(1), Baroda Vs M/s. Bell Granito Ceramics Ltd., Village

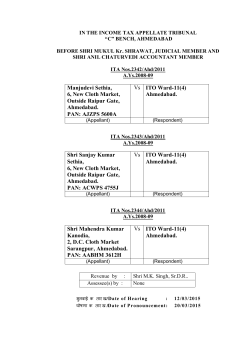

IN THE INCOME TAX APPELLATE TRIBUNAL “C” BENCH, AHMEDABAD BEFORE SHRI MUKUL Kr. SHRAWAT, JUDICIAL MEMBER AND SHRI ANIL CHATURVEDI ACCOUNTANT MEMBER ITA No.2466/Ahd/2011 A.Y.2005-06 DCIT, Circle-1 (1), Baroda Vs M/s. Bell Granito Ceramics Ltd., Village Gavasad, POMobha, Taluka-Padra, District-Baroda. PAN: AAACB 9401D (Appellant) (Respondent) Revenue by : Assessee(s) by : Shri M.K. Singh, Sr.D.R.. Shri K.D. Shah, A.R. सुनवाई क तार ख/ Date of Hea ring : घोषणा क तार ख /Date of P ronouncement: 10/03/2015 13/03/2015 आदेश /O R D E R PER: MUKUL KUMAR SHRAWAT, JUDICIAL MEMBER This is an Appeal filed by the Revenue arising from the order of learned CIT(A)-I, Baroda dated 05.07.2011. The grounds raised by the Revenue are reproduced below:“1. On the facts and in the circumstances of the case and in law, the Id.CIT (Appeals) erred in deleting the addition of Rs.1,86,94,606/u/s.40(a)(ia) of the Income Tax Act, 1961, holding that the provisions of section 40(a)(ia) as amended by the Finance Act, 2010 w.e.f. 01.04.2010, are of clarificatory nature and, therefore, retrospective. 2. The Id.CIT(Appeals) erred in not considering the fact that the relevant portion of the Memorandum Explaining the Provisions in Finance Bill, 2010 clearly states that this amendment is proposed to take effect from 01.04.2010 and will, accordingly, apply in relation to the assessment year 2010-11 and subsequent years.” ITA No.2466/Ahd/2011 DCIT, Cir-1(1), Baroda Vs. M/s. Bell Granito Ceramics Ltd. For A.Y.2005-06 -22. Facts in brief as emerged from the corresponding assessment order passed u/s.143(3) r.w.s. 147 of IT Act dated 10.12.2009 were that the Assessee company has disclosed a return of income at Rs. Nil which was accepted but later on the Assessment was reopened u/s.147 on the ground that the Assessee had not deposited the TDS within the time prescribed. On enquiry, the Assessee has furnished the details of TDS deducted and the dates of payment. The TDS was deducted from transporters, contractors, advertisers, on payment of rent, etc. The undisputed fact as noted by the AO was that the TDS so deducted was deposited before the due date of the filing of the return. We have noted that in the assessment order a chart was reproduced showing details of nature of payment, amount of TDS deducted and the dates of payment. However, the AO was not convinced and made a disallowance u/s.40(a)(ia) of IT Act of Rs.1,86,94,606/-. 3. When the matter was carried before the First Appellate Authority, it was held that the provision was retrospectively applicable. According to which the Assessee was required to deposit the TDS before the due date of filing of the return, relevant portion of the finding of learned CIT(A) are reproduced below: “2.2 Regarding disallowance u/s 40(a)(ia), facts of the case are that AO made disallowance u/s 40(a)(ia) in respect of expenses corresponding to tax deducted at source of Rs.9,77,707/- upto 28.2.2005 which was not deposited to the credit of Government before 31.3.2005. Though tax deducted at source of Rs.9,77,707/- was deposited to the credit of Government before due date of filing of return of income, disallowance of Rs.1,86,94,606/- was made by the AO u/s. 40(a)(ia) as it stood prior to amendment made by Finance Act, 2010. 2.3 In appeal, reliance was placed on the decision of ITAT, Ahmedabad in the case of Kanubhai Ramjibhai Makwana (2011) 9 Taxmann.com 55. 2.4 I have considered the matter. Hon. ITAT, Ahmedabad in the case of Kanubhai Ramjibhai Makwana (2011) 9 Taxmann.com 55, held that amendment made by the Finance Act, 2010 in sec. 40(a)(ia) is of clarificatory nature and it would, therefore, apply retrospectively from 1.4.2005, the date ITA No.2466/Ahd/2011 DCIT, Cir-1(1), Baroda Vs. M/s. Bell Granito Ceramics Ltd. For A.Y.2005-06 -3on which section 40(a)(ia) was inserted by the Finance (No.2) Act, 2004. In view of this, even though tax deducted at source of Rs.9,77,707/- upto 28.2.2005 was not deposited to the credit of Government by 31.3.2005 and was deposited to the credit of Government before due date of filing of return of income as per the assessment order, disallowance of Rs.1,86,94,606/- is cancelled.” 4. With this factual background, we have heard both the sides. From the side of the Revenue-Department, learned Sr.D.R. has placed reliance on the findings of the AO. On the other hand, learned A.R., Mr. K.D. Shah has cited few decisions before us as listed below: “1. CIT Vs. Rajendra Kumar, Tax Appeal No.65/2013 order dated 1st July, 2013 by Delhi High Court. 2. CIT Vs. Royal Builders, 220 taxmann 180 (Guj) 3. Virgin Creations (ITA No.302 of 2011/GA 3022/11 order dated 23rd November, 2011.” 4.1 Further he has also placed on record the dates on which the impugned TDS was deposited. 5. Having heard the submission of both the sides and considering the legal position as stood after the amendment took place in the provisions of Section 40(a)(ia). We are of the conscientious view that the issue involved is now duly covered by few decisions of the Hon’ble Courts. In a situation, when there was no dispute that the impugned TDS was deposited before the due date of filing of return then we can hold that the intention behind the amendment u/s.40(a)(ia) was to ensure the deposit of TDS and that the evidence of deposit of tax should be placed along with returned filed. In view of the legal position as discussed hereinabove, we are not inclined to disturb the factual as well as legal finding of learned CIT(A), and the same is hereby confirmed. We find no force in the ground raised by the Revenue; hence dismissed. ITA No.2466/Ahd/2011 DCIT, Cir-1(1), Baroda Vs. M/s. Bell Granito Ceramics Ltd. For A.Y.2005-06 -4- 6. In the result, the Appeal of the Revenue is dismissed. Sd/- Sd/- (ANIL CHATURVEDI) ACCOUNTANT MEMBER (MUKUL Kr. SHRAWAT) JUDICIAL MEMBER Ahmedabad; Dated 13/03/2015 Prabhat Kr. Kesarwani, Sr. P.S.s आदेश क 1. 2. 3. 4. 5. 6. त ल प अ े षत/Copy of the Order forwarded to : अपीलाथ / The Appellant यथ / The Respondent. संबं धत आयकर आयु त / Concerned CIT आयकर आयु त(अपील) / The CIT(A)-III, Ahmedabad वभागीय त न ध, आयकर अपील य अ धकरण, अहमदाबाद / DR, ITAT, Ahmedabad गाड फाईल / Guard file. आदेशानुस ार / BY ORDER, उप/सहायक पंजीकार (Dy./Asstt.Registrar) आयकर अपील य अ धकरण, अहमदाबाद / ITAT, Ahmedabad

© Copyright 2025