Desk Guide - Missouri Housing Development Commission

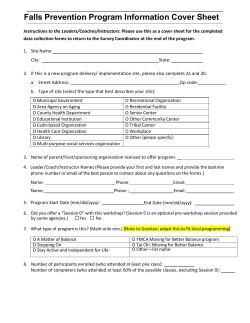

Housing First Desk Guide FY2015 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Table of Contents INTRODUCTION................................................................................................................................................................ 3 GENERAL INFORMATION .............................................................................................................................................. 4 COMPLIANCE ..................................................................................................................................................................... 6 REGIONAL HOUSING TEAM MEETINGS / CONTINUUM OF CARE MEETINGS ............................................... 9 HOMELESS MANAGEMENT INFORMATION SYSTEM (HMIS)............................................................................. 9 INCOME ELIGIBILITY .................................................................................................................................................... 10 GRANT ADMINISTRATION .......................................................................................................................................... 14 Initial Grant Documents ...................................................................................................................................................................... 14 Request for Payment / Back-Up Forms ............................................................................................................................................... 16 On-Site Administration ........................................................................................................................................................................ 22 Records to Maintain ............................................................................................................................................................................ 23 Client File Forms .................................................................................................................................................................................. 24 Close Out ............................................................................................................................................................................................. 25 Effective: April 1, 2015 P a g e |2 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Introduction Purpose The purpose of the Housing First Program (HFP) is to provide funding for any housing/service provider proposing permanent housing solutions with access to supportive services that will address the homeless and at-risk of homelessness population. History In FY 2012, Missouri Housing Development Commission (MHDC) was able to secure $420,000.00 in Fund Balance monies to implement the HFP. Housing First is a national model that relieves program participants of stipulations and barriers to housing. The funding level remained at $420,000.00 in FY 2015. It is the goal of MHDC to continue the HFP through the Fund Balance budget. Eligibility Requirements Who can apply? Applicants must be a non-profit or for-profit corporation or partnership entity formed pursuant to applicable Missouri law, must be in good standing with the state of Missouri, and provide housing or housing services. Applicants must demonstrate access to a substantial supply of permanent housing and client-centered services, as well as a diverse funding stream for housing and services. Who can be served? Any person, or persons (families) who are homeless (by the HUD definition), or at risk of homelessness, and who are considered low-income (50 percent of the area median income or below) and in need of permanent, affordable housing. The HFP provides a link between housing and services; however, the recipient is not obligated to receive case management or treatment in order to receive Housing First assistance. Eligible Uses The grant may be used to support new or existing HFP’s in Missouri. The HFP’s do not have to be standalone entities; it may be integrated into existing systems and programs. Transitional housing may be provided until permanent housing is available. Eligible uses include rental assistance, rental deposits, rental arrears (up to six months), utility assistance, utility deposits, utility arrears (up to six months), and administrative expenses. It is the purpose of the HFP to serve those with the greatest housing and housing service needs in the state of Missouri with attention given to the lowest-income residents in the areas where those needs exist. Effective: April 1, 2015 P a g e |3 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Funding Regions for the 2015 Grant Cycle Allocation Areas Balance of State Adair, Atchison, Audrain , Barry, Barton, Bates, Benton, Bollinger, Boone, Butler, Caldwell, Callaway, Camden, Cape Girardeau, Carroll, Carter, Cass, Cedar, Chariton, Clark, Clay, Clinton, Cole, Cooper, Crawford, Dade, Dallas, Daviess, Dent, Douglas, Dunklin, Gasconade, Gentry, Grundy, Franklin, Harrison, Henry, Hickory, Holt, Howard, Howell, Iron, Johnson, Knox, Laclede, Lafayette, Lawrence, Lewis, Linn, Livingston, Macon, Madison, Maries, Marion, McDonald, Mercer, Miller, Mississippi, Moniteau, Monroe, Montgomery, Morgan, New Madrid, Oregon, Osage, Ozark, Pemiscot, Perry, Pettis, Phelps, Pike, Platte, Polk, Pulaski, Putnam, Ralls, Randolph, Ray, Reynolds, Ripley, Saline, Schuyler, Scotland, Scott, Shannon, Shelby, St. Clair, St. Francois, Ste. Genevieve, Stoddard, Stone, Sullivan, Taney, Texas, Vernon, Wayne, Worth, and Wright Counties Jasper/Newton Counties Kansas City/Independence/Lee’s Summit/Jackson County Springfield/Greene, Christian, Webster Counties St. Charles, Lincoln, and Warren Counties St. Joseph/Andrew, Buchanan, DeKalb Counties St. Louis City St. Louis County General Information Website All information and forms pertaining to the FY2015 Housing First grant can be found under “FY 2015 Items” on the MHDC website at: http://www.mhdc.com/ci/hfp/index.htm Contacts Below are the contacts for the FY2015 grant year. Joselyn Pfliegier is the primary contact for the HFP grant. Please direct all questions, concerns, updates and submission of documents to her, with the exception of Payment Requests and Back-up forms. All Payment Requests and Back-Up forms shall be submitted electronically to Community Initiatives Accountant OR mailed hard-copy to Community Initiatives Department, at the below addresses. Agencies should not send both a hard copy and an electronic copy to avoid processing duplicates. Effective: April 1, 2015 P a g e |4 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Please direct questions, concerns, updates, and miscellaneous submissions to: Joselyn Pfliegier Community Initiatives Coordinator 920 Main, Suite 1400 Kansas City, MO 64105 (816) 759-7228 jpfliegier@mhdc.com