Retail Report for 2015

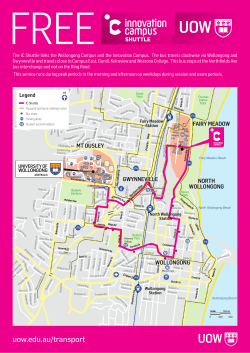

INTRODUCTION CPEX Real Estate is pleased to present our an- Crain’s New York Business; Downtown Brooklyn Partnership; nual Brooklyn Retail Report for 2015, a compre- NYC MTA; New York Daily News; StreetEasy; The Real Deal; U.S. hensive survey of the primary, secondary, and Census Bureau; and the Wall Street Journal). tertiary retail corridors throughout the borough. Considering the dynamics of the Brooklyn retail market and the The 2015 CPEX Brooklyn Retail Report is com- overall economic conditions, these pricing levels are not only sub- piled by the CPEX Retail Leasing Team, with ject to change, but will most likely fluctuate as various market con- assistance from our research and graphics ditions, supply, demand, as well as economic indicators change departments. Once again, 2015 reveals a tale from quarter to quarter. While the actual pricing levels may change of two Brooklyns; Southern Brooklyn didn’t in the coming months, this report can be an important tool for leas- undergo as much expansion or appreciation, ing comparisons, for calculating percent changes across neighbor- while north of Prospect Park saw a significant hoods and boroughs, and for quantifying Net Operating Income spike in density. In this latest version, we have levels in estimating cap rates and performing property valuations. identified 27 additional retail corridors from This report can assist property owners and business owners with a the previous year’s report to account for the current and up-to-date synopsis of their market place. rapidly expanding retail scene in flourishing neighborhoods like Park Slope, Williamsburg, and Crown Heights – home to the most corridors in the borough. This brings the total number of significant retail arteries in the borough to 121, nearly double the total from just two years ago. From 2014, six corridors expanded, four thoroughfares were divided to account for certain sections commanding higher rents, and 15 saw enough of an increase in pricing to jump to the next tier in average price per square foot. For retail landlords and tenants with specific site analysis requirements, please note that each and every property provides unique Careful attention has been paid to summarize characteristics which affect its potential lease pricing levels. Char- the current market conditions. The pricing for acteristics such as location, size, build-out, neighboring tenants, each corridor provided is an estimate and a available transportation, street conditions, residential density, snapshot of the current period, based on the traffic, etc., all have an important impact on contracted leasing data collected from internal and external sourc- rates. As the economic market impacts the retail industry, we es, including: CPEX completed transactions, at CPEX will continue to monitor such changes and make them market reports from our in-house research, ap- available to our clients. Please call us if you have any questions praisers, and various data resources (Brown- regarding this report or if you require further information pertain- stoner.com; Commercial Observer; CoStar; ing to your real estate or business. The CPEX New York Retail Leasing Team Timothy D. King Managing Partner tking@cpexre.com (718) 687-4210 Ryan Condren Managing Director rcondren@cpexre.com (718) 687-4212 George Danut Associate Director gdanut@cpexre.com (718) 687-4220 WWW.CPEXRE.COM 2015 BROOKLYN RETAIL CORRIDOR MAP TOP THREE NEIGHBORHOODS 67 CORRIDORS IN 2013 RETAIL DENSITY 15 13 PARK SLOPE CORRIDORS WILLIAMSBURG 7 CROWN HEIGHTS 92 83 26 33 57 90 118 49 91 55 12 80 116 42 86 58 112 101 100 44 64 77 106 97 47 24 85 103 43 20 65 105 99 104 31 21 120 119 113 48 15 S 63 102 41 18 68 39 17 13 1 40 50 29 73 54 30 60 51 34 61 74 2 108 4 75 52 7 56 76 8 109 