Weekly Market Notes

Baird Market and Investment Strategy

Weekly Market Notes

February 9, 2015

Dow Industrials 17824

S&P 500 2055

Please refer to Appendix – Important Disclosures

Summary

The U.S. Economy a Beacon of Strength

Economy: Manufacturing slows but service

sector growth continues north; labor markets

surprise on the upside

The equity markets roared back last week recapturing nearly all of the losses from

January’s disappointing performance. The rally in stocks came on the heels of a

Fed Policy: Strong wage report prompts

7.0% five-day rally in crude oil. Rising prices for oil and other commodities

rise in expectations of Fed rate hike

including copper put aside, at least for the time being, the notion that the global

economy was dangerously close to recession. The domestic economy also

Sentiment: Indicators remain mixed. AAII

exhibited signs that growth was accelerating following Friday’s report from the

survey shows increase in bears but active

Labor Department. Non-farm payrolls were much stronger than expected in

money managers fully invested

January. Additionally, revisions to the prior two months were substantially higher.

The data showed that the U.S. economy created one million jobs the past three

Strongest Sectors: Consumer

months. The jobs report also included the fact that the average weekly hours are at

discretionary and materials moving into top

the best level in more than eight years and the improvement in hourly earnings in

positions – bullish ramifications for market

January was the best since 2008. The good news supported the consensus view

that the Fed will raise interest rates later this year. We continue to believe a rate

hike is unlikely given the instability in the global economy. Nevertheless, should Fed

Chief Yellen decide to take action on rates, it is not expected to have a negative

influence on stocks. According to Ned Davis Research, the stock market has historically rallied into the first rate hike by the Fed

and trended higher six months following the initial rise in rates.

Since November, stocks have traded between 1970 and 2070 using the S&P 500 and we anticipate that will continue as we move

deeper into the first quarter of 2015. Looking further out, a breakout is expected to be on the upside given the improving

economic fundamentals and technical condition of the equity markets. The strong combination of improving wages and lower

energy costs will provide consumers the ability to improve their balance sheets. Over the long term, the economy and financial

markets do best when consumers are adding liquidity by saving more. Technically, the breadth of the market improved

significantly last week. The percentage of groups within the S&P 500 that are in uptrends climbed to 70% from 67% the previous

week. Despite last week’s performance ranking as the best in 24 months, investor enthusiasm remains muted. Until investor

optimism becomes excessive and deeply seated the longer-term bullish trend is expected to continue.

Sentiment

Current

Previous

Indication

CBOE 10-Day Put/Call Ratio

Below 80% is bearish; Above 95% is bullish

102%

103%

Bullish

CBOE 3-Day Equity Put/Call Ratio

Below 53% is bearish; Above 64% is bullish

65%

71%

Neutral

VIX Volatility Index

Below 16 is bearish; Above 21 is bullish

17.3

20.9

Neutral

American Association of Individual Investors

Twice as many bulls as bears is bearish; more bears than

bulls is bullish

Bulls:

Bears:

35.5%

32.4%

Bulls:

Bears:

44.2%

22.4%

Neutral

Investors Intelligence (Advisory Services)

55% bulls and/or less than 16% bears is considered bearish

Bulls:

Bears:

49.0%

16.3 %

Bulls:

Bears:

53.1.0%

16.3 %

Neutral

National Assoc. of Active Investment Mgrs. (NAAIM)

Below 30% is bullish; Above 80% is bearish

Ned Davis Research Crowd Sentiment Poll

Ned Davis Research Daily Trading Sentiment Composite

Bruce Bittles

Chief Investment Strategist

bbittles@rwbaird.com

941-906-2830

93%

92%

Bearish

Optimism Fading

Optimism Fading

Neutral

Pessimism Fading

Extreme Pessimism

Neutral

Weekly Market Notes

RS Ranking

RS

Current

Previous Trend

Utilities

1

**

1

Consumer

Discretionary

2

**

4

Health Care

3

**

2

Consumer Staples

4

**

3

Materials

Information

Technology

5

7

+

6

6

-

Industrials

7

5

Telecom Services

8

9

Financials

9

8

Energy

10

10

Leaders:

