April 2015 - Tarrant County

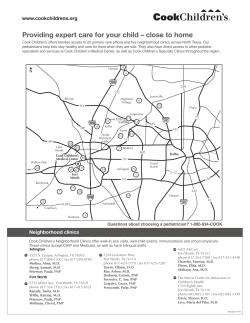

Volume 2, Issue 4 In God We Trust In This Issue: Armed Forces First ..................... 3 Property Tax News ..................... 4 What’s Been Happening............. 6 A Look Back ............................. 9 KAB ........................................... 11 Contact Information and Map of Locations ....................... 24 Ron Wright The Wright Stuff YOU SAID WHAT? Dates to Remember: Value Notices mailed by TAD On residential properties ............. 1 VIT Due ...................................... 10 Income Tax Due (IRS) ................ 15 Earth Day .................................... 22 Exemption Applications due at TAD .................................. 30 Spring is in full bloom, and the tax office has finished one of the most intense months of the year. We are always up to the challenge. Challenge, of course, is a very good thing, but as our mothers warned us, too much of a good thing can cause a hangover. We don’t know yet whether to call it a drama, a mystery, or just another adventure, but the compelling saga of the Tarrant April 1, 2015 Appraisal District’s new Aumentum software program continues to entertain and cause heart palpitations in the Property Tax Division. The one thing on which everybody involved agrees is the romance in the story died long ago. The only things missing now are werewolves and a vampire or two, and we might have a bestseller on our hands. Meanwhile, the Motor Vehicle Division just completed the first month of the state’s new Two Step, One Sticker program, also known as the two-steps-and-it-sticks-toyour-boots program. The Texas Department of Motor Vehicles has taken a great deal of flak over the single sticker program. I remind people that this was not DMV’s idea; it was the brainchild of members of the Texas Legislature who passed it while reciting lines from Macbeth. This reaffirms the old adage that the legislature is like a bunch of cockroaches; it’s not what they find and steal away, but what they fall into and mess up. It also required the cooperative efforts of three state agencies: DPS, TCEQ, and DMV to fully implement. They wanted to Continued on Page 2 Volume 2, Issue 4 Taxing News April 1, 2015 The Wright Stuff, Continued include a federal agency and the local credit union, but they ran out of acronyms. The challenges of the last month have resulted in a great many animated discussions with tax payers, testing the selfdiscipline of every clerk and manager in the office. I found that I, too, was not immune to the temptation to be other than completely professional. One can imagine the conversations some of our clerks could have had, but their professionalism and dedication to excellent customer service overrode what would have been a perfectly human, but regrettable response. From the taxpayer’s perspective, walking into a tax office lobby overflowing with customers waiting to be served ranks up there with root canals and colonoscopies. The impact the single sticker program has had on transaction times which results in much longer wait times is mere frosting on the cake. Only a masochist would relish the experience. Still, nobody has more control over that situation than the customer. Everybody has the right to Standing room only at the Arlington branch location on March 2 wait until January 31st to pay their taxes, but if they wait until January 31, they can expect a lobby full of people who also waited until January 31. Everybody also has the right to wait until the last day of the month to renew their vehicle registration, but if they wait until the last day, they should expect a lobby full of people. The same is true of customers who come on the first day of the month after their registrations have expired. They, too, will find a lobby full of people. Renewing a vehicle registration has never been easier. It can be done online, by mail, at any one of our 41 contractor grocery stores, or at one of eight county tax offices. Unfortunately, it is hard to change the behavior patterns of people who visit the tax office only once or twice a year. Until that can be done, we will continue to greet with a smile whoever comes through our door. I want to take this opportunity to thank the staff of the best tax office in Texas for your dedication to exemplary customer service, no matter the circumstances, and your unfailing professionalism in very challenging situations. Next month and every month on the busiest day at the end of the month when the pressures of a lobby full of customers never seems to end, please know that your efforts are noticed and are very much appreciated. Ron Wright The branch location on Miller Ave. in Fort Worth experienced a packed house on March 2. 