111 115 45 9 62 5 69 3 117 10 15 95 70 96 19 16 6 11 E 78 89 79 82 114 W 81 72 46 94 35 110 38 CORRIDORS 88 121 93 CORRIDORS N 87 71 66 22 25 67 84 27 28 37 23 32 98 107 59 53 67 CORRIDORS IN 2013 80% INCREASE IN AMOUNT OF CORRIDORS 121 CORRIDORS IN 2015 36 2015 RETAIL PPSF Range $35 - $49 PSF $50 - $64 PSF $65 - $79 PSF $80 - $99 PSF $100 - $149 PSF $150 - $199 PSF $200 - $250 PSF $250+ PSF Total Corridors Per Price Range 42 Corridors from $35 - $49 PSF 37 Corridors from $50 - $64 PSF 17 Corridors from $65 - $79 PSF 12 Corridors from $80 - $99 PSF 8 Corridors from $100 - $149 PSF 3 Corridors from $150 - $199 PSF 1 Corridor from $200 - $250 PSF 1 Corridor from $250+ PSF BAY JAMAICA 2013 FLASHBACK Total Corridors Per Price Range 32 Corridors from $35 - $49 PSF 15 Corridors from $50 - $64 PSF 8 Corridors from $65 - $79 PSF 4 Corridors from $80 - $99 PSF 5 Corridors from $100 - $124 PSF 3 Corridors from $150+ PSF 2015 BROOKLYN RETAIL CORRIDORS 1 3rd Ave Bay Ridge Ave 97th Street 61 Flatbush Ave Atlantic Ave St. Marks Ave 2 3rd Ave Atlantic Ave Union St 62 Flatbush Ave St. Marks Ave 8th Ave 3 3rd Ave Union St Prospect Ave 63 Flatbush Ave Empire Blvd Parkside Ave 4 4th Ave Atlantic Ave Sackett St 64 Flatbush Ave Linden Blvd Cortelyou Rd 5 4th Ave Sackett St 6th St 65 Flatbush Ave - The Junction Foster Ave Avenue I 6 4th Ave 6th St 18th St 66 Flatbush Ave Avenue L Avenue P 7 5th Ave Flatbush Ave Bergen Street 67 Flatbush Ave Avenue R Avenue V 8 5th Ave Bergen Street Berkeley St/Sackett St 68 Flushing Avenue Wilson Ave Wyckoff Ave 9 5th Ave Berkeley St/Sackett St 3rd St 69 Franklin Ave St. Marks Ave St. Johns Pl 10 5th Ave 3rd St 12th St 70 Franklin Ave St. Johns Pl Eastern Pkwy 11 5th Ave 12th St 16th St 71 Franklin St Eagle St Milton St 12 5th Ave 17th St 23rd St 72 Front/Water/Plymouth/Jay St - - 13 5th Ave 47th St 54th St 73 Fulton Street Mall Adams St Flatbush Avenue 14 5th Ave Senator St 97th Street 74 Fulton St Flatbush Ave Washington Ave 15 7th Ave Lincoln Pl 1st St 75 Fulton St Washington Ave Bedford Ave 16 7th Ave 1st St 9th St 76 Fulton St Bedford Ave Brooklyn Ave 17 7th Ave 9th St 16th St 77 Gateway Center - - 18 8th Ave 53rd St 61st St 78 Graham Ave Skillman Ave Grand St 19 9th St 4th Ave 6th Ave 79 Graham Ave Boerum St Flushing Ave 20 13th Ave 44th St 49th St 80 Grand St Union Ave Bushwick Ave 21 13th Ave 75th St 82nd St 81 Havemeyer St Grand St Broadway 22 18th Ave 61st St Bay Ridge Pkwy 82 Henry St Middagh St Clark Street 23 86th St 23rd Ave Stillwell Ave 83 Kent Ave North 7th St North 3rd St 24 86th St 4th Ave Fort Hamilton Pkwy 84 Kings Highway Coney Island Ave East 17th St 25 86th St 18th Ave 20th Ave 85 Knickerbocker Ave DeKalb Ave Menahan St 26 86th St Bay Pkwy 23rd Ave 86 Lewis Avenue Hancock St Fulton St 27 86th St (East Side) 20th Ave Bay Pkwy 87 Manhattan Ave Freeman St Greenpoint Ave 28 86th St (West Side) 20th Ave Bay Pkwy 88 Manhattan Ave Greenpoint Ave Nassau Ave 29 Atlantic Ave Clinton St Smith St 89 Metropolitan Ave Berry St Graham Ave 30 Atlantic Ave Smith St 4th Ave 90 Montague St Hicks St Court St 31 Avenue J Coney Island Ave East 15th St 91 Myrtle Ave Carlton Ave Steuben St 32 Avenue U Coney Island Ave Haring St 92 North 6th St Kent Ave Bedford Ave 33 Bedford Ave North 8th St North 3rd St 93 North 4th St Kent Ave Bedford Ave 35 Bedford Ave Metropolitan Ave South 5th St 94 Nassau Ave Dobbin St Russell St 34 Bedford Ave DeKalb Ave Fulton Street 95 Nostrand Ave St. Marks Ave Eastern Pkwy 36 Berry St North 8th St North 3rd St 96 Nostrand Ave Eastern Pkwy Empire Blvd 37 Brighton Beach Ave Brighton 4th St Coney Island Ave 97 Nostrand Ave Avenue D Foster Ave 38 Broadway Kent Ave Roebling St 98 Nostrand Ave Avenue T Belt Pkwy 39 Broadway Flushing Ave Park St 99 Nostrand Ave - The Junction Farragut Rd Avenue I 40 Bushwick Avenue Metropolitan Ave Johnson