Distribution Services: Indonesia`s Backbone to a Stronger Economy

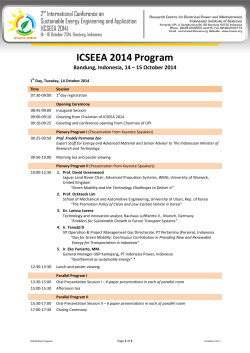

Vol. III | April 2015 Dear Readers, INSIDE THIS EDITION Distribution is the critical part of our daily life. It consists of value chain that links producer farmers, food processors, and manufacturers to end-customers. The efficiency of the distribution sector widely influences consumer welfare and plays a major role in price formation, since its input costs and margin constitute a significant portion of final prices, which can make-up up to 50% of the final price of consumer goods. Over the period of 2000—2007, wholesale and retail trade accounted for 40.2% in value-added creation, making it the biggest contributor from the services sector. In 2010, the value of wholesale and retail trade reached some US$331 billion and in 2015 National Medium-Term Development Plan (RPJMN), Ministry of Trade Republic of Indonesia has set target of growth of average of 7.3%. ISD held a Dialogue Series II on Distribution Services featuring expert speakers and policy makers. It is our hope the proceeding will be valuable input for the Government and public at large to enhance the efficiency and growth of distribution service sector. In addition, we present to you Servicing Indonesia Volume III featuring various articles on Distribution Services. Happy reading! ~Sinta Sirait Executive Director Focus Distribution Services: Indonesia’s Backbone to a Stronger Economy Distribution is a labor-intensive sector in Indonesia. It employs around 17% of total workforce and grows steadily over the last decade, scoring average 7% of annual growth, which is higher than average national growth, 5.8% (Statistics Indonesia). The fact that Top 5 Biggest Retailers “only” account for less than 10% of market share (AIPEG ‘12) makes opportunity in distribution sector remained high. In fact, this sector deals closely with almost all groups in our society—elite, middle class, and grass-root—in term of creating jobs and enhancing entrepreneurship. Indonesia’s distribution sector is perceived as an over-regulated sector. Not only central government, but local government or regulator also contributes in making distribution practices less efficient. Issues such as Indonesia National Standard (SNI), regional minimum wage, and e-commerce trend arise along with the target of President Jokowi-VP Jusuf Kalla Administration to reach 5.7% of economic growth in 2015 (Ministry of Finance ‘15). Distribution sector intertwines with other supporting components such as raw material, logistics reliability, warehouse, policy reform, purchasing power, and Global Value Chain. Therefore, to obtain reasonable growth of distribution sector, Indonesia needs to create investment-friendly climate, put maximum efforts to lower transportation and inventory cost, and also trigger “export-led” thinking. It is only possible through continuous dialogue between private sector and policy maker. Notes from Indonesia Services Dialogue 1 Focus 1 Byline 2 Coffee Talk 2 Coffee Talk 3 Snapshot 3 Global Insight 4 Event 4 DISTRIBUTION IN NUMBER In 2008, turnover of Modern Retail (Hypermarket, Supermarket, Minimarket) was worth Rp55,4 trillion (AC Nielsen) In 2010, trade in Wholesale and Retail contributed 14.34% to Indonesia’s Total GDP (AIPEG) There were 45 million people shaping Indonesia’s “Consuming Class” in 2012 (McKinsey) A.T. Kierney’s Global Retail Development Index 2014 placed Indonesia as the 15th (out of 30 developing countries) most prospective country to expand Retail Sectors, increased from the 19th position in 2013 Act No. 9/1995 about Small Enterprise was the first Act that mentioned the word “Franchise” Servicing Indonesia | April 2015 | 1 Byline 2015—16 Outlook for the Retail and Consumer Products Sector in Asia: Indonesia by Economist Intelligence Unit’s Industry & Management Research Division, PwC The Economist Intelligence Unit forecasts that retail sales in Indonesia will rise from an estimated US$330 billion in 2014 to US$639 billion in 2018. In local-currency terms, growth in retail sales will average 12.1% a year in 2014—18, but rapid inflation means that average annual volume growth will be much lower, at only 4.9%. Together with restaurants and hotels, the retail and wholesale sector employs about one-fifth of the labour force, or around 25 million people. Supply remains highly fragmented and is dominated by informal retailing. For example, in the grocery sector the five largest firms have a combined market share of just 3.8%. In rural areas the retail sector remains dominated by independent grocers and wet markets. However, shopping centres and malls are proliferating in Jakarta. In the other major cities there has been strong growth in the construction of “trade centres”, which offer lower prices than normal malls. As a result, urban areas, which accommodate around 60% of the population, will remain the focus of retail activity. Although Indonesia’s large domestic market and favourable demographic profile (28% of the population is under the age of 15) offer long-term potential, sales growth will continue to be constrained by high levels of poverty and a tightening monetary policy stance. Moreover, very wealthy Indonesians will continue to carry out much of their high-end shopping abroad, with Singapore, Paris and Milan being the most popular destinations. This habit will be further fuelled by the authorities’ decision in December 2013 to raise the tax rate on 870-odd