Daily NCDEX Commodity

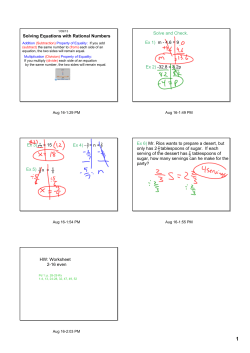

6-Jul-15 Item Open High 35490 35500 Low Close % Cng OI 34945 -1.34 41 Comments Spices Pepper Turmeric 34420 Agro Market 7360 7360 7202 7220 -1.45 Jeera 16280 16410 15910 16010 -1.96 16188 Coriander 12089 12145 11944 11983 -0.64 45260 Cardamom 16815 829 838.2 821 825.2 -0.21 720 Sugar m 2188 2203 2187 2198 0.41 39760 Wheat 1519 1543 1519 1541 1.31 14240 Maize 1239 1242 1225 1231 -0.32 16780 Barley 1245 1245 1231.5 1234 -0.88 10240 Chana 4321 4339 4264 4305 -0.53 169220 Kapas 923 926 915 919 -0.38 2960 16210 16230 16100 16150 -0.37 4958 Mentha Oil 1059.9 1066.5 1048.1 1061.5 0.35 7517 Soya Bean 3640 3664 3532 3552 -2.04 57990 Ref.soya oil 585.5 586.65 583.1 583.9 -0.18 213030 Cpo 446.3 448 445.5 447 0.07 4601 Rmseed 4282 4297 4205 4219 -1.45 62790 Castorseed 4110 4110 4053 4082 -0.24 106090 Cereals Others Cotton The entire spices counter on the NCDEX yesterday ended with losses. Jeera prices ended with more than one and half percent losses followed more than one percent losses in turmeric prices and around half percent losses witnessed in dhaniya prices. Turmeric prices ended with losses on sluggish demand from retailers and stockists against adequate stocks position. Jeera prices ended with losses on late profit booking after prices seen supported earlier as there is expectation of revival of export demand. DAILY MARKET LEVEL COMMODITIES CARDAMOM WHEAT MENTHA OIL CHANA TURMERIC JEERA SOYABEAN R.SOYA OIL CLOSE 825.2 1541 1061.5 4305 7220 16010 3552 583.9 852.4 1573 1087.7 4417 7476 16810 3766 591.0 845.3 1558 1077.1 4378 7418 16610 3715 589.0 835.2 1549 1069.3 4342 7318 16310 3634 587.0 828.1 1534 1058.7 4303 7260 16110 3583 585.0 818.0 1525 1050.9 4267 7160 15810 3502 583.0 810.9 1510 1040.3 4228 7102 15610 3451 581.0 800.8 1501 1032.5 4192 7002 15310 3370 579.0 OI 720 14240 7517 169220 16815 16188 57990 213030 OI (%) -10.78 38.52 2.37 0.29 4.09 4.53 -1.96 -2.23 RESISTANCE P. POINT SUPPORT SPOT MARKETS UPDATE CORIANDER SUGAR SOYABEAN CHANA TURMERIC JEERA R.SOYA OIL WHEAT RM SEED COTTON 11983 2198 3552 4305 7220 16010 583.9 1541 4219 16150 -0.64 0.41 -2.04 -0.53 -1.45 -1.96 -0.18 1.31 -1.45 -0.37 SOYABEAN OPEN HIGH LOW CLOSE % CNG RE CNG OI VOLUME 3640 3664 3532 3552 -2.04 -74.00 57990 136860 MARKET MOVER Soyabean trading range for the day is 3451-3715. Soyabean prices ended with losses led by higher supplies in the market. USDA forecast smaller-than-expected supplies at the beginning of this month, estimating inventories on June 1 at 625 million bushels. Soybean planted area for 2015 is estimated at a record high 85.1 million acres, up 2 percent from last year. At the Indore spot market in top producer MP, soybean dropped -2 rupee to 3593 rupee per 100 kgs. SELL SOYABEAN AUG @ 3580 SL 3620 TGT 3530-34803420.NCDEX MARKET COMMENTARY Soyabean settled down -2.04% at 3552 led by higher supplies in the market. The United States Department of Agriculture (USDA) forecast smallerthan-expected supplies at the beginning of this month, estimating inventories on June 1 at 625 million bushels compared to expectation of 674 million bushels. The USDA estimated farmers will plant 85.139 million acres of soybeans this year, compared to consensus expectation of 85.187 million acres area. Soybean planted area for 2015 is estimated at a record high 85.1 million acres, up 2 percent from last year. Area for harvest, at 84.4 million acres, is also up 2 percent from 2014 and will be record high, if realized. Record high planted acreage is estimated in Kentucky, Minnesota, Ohio, Pennsylvania, and Wisconsin. Timely arrival of the South-West monsoon in the key soyabean growing regions of central India has boosted planting of the oilseed with acreage estimated at 96 lakh hectares as on now. “According to the information gathered from various sources such as farmers and traders the sowing of soyabean has been completed on 96 lakh hectares as on June 28,” said the Soyabean Processors