Helping Customers PAY INSTANTLY

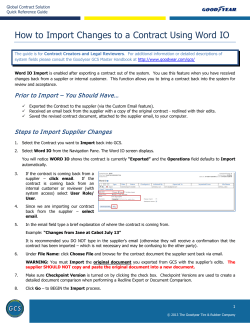

Helping Customers PAY INSTANTLY Learn how Pay by Text — a service for Western Union® Speedpay® clients — helped an energy supplier offer its customers a faster, more convenient way to pay their bills. GOAL: Help an energy supplier expand its mobile-payment options. SOLUTION: Provide customers the ability to authorize payments in a matter of seconds with Pay by Text — a value-add service for billers that use Western Union® Speedpay®. RESULTS: • On average, within 24 hours of a text being sent, 23 percent of notified customers (330 people) made a payment. • Within 30 minutes of a text being sent, 114 customers made a payment. • 1,300 customers enrolled in the Pay by Text program as of late 2011. • The service distinguished the company as a leader in utility customer service. American consumers are relying on their mobile devices in record numbers. As of 2010, 85 percent of Americans own a cell phone, up from 65 percent just six years earlier.1 And as the amount of consumers using mobile phones continues to grow, so too does the demand for mobile payment options. Eighty percent of Gen Y mobile-device owners report using text messaging2 and texting is also on the rise among the 35-plus crowd.3 In all, 72 percent of adults with mobile devices use text messaging.4 Among smartphone owners, the rate is even higher at 87 percent.2 Given this, Western Union wanted to help one of its Speedpay clients — an energy supplier serving the Western United States — expand mobilefriendly payment options for its customers. In July 2010, Western Union began working with the supplier to implement Pay by Text, a value-add service for businesses using Speedpay. When customers opt to sign up for Pay by Text, they are taken to an online site where they enter payment information. Payments are then debited from a savings or checking account or charged through a credit, debit or ATM card. 1. Source: Pew Research Center’s Internet & American Life Project, August 9-September 13, 2010 Tracking Survey 2. Source: Javelin Strategy & Research, 2009 3. Source: eMarketer, MMA 4. S ource: Pew Research Center’s Internet & American Life Project, April 29-May 30, 2010 Tracking Survey 2 “IT WAS ALMOST A SEAMLESS PROCESS TO US. WESTERN UNION DID MOST OF THE HEAVY LIFTING.” Enabled Pay By Text Users 1400 1200 1000 800 600 400 200 0 JUNE MAY APRIL FEBRUARY JANUARY DECEMBER 2011 NOVEMBER OCTOBER SEPTEMBER AUGUST JULY 2010 Although there was a clear appetite for text payments, the energy supplier needed to build awareness of the new service. With this in mind, Western Union designed Pay by Text advertisements for the energy supplier’s website and bill inserts and marketed the new service on the interactive voice response (IVR) system. All communications — which were subject to the energy supplier’s approval — highlighted that Pay by Text could help customers save time and make paying bills more convenient. MARCH The customer then receives a text message five days before their energy bill is due as a reminder to make a payment. If customers reply to the text using standard keywords, such as “YES PAY,” it automatically triggers the payment process — eliminating the transfer of unencrypted sensitive financial information over text message channels. “It’s absolutely amazing the way the [implementation] process flowed,” says the remittance supervisor who oversaw the project on the energy supplier’s side. “Because we were already associated with Western Union Speedpay, our payment process didn’t change. It was just another payment option for our customers. It was almost a seamless process to us. Western Union did most of the heavy lifting.” It took the energy company about six months to build a high level of awareness around the Pay by Text service. In 2010, there were fewer than 100 people enrolled in the program. By late 2011, 1,300 participants had signed up. Of the 1,300 customers now enrolled, 267 had not used one of the energy supplier’s Western Union electronic payment systems before. Payment: JAMIE K. HAMILTON Pay Bill No. 150 199 Water Street, 29th Floor New York, NY 10038 DATE Cell Number: PAY TO THE ORDER OF 212 123 4567 Email Address: email@gmail.com $ DOLLARS For 322271627 Credit 12345678910 150 ACH Reply ATM New Msg (optional) Customer enrolls via Speedpay IVR or Internet 3 Customer provides cell phone number and email address (optional) Customer enters payment information or opts to use payment info on file Customer receives text message stating payment is due Customer replies to text message to complete payment Now, 23 percent of notified customers pay via text message within 24 hours. Within 10 days of receiving the text notification, about 58 percent of customers pay their bills electronically. Even when customers use other channels to make a payment, the text reminder can help to speed up the payment process, since the average time it takes someone to view a text after deployment is one to five minutes versus one to two days for email.5 Of notified customers who made a payment, 55 percent paid via text message and the remaining 45 percent ended up using other self-service channels — with IVR being the most popular. Regardless of which channel customers use, there is a consistent uptick in payment transactions three days after each text message is sent. Success Factors • Promote the Pay by Text option throughout communications — including the company website and by training sales representatives — to maximize customer adoption. • Offer a mobile payment reminder and/or payment option to increase the number of customers who use mobile, online and phone self-service payment options. • Use a bill due-date reminder — such as a text message — that gives customers ample time to make a timely payment. For the energy supplier, the results show that they are taking the right steps to adapt to the changing needs of customers. “I think it shows that — especially in this economy — we’re trying to make it as easy as possible for all of our customers,” says the remittance supervisor for the energy supplier. “It’s just been a great benefit. There’s been a cost savings to us and added convenience to the customer.” 5. Source: Based on comments made by Richard Crone, Principal, Crone Consulting, as captured in “Mobile Retailing Dissected At NRFtech Panel Discussion,” Retail TouchPoints, August 2009 Pay By Text Enabled Notifications 1,300 TOTAL CUSTOMERS 92% have transacted at least once through an electronic channel 4 20% had never used the energy supplier’s Western Union electronic payment systems before

© Copyright 2025