DBR Benefits Briefing - UCSB Human Resources

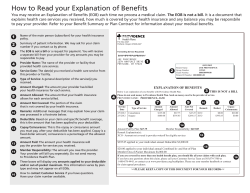

DBR Benefits Briefing This presentation is intended for communication purposes only, it is not a guarantee of benefits. Please see insurance plan documents and http://ucnet.universityofcalifornia.edu/OE for complete information. Thank you DBRs! We rely on you to be an informed resource for the employees in your departments. • • • • • Health insurance benefits Other insurance and programs Retirement benefits Disability Services Human Resources programs and events Your Benefits and Disability Partners Benefits Disability Services Lisa Romero Elizabeth Hammond Delo Gabe Suarez Christie Pryce Cynthia Del Rosario Rachel Miles Rachel Miles Edna Arellano Laura Morgan Kevin Wilson-Smith Agenda for DBR Briefing • • • • • • • Open Enrollment Basics Communication & Events 2015 Medical Plans Medical Plan Rates Other Plans Administrative Actions Fidelity Retirement Services Open Enrollment Dates Start: Thursday, October 30 at 8:00 AM End: Tuesday, November 25 at 5:00 PM All changes effective on January 1, 2015 Actions • Change medical or dental plans • Enroll eligible family members in medical, dental, vision or legal plans • Enroll in Health or Dependent Care Flexible Spending Account (reenroll each year) • Increase waiting period for Supplemental Disability if currently enrolled How to make changes? • Go to Open Enrollment website on UCnet http://ucnet.universityofcalifornia.edu/OE – Select “Sign In” – Sign-in using your AYSO ID and password – Select “Open Enrollment for 2015” link – Select the tab for the change you desire – Confirm your selection – Print your confirmation Resetting Passwords on AYSO https://atyourserviceonline.ucop.edu/ayso/ • Encourage employees to use the “forgot password” and “forgot username” options on At Your Service Online • If that doesn’t work, call or email: Edna Arellano edna.arellano@hr.ucsb.edu x4048 Booklets & Open Enrollment Website Oct. 27 - Booklets mail o Cut-off date for mailing August 31 o Employees input in PPS after this date should be referred to web for OE materials Oct. 27 - OE website launches http://ucnet.universityofcalifornia.edu/oe o News stories on UCnet o Benefit Education Videos o Medical Plan Chooser Videos & News Stories on UCnet Benefit Education Videos Medical Plan Comparison English and Spanish Disability Insurance Medical Terms and Concepts Use Your Medical Benefits Wisely News Stories OE Overview and Rates Medical Plan Satisfaction Survey Changes to Disability Benefit Education Videos Campus Events Mini-Fair & Presentations – November 17 Fair participants - Medical plans, ARAG Legal, Fidelity Presentations by medical plan representatives Presentations by Benefits Staff Medical Plan Comparison Blue Shield Health Savings Plan Health Flexible Spending Account Help Desks Farmers Market Q&A with Computer Lab 2015 Faculty/Staff/Retiree Program 13 vendors > 26 plan renewals > $2 billion annual premium Medical (6 plans) Medicare Retirees (6 plans) Blue Shield of CA UC Care* (self-insured) Health Savings Plan Core (self-insured) Non-Medical (13 plans) Blue Shield of CA Medicare PPO (self-insured) Medicare PPO no Rx (selfinsured) High Option Supplement (selfinsured) Delta Dental Delta Dental PPO DeltaCare USA Health Net Blue & Gold HMO Health Net Seniority Plus Liberty Mutual - Disability UC paid short term disability Employee paid supplemental disability Kaiser Kaiser Senior Advantage Prudential - Life Basic Life Core Life Western Health Advantage One Exchange (outside CA) ARAG - Group Legal Plan Behavioral Health – Optum Wellness - Optum Vision Service Plan Actives, Retirees Supplemental Life Dependent Life (basic/expanded) AIG – AD&D Actives, Retirees Wellness - Optum CONEXIS - Flexible Spending Accounts Dependent Care, Health Care • * UC Care is managed within UCOP Office of Risk Services; all other plans managed within UCOP Benefits Programs & Strategy. • Separate Postdoctoral Scholars program with different portfolio. 3 vendors, 9 plans, $59 million premium. 