2 Armed Forces First In keeping with the Armed Forces First Initiative where the Commissioners have asked that all Tarrant County offices allow uniformed service members to move to the front of any line, we’ve spotted a few servicemen and women in our offices. Thank you for your service! Sgt. Ranesha Robinson, U.S. Army Transferred a title on March 13 Petty Officer 2nd Class Richard Rios, U.S. Navy, processed new resident paperwork on March 17 Dealer 101: Nobody Told Me That There were approximately 35 attendees at the March 24th Texas Independent Automobile Dealer Association session in Fort Worth. Fetina Green, Manager from Dallas County Tax office, was on hand to assist Tarrant County Motor Vehicle Director, Dorothy Starr, with the presentation. Starr has become a requested presenter of this information numerous times in the past and it is always a well attended session. In fact, this course has been offered for the past three years. It is offered quarterly on a rotating schedule in Harris, Bexar, Travis and Tarrant /Dallas counties. The "Dealer 101: Nobody Told Me That" is designed for those dealers new to the business, those considering opening their own dealership, or anyone else needing a refresher on the basics. Tarrant County dealer clerks from our Arlington, Downtown, Northwest and Southlake offices attended the March session. Some of their comments are below. Whitley Nino: I thought overall it was a great experience to learn more about how dealer/ dealerships work. Pictured above, left: Dorothy Starr and right: Fetina Green. Mission Statement We will serve the citizens of Tarrant County with pride, courtesy, respect, and determination. We will achieve excellence in what we do by providing accurate, efficient, and timely service consistent with the laws of the State of Texas and the highest ethical standard. Ann Driskoll: The seminar did an excellent job of covering a lot of information in such a short amount of time, including the basics of start-up and the various permits and rules which I think most individuals don’t even realize are in place when they decide they want to be a dealer. 3 Volume 2, Issue 4 Taxing News April 1, 2015 Property Tax News Omitted Property By Jeff Hodges, Assessment Manager Omitted property is not something that touches a great deal of people in the tax office. Processing is usually confined to the Assessment Department. What is omitted property? In short, it is property, real or personal, that was erroneously left off of the roll. Section 25.21 of the Property Tax Code addresses the issue of omitted property stating that the chief appraiser will appraise property as of January 1 for the year in which the property was erroneously left from the roll, for that year. He/ she is allowed to go back 5 years for real property and 2 years for personal. Where the tax office gets involved is when the appraisal district sends the omitted property to our office. The omitted designation carries an interest with it equal to 1% per month from the time the tax would have gone delinquent. This is found in Section 26.09D of the Property Tax Code. TaxClient adds the omitted designation from the appraisal district and adds the appropriate amount of penalty. You can quickly see that if the appraisal district were to go back 5 years, the interest an owner is required to pay is 60% of the levy! That can be a substantial amount of money. However, a property owner can avoid paying omitted interest on an improvement to real property if three criteria are met. The three criteria are: The land on which the improvement is located was taxed in the year in which the improvement escaped taxation. The appraisal district had actual or constructive notice that the improvement was present in the year in which it escaped taxation, and, The property owner pays all the back taxes due on the improvement within 120 days after the bill for the back taxes is sent. If the omitted property does not meet the three criteria above, section 31.04(a)(1) directs us to allow the owner until the next February 1st to pay, that gives them at least 180 days to pay before the tax goes delinquent. This date is August 4th. For example, if the appraisal district sends an omitted