to the article

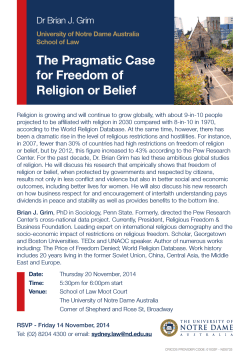

BAN THE BAN: PROHIBITING RESTRICTIONS ON THE ASSIGNMENT OF RECEIVABLES 136 Feature KEY POINTS Restrictions on the assignment of receivables can create problems in practice in financing transactions. The Government plans to prohibit them in most cases. This is the wrong approach. There are better ways to deal with the problem. Author Richard Calnan Ban the ban: prohibiting restrictions on the assignment of receivables This article summarises the key points in the City of London Law Society’s response to the Department for Business, Innovation and Skills’ consultation paper, Nullification of Ban on Invoice Assignment Clauses. ■ Receivables are an important element in the wealth of businesses and, for that reason, they are frequently financed. Receivables can be used as security for a loan, or they can be sold under a factoring or securitisation arrangement. Either way, the financing will involve an assignment (statutory or equitable) or a charge over the receivables. This is relatively straightforward. But most receivables are created by contract, and contracts frequently contain restrictions on assignment. Take, for instance, a simple contract under which a payer has an obligation to pay money to the payee as consideration for goods or services supplied by the payee from time to time. If the contract prohibits the assignment of the receivables without the consent of the payer, then no valid assignment can be created unless the payer consents. Whether or not the particular clause in the contract does prohibit the proposed transaction is a matter of the interpretation of the contract as a whole, read in the context of the background facts at the time the contract was entered into. But if, on its proper interpretation, the intended transaction is prohibited by the contract, then it is ineffective. This can be an important issue in financings in practice. It is not often a problem in relation to large contracts which it is known have to be financed – because they tend to be drafted with an eye on the need for financing. But, where the financing is over a number of smaller contracts, the financier needs to check the terms of the contracts in order to decide whether they prohibit what is intended; and, if they do, it needs to obtain the consent of the payer – which may, or may not, be forthcoming. It is for this reason that, when the Financial Law Committee of the City of London Law March 2015 Society (CLLS) produced a discussion paper on secured transactions reform in November 2012,1 the paper contained a section on restrictions on assignment. A working party of the CLLS is continuing to consider the issues concerned. In particular, it is considering how contracts should best be drafted in order to protect the legitimate interests of the payer, whilst at the same time enabling the payee to finance the receivable. And then the Government entered the debate. In 2014, it published a Small Business, Enterprise and Employment Bill which would, in most cases, have overridden prohibitions on assignment. Then, in December 2014, the Department for Business, Innovation and Skills (DBIS) published the consultation paper Nullification of Ban on Invoice Assignment Clauses. At the same time, it published a draft statutory instrument – The Business Contract Terms (Restrictions on Assignment of Receivables) Regulations 2015. The effect of these regulations would be to override a term of a contract to the extent that it prohibits or restricts the assignment of receivables. It would apply to all contracts unless specifically excluded. In February 2015, the CLLS responded to the consultation paper.2 It made two key comments. First, it considered that the proposed legislation approaches the issue in the wrong way, and that there are preferable ways to deal with it. It is not an answer to the problem caused by restrictions on assignment simply to invalidate them. Secondly, it argued that, if the legislation is to proceed, it needs to protect the payer properly and more thought needs to be given to the extent of its application. This article summarises the key points in the CLLS response. FREEDOM OF CONTRACT It is axiomatic that the parties to a commercial contract can decide its terms, and therefore whether or not it can be assigned. No-one has expressed the importance of freedom of contract better than Sir George Jessel MR in Printing and Numerical Registering Company v Sampson (1874-75) LR 19 Eq 462 at 465: “It must not be forgotten that you are not to extend arbitrarily those rules which say that a given contract is void as being against public policy, because if there is one thing which more than another public policy requires it is that men of full age and competent understanding shall have the utmost liberty of contracting, and that their contracts when entered into freely and voluntarily shall be held sacred and shall be enforced by courts of justice. Therefore, you have this paramount public policy to consider – that you are not lightly to interfere with this freedom of contract.” Of course, that statement was made during the glory days of Victorian free trade. Freedom of contract suffered a setback in the 20th century, largely because of concerns about consumer protection. But, since Photo Production v Securicor [1980] AC 827 in the 1980s, the pendulum has swung back in commercial cases in favour of freedom of contract. Now that consumers are catered for by legislation, there is no reason why freedom of contract should not prevail in the commercial sphere. Parties from all over the world choose English law to govern their contracts. They do this because English law gives effect to what the parties have agreed. Apart from the penalty doctrine – which is now an historical anomaly – a court can very rarely override what the parties have agreed. Freedom of contract should only be restricted in commercial transactions in Butterworths Journal of International Banking and Financial Law exceptional circumstances – where there is clear evidence that allowing the parties to decide for themselves materially damages the UK economy. We have not seen such evidence in relation to restrictions on assignment. And if there is a problem in particular sectors, this is best dealt with by competition and regulatory law in a manner proportionate to the risks