2015 Medical Plan Updates & Mandates All medical plans continue in 2015 No major changes, several enhanced benefits • • • • • Health Net Blue & Gold HMO Kaiser HMO UC Care PPO Blue Shield Health Savings Plan Core 2014 Medical Plan Enrollment 90 Day Maintenance Drug – Retail Option CURRENT Pharmacy 2015 Mail order pharmacy Current mail order and UC UC Medical Centers UC Care : Safeway/Vons, Walgreens, Costco and others Health Net Blue & Gold: CVS Cost sharing • Members pay two copayments (rather than three) Same as current • Kaiser members only receive extended supply for 2 copays through mail order. • Core and Blue Shield HSP subject to deductible and coinsurance – convenient access but no cost savings. Chiropractic/Acupuncture CURRENT 2015 Not covered $20 copay 24 visits yearly for self-referral (combined) American Specialty Health providers Only acupuncture through Kaiser provider is covered ($20 Copay) $15 copay for acupuncture or chiro 24 visits yearly for self-referral (combined) American Specialty Health providers UC Care Chiro/Acupuncture covered as Tier 2 and 3 UC Care aligning Tier 3 coinsurance for chiropractic services to match other services – 50% coinsurance Core Both Acupuncture and Chiro subject to $500 max Eliminate $500 maximum 24 visits yearly (combined) Health Net Blue & Gold Kaiser OR $20 copay through Kaiser provider for acupuncture only Out-of-Pocket Maximum • The most the insurance plan requires you to pay in a year • Once you have paid this amount, the insurance plan pays 100% of future expenses. • Includes deductible, copay, coinsurance for medical services. Some plans also include drug expenses. • Does not include amounts “not allowed” by insurance plan when using out-of-network providers. • Currently, all UC plans have an out-of-pocket maximum for medical expenses. Out of Pocket Maximum Changes 2015 ACA Mandate: Prescription drug (Rx) cost must apply towards an Out-of-Pocket (OOP) Maximum. Blue Shield HSP and Core currently comply. Plans changing to meet mandate: Health Net Blue & Gold - Combined Medical and Rx OOP: $1,000 individual /$3,000 family (>3) Kaiser Permanente - Combined Medical and Rx OOP: $1,500 individual /$3,000 family (>2) UC Care updates described on next slide. 20 Out of Pocket Max – UC Care CURRENT There is only one Out of Pocket Maximum: Medical NEW FOR 2015 UC Care will have two separate Out of Pocket Maximums No Rx out of pocket max. Medical OOP max (individual/family >3) Medical: No change to OOP max amounts Rx: OOP max – In-Network Pharmacies - UC Select: $1,500/$4,500 - Preferred: $3,000/$9,000 - Non-Preferred: $5,000/$15,000 $3,600 individual $4,200 family Other ACA Mandated Changes Nicotine Replacement Over the Counter (OTC) Products - 2015 will be covered at no cost (currently $5 generic copay) when prescribed by a physician. - Take OTC products with prescription to the pharmacy counter to purchase. Women’s Preventive Health - Cancer risk reducing medications for women at increased risk of breast cancer (e.g., Tamoxifen or Raloxifene) - 2015 will be covered at no cost Blue Shield Health Savings Plan Combines high deductible PPO with account to pay out-of-pocket expenses + Medical Coverage Blue Shield PPO Health Savings Account HealthEquity Blue Shield Health Savings Plan Limits IRS annually increases definition of “high deductible” and Health Savings Account maximum annual contribution amounts. In-Network Deductible In-Network Out-of-pocket Max Max HSA Contribution UC HSA Contribution 2014 2015 Change Single $1,250 $1,300 $50 Family $2,500 $2,600 $100 Single $4,000 Family $6,400 No change Single $3,300 $3,350 $50 Family $6,550 $6,650 $100 Single $500 Family $1,000 No change 24 Blue Shield HSP - HSA Contributions Plan members can make pre-tax contributions to the Health Savings Account (HSA) 2014 members - HSA contribution elections made through payroll deduction will automatically carry over into 2015 unless a change is made. HealthEquity Current members and new members can make or change HSA contribution elections through AYSO during Open Enrollment (effective January 1). Members may also make changes at anytime using UPAY850 Calculator tool is available on Health Equity website http://healthequity.com/ed/uc/ UC Care PPO UC Select Tier 1 Blue Shield Preferred Tier 2 Non-Preferred Out-of-Network Tier 3 Copays Deductible Deductible 20% Coinsurance 50% Coinsurance • Your costs are based on the tier/network that the provider is in and the service that you receive • Not all services are covered at as a UC Select/Tier 1benefit • Some services are covered only at the Blue Shield Preferred and Non-Preferred tiers Emergency – UC Care Covered Service UC Select Tier 1 Blue Shield Preferred Tier 2 Non-Preferred (out-of-network) Tier 3 $100 per visit $100 per visit (not subject to the calendar year deductible) (not subject to the calendar year deductible) 20% 20% (not subject to the calendar year deductible) (not subject to the calendar year deductible) CURRENT Emergency facility (not resulting in an admission) ER Physician Services $100 per visit 20% For ER Services resulting in admission – ER fees waived, $250 hospital copay Emergency – UC Care Covered Service UC Select Tier 1 Blue Shield Preferred Tier 2 Non-Preferred (out-of-network) Tier 3 NEW FOR 2015: Combining ER facility and Physician services as one fixed copay amount Emergency facility (not resulting