Please submit electronic Payment Requests and Back-up forms to: Andrea Jenkins Community Initiatives Accountant ajenkins@mhdc.com Please submit hard-copy Payment Requests and Back-up forms to: Missouri Housing Development Commission Community Initiatives Department 920 Main, Suite 1400 Kansas City, MO 64105 Timeline – FY2015 NOFA Posted on MHDC Website: Proposal Deadline: Staff Recommendations: Awards Notification: Funded Training: Grant Year Begins: Quarter 1 (Q1): Q1 Payment Request Deadline (MHDC-KC office): Quarter 2 (Q2): Q2 Payment Request Deadline (MHDC-KC office): Quarter 3 (Q3): Q3 Payment Request Deadline (MHDC-KC office): Quarter 4 (Q4): Q4 Payment Request Deadline (MHDC-KC office): Last Day to Expend Funds: Final Payment Request Deadline (MHDC-KC office): Final Back-up forms Deadline (MHDC-KC office): Grant Close Out Deadline: Effective: April 1, 2015 June 23, 2014 September 5, 2014 December 5, 2014 January 2015 February 10, 2015 April 1, 2015 April 1, 2015-June 30, 2015 June 30, 2015 July 1, 2015-September 30, 2015 September 30, 2015 October 1, 2015-December 31, 2015 December 31, 2015 January 1, 2016-March 31, 2016 March 31, 2016 March 31, 2016 March 31, 2016, 4:30 p.m. April 30, 2016, 4:30 p.m. April 30, 2016 P a g e |5 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Compliance During the grant year, MHDC staff will evaluate the grantee’s capacity to administer their HFP grant. The grantee’s capacity will be evaluated using two compliance levels: minor and major violations. Grantee’s capacity will be assessed during on-site compliance visits conducted at the designated grantee location as well as through grantee’s ability to meet administrative requirements such as meeting required deadlines and submitting fully complete documents. On-Site Compliance Visits An MHDC staff member will perform announced and/or unannounced site visits to review grantee files at the site designated by the grantee. During site visits, the MHDC staff member will review 50 percent of the instances of assistance with a minimum of ten (10) and a maximum of twenty-five (25) randomly chosen instances per visit to check for the required maintained records. This information is gathered from the HMIS Client Detail Report submitted with grantee’s back-up. The MHDC staff member will not provide the grantee the names of the files to be checked prior to the visit; this is to ensure that all files will be reviewed in the state in which they are normally kept. The requested files are expected to be produced within fifteen (15) minutes of the MHDC staff member’s arrival. Failure to produce requested files within fifteen (15) minutes will result in a major compliance violation*. Therefore, it is vital that a grantee staff member is always available to assist the MHDC staff member as needed at the location and during the times provided by grantee. At the conclusion of the site visit the MHDC staff member will discuss the findings of the visit with the appropriate grantee staff member. The MHDC staff member will send a site visit report after the visit detailing findings. * The only exception is if a staff member is assisting a client. Announced Visit The announced site visit is scheduled by MHDC staff with the grantee. If MHDC staff is unsuccessful in scheduling a site visit after three (3) attempts have been made via telephone and/or e-mail, MHDC staff will send an e-mail to the grantee informing them that they have fifteen (15) days to schedule a site visit, otherwise their funding will be suspended and this will be a major compliance violation, where funds are subject to recapture. Unannounced Visit MHDC staff members have the right to conduct unannounced visits at the location and times furnished by the grantee in the original application, updated on the Site Contact Form or updated via email to Joselyn Pfliegier (whichever is most recent). If a MHDC staff member attempts to conduct an unannounced site visit and the designated grantee location is closed or staff is unavailable, this will result in a major compliance violation. It is the grantee’s responsibility to notify MHDC if business hours change or if the grantee will be closed for an extended amount of time. Other If any allegations are made regarding employees putting clients in danger; an immediate site visit will take place and the Community Initiatives Manager will determine compliance violation. Out of Compliance If the MHDC staff member finds that the grantee is out of compliance for reasons such as the files have not been kept to the specified standard, individuals have been assisted who do not meet the income limits or the facility is unsanitary or unsafe, the MHDC staff member will record that the grantee is “out of compliance.” Until the MHDC staff member has Effective: April 1, 2015 P a g e |6 Form: HFP-100 Desk GuideHousing First ProgramFY2015 verified that the issue(s) has/have been resolved, funding will be suspended. During this time, the MHDC staff should be used as a resource to determine what needs to be corrected. If the grantee is found “out of compliance” they will need to submit a Corrective Action Plan (CAP) detailing the reason(s) for “out of compliance” status and how the findings will be corrected. Depending on the reason(s) for “out of compliance” status, grantee may also be subject to a follow-up site visit conducted by MHDC staff in order to ensure that the issues have been resolved. If the compliance issues require a follow-up visit, it will not be until the next completed Back-Up Form is submitted that a MHDC staff member may conduct the follow-up site visit. The follow-up site visit will be based on the most recent back-up documentation. If the issue(s) that caused the grantee to be out of compliance are resolved after the CAP and/or follow-up site visit review, the MHDC staff member will inform the grantee in writing that their funding is no longer suspended. If the issue(s) that caused the grantee to be out of compliance are still not resolved after the CAP and/or follow-up site visit review, the MHDC staff member will send the grantee inform the grantee in writing of their findings, and funding will be suspended for all grants that the agency has been awarded through the Community Initiatives department. If the grantee is determined to be an unclean or an unsafe environment: The grantee will be notified that their funding will be suspended until they have made the necessary accommodations to make the grantee environment clean and safe. A MHDC staff member will return for another site visit to verify changes; upon the MHDC staff members’ approval, funding will be reinstated. If the grantee is lacking files: The grantee will be notified that their funding will be suspended until they have an appropriate system for maintaining client information. Please utilize MHDC staff as a resource to assist in creating/maintaining a filing system. If no personnel are present at an unannounced visit: The grantee will be notified in writing of the attempted unannounced site visit and that the grantee is out of compliance. Additionally, if the grantee personnel refuse the site visit, the grantee will be out of compliance. If no grantee staff is available for the second attempt, funding will be suspended until a compliance officer is able to complete the site visit. On the third attempt, if no grantee staff is available again the grant is subject to recapture. Electronic Files If the grantee elects to maintain electronic files in lieu of paper files, the grantee will be required to print off all required documentation for compliance visits. As with all files, the time limit to produce these files is fifteen (15) minutes during a site visit. Effective: April 1, 2015 P a g e |7 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Compliance Violations Below is a detail of the minor and major compliance violations as well as the consequences of each violation. Minor Minor violations will be noted in grantee file and points may be assessed during future application cycles. 