property to us on the June 2015 supplemental 4 roll, the back taxes and interest created are past due as of February 1, 2016. If they send that same account to us on the September 2015 roll, the back taxes and interest are past due on February 1, 2017. A Vicious But Consistent Cycle By Danny Nichols, Collections Manager Well it’s that time of year again that we’ve just completed a very busy and productive tax year (2014) and it’s already time to start to prepare for the 2015 tax season. It starts with the Tarrant Appraisal District (TAD) as they are feverishly preparing to send out “value notices” to property owners in Tarrant County to advise them of value changes, especially increases. They send them out in April, with an April 1st mailing deadline for residential properties of each year and taxpayers have until the end of May, or 30 days beyond which the notices were mailed, to protest their values. These Continued on Page 5 Property Tax News, Continued protests are then mostly dealt with and heard by the Appraisal Review Board (ARB) to resolve the protest one way or another. These protests are targeted to be resolved by July 20th of each year as the Chief Appraiser must certify the Tax Roll to each taxing entity (at least 95%) by July 25th of each year. The tax office then receives the Certified Tax Roll from TAD and our process begins. We deal with and assist all the taxing entities we collect for while they determine their tax rate. Then we enter their tax rates into our tax office collections software in order to generate tax statements to be mailed around October 1st of each year. It’s then that the collection process starts again and another cycle begins. Texas is a fairly large property tax intensive state. However, according to Dan Patrick, the newly elected Lt. Governor, in order to fulfill his and the Governor’s campaign promises, the state budget will begin to migrate from a heavy property tax state to a greater reliance on sales taxes. In the meantime, if you live in Tarrant County your tax rate is pretty much in the middle of all Texas counties. The average rate in Texas is 1.81% of a property’s assessed fair market value. Tarrant County’s average property tax is $3,193 while the highest average in the state is King County ($5,066). The lowest average is Terrell County ($285). Installment Agreements By Morris Booth, Special Collections Manager Recent Legislation now allows owners of a residence homestead time to pay their 2014 property taxes by an installment agreement with reduced penalties if entered into prior to July 1, 2015. For example, an account with a balance due of $1,692.70 in April 2015 may enter into a residence homestead installment agreement for a period of 12 months. Monthly payments would be approximately $148.00 each. Normally penalty continues to accrue each new month that a balance remains due, but if it is your residence homestead, and you activate a payment agreement with our office before July 1, 2015, new penalty stops including collections fees that attach after July 1. Interest continues to accrue at one percent each month. In order to qualify you must not have had an installment agreement with this office in the preceding 24 months and the account must be your residence homestead. Other conditions may apply by law. If you need time to pay taxes on a non-homestead account you may also contact us about an installment agreement. Penalty and interest will continue to accrue and it will not stop collection fees that attach on July 1. Other conditions may apply by law. To find out more about either payment option, please call and talk to one of our experts at 817-884-1051. 5 Volume 2, Issue 4 Taxing News April 1, 2015 What’s Been Happening…. Arlington Location Celebrates the Chinese New Year Employees at the Arlington branch location enjoy lunch with authentic food prepared by our own May Ann Owens. Pictured here left to right are Gena Cliff, Manager; Tiffany Windsor, Supervisor; Motor Vehicle Specialists May Ann Owens and Wei Xu; and Jana Jenkins, Supervisor. Cash Balancing Tool Birthday Celebration for Arlington Manager: Gena Cliff, pictured above, enjoys several surprises from her staff on March 20. Amy Goldman and Judy Lee from the Accounting Department presented training on the new Cash Balancing Tool at the regular motor vehicle managers meeting on March 18. This Amy Goldman and Judy Lee new tool has now been rolled out to all branch locations and specifies the documents that need to be