imported non-food consumer goods from 2.5% to 7.5% in 2014. Various government officials have also spoken in favour of increasing the rate of the luxury goods tax. The main growth prospects will remain the sale of relatively low-cost staple goods. Sharp inequalities in income distribution will mean that there is also a market for higher-cost, luxury items, especially in the capital, Jakarta, although the weakness of the rupiah in 2014—15 will make many of these imported goods more expensive. To read complete version of this topic, please click HERE Coffee Talk “Export-Led” Thinking to Lift up Local Suppliers to the Next Level Operating 365 stores in 47 countries, the Swedish giant retailer, IKEA, decided to open the first store in Alam Sutera, Tangerang, Indonesia, last 2014. But, the English proverb, “When in Rome, do as the Romans”, sounds very relevant with the situation—each country has its own policy and regulation. Mark Magee, General Manager IKEA Indonesia, reveals IKEA’s journey from the opening up until today. led” thinking because with a very large local market, their focuses are only on local demands. What do you mean by “export-led” thinking? I am from England, country with less than 1% of world population. So, the mentality I was taught is that we have 99% of market outside England. With “export-led” thinking, Indonesian will not think to produce as many products as possible for one IKEA store, but how about producing 10% of total products for the global IKEA? Indonesia is gifted with raw materials and high availability of labors. IKEA has technology, technician, and access to global market. We need partners who are willing enough to see this big picture. Why did IKEA decide to enter Indonesia? If you look at the economy of Jabodetabek (Jakarta, Bogor, Depok, Tangerang, and Bekasi), it has GDP and population greater than Malaysia. There are 28 million Do you find any policy that is causing inefficiency in people and around one-third of them have disposable IKEA operation in Indonesia? income. In the next ten years, we believe I wouldn’t say there is only one Bill that “No company will make causes inefficiency since all businesses it will increase to two-third. significant investment if are facing changes in policy or How did IKEA embrace Indonesian the future is not certain.” regulation. When Ministry of Trade suppliers? introduced policy of 80% of local IKEA has actually sourced products in Indonesia and I sourcing, IKEA was able to build the case for exemption. am very much in favor of Indonesian suppliers because But, it took a year to get the “exemption” status. In that it will save our cost from importing. I encourage them year, if we had plan to expand into other area, the plan to not only supply for IKEA Indonesia, but also to 365 would be delayed. No company will make significant IKEA stores around the world. They must have “export- investment if the future is not certain. The current Servicing Indonesia | April 2015 | 2 status is, that 80% of local sourcing policy will never be applied to the first and the second store of IKEA. It aims to make the opening of second IKEA store easier. For the third store, we have agreed that volume of export will be greater than volume of import. So, if the third IKEA sells more, Indonesia will export more. Besides that, we cannot import any ceramic because no foreign suppliers met Indonesian standard (SNI). Finally, we source ceramic locally. We also face the problem for children toys since its checking procedure is very tough. It took 29 weeks to import our first container of children toys. This long process is translated into prices. Do you have advice for Indonesian Government? We need regulation that is not regularly changed and that the implementation of the regulation avoids the law of unintended consequences, which means that you create a regulation for good reason, but not fully seeing the impact. The Government should make Indonesian suppliers easier to invest in production capability to meet global demands and not only ASEAN. It could be tax incentive on capital investment or something else. Growth in Distribution Services is not Beyond the Reach Turning family-structure business into an integrated functional business with 17 subsidiaries, Shinta W. Kamdani, CEO Sintesa Group & ISD Board of Founders, is acknowledged as one of “Asia’s 50 Powerful Businesswomen” by Forbes (2012—2013). In this edition, she shares her view about the future of Indonesia’s distribution sector. What is the biggest challenge in current distribution services? The biggest challenge we face is fluctuation of oil price because it is linked with delivery cost. In the National Medium-Term Development Plan (RPJMN) 2015—2019, the Goverment aims to reduce logistics cost from 23.5% (2014) to 19.2% in 2019 by commencing the construction of 3,650 roads and toll road, dozens of seaports and airports, and more than 3,000 km of railways. These efforts will shorten delivery time and thus increase efficiency in distribution services. How could Indonesia’s distribution sector benefits from ASEAN Economic Community (AEC) 2015? AEC 2015 is a good opportunity because distribution services is comprised in 12 sectors that will be liberalized. We should put our eyes on Small Medium Enterprise (SME) since 53% of GDP is contributed by SME. With sustainable cooperation between SME and distribution services provider, we can provide the best price of goods to customers. Through AEC 2015, exporting