1. 2. 3. 4. 5. 6. 7. 8. 9. Client file does not contain all required documentation Funded grant training not attended Funded grant documents not received by deadline Funds not drawn quarterly Grant not fully closed by due date (all funds backed up, all required documentation received and correct) Did not attend required number of CoC/RHT meetings for grant year Not within 10 percent of MWOB projections on Close Out Not within 10 percent of 25/50 AMI projections on Close Out Outcome goals were not met Major Major violations may be assessed as indicated below: Description Action Taken 1. Grantee currently out of compliance with HFP “Out of Compliance” status; suspension of HFP funds; points assessed during future application cycles; requires Corrective Action Plan and/or follow-up visit to reinstate “in compliance status” and reinstate funding 2. Grantee out of compliance for more than one site visit “Out of Compliance” status; suspension of all Community Initiatives Department funds; points assessed during future application cycles; requires Corrective Action Plan and/or follow-up visit to reinstate “in compliance status” and reinstate funding 3. Site Visit Compliance: More than one-half of files reviewed during on-site compliance visit contained a minor finding; Files unable to be reviewed during visit; files not produced within 15 minute time frame “Out of Compliance” status; points assessed during future application cycles; Requires Corrective Action Plan (CAP) and/or follow-up visit to reinstate “in compliance status” and reinstate funding 4. Grant partially / fully recaptured – resulting from funds not fully expended by end of grant term or other noncompliance. Noted – points assessed during future application cycles 5. Grantee deemed to be unsafe or unsanitary; allegations of clients being put in danger by grantee “Out of Compliance” status; suspension of all Community Initiatives Department funds; points assessed during future application cycles; Requires CAP and/or follow-up visit to reinstate “in compliance status” and reinstate funding 6. Grantee will not schedule visit; after multiple attempts and no response from letter sent within fifteen (15) days of date of letter “Out of Compliance” status; points assessed during future application cycles 7. Files unable to be reviewed during visit “Out of Compliance” status; suspension of HFP funds; points assessed during future application cycles; Requires CAP and/or follow-up visit to reinstate “in compliance status” and reinstate funding Effective: April 1, 2015 P a g e |8 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Regional Housing Team Meetings / Continuum of Care Meetings In an effort to encourage collaboration and knowledge of services within areas of the state, all Housing First agencies will be required to sign in and attend at least 75 percent of all Continuum of Care (CoC)/Regional Housing Team Meetings in the Continuum in which the majority of its Housing First funding is allocated. These meetings bring together many different agencies working toward the improvement of housing and ending homelessness in the state of Missouri. Grantee will be required to submit attendance tracking sheet for meetings attended at the close out of the grant. It is grantee’s responsibility to provide CoC representative with attendance tracking sheet within the requested timeframe to complete after each meeting that is attended. In the rural communities, these meetings are typically held quarterly. In urban areas they often occur monthly. If you have any questions about which meeting your agency should attend please refer to the contact information for each area. Here is a link to the map of the Continua of Care regions: http://mo-ich.org/MoCoC.pdf Area: Balance of State Kansas City Metro St. Joseph St. Louis City St. Louis County St. Charles Springfield Joplin Contact Person: Dustin Allen - dallen@mhdc.com Vickie Riddle - vriddle@hscgkc.org Randy Sharp - rsharp@inter-serv.org Justin Jackson - jacksonju@stlouis-mo.gov Andrea Holak - aholak@stlouisco.com Dottie Kastigar - dkastigar@communitycouncilstc.org Michelle Garand - mgarand@commpartnership.org Tammy Walker - twalker@escswa.org Homeless Management Information System (HMIS) HMIS is a system that records and stores data regarding the clients that the grantee assists. All funded agencies providing direct client assistance are required to enter data into the HMIS system of their continuum. Grantees are exempt from entering data into HMIS systems if they serve specifically excluded populations i.e., domestic violence victims, foster children and clients that do not consent to being entered into an HMIS system. The data must be entered into the HMIS system that represents the county of service. If grantee serves persons with HFP monies in multiple continua, please ensure that the HMIS data is entered into the appropriate HMIS systems. The following is the contact information for each area: CoC Balance of State, Springfield and Joplin St. Charles St. Louis City and St. Louis County Kansas City and St. Joseph Effective: April 1, 2015 Contact Person: Sandy Wilson- sandy.wilson@icalliances.org Sherry Saunders- ssaunders@communitycouncilstc.org Deb Little –dlittle@misi.org John Rich-jrich@maaclink.org P a g e |9 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Income Eligibility All households assisted through the HFP are required to be at or below 50 percent of the Area Median Income (AMI). If the AMI for the county of service is lower than the Missouri State AMI, grantee shall use the AMI for the State to determine eligibility. Please refer to Maximum Income Limits (Form: HFP-109) to determine recipient eligibility. Grantees are required to use Direct Assistance Summary / Income Worksheet (HFP-105) to determine income eligibility. The income limits are to be used throughout the entire FY2015 grant year unless otherwise notified by MHDC. Currently the HFP program bases