scanned on a daily basis. It also identifies all daily balancing procedures down to the way employees sign the financial records. This tool will help maintain consistency in our processes so that we become more efficient, saving us valuable time and Motor Vehicle Managers resources. Aumentum Training by TAD Staff The Southwest branch location had this surprise visitor on March 17. Pictured at left and below: Tarrant County staff in training D.J. Whitehead, Director, Property tax and Quality Information Assurance staff were provided Services, Tarrant additional training by Tarrant Appraisal District Appraisal staff on the new Aumentum system on March 17. The new system has been in place since October 2014, and it is quite different than the old 20 year old system. We look forward to more training in the future! 6 Our Vision: We are a professional team of positive and dedicated individuals who serve with integrity, tenacity, and compassion in an innovative and inclusive environment. What’s Been Happening…. Prize Winner!! Carlotta Ramirez was the lucky winner of a $100 gift card for her support in the United Way fundraiser recently. Her name was drawn from employees who contributed $25 or more. Congratulations, Carlotta. Leadership Development Series is launched Ann, SL Directors and Managers from all areas of the tax office participate in “Authentic Leadership” course. Poly staff Left to right: Jeanette Johnson, Organizational Development Officer; Ron Wright, Tax Assessor-Collector; and James Bird Guess, Author/ Motivational Speaker/Trainer. Jeanette Johnson and James Bird Guess Motor Vehicle and Property Tax Managers and Directors attended “Authentic Leadership” by James Bird Guess on March 18. Mr. Guess is the author of Lead Like Water: Many Can Manage Few Can Lead. This was the first of 6 leadership training sessions scheduled throughout the upcoming year for managers and directors in the tax office. The course provided in-depth information and education on leadership, and offered an interactive experience for participants. Tarrant County’s Organizational Development Officer assisted with scheduling and was on hand to help facilitate the instruction. We are excited about the personal growth of our managers and directors, the positive impact on our employees, as well as the overall benefit to the tax office and the citizens we serve. Property tax managers Danny Nichols and Jeff Hodges prepare for training, with Jeanette Johnson and James Bird Guess in the background. 7 MV Managers Joanna Fisk, Elvira Simpson, Juana Garnett and QA Director Sue Caldwell on their way to the meeting room. Taxing News Volume 2, Issue 4 April 1, 2015 What’s Been Happening…. Farewell, Jim Pritchard Jim Pritchard, Property Tax Director, retired on March 13 after 7 1/2 years with the tax office. Among the many plans he has during retirement, he seems most excited to be able to spend more time with grandson, Jack. Congratulations! We will miss you. G.K. Maenius, County Administrator, stops by on Jim’s last day to wish him the best. Cake and food...appropriate for a retirement celebration! Ron Wright presents the watch…. ...And the final handshake. ...And the plaque while staff looks on... Mark and Elizabeth W., MV Regional Tax Assessor-Collectors Quarterly Meeting Pictured left to right: Ron Wright, TAC (Tarrant); Dorothy Starr, MV Director (Tarrant); Rachel Kelley, Karla, MV Motor Vehicle Manager (Denton); Michelle French, TAC (Denton); John Ames, TAC (Dallas); and Jason Downing, MV Director (Dallas). 8 Regional Tax AssessorCollectors met on March 17 at Olive Garden inJudyLewisville for their regular quarterly meeting. This month’s discussions revolved around the new Two Steps, One Sticker Program so Tarrant County and Dallas County Motor Vehicle Directors and Denton County’s Motor Vehicle Manager joined John Ames, Michelle French, and Ron Wright. A Look Back ……..by Ron Wright How Commerce Street Got Its Name In 1910 the city council of Fort Worth made the simple, but painful decision to rename a street. The decision came after much soul-searching and public deliberation. It was painful because the street no longer celebrated the memory of a great man, city leaders believed, but was known as a primary artery into the wild, bawdy, and deadly section of town known throughout the West as Hell’s Half Acre. Honor, the council reasoned, had become dishonor, and rather than continue to dishonor the memory of a Texas hero, Rusk Street became Commerce Street. Fort