

9.1

Note: FII Includes depository receipts

Exhibit 26: Top management

Exhibit 27: Board of director

Name

Designation

Name

Name

Navin Agarwal

Chairman

Navin Agarwal

Naresh Chandra*

Mayank Ashar

Managing Director & CEO

Mayank Ashar

Tarun Jain

Sudhir Mathur

CFO

Aman Mehta*

Priya Agarwal

Mike Yeager

Chairman, Operations

Review Board

Omkar Goswami*

Neerja Sharma

Darran Lucas

Director, Exploration

Edward T Story*

*Independent

Exhibit 28: Auditors

Exhibit 29: MOSL forecast v/s consensus

Name

Type

S R Batliboi & Co LLP

Statutory

Nessr & Associates

Secretarial Audit

Shome & Banerjee

Cost Auditor

22 January 2015

EPS (INR)

FY15

FY16

FY17

MOSL forecast

39.0

22.4

23.1

Consensus

forecast

45.2

38.3

34.1

Variation (%)

-13.7

-41.6

-32.3

11

Cairn India

Financials and valuations

(INR Million)

Income Statement

Y/E March

Net Sales

Change (%)

Change in Stock

Employee Costs

Operating Costs

EBITDA

% of Net Sales

2010

16,230

13.3

-366

1,102

5,689

9,805

60.4

2011

102,779

533.3

-264

1,105

16,709

85,228

82.9

2012

131,130

27.6

-263

861

22,475

108,056

82.4

2013

175,241

33.6

-274

1,033

39,603

134,880

77.0

2014

187,617

7.1

-141

2,741

44,233

140,784

75.0

2015E

148,274

-21.0

-331

2,000

48,514

98,091

66.2

2016E

134,447

-9.3

0

2,300

58,924

73,223

54.5

2017E

153,800

14.4

0

2,645

66,837

84,318

54.8

D,D&A (incl. w/off)

Interest

Other Income

EBIT

Forex Fluctuations

Exceptional Item

PBT

Tax

Rate (%)

Adjusted PAT

Change (%)

-3,570

-295

3,505

9,446

718

0

10,164

-348

-3.7

10,511

30.1

-13,596

-2,909

1,288

70,011

-1,112

0

68,899

5,556

7.9

63,343

502.6

-17,391

-2,220

3,194

91,639

6,148

-13,552

84,235

4,857

5.3

92,929

46.7

-23,008

-687

7,228

118,414

3,134

1,888

123,436

2,351

2.0

119,198

28.3

-27,098

-415

7,834

121,106

7,390

0

128,496

4,178

3.4

124,318

4.3

-37,167

-168

13,151

73,906

6,927

0

80,834

7,685

10.4

73,148

-41.2

-43,554

0

15,846

45,516

0

0

45,516

3,528

7.8

41,988

-42.6

-47,111

0

17,229

54,437

0

0

54,437

11,151

20.5

43,286

3.1

2010

18,970

319,714

338,683

34,007

4,619

377,310

2011

19,019

383,913

402,932

26,782

5,750

435,465

2012

19,074

463,847

482,921

0

6,841

489,762

2013

19,102

457,892

476,994

0

4,641

481,635

2014

19,076

555,301

574,377

0

7,356

581,733

2015E

18,746

592,023

610,769

0

8,834

619,603

2016E

18,746

606,064

624,810

0

8,606

633,416

2017E

18,746

639,033

657,780

0

8,334

666,114

1,270

4,995

91,635

59,236

20,850

39,819

59,294

30,207

45,002

60,645

33,366

43,850

60,193

38,644

56,969

56,349

32,979

95,792

51,897

24,196

131,956

46,836

13,277

141,307

253,193

17,124

253,193

10,945

253,193

18,356

151,889

103,823

151,922

163,638

151,922

143,105

151,922

143,105

151,922

143,105

2,909

3,067

9,294

8,462

3,277

14,829

44,847

16,655

8,268

14,968

70,135

35,010

6,420

22,852

55,568

61,600

56,798

25,124

17,619

86,002

22,343

20,311

27,234

176,360

20,259

18,417

14,669

180,456

23,175

21,068

57,781

180,456

9,869

4,937

8,928

377,310

12,638

16,628

50,342

435,465

24,828

19,946

83,608

489,762

17,399

40,978

88,063

481,635

27,166

48,009

110,367

581,733

54,841

51,951

139,455

619,603

49,727

53,735

130,340

633,416

56,885

55,930

169,667

666,114

Balance Sheet

Y/E March

Share Capital

Reserves & Surplus

Net Worth

Total Loans

Deferred Tax

Capital Employed

Net Fixed Assets

Prod. Proper.(net of depletion)

Capital WIP

Goodwill

Investments

Curr. Assets, L & Adv.