Ave 100 Pennsylvania Ave Linden Blvd Flatlands Ave 41 Church Ave East 7th St Argyle Rd 101 Pitkin Ave East New York Ave Mother Gaston Blvd 42 Church Ave Buckingham Rd Ocean Ave 102 Prospect Park West 15th St 17th St 43 Church Ave Ocean Ave Bedford Ave 103 Ralph Ave Broadway Decatur St 44 Church Ave East 49th St East 53rd St 104 Ralph Ave Flatlands Ave Avenue K 45 Classon Ave Atlantic Ave Eastern Pkwy 105 Rockaway Pkwy Farragut Rd Flatlands Ave 46 Columbia St DeGraw St President St 106 Rockaway Pkwy Seaview Ave Belt Pkwy 47 Coney Island Ave Avenue J Cortelyou Rd 107 Sheepshead Bay Rd Avenue Z Voorhies Ave 48 Cortelyou Rd Coney Island Ave East 16th St 108 Smith St Atlantic Ave Union St 49 Court St Montague St Atlantic Ave 109 Smith St Union St 2nd Pl 50 Court St Atlantic Ave Bergen St 110 Union Ave Metropolitan Ave Grand St 51 Court St Bergen St Baltic St 111 Union St Nevins St 4th Ave 52 Court St Blatic St 4th Pl 112 Utica Ave St. Johns Pl Union St 53 Cropsey Ave Belt Pkwy Neptune Ave 113 Utica Ave Linden Blvd Snyder Ave 54 Dekalb Ave Cumberland St Clinton Ave 114 Van Brunt St Commerce St Reed St 55 Dekalb Ave Flatbush Ave Fort Greene Pl 115 Vanderbilt Ave Atlantic Ave Park Pl 56 Douglass St Nevins St 4th Ave 116 Washington Ave Flushing Ave Park Ave 57 Driggs Avenue North 11th St Grand St 117 Washington Ave Pacific St Eastern Pkwy 58 Eastern Pkwy Schenectady Ave Utica Ave 118 Willoughby St Boerum Pl Flatbush Ave 59 Emmons Ave Nostrand Ave Ocean Ave 119 Wilson Ave Flushing Ave Dekalb Ave 60 Flatbush Ave Willoughby St Livingston St 120 Wyckoff Ave Flushing Ave Myrtle Ave 121 Wythe Ave North 12th St North 3rd St NOTABLE RETAIL CORRIDORS 1 86th Street Union Street – Historically, the stretch of 86th Street from 4th Avenue to Fort Hamilton Parkway has been one of the top retail locales in Southern Brooklyn. That has drawn prominent retailers to the area, including recent lease signings by Chipotle, Victoria’s Secret, and Panera Bread. In addition, Century 21’s expansion to 87th Street has brought shoppers from outside the neighborhood, broadening the customer base for all retailers in the area. An extra 40,000 square feet and a 280-car parking garage will do that! (4TH AVE - FORT HAMILTON PKWY) (ATLANTIC AVE - 2ND PL) – It wasn’t too long ago that Smith Street was known almost exclusively as “Restaurant Row.” Now, however, the Smith Street landscape is changing. The mix of retailers is quickly diversifying as national apparel and wearable brands such as Lululemon Athletica, Intermix, SEE, Free People, and Lucky Jeans join Smith Street’s signature series of culinary delights. Retail SQUARE FEET OF RECENT DIVERSIFICATION BROOKLYN WELCOMED THESE TENANTS IN 2014 WWW.CPEXRE.COM 5 UNION STREET SUBWAY STATION 2,058,555 N. 4th Street (KENT AVE - BEDFORD AVE) – As Bed- ford Avenue in Williamsburg has become arguably one of the best retail corridors in Brooklyn, its magnetism has led retailers to the surrounding side streets just to be in proximity to this rapidly ascending retail destination. North 4th Street was particularly poised to capitalize on Bedford Avenue’s success with its uniquely large floor plate, attracting recent tenants such as Whole Foods, Joe Fresh, New York Sports Club, Blue Bottle, and Steven Alan Home. This is the prime example of a side street that not so long ago had zero retail traction, but is now incredibly one of the more expensive blocks in the borough. 