its calculation method from HUD’s Part 5 definition; however, there are minor differences. Standard Forms of Income Grantees are expected to utilize the list below when calculating a household’s income. Inclusions: • • • • • • • • Income from all members of the household age 18 and over Gross wages Full amount of periodic payments Unemployment, Worker’s Compensation, Severance Entitlements (TANF, SSI) Periodic and determinable allowances (alimony and child support) Net income from business operations Interest, dividends or other net income from personal property Exclusions: • • • • • • • • • • • • • • Income from children under 18 years of age Foster care payments Lump sum payments Reimbursement or payment of medical expenses Income of live-in aide Financial Aid Resident service stipend (part-time work that enhances the quality of life – not to exceed $200/month) Temporary, non-recurring income (gifts) Earnings over $480/year for full time students 18 years and older (excluding Head of Household) Adoption assistance payments Amounts paid by state to household with a developmentally disabled child to keep them in the home Food Stamps LIHEAP Earned Income Tax Credit WIC Payments Additional Forms of Income when a household’s assets have a value of $5,000 or over, that should be included as income. Inclusions: • • Cash held in savings and checking accounts, safe deposit boxes, home, etc. Cash value of revocable trusts Effective: April 1, 2015 P a g e | 10 Form: HFP-100 Desk GuideHousing First ProgramFY2015 • • • • • • • Equity in rental property Cash value of stocks, bonds, treasury bills, CDs and money market accounts Individuals Retirement and Keogh Accounts Retirement and pension funds Cash value of life insurance policies Personal property held as an investment Lump sums not intended as periodic payments Exclusions • • • • • • • • Necessary personal property (clothing, furniture, cars, primary residence, etc.) Interest in Indian Trust Lands Assets not effectively owned by applicant When assets are held in an individual’s name, but the benefit is to someone that is not in the household Equity in co-operations in which the family lives Assets not accessible to and that provide no income Term life insurance policies Assets that are part of an active business Direct Assistance Summary / Income Worksheet (HFP-105) Due Date: Income eligibility must be certified at first instance of assistance with HFP. If household is receiving ongoing HFP financial assistance, income needs to be re-certified every six months thereafter. At each income eligibility certification, proof of income must be current within 30 days. Required: Yes Submission / Retention: Retained in client file Description: This form is intended to be used to verify income eligibility as well as to summarize all assistance details for instances of assistance. This form will also serve as a checklist for grantees as well as MHDC staff when an on-site compliance visit is conducted. This form contains all the elements reviewed during a compliance visit. Completion Instructions: The electronic form can be obtained on the MHDC website at MHDC.com at http://www.mhdc.com/ci/hfp/index.htm under “FY2015 Items” 1. Household Members: Complete Household information for all members of the household. The “Total Number of Members in Household” will automatically calculate depending on the number of persons listed in the Household Members section. The number of members in the household is used to automatically calculate the AMI for the household size; therefore it is very important that all members of the household are included in that section. 2. Income Calculation: This step must be completed before the calculation of Area Median Income. Once all the members of the household are listed, income will need to be calculated for all members 18 and older. There are eight “Income” tabs at the bottom of the workbook which contain an income calculation worksheet. A separate tab should be used for each individual in the household that is over 18 years of age. If an individual has zero income please indicate “Zero Income” under “Income Type” and record the date the Zero Income Certification was signed under “Date of Income / Letter”. If individuals share assets (i.e., couple that has a shared savings account) which will be used in calculating income, please only list the assets on ONE income calculation worksheet, otherwise the assets will be calculated twice. Effective: April 1, 2015 P a g e | 11 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Submission Instructions: 3. Area Median Income (AMI): Once all of the income calculation and deductions worksheets have been completed for all members of the household 18 and older, the AMI can be calculated. Choose the county of service from the drop down. If the county of service is not listed then that county’s AMI is lower than the State AMI and the “MISSOURI - State” should be selected. If “MISSOURI – State” is selected, please also select the county of service from the drop down. Once the appropriate county is selected the AMI breakdown for that selection should populate. The total household income is automatically calculated and is populated from the individual income calculation worksheets. The service provider can then compare the household income to the AMI breakdown for the county of service to determine if household meets income eligibility requirements. 4. Assistance Information: This section summarizes the assistance information that is required to be kept for HFP files. This is information that MHDC staff will look at in the client file during the audit. The completion of this section should act as a checklist for required information/items for compliance site visits. Retained in client file for every income certification Effective: April 1, 2015 P a g e | 12 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Direct Assistance Summary / Income Verification Form (HFP-105) - Example 1 3 3 4 2 Effective: April 1, 2015 P a g e | 13 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Grant Administration The administration of your FY2015 HFP grant will consist of forms/documents/information that will be submitted to MHDC and forms/documents/information that is required to be kept on site. This section will discuss, in detail, the requirements for document submission as well as the information that is required to be kept on site for this grant type. Throughout this section, forms that require submission will indicate if a hard-copy or electronic version is required. Below is the information for each submission; please ensure that the document is submitted to the correct contact. Hard-Copy Submissions: Missouri Housing Development Commission Community Initiatives Department 920 Main, Suite 1400 Kansas City, MO 64105 Electronic Submissions: jpfliegier@mhdc.com Electronic Payment Request and Back-Up Submissions: ajenkins@mhdc.com Initial Grant Documents Before any funds can be released, all required initial grant documents must be complete and received by MHDC by April 1, 2015. 