Inventory

Debtors

Cash & Bank Balance

Loans & Adv. and Other CA

Current Liab. & Prov.

Liabilities

Provisions

Net Current Assets

Application of Funds

E: MOSL Estimates

22 January 2015

(INR Million)

12

Cairn India

Financials and valuations

Ratios

Y/E March

Basic (INR)

EPS

Adjusted EPS

Cash EPS

Book Value

Adj. Book Value

DPS

Payout (incl. Div. Tax.)

2010

2011

2012

2013

2014

2015E

2016E

2017E

5.5

5.5

6.3

178.1

44.9

0.0

0.0

33.3

33.3

39.6

211.9

78.7

0.0

0.0

41.6

48.7

49.2

253.2

120.4

0.0

0.0

63.1

63.1

72.8

249.7

170.2

11.5

21.6

65.2

65.2

77.2

301.1

221.5

12.5

22.5

39.0

39.0

46.6

325.8

244.8

12.5

38.2

22.4

22.4

40.7

333.3

252.3

4.6

24.6

23.1

23.1

42.8

350.9

269.8

4.8

24.6

5.7

4.9

3.5

10.7

0.9

0.0

3.8

3.3

2.2

7.6

1.0

4.8

3.7

3.1

2.0

6.4

0.8

5.2

6.1

5.1

2.9

6.4

0.7

5.2

10.7

5.9

4.1

6.6

0.7

1.9

10.3

5.6

3.0

5.7

0.7

2.0

Valuation (x)

P/E

Cash P/E

EV / EBITDA

EV / BOE (in USD, 1P basis)

Price / Book Value

Dividend Yield (%)

Profitability Ratios (%)

RoE

RoCE

3.2

2.6

17.1

17.9

21.0

20.3

24.8

24.5

23.6

22.9

12.3

12.3

6.8

7.3

6.7

8.4

Turnover Ratios

Debtors (No. of Days)

Fixed Asset Turnover (x)

52

7.3

32

1.5

41.5

1.8

39.4

2.1

46.7

2.1

50.0

1.5

50.0

1.3

50.0

1.4

Cash Flow Statement

Y/E March

Profit /(Loss) before Tax

Depreciation

Other op activities

Direct Taxes Paid

(Inc)/Dec in Wkg. Capital

CF from Op. Activity

(Inc)/Dec in FA & CWIP

(Pur)/Sale of Investments

Interest & dvd received

CF from Inv. Activity

Change in Equity

Inc / (Dec) in Debt

Other fin, activities

Dividends Paid

CF from Fin. Activity

Inc / ( Dec) in Cash

Add: Opening Balance

Closing Balance b/f deposit

Bank deposit

Closing Balance

22 January 2015

(INR Million)

2010

10,164

1,780

-2,012

-1,753

-7,082

1,097

-33,662

25,194

2,360

-6,108

20

-8,713

-1,760

0

-10,453

-15,464

21,733

6,269

3,025

9,294

2011

68,900

12,226

4,935

-12,592

-10,088

63,381

-25,648

-24,438

903

-49,183

670

-7,348

-2,052

0

-8,730

5,468

6,223

11,691

33,156

44,847

2012

84,235

14,709

-6,915

-21,291

-29

70,710

-29,558

-196

2,449

-27,306

566

-14,419

-1,363

0

-15,216

28,188

11,467

39,656

30,480

70,135

2013

121,548

18,873

-1,448

-22,687

-5,730

110,556

-16,313

-117,506

3,238

-130,581

589

-12,500

-968

-11,098

-23,977

-44,002

44,463

462

55,106

55,568

2014

128,496

23,545

-773

-26,227

-14,113

110,928

-28,733

-55,700

3,142

-81,291

-945

0

-358

-27,939

-29,242

395

463

858

16,762

17,619

2015E

80,834

30,519

4,632

-6,207

-19,474

90,303

-66,482

20,533

2,016

-43,933

-11,055

0

0

-25,701

-36,756

9,614

17,619

27,234

2016E

45,516

34,246

6,690

-3,755

-3,449

79,248

-66,482

0

2,617

-63,865

0

0

0

-27,947

-27,947

-12,564

27,234

14,669

2017E

54,437

36,990

6,167

-11,423

3,785

89,956

-40,482

0

3,954

-36,529

0

0

0

-10,316

-10,316

43,112

14,669

57,781

27,234

14,669

57,781

13

Disclosures

This document has been prepared by Motilal Oswal Securities Limited (hereinafter referred to as Most) to provide information about the company(ies) and/sector(s), if any, covered in the report and may be

distributed by it and/or its affiliated company(ies). This report is for personal information of the selected recipient/s and does not construe to be any investment, legal or taxation advice to you. This research report does

Cairn

not constitute an offer, invitation or inducement to invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon

it. ThisIndia

report is not

for public distribution and has been furnished to you solely for your general information and should not be reproduced or redistributed to any other person in any form. This report does not constitute a personal

recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, investors should consider

whether it is suitable for their particular circumstances and, if necessary, seek professional advice. The price and value of the investments referred to in this material and the income from them may go down as well as

up, and investors may realize losses on any investments. Past performance is not a guide for future performance, future returns are not guaranteed and a loss of original capital may occur.