6 5th Avenue (SACKETT ST/BERKELEY ST - 3RD ST) – 5th Avenue in Park Slope, running from Sackett Street/ Berkeley Place to 3rd Street, has become a “Restaurant Row” in its own right. Grand Central Oyster Bar, offshoot of the iconic seafood eatery at, you guessed it, Grand Central, opened here last year, along with Two Boots pizza, which also relocated from the same location. It’s also home to popular dining and drinking destinations such as al di la Trattoria (Brooklyn-born Italian restaurant perennially recommended by the Michelin guide), Calexico, Blue Ribbon Brooklyn, Naturo Ramen, the punny Pork Slope, and many more. RAPID TRANSFORMATION NOT ON MAP 2015 Smith Street 605,000 an interdisciplinary gallery and reading room along the canal, also serves as a cultural destination that boosts the number of visitors to the Union Street retail scene. ANNUAL RIDERSHIP 2013 3 ADDED – Located in the Gowanus, the section of Union Street that connects Carroll Gardens to Park Slope has several noteworthy retailers, including Dinosaur BBQ, The Royal Palms Shuffleboard Club, and Ample Hills Creamery, voted one of the top ten ice cream parlors in the country. Union Street’s popularity is due in large part to its proximity to the R train at Union Street and 4th Avenue and, similar to North 4th Street in Williamsburg, its large floor plates. It also benefits from having the Holiday Inn Express (115 rooms) and will soon add the Gowanus Inn & Yard, an 82-room boutique hotel. The Proteus Gowanus, (NEVINS ST - 4TH AVE) NORTH 4TH STREET way Center has super-sized into a one-stop shopping experience in East New York. Indeed, with over 1.19 million square feet, the Gateway Center is one of Brooklyn’s largest suburban-style retail developments accessible at shoppers’ urban convenience. Phase 1 of the project brought in BJ’s Wholesale, Home Depot, Bed Bath & Beyond, Target, Best Buy, Staples, Olive Garden, Boulder Creek Steakhouse, and others. That success helped pave the way for Phase 2 tenants such as Bank of America, Nordstrom Rack, Buffalo Wild Wings, Sports Authority, TJ Maxx, Burlington Coat Factory, Applebee’s, and JCPenney’s first ever Brooklyn location. 2014 LEASES PHASE II 2 Gateway Center (EAST NEW YORK) – The Gate- 4 $100-$149 PSF AVERAGE HOUSEHOLD INCOME $150K WWW.CPEXRE.COM MARKET FACTORS: WHAT IS DRIVING RETAIL? RESIDENTIAL 1 DEVELOPMENT 2 New permits in OFFICE 19,082 Brooklyn new unit permits in brooklyn have also seen a almost 2X that of manhattan 149% over all the other since 2013 brooklyn permits outer boroughs 116% combined vacancy rate is 4.2% Lowest in united states 63,859 students EDUCATION 3 universities, colleges, & seminaries 33 WWW.CPEXRE.COM 4 HOSPITALITY 50 21 more hotels in pipeline by 2017 bringing the total to 71, a 154% existing hotels with 4,272 rooms since 2008 81% occupancy in brooklyn 16% above national average TOURIST 5 ATTRACTIONS prospect park 10M people visit every year second only to central Park second only to central Park Brooklyn Bridge Spanning over 1.3 miles hosts about 220 or more events per year, an average of four per week Starting this year it will be home to One of the New York area’s most important entertainment and arts venues, BAM provides a focus on avant-garde performance art and progressive dance for both the local community and those from further afield. of brooklyn waterfront Mccarren Park 35 acres of bustling activity shared by locals and tourists BAM Over 550,000 people pass through its doors annually WWW.CPEXRE.COM TRANSFORMING RETAIL Bedford-Stuyvesant Bedford-Stuyvesant (Bed-Stuy) has been gaining in popularity and price over the past year. Demand from an influx of new residents (that infamous “G” word, gentrification) has caused average property values to increase by 36% between October 2013 and October 2014. The spike in demand for Bed-Stuy residences has opened the door for a multitude of restaurants and cafés to, well, open their doors throughout the neighborhood. According to a CPEX study of retail leases signed in 2014 in Bed-Stuy, 33 new retail locations opened in the neighborhood in the past year, 28 of which were a restaurant, café, or bar. While not primed to be the next Williamsburg due to its residential density, Bed-Stuy can expect