Laggards:

Leaders:

Laggards:

Leaders:

Laggards:

Leaders:

Laggards:

Leaders:

Laggards:

Leaders:

Laggards:

Leaders:

-

Laggards:

Leaders:

Laggards:

Leaders:

Laggards:

Leaders:

Laggards:

** Denotes Current Relative Strength-Based Overweight Sectors

** 1 = Strongest Relative strength 10 = Weakest Relative strength

Sub-Industry Detail

Independent Power Producers

Home Furnishings; Household Appliances; General Merchandise

Stores; Apparel Retail; Home Improvement Retail; Automotive

Retail; Homefurnishing Retail

Tires & Rubber; Motorcycle Manufacturers; Leisure Products;

Apparel, Accessories & Luxury Goods; Casinos & Gaming;

Broadcasting

Managed Health Care

Drug Retail; Food Retail; Distillers & Vintners

Aluminum

Diversified Metals & Mining; Steel

Home Entertainment Software; Electronic Components

Electronic Equipment & Instruments

Diversified Support Services; Human Resources & Employment

Services

Construction & Engineering; Electrical Components & Equipment;

Construction Machinery & Heavy Trucks; Trading Companies &

Distributors; Office Services & Supplies

Diversified REITs; Office REITs; Residential REITs; Retail REITs

Consumer Finance; Life & Health Insurance; Multi-line Insurance

Oil & Gas Equipment & Services; Coal & Consumable Fuels

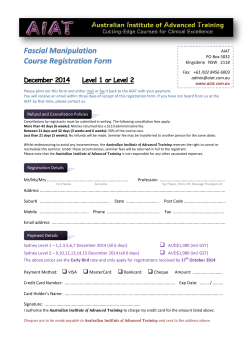

S&P 500 Around Six Months Before and After Starts of Fed Tightening Cycles

110.0

110.0

109.5

109.5

109.0

109.0

Average of 13 Cases Since 1928

108.5

108.5

108.0

108.0

107.5

107.5

107.0

107.0

106.5

106.5

106.0

106.0

105.5

105.5

105.0

105.0

104.5

104.5

104.0

104.0

103.5

103.5

103.0

103.0

102.5

102.5

102.0

102.0

101.5

101.5

101.0

101.0

100.5

100.5

100.0

100.0

-6

-5

-4

-3

-2

-1

0

Start of Tightening Cycle

1

2

Source:

3

S&P Dow Jones Indices

4

5

6

Months Prior | Months Post

SSF14_15A_C

© Copyright 2014 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved.

See NDR Disclaimer at www.ndr.com/copyright.html

For data vendor disclaimers refer to

www.ndr.com/vendorinfo/

Source: Source: Stockcharts

Robert W. Baird & Co.

Page 2 of 3

Weekly Market Notes

Appendix – Important Disclosures and Analyst Certification

This is not a complete analysis of every material fact regarding any company, industry or security. The

opinions expressed here reflect our judgment at this date and are subject to change. The information has

been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

ADDITIONAL INFORMATION ON COMPANIES MENTIONED HEREIN IS AVAILABLE UPON REQUEST

The indices used in this report to measure and report performance of various sectors of the market are

unmanaged and direct investment in indices is not available.

Baird is exempt from the requirement to hold an Australian financial services license. Baird is regulated by the

United States Securities and Exchange Commission, FINRA, and various other self-regulatory organizations

and those laws and regulations may differ from Australian laws. This report has been prepared in accordance

with the laws and regulations governing United States broker-dealers and not Australian laws.

Copyright 2015 Robert W. Baird & Co. Incorporated

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other

countries for which Robert W Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2)

of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are

investment professionals and may not be distributed to private clients. Issued in the United Kingdom by

Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M

7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the

Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services

license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may

differ from Australian laws. This document has been prepared in accordance with FCA requirements and not

Australian laws.

Robert W. Baird & Co.

Page 3 of 3

© Copyright 2025