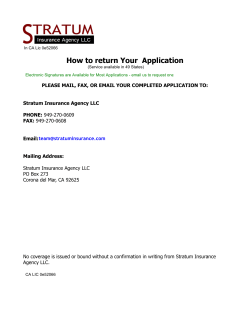

axisrespol 01/2015 - Axis Underwriting