involved, not by a blanket ban. There is no doubt that restrictions on assignment can cause practical problems in financing transactions. That is why a working party of the CLLS is looking at them at the moment. But the problem is not so grave that it warrants overriding the rights of one party to a contract in order to give an advantage to the other party. The draft regulations exclude from their scope certain types of contract (such as contracts for financial services) where it is considered that the parties should be free to restrict assignment. It is recognised – quite rightly – that a payer may have a perfectly good reason why it wants to restrict the assignability of a receivable in a financial services contract. But this is also true of other types of contract. It is impossible to specify all those types of contract where the payer may have a legitimate commercial reason for restricting the identity of its payee. In a commercial context, this should be left to the parties to decide. It is for this reason that the best way to deal with the problem is consensually – by explaining the issues to the parties and encouraging them to agree restrictions on transfer which allow receivables to be sold or charged by the payee whilst at the same time protecting the legitimate interests of the payer. The right approach is very much dependent on the particular contract concerned. The issues are too nuanced to be solved by legislation which simply prohibits certain contractual provisions. There is no doubt that, in many contracts, restrictions on assignment are inserted with very little thought being given to their purpose and effect. But there are other cases where these provisions are carefully drafted to serve a particular purpose, or are negotiated between the parties in order to reflect the agreement they have reached. What is needed in practice is a better understanding of the types of restriction, and their effects. This process can be assisted by the drafting of model clauses and commentaries. But what is totally unhelpful is legislation which rides roughshod over the parties’ agreement. PROTECTING THE PAYER The payer should not suffer as a result of its contract being overridden. If legislation is to be passed, it should make it clear that the payer’s economic obligations will not be increased as a result of the payee assigning receivables to a third party in breach of the terms of the contract. For instance, the payer should be able to exercise the same rights of set-off which it would have had in the absence of the assignment. This would not be the case under the general law. Once notice of assignment is given, the payer is unable to exercise new rights of set-off which it obtains against the assignor. The payer ought to be able to exercise these rights against the assignee, even though there has been an assignment. If the contract prevents assignment, it would be unfair on the payer to require it to pay more than it would have had to pay if the terms of the contract had been complied with. THE SCOPE OF THE LEGISLATION The draft regulations override restrictions on assignment in any contract to which they apply. There are three elements of uncertainty here. The first is the type of transaction which the legislation is intended to override. It is expressed to apply to assignments of receivables. This is presumably intended to cover security assignments as well as to outright assignments, but there is no reference to charges. Are they intended to be covered, or not? The second concern relates to the identity of the companies which can benefit from the regulations. It appears from the consultation paper that the key driver for the legislation is the protection of small businesses. But there is nothing in the draft legislation which restricts its application to small businesses. The regulations outlaw restrictions on assignment in any relevant contract, even if it is made between two large multi-national companies. Is that really the intention? Butterworths Journal of International Banking and Financial Law Indeed, even if it were restricted to small companies, it should not be forgotten that, for every small company which is owed a receivable, there is another small company which owes one. Is it appropriate to override the interests of a small company payer in favour of a large company payee? The final concern involves the territorial scope of the legislation. There is no indication in the regulations as to the extent of its territorial application. Is it intended to apply to all contracts governed by English law, regardless of where the parties are situated? Or is it meant to apply to contracts between parties situated in the UK, regardless of the law which governs them? Or is there to be some combination of these two tests? These are crucial questions, and there is nothing in the draft regulations which deals with them. There is potential here for significant damage to the use of English law by parties to international contracts. CONCLUSION There is no doubt that restrictions on assignment can cause problems in practice. But that is not a reason to cut across the basic principle of freedom of contract in commercial transactions. What is needed is an approach which understands the legitimate reasons why parties impose restrictions and which helps the parties to agree provisions which recognise that they both have an interest in achieving a sensible outcome. BAN THE BAN: PROHIBITING RESTRICTIONS ON THE ASSIGNMENT OF RECEIVABLES Feature Biog box Richard Calnan is a partner in Norton Rose Fulbright LLP and Visiting Professor at University College London. He is the author of Taking Security (3rd ed, Jordans, 2013). Email: richard.calnan@nortonrosefulbright.com 1 CLLS Financial Law Committee Discussion Paper on Secured Transaction Reform, 22 November 2012. See www.citysolicitors.org.uk; select “City of London Law Society”, then “Committees” and then “Financial Law”. 2 CLLS Response to DBIS on Nullification on Ban on Invoice Assignment Clauses, 2 February 2015. See www.citysolicitors.org.uk as above. Further reading Prohibitions on assignment: Contract or property? [2014] 11 JIBFL 692 Fixed and floating charges: the Great British Fund-Off? [2015] 1 JIBFL 3 LexisNexis Loan Ranger blog: Real impetus for reform and research into English law on secured transactions March 2015 137

© Copyright 2025