Association of India (SOPA). Technically market is under long liquidation as market has witnessed drop in open interest by -1.96% to settled at 57990 while prices down -74 rupee, now Soyabean is getting support at 3501 and below same could see a test of 3451 level, And resistance is now likely to be seen at 3633, a move above could see prices testing 3715. RM Seed OPEN HIGH LOW CLOSE % CNG RE CNG OI VOLUME 4282 4297 4205 4219 -1.45 -62.00 62790 63060 MARKET MOVER Rmseed trading range for the day is 4148-4332. Mustard seed prices ended with losses tracking weakness in spot demand amid weak export demand. Rapeseed meal exports from India dropped 44.86% on year to 69,398 tons in April on weak demand from South Korea, Iran and Thailand. NCDEX accredited warehouses mustard seed stocks gained by 49 tonnes to 63850 tonnes. In the Alwar spot market in Rajasthan the price remains unchanged at0 rupee to 4321.55 rupees per 100kgs. SELL RMSEED AUG @ 4230 SL 4260 TGT 4190-4150.NCDEX MARKET COMMENTARY Rmseed settled down -1.45% at 4219 tracking weakness in spot demand amid weak export demand. Prices of the seeds will be under pressure on subdued export demand for the rape seed meal. Rapeseed meal exports from India dropped 44.86% on year to 69,398 tons in April on weak demand from South Korea, Iran and Thailand, data released from Solvent Extractors Association of India (SEA) showed. Sources have reported that around 17.77 lakh hectare (lh) mustard crop has been damaged in the Rajasthan, Haryana and Uttar Pradesh, which contribute nearly 25 % of the area planted in 2014-15. Domestic production for the same period is projected at 5.74 mt, down 12% on lower area according to Solvent Extractors' Association of India (SEA). The acreage in the country for year 2014-15 season is down by about 3.2% at about 63.8 lakh hectares (lh). This would imply that the old season inventory currently remains lower versus last year same period. Mustard production in Gujarat may tumble 37% to 3.06 lakh tons during 2014‐15 against 4.86 lakh tons a year ago, according to third advance estimates released by state agriculture department. The department has projected output at 3.28 lakh tons in second advance estimate. Technically market is under fresh selling as market has witnessed gain in open interest by 5.48% to settled at 62790 while prices down -62 rupee, now Rmseed is getting support at 4184 and below same could see a test of 4148 level, And resistance is now likely to be seen at 4276, a move above could see prices testing 4332. MENTHA OIL OPEN HIGH LOW CLOSE % CNG RE CNG OI VOLUME 1059.9 1066.5 1048.1 1061.5 0.35 3.70 7517 5075 MARKET MOVER Menthaoil trading range for the day is 1040.3-1077.1. Menthaoil spot is at 1145/-. Spot market is up by Rs.17/-. Mentha oil prices ended with gains as reports of lower production this season supported prices. Though, falling demand from consuming industries in the spot market against sufficient stocks, capped some gains. Mentha oil production is expected to fall this year by 30 per cent to 40,000 tonnes from 55,000 tonnes a year ago. BUY MENTHA OIL JULY ABV 1065 SL BELOW 1048 TGT 10741085-1098. MCX MARKET COMMENTARY Menthaoil settled up 0.35% at 1061.5 as reports of lower production this season supported prices. Though, falling demand from consuming industries in the spot market against sufficient stocks, capped some gains. Farmers are preparing field for new crop in major regions of Uttar Pradesh, Bihar and Haryana. As per sources, this year Mentha acreage is likely to down by around 10-15% from last year in Uttar Pradesh. Mentha oil production is expected to fall this year by 30 per cent to 40,000 tonnes from 55,000 tonnes a year ago, with acreage under the commodity declining as farmers sentiment were dampened due to lower prices. Mentha oil arrivals to the spot market, especially from the Chandausi in Uttar Pradesh, have increased substantially. The resulting fall in prices was capped due to lower