MOSt and its affiliates are a full-service, integrated investment banking, investment management, brokerage and financing group. We and our affiliates have investment banking and other business relationships with a

some companies covered by our Research Department. Our research professionals may provide input into our investment banking and other business selection processes. Investors should assume that MOSt and/or

its affiliates are seeking or will seek investment banking or other business from the company or companies that are the subject of this material and that the research professionals who were involved in preparing this

material may educate investors on investments in such business. The research professionals responsible for the preparation of this document may interact with trading desk personnel, sales personnel and other

parties for the purpose of gathering, applying and interpreting information. Our research professionals are paid on the profitability of MOSt which may include earnings from investment banking and other business.

MOSt generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

Additionally, MOSt generally prohibits its analysts and persons reporting to analysts from serving as an officer, director, or advisory board member of any companies that the analysts cover. Our salespeople, traders,

and other professionals or affiliates may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary

trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all of the foregoing

among other things, may give rise to real or potential conflicts of interest. MOSt and its affiliated company(ies), their directors and employees and their relatives may; (a) from time to time, have a long or short position

in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein. (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation

or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with

respect to any recommendation and other related information and opinions.; however the same shall have no bearing whatsoever on the specific recommendations made by the analyst(s), as the recommendations

made by the analyst(s) are completely independent of the views of the affiliates of MOSt even though there might exist an inherent conflict of interest in some of the stocks mentioned in the research report

Reports based on technical and derivative analysis center on studying charts company's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as

such, may not match with a report on a company's fundamental analysis. In addition MOST has different business segments / Divisions with independent research separated by Chinese walls catering to different set

of customers having various objectives, risk profiles, investment horizon, etc, and therefore may at times have different contrary views on stocks sectors and markets.

Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its affiliates or

employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees to hold MOSt or any of

its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The information contained herein is

based on publicly available data or other sources believed to be reliable. Any statements contained in this report attributed to a third party represent MOSt’s interpretation of the data, information and/or opinions

provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party. This Report is not intended to be a complete statement or

summary of the securities, markets or developments referred to in the document. While we would endeavor to update the information herein on reasonable basis, MOSt and/or its affiliates are under no obligation to

update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its affiliates or employees shall not be in any way

responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any of its affiliates or employees do not provide, at any time,

any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations.

This report is intended for distribution to institutional investors. Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any investment decision based on

this report or for any necessary explanation of its contents.

Most and it’s associates may have managed or co-managed public offering of securities, may have received compensation for investment banking or merchant banking or brokerage services, may have received any

compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months.

Most and it’s associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

Subject Company may have been a client of Most or its associates during twelve months preceding the date of distribution of the research report

MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise of over 1 % at the end of the month immediately preceding the date of publication of the research in the securities

mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the

report.

Motilal Oswal Securities Limited is under the process of seeking registration under SEBI (Research Analyst) Regulations, 2014.

There are no material disciplinary action that been taken by any regulatory authority impacting equity research analysis activities

Analyst Certification

The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be

directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally responsible for preparation

of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues

Disclosure of Interest Statement

Analyst ownership of the stock

Served as an officer, director or employee

CAIRN INDIA

No

No

Regional Disclosures (outside India)

This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary to law,

regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions.

For U.S.

Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United States. In

addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state laws in the

United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services described herein are not available to or

intended for U.S. persons.

This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major institutional

investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only available to major

institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the

"Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the U.S., MOSL has entered into a chaperoning

agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to this report will have to be executed within the provisions of this

chaperoning agreement.

The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered broker-dealer, MOSIPL,

and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a research analyst account.

For Singapore

Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial Advisors

Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed in Singapore to

accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time.

In respect of any matter arising from or in connection with the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited:

Anosh Koppikar

Kadambari Balachandran

Email : anosh.Koppikar@motilaloswal.com

Email : kadambari.balachandran@motilaloswal.com

Contact : (+65)68189232

Contact : (+65) 68189233 / 65249115

Office Address : 21 (Suite 31),16 Collyer Quay,Singapore 04931

Motilal Oswal Securities Ltd

22 January 2015

Motilal Oswal Tower, Level 9, Sayani Road, Prabhadevi, Mumbai 400 025

Phone: +91 22 3982 5500 E-mail: reports@motilaloswal.com

14

© Copyright 2025