in an admission) ER Physician Services $200 per visit No Charge $200 per visit $200 per visit (not subject to the calendar year deductible) (not subject to the calendar year deductible) No Charge No Charge For ER Services resulting in admission – no change; remains $250 copay. Ambulance – UC Care Covered Service UC Select Tier 1 Blue Shield Preferred Tier 2 Non-Preferred (out-of-network) Tier 3 20% 20% CURRENT Ambulance Services N/A (services covered under Blue Shield Preferred) NEW FOR 2015: Changing from coinsurance to a flat copay Ambulance Services N/A (services covered under Blue Shield Preferred) $200 per transport $200 per transport Vaccinations – UC Care Coverage for the following vaccinations expanded to in-network pharmacy: tetanus, whooping cough (pertussis) pneumococcal, meningococcal, cervical cancer (HPV) and shingles (herpes zoster). Per medical plan Preventive Health Benefits (based on age and gender requirements) CURRENT Covered at a $0 copay NEW FOR 2015 Covered at a $0 copay Services received from an in-network physician Allow adults to receive services from an in-network physician or in-network pharmacy UC Care - Santa Barbara Network Update Provider Status Sansum Clinic Sansum will remain in the UC Select/Tier 1 Quest Diagnostic Lab Unilab Will remain in the UC Select/Tier 1 Pueblo Radiology Pueblo Radiology is currently being reviewed Cottage Hospital Cottage remains in Blue Shield Preferred/Tier 2 Pacific Diagnostic Lab PDL remains in Blue Shield Preferred/Tier 2 Santa Barbara Preferred Health Partners Some physicians affiliated with SB Preferred Health Partners are in Blue Shield Preferred/Tier 2 No changes in the Ventura and Santa Maria networks. Teladoc – Blue Shield Telemedicine services available by phone, mobile applications or online video Board certified physicians 24/7/365 UC Care: $20 copay (copay does NOT count towards deductible, does count towards OOP) Core and Blue Shield Health Savings Plan: $40 copay until deductible met and then 20% coinsurance after (copay counts towards deductible and OOP) Prescription Management Top 10 Diagnoses • • • • • • • • • • Sinus Problems Urinary Tract Infection Pink Eye Bronchitis Upper Respiratory Infection Nasal Congestion Allergies Flu Cough Ear Infection • • • • Electronic prescribing (SureScripts) or by phone, if needed Use of antibiotics limited to short durations No prescribing of DEA-controlled substances, medication for psychiatric illness, or lifestyle drugs Generic drugs are automatically recommended 2015 Medical Plan Rates • On average, UC pays 86.6 percent of the total cost of medical premiums. • Medical plan premiums based on your full-time equivalent salary rate as of Jan. 1, 2014. • Note for union-represented employees: Rates shown on chart indicate only proposed rates for some union-represented employees and are subject to ongoing collective bargaining as appropriate. Please contact your union for current rates. 2015 Medical Pay Band Adjustments 2014 Pay Band Definition of Range for Medical Contribution Base Using Full-Time Salary As of Jan. 2013 2015 Pay Band Definition of Range for Medical Contribution Base Using Full-Time Salary As of Jan. 2014 1 $51,000 & under 1 $51,000 & under 2 $51,001 to $101,000 2 $51,001 to $101,000 3 $101,001 to $151,000 3 $101,001 to $152,000 4 $151,001 & over 4 $152,001 & over Pay Bands are adjusted annually, based on the change in California consumer price index from February of prior year to February of current year (determined by the California Department of Finance). The index used is that for urban wage earners and clerical workers (CPI-U). The change from February 2013 to February 2014 was 0.9%. Definition of Covered Salary for Life, Disability and MCB • UC changed the definition of covered salary for Life Insurance, Disability Insurance, and Medical Contribution Base (MCB) effective 1/1/2014. All definitions were simplified to “base salary” only “Extra” pay such as stipends, shift differentials, overtime, etc. are excluded from all salary base calculations Multiple appointments with different rates will receive prorated salary base (instead of highest rate) Dental & Vision – No changes Dental o Delta Dental PPO o DeltaCare HMO Vision o Vision Services Plan No contributions for employee dental and vision Retiree vision open for 2015, no rate change Legal - ARAG The plan will be open for new enrollments this year. Claims experience has been consistent, thus rates are not increasing. Expanded identity theft protection benefit added that includes: - Full service identity restoration - Identity Theft Insurance up to $1million - Lost wallet services - Credit monitoring service, internet surveillance of personal information and