production of the commodity this season. Acreage is expected to fall by 20 per cent this year, to 17,500 hectare on the back of a large carry-over stock from last year. At Barabanki market total arrivals are at 400 Drums(1-drum-180kg), steady as against previous day’s arrival. At Chandausi market total arrivals are at 35 Drums(1-drum-180kg), lower by 15 Drums(1-drum-180kg) as against previous day. At Sambhal market total arrivals are at 80 Drums(1-drum=180kg), down by 20 Drums(1-drum=180kg) as against previous day. At Bareilly market total arrivals are at 5 Drums(1-drum-180kg), up by 3 Drums(1-drum-180kg) as against previous day. Technically market is under fresh buying as market has witnessed gain in open interest by 2.37% to settled at 7517 while prices up 3.7 rupee, now Menthaoil is getting support at 1050.9 and below same could see a test of 1040.3 level, And resistance is now likely to be seen at 1069.3, a move above could see prices testing 1077.1. CHANA OPEN HIGH LOW CLOSE % CNG RE CNG OI VOLUME 4321 4339 4264 4305 -0.53 -23.00 169220 155220 MARKET MOVER Chana trading range for the day is 4228-4378. Chana prices ended with losses on account of fall in demand in the spot market against higher supplies from the major producing belts. The area under Kharif Pulses has risen to 11.04 lakh ha as of now June vs 6.14 lakh ha same period last year. NCDEX accredited warehouses chana stocks gained by 30 tonnes to 141305 tonnes. In Delhi spot market, chana dropped by -26.45 rupee to end at 4373.55 rupee per 100 kgs. SELL CHANA AUG BELOW 4320 SL ABV 4360 TGT 4280-4240. NCDEX (STBT) MARKET COMMENTARY Chana settled down -0.53% at 4305 on account of fall in demand in the spot market against higher supplies from the major producing belts. However, reports of Monsoon likely to weaken in July, capped some losses. As per latest Govt reports, the area under Kharif Pulses has risen to 11.04 lakh ha as of now June vs 6.14 lakh ha same period last year. Above normal rains in Central and South India have improved sowing for Pulses, keeping prices down. Rajasthan Govt relaxed imposing stock limit on Pulses w.e.f. 15th July to 30th Nov, the limit for wholesalers: 2500 Q for 45 days and for retailers: 400 Q. Chana withstood a government's move to import pulses to augment local supplies of the nutrient and curb prices on speculation that a less than average monsoon rainfall will hit local output and demand will outpace the available stock. India's 2014-15 total chana output is at 7.59 million tons as compared to 9.93 million tons a year ago due to lower sowing and untimely rains. Domestic chana prices rose to Rs 4,885 per quintal due to lower output estimates. India will be importing pulses between six to seven million tons at very high prices resulting unprecedented hike in the market if adequate precautionary measures are not taken timely. Technically market is under fresh selling as market has witnessed gain in open interest by 0.29% to settled at 169220 while prices down -23 rupee, now Chana is getting support at 4266 and below same could see a test of 4228 level, And resistance is now likely to be seen at 4341, a move above could see prices testing 4378. TURMERIC OPEN HIGH LOW CLOSE % CNG RE CNG OI VOLUME 7360 7360 7202 7220 -1.45 -106.00 16815 8460 MARKET MOVER Turmeric trading range for the day is 7102-7418. Turmeric prices ended with losses on sluggish demand from retailers and stockists against adequate stocks position. Sources are expecting the total production in the range of 5052 lakh bags in the current year, down 20 lakh bags from the last year. NCDEX accredited warehouses turmeric stocks gained by 50 tonnes to 14479 tonnes. In Nizamabad, a major spot market in AP, the price ended at 7276.3 rupees dropped -13.7 rupees. SELL TURMERIC AUG @ 7250 SL 7400 TGT 7100-6980.NCDEX MARKET COMMENTARY Turmeric settled down -1.45% at 7220 on sluggish demand from retailers and stockists against adequate stocks position. Sources are