EHP Advantage Fund

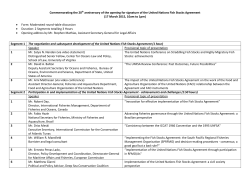

FEBRUARY 2015 EHP Advantage Fund Returns (Class A units, net of all fees and expenses) JAN FEB 2015 5.3% 2.4% 2014 0.6% 4.7% MAR APR MAY JUN JUL AUG SEP OCT NOV DEC YTD 0.4% 1.4% 1.2% 2.3% -0.6% 2.7% -1.0% 5.1% 1.0% 2.6% 22.2% 3.2% 3.4% 1.5% 1.4% 1.2% 4.6% 3.7% 2.0% 22.9% 7.9% 2013 Growth of $100,000 (daily) Risk/Reward Analysis $175,000 $165,000 $155,000 $145,000 $135,000 $125,000 $115,000 $105,000 $95,000 Apr/13 Jul/13 Oct/13 Jan/14 Apr/14 Jul/14 Oct/14 Jan/15 Compound Returns (%) Fund Benchmark* 1 Mo 2.4% 4.0% Annualized Return Annualized Std Deviation Winning Months Average Monthly Gain Average Monthly Loss Largest Drawdown Sharpe Ratio (1.5%) Correlation Beta Net Exposure Gross Exposure Fund Benchmark* 30.1% 24.1% 6.0% 6.0% 91% 91% 2.5% 2.2% -0.8% -1.4% -1.0% -1.7% 4.7 3.8 0.48 0.46 113% 188% Source of Returns for Most Recent Month 3 Mo 10.6% 8.0% 6 Mo 16.3% 10.1% 1 Yr 25.1% 20.3% Incep. 62.0% 48.5% Returns from Longs Returns from Shorts 4.5% -2.1% *50/50 composite of S&P/TSX TR and S&P 500 TR in $CAD terms Commentary The EHP Advantage Fund Class A units increased 2.4% for the month of February versus 4.0% for the TSX Composite and 4.0% for the S&P 500 in CAD terms. February saw a bit of a reversal from recent trends and our move to gear risk back up at the end of January served us well, but we lagged the “junk” rally in beatenup cyclicals and lost money on the short side of our strategies. Value was our best performing strategy in both markets, with its heavier concentration in legacy technology in the U.S. and cyclicals in Canada. Momentum and Low Volatility strategies trailed as defensive staples, utilities and telcos checked back from recent strong gains and the most volatile stocks with stressed balance sheets (where our shorts tend to be concentrated) led gains. Our Credit Momentum strategy had gains as we were fully invested in recovering high yield debt, having switched out of our flight-to-safety U.S. treasuries at the end of January. Finally, Issuance Arbitrage had good gains as deal flow picked up and a number of companies took advantage of stronger markets to do badly needed balance sheet repair – a trend we expect to continue in coming months assuming continued market strength. EdgeHill Partners 2 Bloor Street East Suite 2102 Toronto, Ontario M4W 1A8 (416) 360-0310 info@ehpfunds.com www.ehpfunds.com The big question is whether February’s shifting tides represents a change in trend from a strong USD, weak commodities, falling government bond yields and defensive leadership, or just a temporary pause. Our observation last month that the big moves in yields, currencies and commodities represented “blow-off” behaviour was correct, but the jury is still out as to whether those trends reassert themselves in coming months. Our strategies have responded by further adding cyclical exposure, and energy in particular has moved up the ranks to represent our third largest sector weight in Canada. We expect the sector to remain volatile, but good value is finally starting to outweigh bad momentum and earnings in general have been “less bad” than the now overly pessimistic street outlook. That all said, our largest weighting remain financials and consumer discretionary in Canada and tech, financials and healthcare in the U.S. which we view as having the best combination of cheap, rising and stable stocks. Perhaps our greatest concern with markets in general is the rising disconnect with multiple expansion (markets are by no means cheap at some 18.5x earnings) and the fall-off in expected future earnings. Analysts now expect declining U.S. earnings over the next year for tech, staples, telecom, materials, energy and utilities (data courtesy FactSet) which should ultimately find its way into stock valuations if earnings do indeed