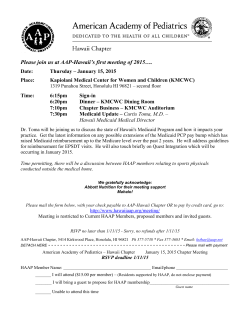

Inside CMS - InsideHealthPolicy.com