expecting the total production in the range of 50-52 lakh bags in the current year, down 20 lakh bags from the last year in the same period. Sources also stated that around 75lakh bags of total stocks have been reported in local mandies. At Erode market arrivals were reported at 3000 quintals, up by 1000 quintals from previous day’s arrivals. At Nizamabad market total arrivals are at 1500 quintals, unchanged as compared to previous day’s arrival. At Sangli market total arrivals are at 1200 quintals, higher by 400 quintals from previous trading day. There are also reports of stockists reportedly holding on to the stocks in anticipation of a recovery in price. Agriculture Department estimates put turmeric production this year at around 3.7 million bags compared with 5.2 million bags a year ago. As per the Spice Board of India, turmeric exports rose 8% in 2014-15. In the early nine months of the fiscal year India exported 65,000 tons of turmeric against 60,000 tons in the corresponding period a year ago while its target is 80,000 tons. Technically market is under fresh selling as market has witnessed gain in open interest by 4.09% to settled at 16815 while prices down -106 rupee, now Turmeric is getting support at 7161 and below same could see a test of 7103 level, And resistance is now likely to be seen at 7319, a move above could see prices testing 7419. JEERA OPEN HIGH LOW CLOSE % CNG RE CNG OI VOLUME 16280 16410 15910 16010 -1.96 -320.00 16188 7254 MARKET MOVER Jeera trading range for the day is 15610-16610. Jeera prices ended with losses on late profit booking after prices seen supported earlier as there is expectation of revival of export demand. According to latest spice board press release, cumin export is stood at 155,500 tonnes for 2014-15 period. NCDEX accredited warehouses jeera stocks gained by 195 tonnes to 20371 tonnes. In Unjha, a key spot market in Gujarat, jeera edged up by 69.25 rupees to end at 16869.25 rupee per 100 kg. SELL JEERA AUG @ 16150 SL 16350 TGT 15980-15800.NCDEX MARKET COMMENTARY Jeera settled down -1.96% at 16010 on late profit booking after prices seen supported earlier as there is expectation of revival of export demand. Tight arrivals in major trading centres have kept Jeera buoyant in local mandies. Production and Exports As per third advance estimate of Gujarat State, production is expected at 1.58 lakh tonnes in 2014-15 which is 54.3 per cent lower compared to last years’ production of 3.46 lakh tonnes. According to Gujarat government data released on 19th Jan 15, Jeera recorded 2.64 lakh hac, 42% less sowing compared to last year’s 4.54 lakh hac. There is concern over production due to untimely rainfall in March in Gujarat and Rajasthan. As per Government data, 2.41 lakh hectare of cumin crop is damaged in Rajasthan. According to latest spice board press release, cumin export is stood at 155,500 tonnes for 2014-15 period and earned foreign exchange worth Rs 1,838.20 crore while in 2013-14, the figures stood at 121,500 tonnes valued at Rs 1,600 crore. Export orders are diverted to India due to Geo-political tensions in Syria and Turkey. As per Government data, 2.41 lakh hectare of cumin crop is damaged in Rajasthan. Harvesting has been affected on late rains in Rajasthan and overall output could suffer. Technically market is under fresh selling as market has witnessed gain in open interest by 4.53% to settled at 16188 while prices down -320 rupee, now Jeera is getting support at 15810 and below same could see a test of 15610 level, And resistance is now likely to be seen at 16310, a move above could see prices testing 16610. CASTORSEED OPEN HIGH LOW CLOSE % CNG RE CNG OI 4110 4110 4053 4082 -0.24 -10.00 106090 VOLUME 28800 SUP-3 3997 SUP-2 4025 SUP-1 4054 P.P. 4082 RES-1 4111 RES-2 4139 RES-3 4168 OI (%) 1.67 MARKET COMMENTARY Castorseed settled down -0.24% at 4082, technically market is under fresh selling as market has witnessed gain in open interest by 1.67% to settled at 106090 