roll over, and yet an overly accommodative Fed and low rates are keeping investors in stocks as the “only” alternative. A change in Fed policy and a shift to raise rates could indeed be the trigger for this disconnect to unwind. While we don’t second-guess a rising market, as always we have a pre-defined process to gear down risk if that changes. Page 1 FEBRUARY 2015 Fund Structure Strategy Allocation Country Allocation Momentum Capital Allocation Short U.S. Value Low Volatility Canada Long Issuance Arb Credit Canadian Equity - Top 10 Longs U.S. Equity - Top 10 Longs Alimentation Couche-Tard Inc Dollarama Inc Linamar Corp Toromont Industries Ltd CCL Industries Inc Power Financial Corp Canadian National Railway Co Magna International Inc Transcontinental Inc Intact Financial Corp 1.4% 1.4% 1.4% 1.2% 1.1% 1.1% 1.0% 1.0% 0.9% 0.8% Sector Allocations % of NAV - Canadian Equity -10% -5% 0% 5% 0.7% 0.7% 0.6% 0.6% 0.6% 0.6% 0.5% 0.5% 0.5% 0.5% Sector Allocations % of NAV - U.S. Equity 10% 15% Financials Consumer Discretionary Energy Materials Information Technology Industrials Consumer Staples Health Care Telecommunication… Utilities Long Travelers Cos Inc/The Harman International Industrie Apple Inc Lockheed Martin Corp Edwards Lifesciences Corp Cardinal Health Inc Progressive Corp/The Boeing Co/The Delphi Automotive PLC Electronic Arts Inc -10% -5% 0% 5% 10% 15% Information Technology Financials Health Care Industrials Consumer Discretionary Consumer Staples Telecommunication… Utilities Materials Energy Short Net Long Short Net Fund Information The Fund’s investment objective is to construct a long/short portfolio of North American stocks by buying undervalued, rising, stable stocks and shorting overvalued, declining, volatile stocks. The Fund actively gears down risk in declining markets and tilts toward more defensive stocks and strategies to preserve capital. The Fund emphasizes a disciplined process of stock selection, risk control and liquidity. The Fund targets returns of 10-12% net of all fees. EdgeHill Partners 2 Bloor Street East Suite 2102 Toronto, Ontario M4W 1A8 (416) 360-0310 info@ehpfunds.com www.ehpfunds.com Portfolio Manager: Jason Mann Fund Structure: Mutual Fund Trust RSP Eligible: Yes Fee Structure: 2% Mgmt Fee, 20% Performance Fee Subscription Amounts: CAD $25,000 Minimum Subscriptions: Weekly, Friday 4pm deadline Redemptions: 6 days notice, no penalty Reporting Frequency: Lockup: High Water Mark: Fund Administrator: Prime Broker: Legal: Auditors: Weekly None Yes, permanent (no reset) CommonWealth Fund Services Bank of Nova Scotia McMillan LLP KPMG Page 2 DISCLAIMER: Performance returns refer to initial series of Class "A" Units, and are net of all fees and certain operating expenses. Returns are unaudited. Return calculations are annualizedand since inception unless otherwise noted. Statistics are calculated using monthly returns unless otherwise noted. Strategy Allocations are represented as percentages of net assets. Cash includes short proceeds. Benchmark statistics use total return Indicies. The composition of the Funds’ portfolio will significantly differ from the benchmark due to the investment strategy employed. Please see “Investment Strategies” in the Confidential Offering Memorandum for more details. This presentation is not an offer to sell nor a solicitation of an offer to purchase interests of the Funds. The Manager reserves the right to change any terms of the offering at any time. Offers and sales of interests in the Funds will be made only pursuant to an offering memorandum, complete documentation of the relevant Fund and in accordance with the applicable securities laws, and this presentation is qualified in its entirety by reference to such documentation, including the Risk Factors and Potential Conflicts of Interest disclosure set forth therein.

© Copyright 2025