2015 Grant Agreement Due Date: Required: Submission / Retention: Description: Completion Instructions: Submission Instruction: (Agency Grantee) April 1, 2015 Yes Submitted to MHDC The grant agreement specifically details the requirements and expectations for the administration of the grant. It is the grantee’s responsibility to know and adhere to all provisions set forth in the grant agreement. There are three places where the Grant Agreement must be signed by grantee: 1. Signature page – signature and notary. 2. Workforce Eligibility Affidavit – signature and notary; and 3. Rider B – signature. All signatures must be ORIGINAL and by an authorized signatory as designated in HFP101. The entire original signed, notarized agreement must be returned to MHDC to be considered complete. If any pages of the grant agreement are missing, the Grant Agreement will not be considered complete. Failure to submit a fully complete, properly executed grant agreement before April 30, 2015 will result in grant recapture. Please note that the Rider “A” is a part of your grant agreement and specifically details the eligible uses for the grant year. Hard-copy, original signatures to Joselyn Pfliegier Direct Deposit Form (HFP-118)/ Blank Check Due Date: April 1 2015 Required: Yes Submission / Retention: Submitted to MHDC Effective: April 1, 2015 P a g e | 14 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Description: Completion Instructions: Submission Instructions: All disbursements from MHDC to grantee will occur using an Electronic Funds Transfer (EFT). This form is required to be submitted with initial grant documents. It provides MHDC with the grantee’s banking information for the electronic transfer. A blank voided check from the indicated banking institution is also required to be submitted with the Direct Deposit form. Please note that by default your grantee’s banking information will be updated for ALL MHDC accounts. If the banking information provided is for the Housing First program or one grant ONLY – it must be indicated on the direct deposit form. PDF fillable form can be obtained at MHDC.com. Form must be signed with original signatures by authorized signatory. Hard-copy, voided hard-copy check, original signatures to Joselyn Pfliegier. Authorized Signature Card (HFP-101) Due Date: April 1, 2015, updated as needed Required: Yes Submission / Retention: Submitted to MHDC Description: This form designates all authorized signatories for each grant. All documents/forms that are required to be signed by grantee MUST be signed by a designated authorized signatory from this form. If an unauthorized person signs a document/form, the document/form will be rejected. Completion Instructions: Electronic form can be obtained from MHDC.com. Form must designate AT LEAST two authorized signatories. The form must have ORIGINAL signatures from all designated signatories. Please note the Authorizing Official must sign in the Authorizing Official box as well as at the bottom of the form. Submission Instructions: Hard-copy, original signatures to Joselyn Pfliegier Sources and Uses (Grant Agreement) Due Date: April 1, 2015 Required: Yes Description: The Sources and Uses details the program budget for the FY2015 grant year. Completion Instructions: Grantee shall update the Sources and Uses from what was initially provided at time of application. The updated Sources and Uses should reflect the actual amount of HFP funds awarded for this grant. Submission Instructions: Hard-copy, original signatures to Joselyn Pfliegier E-Verify Memorandum of Understanding (MOU) Due Date: April 1, 2015 Required: Yes Description: The E-Verify MOU is an agreement between the Department of Homeland Security (DHS) and Grantee stating that grantee agrees to participate in the Employment Eligibility Verification Program (E-Verify). Completion Instructions: Grantee shall submit a copy of the full and complete MOU generated from DHS’ E-Verify online system. Submission Instructions: Hard-copy, to Joselyn Pfliegier Certificate of Liability Insurance Due Date: April 1, 2015 Required: Yes Effective: April 1, 2015 P a g e | 15 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Submission / Retention: Description: Completion Instructions: Submission Instructions: Site Contact Form (HFP-110) Due Date: Required: Submission / Retention: Description: Completion Instructions: Submission Instructions: Submitted to MHDC The Certificate of Insurance is a one page summary of Liability Insurance held by grantee. The insurance held by grantee may include: General Liability, Automobile Liability Umbrella Liability, Excess Liability, Worker’s Compensation and Employers’ Liability. The Certificate of Liability Insurance must be current. If coverage lapses during to the grant year, it is grantee’s responsibility to provide MHDC with an updated Certificate. Grantee shall provide a copy of the Certificate of Liability Insurance. Hard-copy, to Joselyn Pfliegier April 1, 2015 Yes Submitted to MHDC This form will be submitted with initial grant documents. This form is to ensure that MHDC has updated information for the upcoming grant year. The site visit location and hours of operation will be used to conduct scheduled and unscheduled site visits. Complete information pertaining to the grant. If grant contact or hours of operation change, grantee is responsible for submitting an updated Site Contact Form. Hard-copy, to Joselyn Pfliegier Request for Payment / Back-Up Forms Before any funds can be released for FY2015, the following criteria must be met: 1. All previous HFP grants must be completely closed out: a. All funds expended; b. Close Out form received; c. Updated Sources and Uses; and d. Previous grant(s) are fully backed up. 2. All current year grant documents are complete and received. 3. All previous compliance issues are resolved (i.e., grantee is “in compliance”). Once all the above criteria are met, grantee may then begin requesting funds from their FY2015 grant. Receiving funds for an HFP grant is split into two processes: Request for Payment and Back-Up form. This is split into two processes to allow grantees to advance up to 25 percent of their grant award throughout the year. Once any amount of funds is advanced, that amount must be fully backed up before any further funds will be released. Funded agencies may submit payment requests and/or any back-up documentation electronically by emailing the documents to the Community Initiatives Accountant (Andrea Jenkins at ajenkins@mhdc.com). Funded agencies may choose to send in original paper copies if they prefer this method instead. Agencies should not send in both electronic and hard copies to avoid processing duplicates. Request for Payment The grantee may submit a Request for Payment as of April 1, 2015. The grantee may choose to draw up to 25 percent of their total grant award without back-up documentation. This amount must be backed up before additional funds can Effective: April 1, 2015 P a g e | 16 Form: HFP-100 Desk GuideHousing First ProgramFY2015 be released. If the Request for Payment is under 25 percent that amount must still be backed up before the next Request for Payment will be processed. After the first Request, no Requests over 25 percent of the grant can be processed without back-up at the time of the request. The following form must be used for all requests for payment: Request for Payment (HFP-102) Due Date: At least quarterly until funds expended Required: Yes Submission / Retention: Submitted to MHDC Description: The Request for Payment form is required to be submitted for any and all disbursements of grantee funds. Completion Instructions: All fields are required to be completed for Request for Payment form to be accepted and processed. 