Worth began growing the moment the U.S. Army abandoned the fort in 1853, and settlers took over the fort buildings and made a small town. Initial growth emanated south from the fort. Once Fort Worth became the county seat following the much-maligned and much-disputed election of 1856, a log courthouse was built on land donated for that purpose by Col. Middleton Tate Johnson immediately east of the fort buildings where the Tarrant County Courthouse stands today. Growth then emanated south and east from the courthouse square. The town was laid out with streets running in a north/south and east/west grid that formed city blocks. East/west streets were numbered, and north/south streets were named to honor great men, most of whom were considered Texas heroes. They included the three presidents of the Republic of Texas: Houston, Lamar, and Jones. The north/south streets that formed the east and west borders of the courthouse square were named for two heroes of the Texas Revolution, two leaders of the young republic that followed, and the first two U.S. senators from Texas after Texas became a state: Sam Houston and Thomas Rusk. Both men had been generals, had fought at San Jacinto, and had served the republic, Houston as a president and Rusk as a secretary of war. It was the legislature’s choice of Rusk over former President Anson Jones to be one of Texas’ first U.S. senators that began Jones’ mental and emotional decline that culminated years later in his suicide in a Houston hotel room. Born in South Carolina in 1803, Thomas Jefferson Rusk taught himself the law and was admitted to the Bar in 1825. He was practicing law in Georgia and had invested heavily in gold mines there. In 1834 the manag9 Thomas Jefferson Rusk ers of the company in which he had invested embezzled the money and fled to Texas, then part of Mexico. Rusk pursued them as far as Nacogdoches, but never recovered the money. He did, however, fall in love with Texas and decided to stay. He applied for a land grant and sent for his family to join him. The following year Rusk got involved with the growing revolution movement. A friend of interim President David G. Burnet, Rusk participated in the Convention of 1836 and signed the Texas Declaration of Independence. Appointed secretary of war, Rusk joined Houston in the bayou country and urged him to take a stand against Mexican General Santa Anna. Houston heeded Rusk’s advice and made his stand at San Jacinto, which won the war for independence. When Houston Continued on Page 10 Taxing News Volume 2, Issue 4 April 1, 2015 A Look Back, continued …. travelled to New Orleans to seek medical treatment for the wounds he suffered in the battle, Rusk became commander-inchief of the Texas Army and followed the Mexican troops to the Rio Grande to make sure all of them left Texas. After serving as Houston’s first Secretary of War in the new republic, Rusk served in the congress of the Republic. In 1838, he was elected Chief Justice of the republic’s Supreme Court. In 1843 Rusk again assumed military leadership as Major General of the Republic of Texas militia. square in Fort Worth. The trouble with the street began with the great cattle drives from Texas to Kansas and Missouri. The drives began in 1867 and lasted two decades. Great trails were blazed, including the famous Chisholm Trail, which came through Fort Worth. The frontier town became a major supply depot for the trip north and an oasis of fun for cowboys on the way back. Rusk supported annexation to the United States, served as president of the 1845 convention that accepted the terms of annexation, and with Houston 19th Century bordello and houses on Rusk Street, Fort Worth was appointed a U.S. senator the following year by the state Saloons, bordellos and gamlegislature. He served with disbling houses sprang up in town tinction in the senate until his along with all the undesirable death in 1857. His wife, Mary, elements those places usually had succumbed to tuberculosis attracted in the 19th century. in 1856. Increasingly despondAlthough called Hell’s Half ent over the loss of his wife and Acre, or simply the Acre, it suffering from a tumor at the eventually encompassed much base of his neck, he ended his of the southeast quadrant of own life with a gun shot on July what is now downtown Fort 29, 1857 at the age of 53. At the Worth. Businesses there were time of his death, Thomas Rusk patronized by the likes of Butch was one of the most popular figCassidy and his