distribution services would be much easier. But, there are three things to consider before we decide to export: improving our competitiveness, examining distribution system of a country we wish to export, and calculating the risk. What should the Government do to accelerate growth in Indonesia’s distribution sectors? People are keen to imported goods for daily necessities whereas local products provided by local SME are actually not less adequate compared to the imported. The Government should reinforce SME to participate in retail sector by accomodating wide range of facilities to increase their competitiveness. Distribution services is an economic catalyst that connects producers and consumers. Therefore, the Government should improve transportation infrastructure to build inter-island connectivity and in the same time accelerate the growth of SME. What is your “secret recipe” to build a successful distribution company? The biggest portion in distribution services are transportation and inventory cost. In this sense, the company needs to arrange right schedule in storage and transportation management. We also need to restructure working environment, urging more productivity whilst giving more incentives to those who perform better. Besides physical investment in distribution center, warehouse and transportation, investment in qualified human capital, standard of quality, and information technology should be carried out since it will result on future success. Snapshot “What should private sector do to increase efficiency in Distribution Services?” “To reduce logistic costs, improve high standard in distribution services, and solve problems arising from infrastructure bottlenecks, it would be good to have engagement at all levels of government with private sector. In the end, this will benefit both private sector and society as a whole.” -Catharina Widjaja, Director PT. Gajah Tunggal Tbk. “Distribution sector depends on other services such as logistics and transporation as well as better regulatory framework. However, improvement can be achieved with the adoption of technology and modern management, which ensure lower cost of inventory and selling. Better and more direct arrangement with producers, which cuts supply chain of products, would also increase the efficiency.” -Yose Rizal Damuri, Head of the Department of Economics, CSIS Servicing Indonesia | April 2015 | 3 Global Insight “SERVICES are tradeable” In his visit to Jakarta last March, John Goyer, former Vice President of U.S. Coalition of Services Industries (2003—2011) who is currently serves as Senior Director, Southeast Asia, at U.S. Chamber of Commerce, emphasized the importance of services sectors for national economic growth. He came with representatives from Walt Disney, Universal Music, ESPN Sport, and also conducted dialogue with various local Indonesian film, music, and entertainment sectors leaders. Left-Right: Sherly Susilo, Sinta Sirait, Tami Overby, Hariyadi BS. Sukamdani, A. Lin Neumann, John Goyer “Indonesia has large number of young population. There are so many talents in Indonesia that can work together with Walt Disney or Universal Music. Services are tradeable in cross-border context because Indonesian talents can work from Indonesia and do not necessarily need to go to Walt Disney’s Headquarter in California,” said Goyer. According to Goyer, services sectors generate around 80% of GDP in USA. And, the rule of thumb is that the greater per-capita income, the greater portion of GDP generated by services sectors. Therefore, increment of Indonesia’s per-capita income, which result in emerging number of middle class, should claim services sectors as “golden child” as it will strengthen economic fundamental and create numerous jobs for Indonesian. Opportunity for export in services is widely open since services are tradeable in cross-border context. The growth of one services sector might influence the others. For example, when we talk about music in online market, it helps driving the development of broadband services. The greater demand of downloaded online music, the greater the needs of internet broadband. In the end, it will also strengthen another business like e-commerce. “The change in one services sector will bring knock-on effect to many other sectors,” added Goyer. Event On March 25th 2015, Indonesia Services Dialogue held Dialogue Series II on Distribution Services “Enhancing Domestic Efficiency, Identifying Trade Opportunity”. For complete review, please click HERE 1. Noke Kiroyan from ISD Board of Founders gives opening remarks. 2. Mark Magee, GM IKEA Indonesia. 3. Jimmy Bella, Secretary of Directorate General of Domestic Trade Ministry of Trade RI. 4. Question & Answer Session. 5. Ahmad Junaidi, the Director of Case and Decision Proceeding Commission for the Supervision of Business Competition. 6. Anthony Cottan, COO PT. Mitra Adiperkasa Tbk. 7. Participants of Dialogue Series II. 8. Speakers, Panelists, and Moderator. SAVE THE DATE Date Time Venue : May 7th 2015 : 14.00—17.00 WIB : Mitra Building (HO of PT. Indika Energy Tbk.) Jl. Gatot Subroto Kav. 21 Jakarta Agenda : Dialogue Series III on Energy Services “Services Role in the Energy Sector” Permata Kuningan Building, 20th Floor. Jalan Kuningan Mulia Kav. 9C. Setiabudi, South Jakarta, Indonesia 12980 Phone: +6221-8378 0594. Fax: +6221-8378 0594. Website: http://www.isd-indonesia.org. Email: secretariat@isd-indonesia.org Servicing Indonesia | April 2015 | 4

© Copyright 2025