1. Complete general fields: Date, Grantee, Grant Number, Site Address, and Grant Award Amount. 2. Requested Amount. No more than 25 percent of the grant award amount can be requested without back-up. 3. Check the box for which disbursement is being submitted. If “Final Disbursement” please indicate. 4. Two authorized signatories listed on the Authorized Signature Card (HFP-101) must sign the Request for Payment. Submission Instructions: Electronically to Community Initiatives Accountant (Andrea Jenkins at ajenkins@mhdc.com) OR Hard-copy to the Community Initiatives Department. Agencies should not send both a hard copy and an electronic copy to avoid processing duplicates. Quarterly Draws The grantees must have a minimum of one disbursement per quarter. Discarded or zero amount Requests for Payment will not fulfill the Quarterly Draw requirements. HFP quarters and submission deadlines are detailed above under “Timeline – FY2015” Incomplete/Ineligible Requests for Payment If the grantee submits a Request for Payment that is incomplete/ineligible MHDC will notify grant contact via email that the Request for Payment is incomplete or ineligible and that the Request is being discarded. Grantee will need to submit a new and complete Request for Payment. EXAMPLES: Unsigned or dated forms, previous request not fully backed-up, compliance issues, etc. Back-Up Grantee is required to submit the following form to account for all HFP spending during the FY2015 grant year. Back-Up Form – (HFP-103) Due Date: After initial disbursement, before disbursement of additional funds Required: Yes Submission / Retention: Submitted to MHDC Completion Instructions: 1. General Information / Back-Up Check List / Summary: All fields in these sections are REQUIRED. If information is missing from these sections, the Back-Up form will be considered incomplete and will be discarded. The dates listed in the Reporting Period section should reflect the dates the expenses were Effective: April 1, 2015 P a g e | 17 Form: HFP-100 Desk GuideHousing First ProgramFY2015 2. 3. 4. 5. 6. incurred AND paid. Grantee must check whether the Back-Up form is a current submission or whether it is a replacement for a previous back-up submission. Summary of Direct Assistance by Region: This section summarizes the information from the attached HMIS report / Non-HMIS Client Detail Report. Please pay attention to the regions in which HFP monies are spent. Monies cannot be spent outside of the region(s) specified in the grant agreement. Total HMIS Summary: This section is a summary of all HMIS Reports/ Non-HMIS Client Detail Reports submitted with the back-up. Please note that each line should represent the sum of the entire HMIS report / Client Detail Report not each of the page totals. Please limit each Back-Up form to five (5) HMIS / Client Detail Reports per submission. Additional Reports will need to be submitted in a separate back-up form. Administrative Detail Report (if taking 10 percent administrative fee): If a grantee chooses to take the 10 percent administrative fee (as indicated in grantee’s Rider “A”), the Administrative Detail Report form is required to be completed detailing all expenses that will be charged to HFP. This form is a part of the BackUp form and has separate tabs on the Excel Back-Up form. For staff salaries please include the last four digits of the employee’s Social Security number in the detail section of the Administrative Detail Report Form. Administrative Back-Up (if taking 10 percent administrative fee): Administrative back-up support of cost incurred AND proof of payment is required to be submitted with Back-Up form for every line item in the Administrative Detail Report. See Administrative Records chart below for acceptable forms of documentation to be submitted with back-up. Back-Up Total Summaries: This section sums up all back-up being submitted in the report. a. Total Direct Assistance – Summary of all HMIS / Client Detail Reports submitted for back-up, summed from the line item detail entered above. This number should equal the Total Spent for all regions from the Summary of Direct Assistance by Region section. b. Total Administrative Expenses –Summary from all Administrative Detail Reports completed within this Excel workbook. This total automatically sums as the Administrative Detail Report is completed. c. Total HFP Grant Funds Expended – Summary of Total Direct Assistance and Total Administrative Expenses. Submission Instructions: Electronically to Community Initiatives Accountant (Andrea Jenkins at ajenkins@mhdc.com) OR Hard-copy to the Community Initiatives Department. Agencies should not send both a hard copy and an electronic copy to avoid processing duplicates. Effective: April 1, 2015 P a g e | 18 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Administrative Expenses Below is a detail of the eligible and ineligible uses of the ten percent administrative fee and required documentation. Eligible Administrative Costs: • • • Ineligible Administrative Costs: Each sub-grantee can use up to 10 percent of what was awarded for administration costs as long as it is specified in the grantee’s Rider “A” Examples: Program staff salary, administration building; utility bills, program audits, office supplies, maintenance and travel when clients are present Maintenance activities include routine or minor measures to upkeep office space equipment and fixtures, and/or preventative measures to keep the building and its property working appropriately. • Funds cannot be used for conferences and training costs, travel when clients are not present or any food purchases Administrative Records Record Bills Paid Services Performed Office Supplies Salary Acceptable Forms of Documentation (both Cost Incurred and Proof of Cleared Payment are required) Cost Incurred Proof of Payment • • Invoice Receipt • • Payroll report with pay period dates, and HFP portion detailed Check register or credit card statement with payments made by HFP highlighted and/or returned checks log Last four digits of SSN and position at agency Proof of position • • Effective: April 1, 2015 • Check register or credit card