while prices down -10 rupee, now Castorseed is getting support at 4054 and below same could see a test of 4025 level, And resistance is now likely to be seen at 4111, a move above could see prices testing 4139. Castorseed trading range for the day is 4025-4139. BUY CASTORSEED JUNE @ 3160 SL 3135 TGT 3185-3210.NCDEX The spot prices of castorseed in Disa mandi dropped -17.1 rupee to 4007.9 rupees per kg. MAIZERABI OPEN HIGH LOW CLOSE % CNG RE CNG OI 1239 1242 1225 1231 -0.32 -4.00 16780 VOLUME 2330 SUP-3 SUP-2 SUP-1 P.P. RES-1 RES-2 RES-3 OI (%) 1207 1216 1224 1233 1241 1250 1258 0.30 MARKET MOVER Maize trading range for the day is 1216-1250. Maize dropped on profit booking after supported by overseas prices as adverse weather in the parts of the U.S. Midwest and Western Europe threatened crops. The latest production estimate for the total maize harvest this season in South Africa which was release last week is 9,755 million tons. NCDEX accredited warehouses maize stocks gained by 511 tonnes to 16975 tonnes. In Nizamabad maize prices dropped -4.6 rupee to end at 1325 rupees per 100 kg. SELL MAIZE AUG @ 1240 SL 1265 TGT 1220-1200.NCDEX MARKET COMMENTARY Maize settled down -0.32% at 1231 on profit booking after supported by overseas prices as adverse weather in the parts of the U.S. Midwest and Western Europe threatened crops. The latest production estimate for the total maize harvest this season in South Africa which was release last week is 9,755 million tons with an average yield of 3,7 tons per hectare. The total harvest last year was 14,25 million tons with an average yield of 5,3 tons per hectare. Sowing area of summer maize and summer coarse cereals have respectively increased to 2.72 lakh hectare and 6.30 lakh hectare compared to 1.97 lakh hectare and 5.59 lakh hectare in previous year. Similarly, sowing area of summer maize and summer coarse cereals have respectively increased to 2.72 lakh hectare and 6.30 lakh hectare compared to 1.97 lakh hectare and 5.59 lakh hectare in previous year. At Naugachia market in Bihar estimated market supply was at 3333 Quintal, unchanged as compared to previous day’s arrival. At Nizamabad market in Andhra Pradesh estimated market supply was at 400 Qtl, unchanged as compared to previous day’s arrival. At Khanna market in Punjab total arrivals are at 1950 Quintal, steady as against previous day’s arrival. At New Delhi market estimated market supply was at 500 quintals, down by 200 quintals from previous day’s arrivals. At Davanagere market total arrivals are at 1000 Bags, steady as against previous day’s arrival. Technically market is under fresh selling as market has witnessed gain in open interest by 0.3% to settled at 16780 while prices down -4 rupee, now Maize is getting support at 1223 and below same could see a test of 1216 level, And resistance is now likely to be seen at 1240, a move above could see prices testing 1250. MONTH OPEN HIGH LOW CLOSE OPEN INT CHANGE IN RS. CHANGE IN % VOLUME OI (%) 824 -10.78 OTHER COMMODITY ITEMS TRADING LEVEL MCX CARDAMOM Jul 2015 INTRA-DAY LEVEL FOR Jul 2015 MONTH 829.0 Support Resistance 838.2 821.0 825.2 Sup-1 Sup-2 Sup-3 818 811 801 Res-1 Res-2 Res-3 835 845 852 586.7 583.1 583.9 Sup-1 Sup-2 Sup-3 583 581 579 Res-1 Res-2 Res-3 587 589 591 448.0 445.5 447.0 Sup-1 Sup-2 Sup-3 445.6 444.3 443.1 Res-1 Res-2 Res-3 448.1 449.3 450.6 1245.0 1231.5 1234.0 Sup-1 Sup-2 Sup-3 1229 1223 1215 Res-1 Res-2 Res-3 1243 1251 1257 4297 4205 4219 Sup-1 Sup-2 Sup-3 4183 4148 4091 Res-1 Res-2 Res-3 4275 4332 4367 3664.0 3532.0 3552.0 Sup-1 Sup-2 Sup-3 3502.0 3451.0 3370.0 Res-1 Res-2 Res-3 3634.0 3715.0 3766.0 1543 1519 1541 Sup-1 Sup-2 Sup-3 1525 1510 1501 Res-1 Res-2 Res-3 1549 1558 1573 2203 2187 2198 Sup-1 Sup-2 Sup-3 2189 2180 2173 Res-1 Res-2 Res-3 2205 2212 2221 720 -1.7 -0.21 P.POINT Weak 828 NCDEX REF.SOYA OIL Aug 2015 INTRA-DAY LEVEL FOR Aug 2015 MONTH 585.5 Support Resistance 213030 -1.05 -0.18 47985 -2.23 P.POINT Weak 585 MCX CRUDE PALM OIL Jul 