Derivatives Report

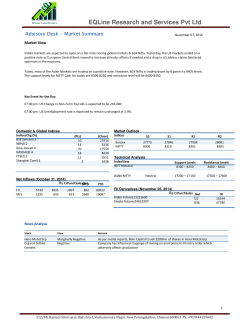

EQLine Research and Services Pvt Ltd Mar 13, 2015 Derivative Report Nifty Vs OI Comments The Nifty futures open interest increased by 0.46% BankNifty futures open interest has decreased by 2.28% as market closed at 8776.00 levels. The Nifty March future closed at premium of 37.05 points against a premium of 52.10 points. The April series closed at a premium of 103.70 points. The Implied Volatility of at the money options has decreased from 15.93% to 14.56%. Nifty PCR-OI has increased from 0.95 to 0.98 levels. The total OI of the market is Rs. 2,34,950/- cr. and the stock futures OI is Rs. 75,164/- cr. Few of the liquid counters where we have seen high cost of carry are HDFCBANK, JSWENERGY, IDFC, INDIACEM and RCOM. View OI Gainers SCRIP OI CHANGE (%) PRICE PRICE CHANGE (%) 4953000 20.86 289.25 7.13 46104000 16.61 149.85 0.27 201285000 9.78 20.95 4.75 OI VOLTAS NTPC UNITECH UBL 741500 9.12 1025.30 -0.12 MINDTREE 229000 8.79 1406.45 0.36 OI Losers OI CHANGE (%) OI CAIRN 13583000 -4.96 234.95 4.45 IDEA 18418000 -4.46 174.60 6.56 ICICIBANK 70686250 -4.04 339.60 1.22 9790000 -4.04 108.10 1.74 35204000 -3.78 135.60 3.43 ALBK HINDALCO PRICE PRICE CHANGE (%) SCRIP Put-Call Ratio Yesterday market showed strength but FIIs participation was more or less invisible in derivatives segment. FIIs were net buyers in cash market segment of worth Rs. 733 crores. In Index Futures they activity was subdued. In Index Options they bought of Rs. 224 crores with rise in open interest indicating some long formation. We saw 9200 call options adding some open interest followed by good amount of profit booking by buyers of 9000 & 9100 strike price. On the other hand in put options 8700 & 8800 strike added decent buildup. Some unwinding was also visible in 8500 put options. Maximum buildup in current series is seen in 9000 call & 8500 put option. Yesterday we hardly saw any relevant activity; FIIs data still haven’t showed any negative signal in fact we are seeing buying figure in Index Futures from last two trading sessions. Still their long positions are in system and they have also bought call options of 8800-9000 strikes in this week which they are still holding. We believe market is heading towards the resistance zone of 8900-8950. Historical Volatility SCRIP PCR-OI PCR- PCR-VOL PCR- NIFTY 0.98 0.89 RELCAPITAL 66.31 BANKNIFTY 0.70 0.61 IDEA 55.18 SBIN 0.33 0.31 VOLTAS 58.55 RELIANCE 0.46 0.41 EXIDEIND 43.73 ITC 0.42 0.31 SIEMENS 51.75 MRF 49.81 SCRIP HV 212/4B, Ramani Srinivasan IInd street, Venkateswara Nagar, New Perungalathur, Chennai 600063. Ph: +919444119602 1 EQLine Research and Services Pvt Ltd Derivative Report Mar 13, 2015 Turnover on 12-Mar-2015 FII Statistics for 12-Mar-2015 Open Interest Detail Buy Sell Instrument Net Value Change (Rs in cr.) (%) Contracts INDEX FUTURES INDEX OPTIONS 1284.29 1158.77 10983.11 10758.73 No. of Contracts Turnover (Rs in cr.) Change (%) 125.52 912417 21478.14 (0.52) INDEX FUTURES 4,17,858 11572.8 -31.90 224.38 2017770 56666.20 1.61 INDEX OPTIONS 48,96,713 115314.68 -23.47 STOCK FUTURES 2248.45 2347.32 (98.87) 1995223 60897.13 1.19 STOCK FUTURES 7,51,755 23511.52 -9.31 STOCK OPTIONS 1704.50 1671.43 33.07 103355 3215.34 4.11 STOCK OPTIONS 3,67,784 11457.69 -10.81 284.10 5028765 142256.82 1.10 TOTAL 64,34,110 161856.69 -21.60 TOTAL 16220.34 15936.25 Nifty Spot =8776.00 Lot Size = 25 Bull-Call Spreads Action Strike Buy 8800 Bear-Put Spreads Price 106.90 Sell 8900 60.50 Buy 8800 106.90 Sell 9000 31.05 Buy 8900 60.50 Sell 9000 31.05 Risk 46.40 75.85 29.45 Reward 53.60 124.15 70.55 BEP Action Price Buy 8800 94.80 Sell 8700 58.45 Buy 8800 94.80 Sell 8600 34.75 Buy 8700 58.45 Sell 8600 34.75 8846.40 8875.85 Strike 8929.45 Risk Reward BEP 36.35 63.65 8763.65 60.05 139.95 8739.95 23.70 76.30 8676.30 Note: Above mentioned Bullish or Bearish Spreads in Nifty (Mar Series) are given as an information and not as a recommendation. Nifty Put-Call Analysis 212/4B, Ramani Srinivasan IInd street, Venkateswara Nagar, New Perungalathur, Chennai 600063. Ph: +919444119602 2 EQLine Research and Services Pvt Ltd Mar 13, 2015 Derivative Report Strategy Date 02-03-2015 02-0309-03-2015 09-03- Symbol NIFTY HEROMOTOCO Research Team Con No: 9444119602 Strategy Long Put Long Call Ladder E-mail: info@eqinfotech.com Status Profit booked on 10-03-15 Open Website: www.eqinfotech.com Disclaimer The information herein, together with all estimates and forecasts, can change without notice. This report does not purport to be a complete solicitation of offers to buy or sell any securities. Visitors to the site are advised to consult experts or study prospectus and other legal offer documents issued by companies before taking any decisions based on information provided in the site. Neither http://www.eqinfotech.com or EQLine nor its Directors or Analysts or Employees accept any liability whatsoever nor do they accept responsibility for any financial consequences arising from the use of the research or information provided herein. EQLINE RESEARCH 212/4B, Ramani Srinivasan IInd street, Venkateswara Nagar, New Perungalathur, Chennai 600063. Ph: +919444119602 3

© Copyright 2025