child identity monitoring (register on website) - Powered by CSID, leader of global enterprise level identity protection and fraud detection solutions. ARAG’s New Expanded ID Theft Protection Many of the new tools are full service/ concierge type, rather than just information based ARAG will work on the member’s behalf to completely resolve the ID theft problem Free insurance covers members’ costs associated with ID theft restoration - For example: child care expenses, unpaid time off work, mileage Family Member Eligibility Verification Employees adding a new family member during Open Enrollment will receive a notice from SECOVA in January. Employees who add new family members to their health plans are required to participate in the Family Member Eligibility Verification (FMEV) program. SECOVA asks for documentation to verify that the family member satisfies the UC eligibility criteria. See UCnet for more information: – UC Group Insurance Eligibility Factsheet – Family Member Eligibility Verification Process Flexible Spending Accounts (FSA) • Tax savings on health and dependent care expenses • Must enroll or reenroll to participate in 2015 – Blue Shield Health Savings plan member may NOT enroll in a Health FSA • DepCare – no changes • Health FSA – The “use it or lose it” rules will be modified for the 2015 plan year. • 2015 plan members will be able to “carry over” $500 into 2016 • See FSA workshops offered during Open Enrollment • More information will be available on UCnet – 2014 plan members must make eligible purchases prior to 3/15/15 or they will lose any remaining contributions. UC Living Well • Wellness program • Co-sponsored by Optum and campus wellness programs • Program continues with few changes • Spouses and domestic partners are no longer eligible for gift card • See UCnet for complete eligibility and program information Supplemental Disability 19% increase in Supplemental Disability Rates - the first rate increase in 5 years. Rates increase for 7 and 30 day waiting periods - NOT 90 and 180 day. Employees can increase their waiting period through At Your Service Online (AYSO) during the OE period with an effective date of January 1, 2015. Premium calculator tool will be available on UCnet during OE. FAQ will be available in English and Spanish later this month. New Disability Coordinator, Rachel Miles Rachel.Miles@hr.ucsb.edu 805-893-4263 Supplemental Disability - Examples Rates are based on age, salary and waiting period elected. Examples: Age 40, $100k salary, 30 day waiting period Age 50, $100k salary, 30 day waiting period Rate increase of $6.97 ($36.67 to $43. 64) Rate increase of $10.45 ($55.00 to $65.45) Supplemental Disability: AYSO Via AYSO: Can only change coverage with waiting period longer than current. Example: Options presented to someone with 7-day waiting period currently. ACA - Employer Shared Responsibility Provision of Affordable Care Act (ACA) that defines the percentage of full time employees who must be offered insurance by an employer 2015 - UC meets requirements under our existing eligibility rules. 2016 - UC does not meet the requirements under our existing eligibility rules. Eligibility will expand to appointment types that currently are not eligible. More information and training will be coming in the new year. UCPath – Best Practices Best practices will be posted on http://www.ets.ucsb.edu/projects/ucpath Reminders: Use legal names in PPS - not “preferred” names. Enter full addresses with zip code Original hire date should never change and student employment counts Most recent hire date (IGEN screen): For UC transfers without a break in service - date should be the date provided by the previous campus. Do not use the date they are hired on this campus. Our Retirement Partners UC Retirement Administration Service Center (RASC) Provides retirement counseling for staff and academic employees Services include: Answering questions about service credit, retirement estimator tool Retiree Health Insurance eligibility Service credit buyback inquires/processing UCnet: Contact RASC Customer Service via Online Form Phone: 1-800-888-8267 (in U.S.) Phone: 1-510-987-0200 (from outside the U.S.) Monday–Friday, 8:30 a.m. 4:30 p.m. (PT). Fax: 1-800-792-5178 Our Retirement Partners Fidelity Retirement Services Provides the record keeping, financial education and account services for the UC Retirement Savings Programs Cesar Cap - Retirement Counselor for UC Santa Barbara Workshops on campus and via webinar Department workshops/help desk Lindsey Grainger –Fidelity Workplace Planning and Guidance Consultant In person One-on-One meetings available by appointment 1-800-558-9182 Netbenefits.com 1-866-682-7787

© Copyright 2025