statement with payments made by HFP highlighted and/or returned checks log P a g e | 19 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Back-Up Form-(HFP-103) - Example 1 5 2 4 Auto Fill Effective: April 1, 2015 P a g e | 20 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Back-Up Form-(HFP-103) – Example (continued) 3 6 a b c Incomplete/Ineligible Back-Up If the grantee submits a Back-Up form that is incomplete or ineligible MHDC will notify grantee that the Back-Up is incomplete or ineligible and MHDC will discard it. Grantee will need to submit a new and complete Back-Up form, including all attachments and signatures. Other Back-Up Forms HMIS Report Due Date: Required: Submission / Retention: Description: Completion Instructions: Submission Instructions: Submitted with Back-Up form Yes Submitted to MHDC with Back-Up form The HMIS report is generated from the respective HMIS systems. The report generated details information about each instance of assistance as well as a sum of the direct assistance. The entering of information and the generating of the report should be executed as instructed by HMIS system. All HFP recipients should be entered into the appropriate HMIS system unless the recipient is a part of a protected population (i.e., domestic violence, youth) or refuses to be entered into the HMIS system. The HMIS report should be submitted with the HFP Back-Up form. The HMIS report does require signatures by authorized signatories as designated in HFP-101. Non-HMIS Client Detail Report Form – (HFP-107) Due Date: Submitted with Back-Up form Required: Yes – ONLY for recipients that are not entered into HMIS (i.e., domestic violence, youth, refused to be entered into HMIS) Submission / Retention: Submitted to MHDC with HFP Back-Up form Effective: April 1, 2015 P a g e | 21 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Description: Completion Instructions: Submission Instructions: The Non-HMIS Client Detail Report Form is specifically for recipients that have not been entered into an HMIS system. These recipients would include protected populations (i.e. domestic violence, youth) or recipients which refuse to be entered into the HMIS system. Grantee must receive prior approval before using the Non-HMIS Client Detail Report Form. If grantee submits both an HMIS report AND the Non-HMIS Client Detail Report Form, all instances of assistance listed should be distinct from each other. There should be NO DUPLICATION of instances of assistance between the two reports. Grantee should complete all fields for every instance of assistance. Therefore if recipient is receiving repeated service (i.e., rent paid for multiple months) every instance of assistance should have its own line on the form. The HMIS report should be submitted with the HFP Back-Up form. The HMIS report does require signatures by authorized signatories as designated in HFP-101. On-Site Administration Client Files Below is a list of eligible uses for Housing First. An agency is restricted to the uses specified in their Rider “A “of the grant agreement. Eligible Uses: • • • • • • Rental Payments (current month’s rent only) Utility Payments Rent Deposits Utility Deposits Rental Arrears ( up to six months) Utility Arrears (up to six months) Effective: April 1, 2015 Ineligible Uses: • Individuals or families needing assistance with bills that are not necessities. o Examples: telephone, cable television, internet, etc. • Individuals or families needing assistance to pay any sort of taxes • Rental/Utility Arrears in excess of six months P a g e | 22 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Records to Maintain All of the following should be kept on file and should be easily accessible for compliance purposes: These items are specified in the Rider “A” of the grant agreement. Client Records Record *Direct Assistance Summary/ Income Verification Form (HFP105) Income Verification Criteria • Use to calculate income eligibility • • • • Income eligibility must be certified every six months for households receiving ongoing HFP financial assistance At each certification, proof of income must be current within 30 days of instance of assistance Proof of gross monthly income needed for all members of the household age 18 and over NO INCOME (18 and older in household): Certification of Zero Income” (HFP-104) found at www.mhdc.com Documentation of housing status Proof of Residence • Payment Contact • Proof of Payment • Proof of Requested Need • Documentation of client/household’s need for HFP assistance. Photo Identification • Needed for all members of the household age 18 and over Social Security Identification • Consent Form • Card/number needed for all members of the household to document number of individuals in the household This signed form gives MHDC the right to review files and verifies “safe and decent housing”. This form needs to be filled out every six months. Form provided by MHDC and can be found on MHDC’s website at www.mhdc.com • Documentation of whom assistance was paid to, address, and phone number Payment date must be within 30 days of each instance of assistance Effective: April 1, 2015 Acceptable forms of Documentation • Direct Assistance Summary / Income Verification Form (HFP105) • Pay stub, SSI/SSDI award letter/printout, child support statement • Signed/dated statement from employer verifying frequency and amount of hourly wages (including cash payments) • Certification of Zero Income (HFP -104) • • • • • • Letter from landlord or emergency shelter Copy of lease Piece of mail Copy of current lease Letter from Landlord Copy of bill • Copy of check register or credit card statement with payment highlighted and/or returned check log Copy of bill Eviction notice Letter from the landlord or emergency shelter Signed, current program contract or copy of lease Driver’s license, state ID, temporary ID/license, school ID with photo, passport-U.S. or foreign, U.S. passport card, permanent resident card, employment authorization document, U.S. citizen ID card, military ID, Native American tribal card • Copy of Social Security Card • Print out from social security office • • • • • • HFP Consent Form (HFP- 106) P a g e | 23 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Client File Forms Direct Assistance Summary / Income Verification Form (HFP-105) Please see “Income Verification” section Certification of Zero Income (HFP-104) Due Date: Completed at first instance of assistance, and re-certified every six months thereafter for households receiving ongoing HFP financial assistance Required: Yes – All members of household without income, 18 and over Submission / Retention: Retained in client file Description: The Certification of Zero Income form must be completed and signed by all recipients of the household age 18 and over who do not have income. The current year HFP-104 form is the only acceptable form of certification of zero income and other versions or alterations of this form will not be accepted. Completion