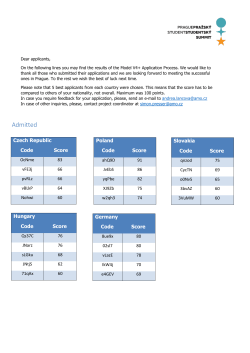

Middle-Income Trap in V4 Countries? – Opening theses