more mature retail options to follow moving forward from the culinary wave of 2014. Industry City Area Originally dubbed Bush Terminal at the turn of the 20th Century, Industry City has evolved from a classic waterfront manufacturing, warehousing and distribution center into the “Soho of Sunset Park,” according to a 2014 New York Times article. After falling into disuse and disrepair, the 16 building, six million square foot complex was taken over by Jamestown Properties and its associates in late 2013, and is now on the verge of a renaissance as a new age community for creative, technological, and manufacturing use. Down the block at 850 3rd Avenue, CPEX represented the landlord at Liberty View Industrial Plaza in welcoming Bed Bath & Beyond and three of its subsidiaries in the largest retail lease in all of Brooklyn for 2014, totaling approximately 120,000 square feet. Their presence, along with the ever-changing, up-and-coming dynamics of Industry City, creates a perfect storm for retail to take off in the surrounding area. Extending Fulton Street Mall The Fulton Street Mall has long been a focal point when it comes to Brooklyn retail, especially with its recent makeover of the past few years that diversified its tenant mix. The extension of the Fulton Street Mall – by Brooklyn Heights Plaza to the east and City Point to the west – will only expedite the growth of the area’s retail. Both bookends of the newly lengthened Mall have signed significant leases with major tenants: Neiman Last Call, Sephora, Its Sugar, Yogaworks, and Soul Cycle on the eastern side, and Alamo Drafthouse, Century 21, and Target at the western end. As more of the luxury residential towers in Downtown Brooklyn are built and occupied, more retailers will join the new occupants on the Fulton Mall. And who knows? It may have to be lengthened again to keep up with the demand for amenities in the area. WWW.CPEXRE.COM CPEX NEW YORK RETAIL LEASING TEAM Timothy D. King Managing Partner Timothy D. King aligned with partner Brian Leary to found CPEX in 2008. In his role as Managing Partner, Mr. King co-heads the firm’s business line divisions and business development. During his forty-plus years in real estate operations, he has been instrumental in attracting numerous national retailers to the outer boroughs. Under his direction, the New York Retail Leasing Team has become a powerhouse of performance and the firm of choice for landlords, tenants, and tenant representation brokers. Ryan Condren Managing Director Ryan Condren was promoted to Managing Director of the New York Retail Leasing Team in 2011 after joining CPEX as an Associate Director in 2008. His achievements in retail leasing have gained him recognition as a two-time CoStar Power Broker (2011, 2012), and he was also honored in the Home Reporter and the Brooklyn Spectator for earning the 2012 Brooklyn Rising Stars Award. With Mr. Condren as one of its leaders, the New York Retail Leasing Team has been responsible for the completion of over 100 lease transactions totaling more than 450,000 square feet of retail space with an aggregate lease value of over $425 million. George Danut Associate Director George Danut has been a part of the CPEX New York Retail Leasing Team since September 2012. As an Associate Director, he supports the New York Retail Leasing Team by providing market research, valuating leases, preparing marketing packages, and executing the lease of properties. Since the beginning of 2013, Mr. Danut has assisted in the lease of over 48 retail spaces with such notable tenants as Harbor Freight, LePort Schools, Duane Reade, Gymboree Play & Music, Bar Method, and Benefit Cosmetics. WWW.CPEXRE.COM PREPARED BY THE CPEX RETAIL LEASING TEAM 81 WILLOUGHBY STREET, 8TH FLOOR | BROOKLYN, NY | 11201 | 718.935.1800 WWW.CPEXRE.COM

© Copyright 2025