Hole in the Wall ures in Texas politics, eclipsed Gang and other outlaws who only by his friend, the great Sam sought escape in the Acre. VioHouston. It was only natural lence was rampant and deaths that a street named in his honor common, although most of the would help frame the courthouse deaths that occurred there were 10 down-on-their-luck prostitutes who committed suicide, ladies that newspapers of the day euphemistically referred to as “fallen angels”. The Acre also produced the peculiar dichotomy known as the bookends of 11th Street, a notorious house of ill repute on one end of the street facing St. Patrick Catholic Church on the other end. In this war for souls, it appears the church won. The bordello is gone, but St. Patrick’s is still there. Although numerous attempts had been made to reform the Acre, it was not until a fiery Baptist preacher, J. Frank Norris, formed an unlikely alliance with the U. S. Army that the lid on the Acre’s coffin was nailed shut. Norris had made closing down the Acre a mission of his First Baptist Church of Fort Worth, and the commander of the World War I training camp, Camp Bowie, sought to protect the virtue of his young recruits. He threatened to move the camp away from Fort Worth if city leaders didn’t do something about the Acre. By 1918, Hell’s Half Acre was all but dead. Its final remnants were demolished to make way for the new convention center in the mid 1960s. By then, Commerce Street had been the name for more than 50 years and Rusk Street was all but forgotten. Weakness of attitude becomes weakness of character. – Albert Einstein Letty, VIT Downtown: “...great customer service and helps out with any questions and issues customers have…” Customer service is not a department, it’s everyone’s job. Brandy, MV Downtown: “We were very impressed with Brandy’s friendliness, kind attitude and helpfulness! Much better experience than we expected in a government office.” Denise, SW: “She was very helpful and kind.” Judy, SL: “Friendly, warm team members. Went out of their way to assist.” Jayne, NW: “...fast, quick, efficient and friendly.” Britney, Poly: “...positive attitude. Britney is awesome.” Carmen, Mansfield: “...efficient and friendly making for a pleasant experience.” Congratulations to these employees who will be recognized in Commissioners Court in April: 5 Years: Richard Devaney Alicia Whiteley 10 Years: Charlotte Lotspeich-Larson 20 Years: Donna Martin Chris Neal.................................. 4 Britney Miller ............................ 20 Linda Finley .............................. 6 Donna Foxe ............................... 22 Ron Wright ................................ 8 Cierra Hernandez ....................... 22 Anthony Campbell .................... 12 Patricia Medley ......................... 23 Christi Bellamy ......................... 14 May Ann Owens ........................ 24 Mark Butler ............................... 14 Karla Garces .............................. 25 11 Ingrid Lira ................................. 27 Taxing News Volume 2, Issue 4 Tarrant County Tax Office Locations Hours: Monday—Friday 8:00 am—5:00 pm April 1, 2015 CONTACT US Main Office Building 100 East Weatherford St. Fort Worth, TX 76196 Phone: 817-884-1100 Northwest 6713 Telephone Rd. Rm. 101 Lake Worth, TX 76135 Phone: 817-238-4435 Arlington 700 E. Abram St. Arlington, TX 76010 Phone: 817-548-3935 Poly 3212 Miller Ave. Fort Worth, TX 76105 Phone: 817-531-5635 Mansfield 1100 E. Broad St. Mansfield, TX 76063 Phone: 817-473-5127 Southlake 1400 Main St. Suite 110 Southlake TX 76092 Phone: 817-481-8141 Northeast 645 E. Grapevine Highway Hurst, TX 76054 Phone: 817-581-3635 Southwest 6551 Granbury Rd Fort Worth, TX 76133 Phone: 817-370-4535 817-884-1100 Email Property Tax Department at: taxoffice@tarrantcounty.com Email Motor Vehicle Department at: mvt@tarrantcounty.com Questions about the newsletter may be directed to Vickie Doane at Tax-SDC@tarrantcounty.com Visit our website at: www.tarrantcounty.com Registration renewals may be purchased at your local Carnival, Fiesta, Kroger, and Tom Thumb stores in Bedford, Hurst, Keller, Mansfield, Southlake, Arlington, Grapevine, and Fort Worth. Check our website for a list of locations at www.tarrantcounty.com. Be sure to bring your renewal notice, proof of insurance and an acceptable form of ID such as a Texas Driver’s License or ID card. Email Tax-SDC@tarrantcounty.com to subscribe to our monthly newsletter distribution list. 12

© Copyright 2025