2015 INTRA-DAY LEVEL FOR Jul 2015 MONTH 446.3 Support Resistance 4601 0.3 0.07 815 -4.88 P.POINT Positive 446.8 NCDEX BARLEY Aug 2015 INTRA-DAY LEVEL FOR Aug 2015 MONTH 1245.0 Support Resistance 10240 -11 -0.88 2550 4.7 P.POINT Weak 1237 NCDEX RMSEED Aug 2015 INTRA-DAY LEVEL FOR Aug 2015 MONTH 4282 Support Resistance 62790 -62 -1.45 63060 5.48 P.POINT Weak 4240 NCDEX SOYABEAN Aug 2015 INTRA-DAY LEVEL FOR Aug 2015 MONTH 3640.0 Support Resistance 57990 -74 -2.04 136860 -1.96 P.POINT Weak 3583.0 NCDEX WHEAT Aug 2015 INTRA-DAY LEVEL FOR Aug 2015 MONTH 1519 Support Resistance 14240 20 1.31 8470 38.52 P.POINT Positive 1534 NCDEX SUGARM Oct 2015 INTRA-DAY LEVEL FOR Oct 2015 MONTH 2188 Support Resistance 39760 9 0.41 3540 P.POINT Positive 2196 NCDEX REF.SOYA OIL JUNE -1.85 SPREAD UPDATE DAILY SPREAD IN MENTHA OIL - MCX MONTH RATE Jul 2015 1061.5 Aug 2015 1077.4 Sep 2015 1091.8 Jul 2015 DAILY SPREAD IN SOYABEAN - NCDEX Aug 2015 Sep 2015 MONTH RATE 15.9 30 Aug 2015 3552 14.4 Oct 2015 3329 Nov 2015 3309 Aug 2015 Oct 2015 Nov 2015 -223 -243 -20 Spread between Menthaoil JUL & AUG contracts yesterday ended Spread between Soyabean AUG & OCT contracts yesterday at Rs.15.9, we have seen yesterday Menthaoil future had traded ended at Rs.-223, we have seen yesterday Soyabean future had in a positive zone and settled 0.35% up. traded in a negative zone and settled -2.04% down. DAILY SPREAD IN CPO - MCX MONTH RATE Jul 2015 447 Aug 2015 447 Sep 2015 447 Jul 2015 DAILY SPREAD IN CHANA - NCDEX Aug 2015 Sep 2015 MONTH RATE 0 0 Aug 2015 4305 0 Sep 2015 4395 Oct 2015 4476 Aug 2015 Sep 2015 Oct 2015 90 171 81 Spread between CPO JUL & AUG contracts yesterday ended at Spread between Chana AUG & SEP contracts yesterday ended at Rs.0, we have seen yesterday CPO future had traded in a positive Rs.90, we have seen yesterday Chana future had traded in a zone and settled 0.07% up. negative zone and settled -0.53% down. DAILY SPREAD IN JEERA - NCDEX MONTH RATE Aug 2015 16010 Sep 2015 16385 Oct 2015 16845 Aug 2015 DAILY SPREAD IN TURMERIC - NCDEX Sep 2015 Oct 2015 MONTH RATE 375 835 Aug 2015 7220 460 Sep 2015 7306 Oct 2015 7476 Aug 2015 Sep 2015 86 Oct 2015 256 170 Spread between Jeera AUG & SEP contracts yesterday ended at Spread between Turmeric AUG & SEP contracts yesterday ended Rs.375, we have seen yesterday Jeera future had traded in a at Rs.86, we have seen yesterday Turmeric future had traded in negative zone and settled -1.96% down. a negative zone and settled -1.45% down. DAILY SPREAD IN CARDAMOM - MCX MONTH RATE Jul 2015 825.2 Aug 2015 821.6 Sep 2015 804.5 Jul 2015 DAILY SPREAD IN REF.SOYA - NCDEX Aug 2015 Sep 2015 MONTH RATE -3.6 -21 Aug 2015 583.9 -17.1 Oct 2015 569.55 Nov 2015 566.45 Aug 2015 Oct 2015 -14.35 Nov 2015 -17 -3.1 Spread between Cardamom JUL & AUG contracts yesterday Spread between Ref.Soyaoil AUG & OCT contracts yesterday ended at Rs.-3.6, we have seen yesterday Cardamom future had ended at Rs.-14.35, we have seen yesterday Ref.Soyaoil future traded in a negative zone and settled -0.21% down. had traded in a negative zone and settled -0.18% down. NEWS YOU CAN USE The Cabinet Committee on Economic Affairs (CCEA) may consider a proposal to extend by one year the ban on hoarding of onions beyond a prescribed limit. The validity of the order, that empowers states to impose stock limits on traders for holding onion and ban hoarding beyond the set limit, expires on July 2. ‘The CCEA meeting is scheduled for tomorrow. A proposal related to stock holding limit order on onion is on the agenda for discussion,’ according to sources. In the Cabinet note, the consumer affairs ministry has sought extension of the order by another year in view of increase in onion prices due to short supply. The proposal aims to enable state governments take effective de-hoarding measures under the Essential Commodities Act (ECA), 1955 and help tackle the problem of rising prices and improve the availability of onion for general public. Last year, both