Instructions: All members of household without income, 18 and over must sign a Certification of Zero Income. The date of the form must be within 30 days of the instance of assistance. Submission Instructions: The original signed forms retained in client file. Consent Form (HFP-106) Due Date: Required: Submission / Retention: Description: Completion Instructions: Submission Instructions: Completed at first instance of assistance, and re-certified every six months thereafter for households receiving ongoing HFP financial assistance Yes Retained in client file The consent form must be completed and signed by head of household at each certification. The current year HFP-106 form is the only acceptable consent form and other versions or alterations of this form will not be accepted. The head of household must sign the Grant Recipient’s Consent to Release Information every six months. The date of the form must be within 30 days of the instance of assistance. The head of household must also check one of the boxes at the bottom of the consent form. If a box is not checked then the form is not considered complete. If recipient checks the “IS NOT” box, please address in client file. The original signed form retained in client file. Maximum Income Limits (HFP-109) Due Date: N/A Required: Yes – Must use to determine income eligibility of all HFP recipients Submission / Retention: Retained for grantee reference Description: The Maximum Income Limits designate the maximum income limits, by household size, allowable by HFP for the FY2015 grant year. This break out of AMI by household is calculated by HFP statute. These income calculations should be used to determine household eligibility for the entire FY2015 grant year. Completion Instructions: N/A – for grantee reference Submission Instructions: N/A – for grantee reference Effective: April 1, 2015 P a g e | 24 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Fair Market Rents (HFP-108) Due Date: Required: Submission / Retention: Description: Completion Instructions: Submission Instructions: N/A Yes – If grantee owns property where rents are paid. It is strongly recommended that Fair Market Rent guidelines are followed when paying rent outside of grantee’s property. Retained for grantee reference Fair Market Rents as determined by HUD for 2015. These will be in effect for the entire FY2015 HFP grant year. Adhering to Fair Market Rents is REQUIRED for grantees paying rent on property owned by grantee. N/A – for grantee reference N/A – for grantee reference Close Out Once all funds have been expended, grantee is required to “Close Out” their grant. The Close Out process consists of several components: 1. Close Out Form 2. Sources and Uses (Updated) 3. Housing Meeting Attendance Form 4. All funds backed up All complete and final Close Out information is due to MHDC by April 30, 2016. Any funds that are not backed up by April 30, 2016 are subject to recapture. Close Out Forms Close Out Form – (HFP-112) Due Date: Required: Submission / Retention: Description: Completion Instructions: April 30, 2016 Yes Submitted to MHDC The close out form is a collection of summary questions about the administration of the grant throughout the FY2015 grant year. All information is required to be completed. 1. General Information: Please complete general information including date, agency, grant number, and grant award amount. 2. Percentage of households assisted: Grantee will report on the percentage of households assisted for the entire FY2015 grant year. Please note that these reported numbers will be assessed against your original projections in your FY2015 application. Grantees more than 10 percent off from their original projections are subject to point deductions in future application rounds. 3. Minority / Women Owned Business: Grantee will report on the certified Minority / Women Owned businesses utilized throughout the ENTIRE AGENCY for the FY2015 grant year. Proof of costs incurred and proof of payment for services are NOT required to be submitted with back-up, but MHDC does reserve the right to request that information and those records should be maintained. 4. Program Information Breakdown: Grantee will provide a breakdown of funds spent during FY2015 grant year. Effective: April 1, 2015 P a g e | 25 Form: HFP-100 Desk GuideHousing First ProgramFY2015 Submission Instructions: Sources and Uses (Close Out) Due Date: Required: Description: Completion Instructions: Submission Instructions: 5. Service Demographics. Grantee will report on the categories of clients served in program for FY2015 grant year. 6. Outcomes: Grantee will report on outcomes that were indicated in FY2015 HFP Application submitted. Grantee will provide results of outcomes as well as discussion of the outcome results. 7. General Housing First information: Grantee will discuss any comments on HFP requirements and processes, how HFP has benefited grantee and will attach any additional information about program. 8. Point-In-Time Count information: Grantee will indicate whether or not they are involved in their community’s annual Point-In-Time Count. If involved, grantee should detail their involvement. 9. Project Homeless Connect information: Grantee will indicate whether or not their community has conducted a Project Homeless Connect. If not, grantee should indicate whether or not they are interested in conducting an event in their community. 10. Clients Served. Grantee will designate the percentage of total HFP grant spent by county. If grantee did not spend funds in a county, please leave blank. Electronic submission to Joselyn Pfliegier April 30, 2016 Yes The Sources and Uses detail the program budget for the FY2015 grant year. Grantee shall update the Sources and Uses from what was provided at the beginning of grant year. The updated Sources and Uses should reflect the actual amount expended in this program. If grantee received more than one grant from MHD for the FY2015 grant year, the funds should be designated in separate columns. Electronic submission to Joselyn Pfliegier CoC/RHTM Housing Meeting Attendance Due Date: April 30, 2016 Required: Yes Submission / Retention: Submitted to MHDC with grant’s Close Out form Description: The CoC / Regional Housing Team Meeting (RHTM) Attendance form will be used by grantees to keep a record of attendance to their designated CoC / RHTM meeting. Completion Instructions: Grantee will complete the initial information: Agency, HFP Grant Number, and Designated CoC Meeting. The form with the initial completed information will be taken to every CoC / RHTM meeting attended. The Meeting Date, Agency Representative, CoC Representative and CoC Representative (signature) will be obtained for every meeting attended. Submission Instructions: The completed form will be submitted electronically to Joselyn Pfliegier along with grantee’s close out form. This form will not be accepted before the close of the grant. Effective: April 1, 2015 P a g e | 26

© Copyright 2025