onions and potatoes were brought under the purview of the ECA and gave powers to state governments to impose upper limit for holding the stock of these two items by traders and ban hoarding beyond the set ceiling for an year. Other commodities that come under the ambit of stock holding limits order are pulses, edible oils, oilseeds, rice and paddy. Timely arrival of the South-West monsoon in the key soyabean growing regions of central India has boosted planting of the oilseed with acreage estimated at 96 lakh hectares as on now. “According to the information gathered from various sources such as farmers and traders the sowing of soyabean has been completed on 96 lakh hectares as on June 28,” said the Soyabean Processors Association of India (SOPA), the apex industry body in a statement. Madhya Pradesh, the largest producer of the oilseed, leads the acreage presently estimated at 54 lakh hectares (lh), followed by Maharashtra at 28 lh, Rajasthan at 6 lh and other States at 8 lh. “We expect the area this year will be 7-10 per cent higher than last year,” SOPA said estimating that acreage could touch 118 lakh hectares. SOPA officials said the germination of the planted soyabean has been good and that farmers are switching over from crops such as cotton and paddy to the oilseed due to the timely arrival of the rains. Also, there is a preference for early maturing varieties such as 9560 – an 85-day crop. SOPA expects acreage to touch 60 lh in Madhya Pradesh, 38 lh in Maharashtra, 10 lh in Rajasthan and another 10 lh in other States including Karnataka, Andhra Pradesh and Gujarat. According to Skymet, a private forecaster, the monsoon will be slightly weak in Madhya Pradesh and Maharashtra from July 2-6 and light rains are expected on July 6 and 7. It will revive thereafter and there will be rainfall on July 13 and 14 and again between July 20 and 22. This is favourable for soyabean crop, SOPA added. Corporate Office 301/302, Payal Tower II, Sayajigunj, Vadodara 390005, Call: +91 265 2226201 Email: info@jhaveritrade.com SMS JHAVERI to 54959 Disclaimer : The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. Certain transactions -including those involving futures, options and other derivatives as well as non investment grade securities - involve substantial risk and are not suitable for all investors. Jhaveri Credit & Capital Ltd has not independently verified all the information given in this document. Accordingly, no representation or warranty, express or implied, is made as to the accuracy, completeness or fairness of the information and opinions contained in this document. The Disclosures of Interest Statement incorporated in this document is provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alternations to this statement as may be required from time to time without any prior approval. Jhaveri Credit & Capital Ltd, its affiliates, their directors and the employees may from time to time, effect or have effected an own account transaction in, or deal as principal or agent in or for the securities mentioned in this document. They may perform or seek to perform investment banking or other services for, or solicit investment banking or other business from, any company referred to in this report. Each of these entities functions as a separate, distinct and independent of each other. The recipient should take this into account before interpreting the document. This report has been prepared on the basis of information that is already available in publicly accessible media or developed through analysis of Jhaveri Credit & Capital Ltd. The views expressed are those of the analyst and the Company may or may not subscribe to all the views expressed therein. This document is being supplied to you solely for your information and may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. Neither the Firm, not its directors, employees, agents or representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

© Copyright 2025